Get the free IRS Form 8962: A Guide to the Premium Tax Credit

Get, Create, Make and Sign irs form 8962 a

Editing irs form 8962 a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs form 8962 a

How to fill out irs form 8962 a

Who needs irs form 8962 a?

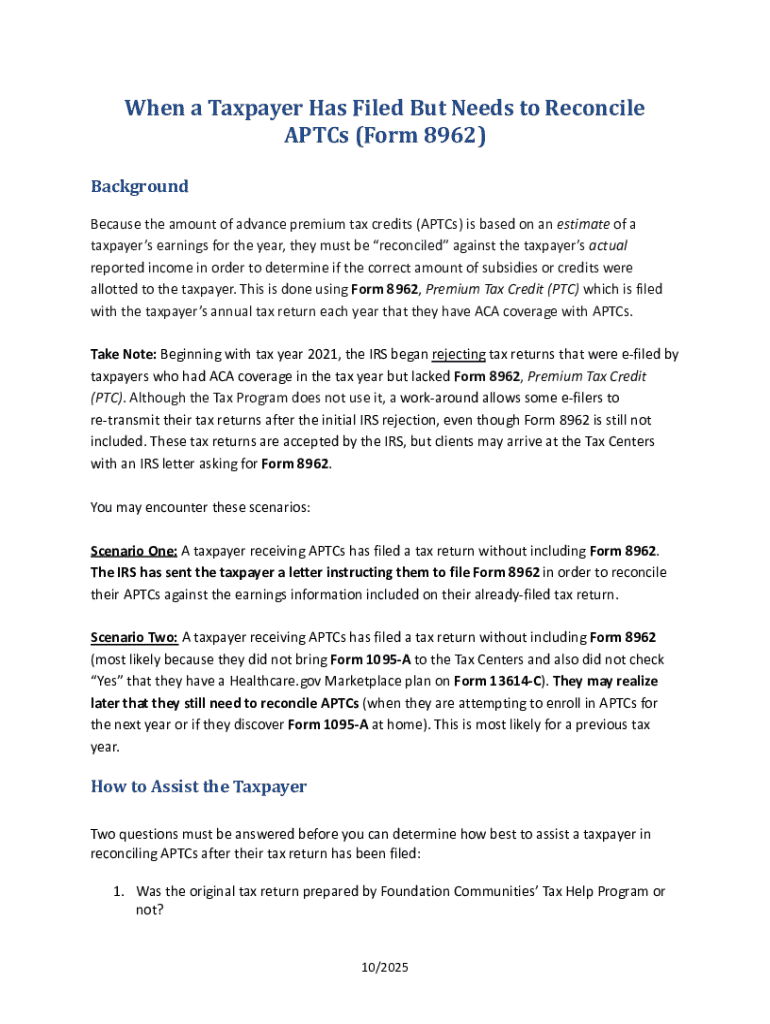

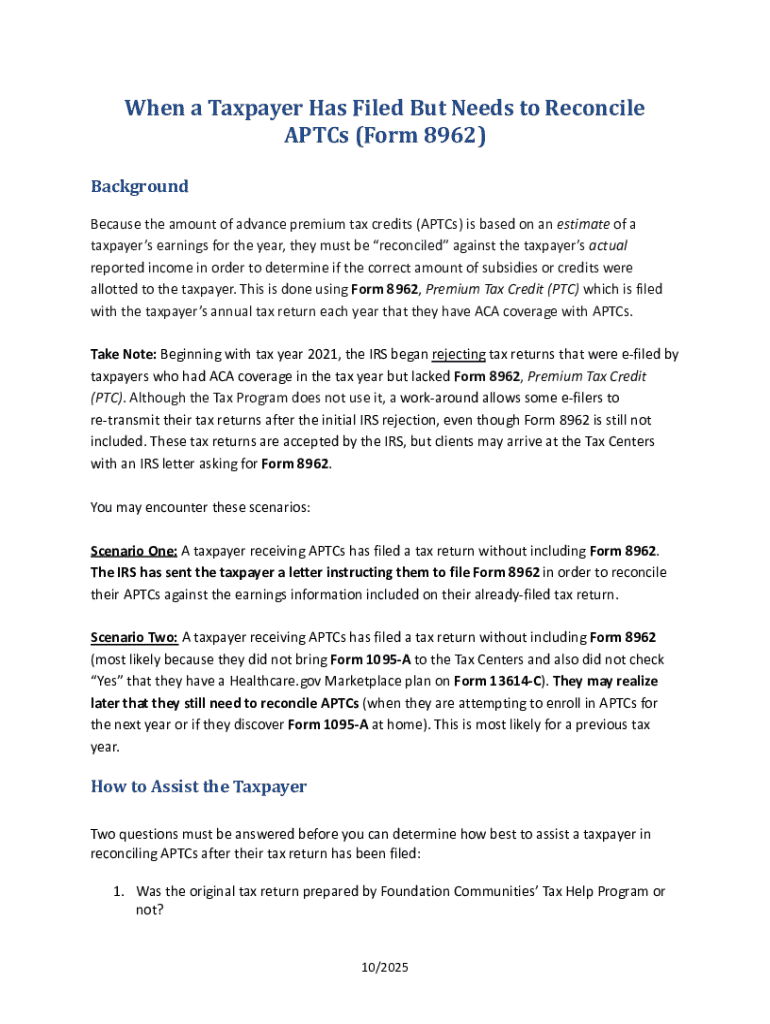

Understanding IRS Form 8962: A Comprehensive Guide

Definition and purpose of IRS Form 8962

IRS Form 8962, also known as the Premium Tax Credit (PTC) form, is vital for individuals who have obtained health coverage through the Health Insurance Marketplace. This form is used to reconcile any premium tax credits received in advance, based on an estimate of income, with actual income reported at tax filing time. If you have received a Form 1095-A, which details your health insurance coverage, you must complete Form 8962 when filing your tax return.

Accurately filling out Form 8962 is crucial as it ensures compliance with IRS regulations while potentially affecting the amount of your tax refund or due taxes. By correctly calculating your premium tax credits, you align your estimated credits with your final tax obligation, thus facilitating proper tax filings and incentives for maintaining health insurance coverage.

Essential components of IRS Form 8962

When completing IRS Form 8962, you’ll be required to provide extensive details about your personal situation. This includes taxpayer information, household size, and specific data related to the premium tax credit calculation. The form comprises separate sections where you’ll input your Modified Adjusted Gross Income (MAGI) and the applicable amount of health insurance premiums spent throughout the year.

Important definitions related to IRS Form 8962

To navigate Form 8962 effectively, familiarize yourself with critical terminology that influences how you fill out the document. Understanding these terms will ensure you correctly apply the tax credit to your filing.

Step-by-step guide to filling out Form 8962

Filling out Form 8962 can seem daunting, but breaking it down into manageable steps simplifies the process. Let’s go through a structured approach for successful completion.

Common mistakes to avoid when filing Form 8962

