Get the free 8-K - 10/28/2025 - United Parcel Service, Inc. - UPS Investor Relations

Get, Create, Make and Sign 8-k - 10282025

How to edit 8-k - 10282025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 8-k - 10282025

How to fill out 8-k - 10282025

Who needs 8-k - 10282025?

8-K - 10282025 Form - A Comprehensive Guide

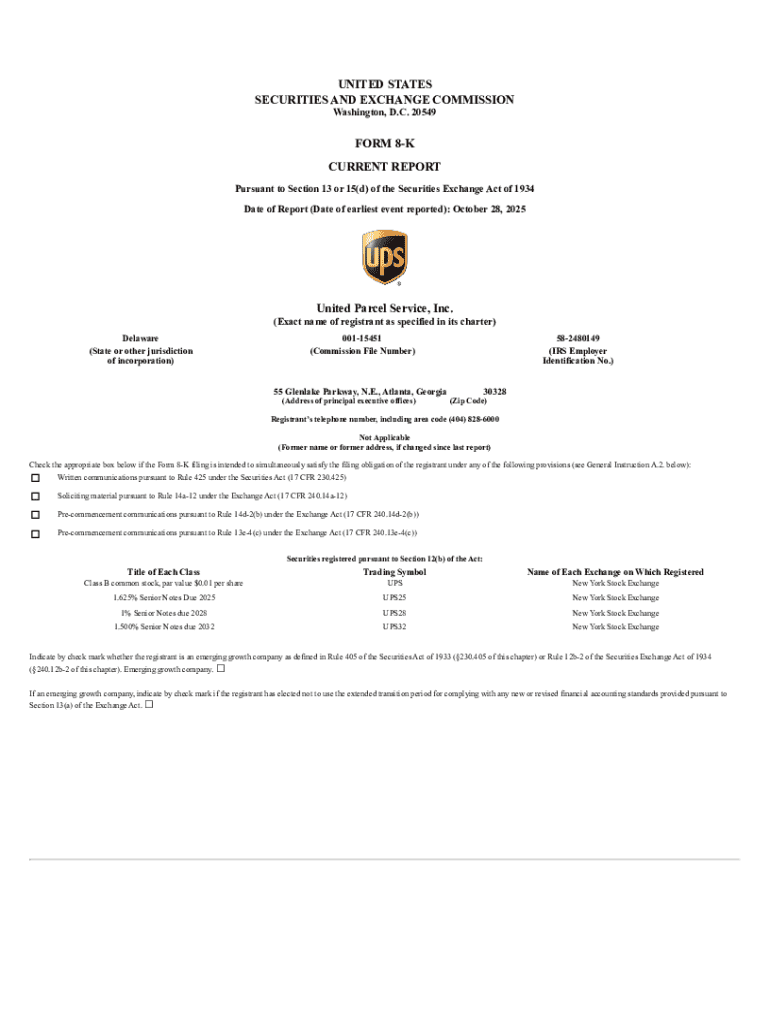

Understanding the 8-K form

The 8-K form is an essential filing for public companies, designed to inform investors and the general public about significant events that may impact the company's financial health or operations. It serves as a critical component of corporate transparency, allowing stakeholders to stay informed about changes within the organization.

Public companies are required to file an 8-K under specific circumstances, making this form a crucial tool in the regulatory landscape of corporate governance. The Securities and Exchange Commission (SEC) mandates this filing to uphold investor confidence and market integrity.

Specifics of the 10282025 filing

The 8-K - 10282025 form, filed on October 28, 2025, marks a significant moment in the company’s timeline, primarily related to changes in management and strategic direction. This date is pivotal as it follows several key developments within the company that led to the need for such a public disclosure.

Notably, the filing encompasses critical events, including a new appointment to the executive team, which may alter the strategic focus of the organization. In this context, this 8-K is not just a regulatory requirement but a vital communication piece with potential implications for future earnings and company direction.

Step-by-step guide to completing the 8-K form

Completing the 8-K form requires careful planning and execution. Begin by gathering all necessary information and documentation pertinent to the filing. This includes understanding the events that trigger the filing requirement, such as contract resolutions or changes in senior management.

