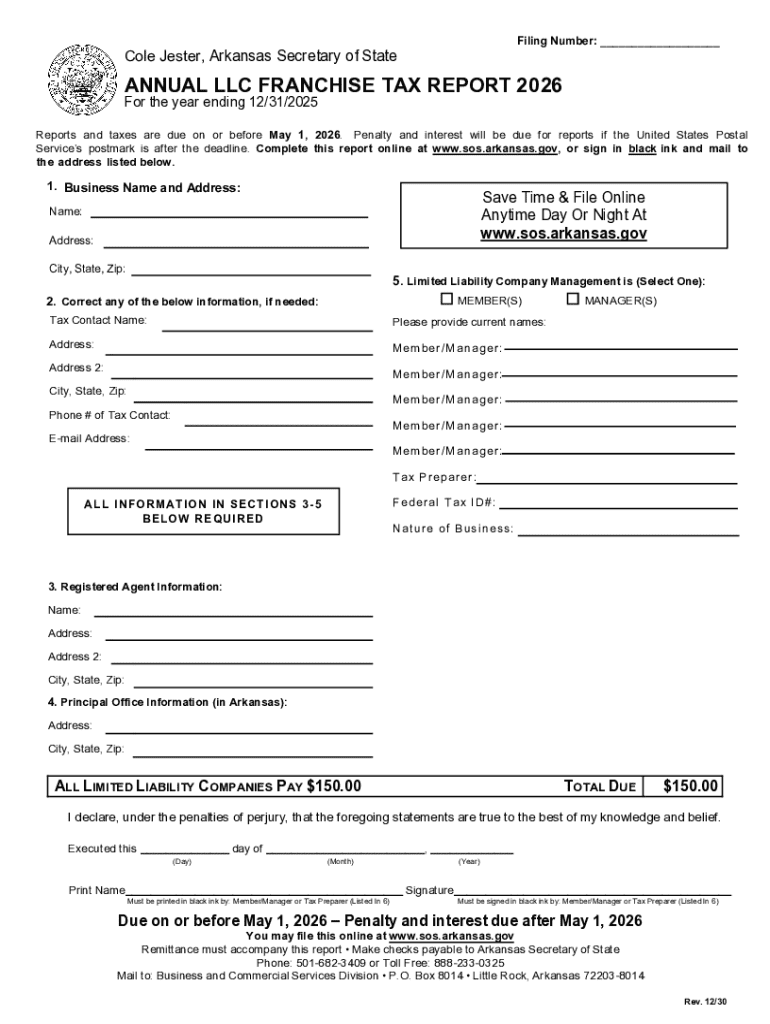

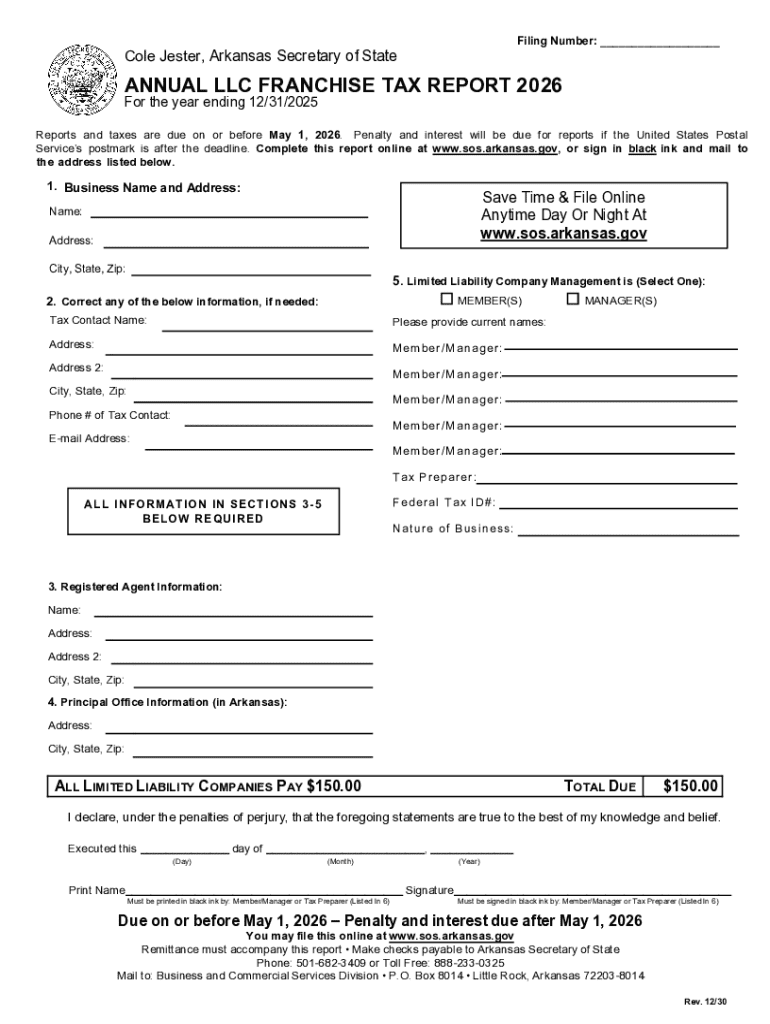

Get the free annual corporation franchise tax report 2026

Get, Create, Make and Sign annual corporation franchise tax

How to edit annual corporation franchise tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annual corporation franchise tax

How to fill out annual corporation franchise tax

Who needs annual corporation franchise tax?

Annual Corporation Franchise Tax Form: Your Ultimate Guide to Filing

Understanding the annual corporation franchise tax

The annual corporation franchise tax is a crucial tax requirement for many businesses operating in the United States. Unlike federal taxes, franchise taxes are imposed by individual states, which can vary significantly in terms of rates and structures. This tax is primarily levied on corporations for the privilege of conducting business within a state’s boundaries. This essential revenue source helps fund various state services and infrastructure, making it vital for corporate compliance.

The importance of the annual corporation franchise tax cannot be overstated. Failing to remit this tax can lead to severe penalties, including fines, interest on unpaid dues, and even the dissolution of the corporation in extreme cases. Understanding this tax and fulfilling filing obligations is crucial for any corporation aiming to maintain good standing with state tax agencies and avoid unnecessary legal complications.

Who is required to file?

