Get the free Rhode Island Sales Tax Exemption Certificate: How to ... - tax ri

Get, Create, Make and Sign rhode island sales tax

How to edit rhode island sales tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out rhode island sales tax

How to fill out rhode island sales tax

Who needs rhode island sales tax?

Rhode Island Sales Tax Form: A Comprehensive Guide

Overview of Rhode Island sales tax

Rhode Island’s sales tax is a critical component of the state's revenue system, providing essential funds for public services. Sales tax is levied on the sale of tangible personal property and certain services. As of 2023, the state’s general sales tax rate is 7%, which is vital for funding education, infrastructure, and various state agencies.

Understanding this tax is essential for both businesses and consumers. Not only does it impact pricing structure, but it also fosters compliance with local regulations, avoiding fines and penalties. Additionally, knowledge of sales tax can inform purchasing decisions, which can be significant in a retail-rich environment.

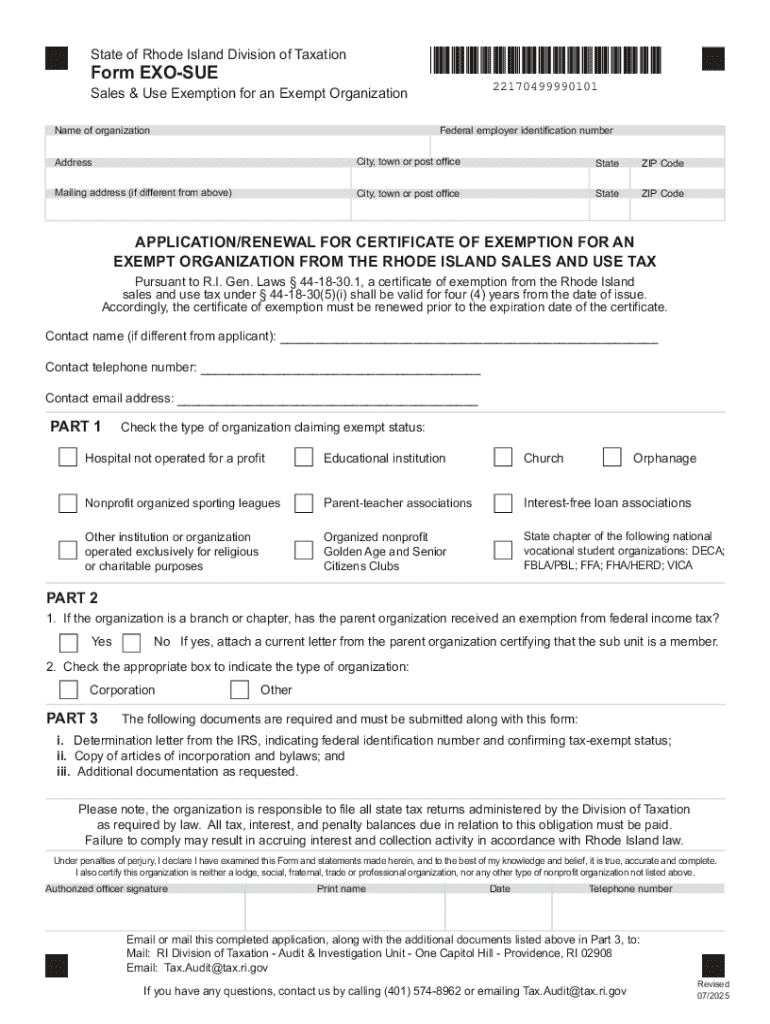

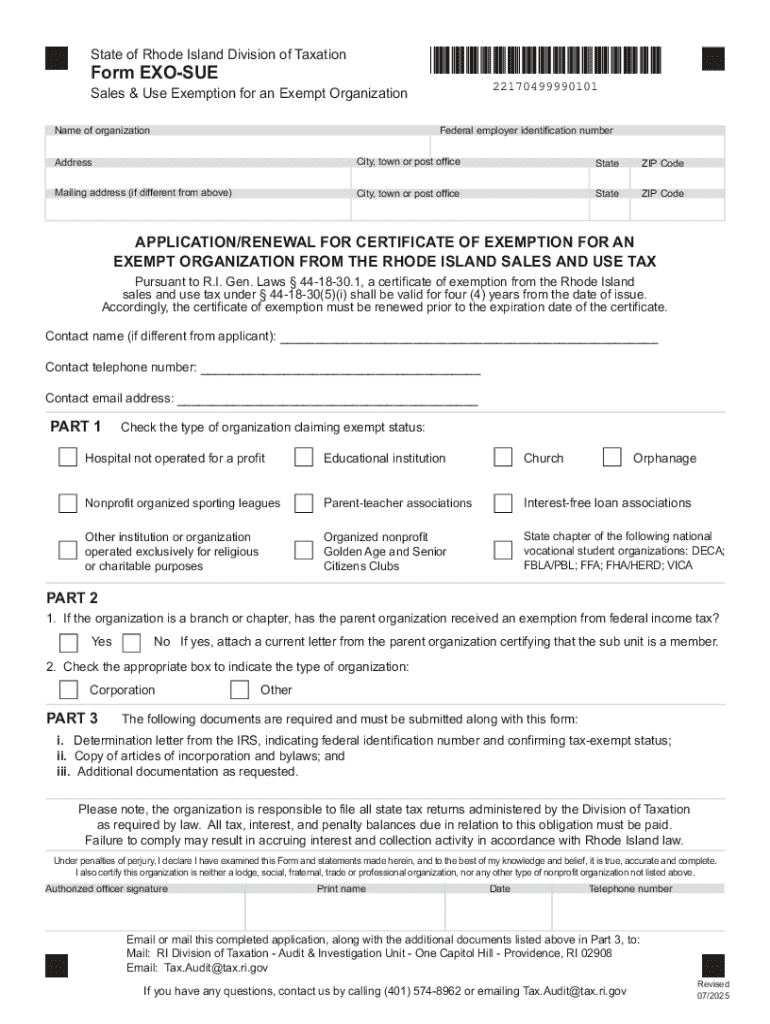

Understanding the Rhode Island sales tax form

The Rhode Island Sales Tax Form is a standardized document used by businesses to report and remit sales tax. This form helps businesses calculate the amount of tax due on sales made and submit payments to the Division of Taxation. Proper completion of this form is crucial for maintaining compliance with Rhode Island tax laws.