When submitting IRS Form 8962, awareness of common pitfalls can safeguard against potential rejections or audits. Many taxpayers unknowingly make critical errors that can complicate their filings.

In addition to recognizing common mistakes, ensuring accuracy during completion is paramount. Use checklists and worksheets to verify that your data is entered correctly before submission.

Frequently asked questions about IRS Form 8962

Navigating the intricacies of IRS Form 8962 raises numerous questions. Below are some common inquiries and the essential answers you need.

pdfFiller’s features for IRS Form 8962

To enhance your tax filing experience, pdfFiller offers interactive tools tailored for IRS Form 8962 management. This platform empowers users to create, edit, and securely manage their tax documents from the comfort of their own devices.

Moreover, with cloud-based features, users can access their forms from anywhere, ensuring flexibility during tax season.

Pro tips for using pdfFiller with IRS Form 8962

Maximizing the benefits of pdfFiller for IRS Form 8962 can streamline your tax documentation process substantially.

Implementing these tips can enhance the efficiency and accuracy of your tax preparation efforts.

Conclusion: Mastering your tax filing with IRS Form 8962

Successfully managing IRS Form 8962 is critical for those utilizing health insurance coverage through the Marketplace. By leveraging interactive tools like pdfFiller, you can simplify the tax preparation process, improve the accuracy of your filings, and remain compliant with IRS requirements. With a structured approach to filling out the form, along with an understanding of the necessary definitions and common pitfalls, you can ensure a smooth tax season, optimizing your potential benefits and savings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send irs form 8962 a for eSignature?

How do I complete irs form 8962 a online?

How do I edit irs form 8962 a on an iOS device?

What is IRS Form 8962 A?

Who is required to file IRS Form 8962 A?

How to fill out IRS Form 8962 A?

What is the purpose of IRS Form 8962 A?

What information must be reported on IRS Form 8962 A?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.