As you move into the actual filling out of the form, access the online platform through pdfFiller. This user-friendly interface allows you to input executive summaries and event details seamlessly. It's crucial to attach any supplementary documents that support your disclosures, ensuring compliance with SEC regulations.

Editing and signing the 8-K form

Once you've completed the initial filing of the 8-K - 10282025 form, utilize the editing tools provided by pdfFiller to make any necessary changes. The platform’s collaborative features allow team members to input their feedback and suggestions, ensuring that the final document accurately reflects the company's position.

The eSigning process is straightforward and integrates seamlessly with pdfFiller's platform. Adding electronic signatures legally validates your document, making it compliant with SEC requirements. This ensures that your submission is not only timely but also fulfills legal obligations.

Managing your 8-K filings

Managing your filings effectively is crucial for ongoing compliance. Utilize pdfFiller to store and track all 8-K documents, creating a comprehensive overview of your company's disclosures. This ensures easy access to critical filings and their histories, aiding in future compliance efforts.

Setting up alerts through pdfFiller for filing confirmations can further streamline your compliance process. After submitting the 8-K, it’s also essential to consider any related follow-up documentation, such as the 10-Q or 10-K, ensuring that all information is cohesively reported.

Common challenges and solutions

Many companies encounter common challenges while filing the 8-K form. Misclassification of events is a frequent issue that can arise, leading to potential regulatory scrutiny. Ensuring that all events are correctly categorized is vital for compliance and minimizes the risk of penalties.

Late submissions pose another challenge, which can severely impact the company’s reputation and create legal exposures. To mitigate this, companies should establish an internal deadline well ahead of the actual filing date. Utilizing pdfFiller's customer support and consulting with legal or financial advisors can provide additional layers of assurance.

Case studies of 8-K filings

Analyzing notable 8-K filings can provide insights into the impact such disclosures can have on a company. For instance, significant management changes often lead to fluctuations in stock price and investor sentiment. This offers valuable lessons on the importance of timely and transparent communication with stakeholders.

Examining the context of the 10282025 filing as a case study showcases how a well-prepared disclosure can mitigate confusion among investors. The proactive communication regarding management changes allowed stakeholders to react positively, demonstrating the effectiveness of proper regulatory compliance.

Conclusion and next steps

Preparing for future filings requires ongoing diligence. Setting reminders for compliance tasks and utilizing pdfFiller's tools will streamline your documentation process. By remaining proactive, companies can effectively manage their disclosures and maintain transparency with stakeholders.

Beyond just the 8-K, organizations should be aware of additional filings such as the 10-Q and 10-K. Ensuring that all financial and operational disclosures are cohesively managed strengthens corporate governance and offers stakeholders a comprehensive view of the company's performance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 8-k - 10282025 on a smartphone?

How do I fill out the 8-k - 10282025 form on my smartphone?

How do I edit 8-k - 10282025 on an iOS device?

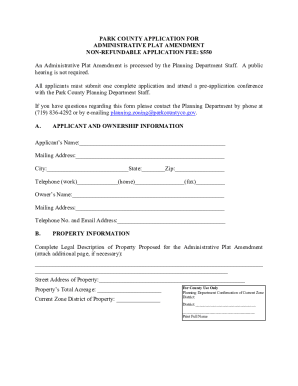

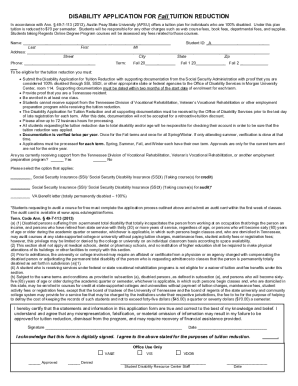

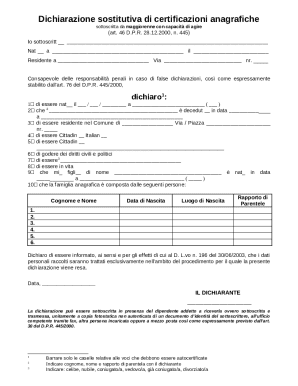

What is 8-k - 10282025?

Who is required to file 8-k - 10282025?

How to fill out 8-k - 10282025?

What is the purpose of 8-k - 10282025?

What information must be reported on 8-k - 10282025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.