This form can be used by a variety of businesses, whether a small shop or an online retailer, in reporting sales tax accurately. With transactions ranging from retail sales to services provided, the sales tax form is designed to accommodate all taxable activities effectively.

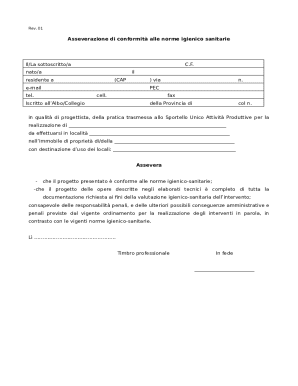

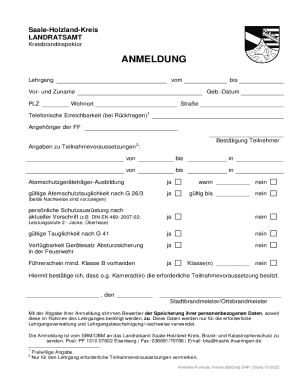

Eligibility for filing the Rhode Island sales tax form

Yes, businesses must file the Rhode Island Sales Tax Form if they engage in taxable sales. This includes businesses that have a physical presence in the state or have sales exceeding the threshold set by the Division of Taxation. Knowing whether you need to file is key to avoiding potential audits or fines.

Certain exemptions may apply, allowing individuals or organizations to avoid paying sales tax. Non-profit organizations, for instance, typically qualify for exemption but need to provide appropriate documentation. Resale exemptions apply to businesses purchasing goods for resale, while wholesale transactions generally fall outside the taxable category.

How to obtain the Rhode Island sales tax form

Obtaining the Rhode Island Sales Tax Form is straightforward. The official state website provides downloadable versions for various tax scenarios. Additionally, third-party platforms like pdfFiller offer easy access to forms, allowing customization and management online.

Selecting the correct form version is crucial. Ensure you have the latest version that corresponds to the current tax year, as using outdated forms could lead to errors in your tax reporting. The state’s Division of Taxation updates forms regularly to reflect tax changes.

Step-by-step guide to filling out the Rhode Island sales tax form

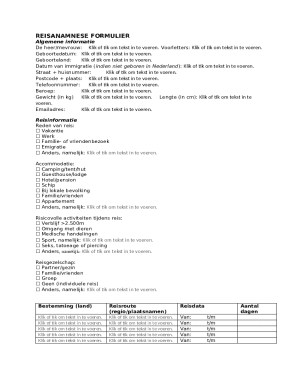

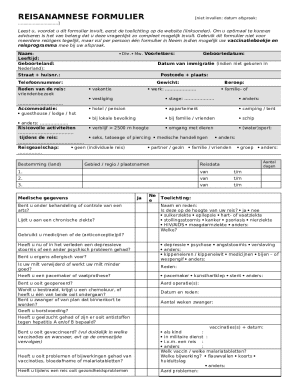

Completing the Rhode Island Sales Tax Form involves careful attention to detail. Begin with the header information, where you'll fill out your business name, address, and tax identification number. This information identifies you as the taxpayer.

Next, provide detailed sales information. List all taxable sales, non-taxable sales, and any deductions or exemptions that may apply. Accurately calculating total tax due is critical, as errors can lead to discrepancies. Lastly, check your calculations against revenue records before submitting.

Common errors to avoid include miscalculation of taxable items and failing to report non-taxable sales accurately. Using interactive tools offered by pdfFiller can streamline this process, helping users to fill in forms correctly and efficiently.

Submission process for the Rhode Island sales tax form

Submitting the Rhode Island Sales Tax Form can be done either online or through traditional mail. Online submission is often preferred due to its speed and ease. The Rhode Island Division of Taxation provides an online filing system that simplifies the process and allows for immediate confirmation of submission.

Key filing deadlines must be adhered to avoid penalties. Typically, businesses are required to file their sales tax returns on a monthly or quarterly basis, based on their sales volume. Payment options vary; businesses can choose from electronic funds transfer, checks, or other accepted methods.

Managing your sales tax obligations

Effective management of sales tax obligations is crucial for businesses in Rhode Island. Keeping meticulous records of sales transactions, tax collected, and any exemptions claimed is essential. The Rhode Island Division of Taxation emphasizes the importance of maintaining these records for at least five years in case of audits or inquiries.

If you discover an error after filing, amending the sales tax form is necessary. Ensure that corrections are made promptly to avoid additional penalties. Late filings or payments could result in interest and penalties. Familiarity with the consequences keeps businesses vigilant.

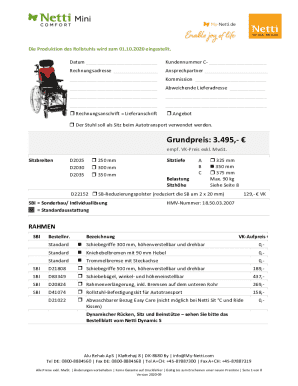

Utilizing pdfFiller for Rhode Island sales tax form management

pdfFiller significantly eases the management of the Rhode Island Sales Tax Form. The platform offers features such as PDF editing capabilities that allow users to amend and customize forms effortlessly. Users can seamlessly integrate electronic signatures, minimizing the time spent on paperwork and expediting the filing process.

Collaboration features enable teams to work together on form completion. This is particularly beneficial for businesses with multiple stakeholders involved in tax reporting. Utilizing a cloud-based platform allows users to access documents from anywhere, streamlining the workflow.

Related tax forms and resources

Alongside the Rhode Island Sales Tax Form, various other tax forms may be relevant for businesses operating in the state. This includes Use Tax Forms for taxable goods not sold by a retailer and Annual Reconciliation Forms that summarize the year’s financial information. Businesses should familiarize themselves with related filing requirements to ensure comprehensive compliance.

For those looking to expand their knowledge about tax management in Rhode Island, numerous resources are available. Links to these resources can often be found on the Rhode Island Division of Taxation website, providing taxpayers the necessary information to navigate their obligations effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find rhode island sales tax?

How do I execute rhode island sales tax online?

Can I edit rhode island sales tax on an Android device?

What is rhode island sales tax?

Who is required to file rhode island sales tax?

How to fill out rhode island sales tax?

What is the purpose of rhode island sales tax?

What information must be reported on rhode island sales tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.