Typically, most corporations that are registered to do business in a state will need to file an annual franchise tax return. Generally, corporations that generate revenue within the state, regardless of where they are incorporated, fall under this requirement. However, specific criteria may differ depending on the state, with some exempting certain types of organizations, such as non-profits or small businesses earning below a particular threshold.

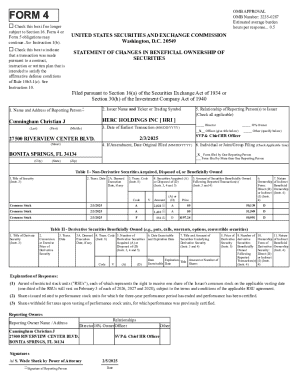

Regarding types of corporations affected, both C corporations and S corporations are generally subject to franchise taxes. Additionally, certain limited liability companies (LLCs) operating as corporations may also be included in classification for filing. Understanding your corporation's structure and obligations will help assure compliance with your state's regulations, effectively maintaining your operational standing.

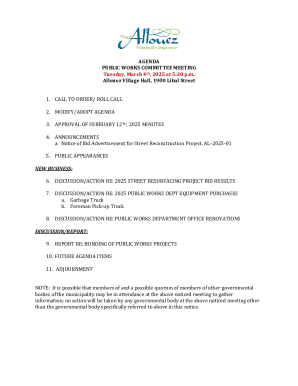

Key dates and deadlines

Each state has its own filing deadlines regarding the annual corporation franchise tax, so corporations must be aware of varying dates. In most cases, the filing deadline typically coincides with the corporation's fiscal year-end or calendar year-end, often due within a few months of that date. Common deadlines can range from March 15 to May 15, depending on state regulations.

Timely filing is imperative to avoid incurring penalties, late fees, or interest charges that can accumulate quickly and burden your financial standing. Additionally, states may impose administrative penalties, including late fees and loss of good standing status for corporations that fail to file on time. By keeping an organized schedule and adhering to deadlines, businesses can sidestep these unwanted consequences.

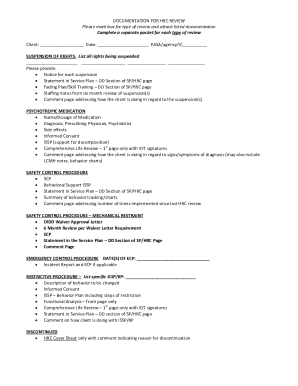

Preparing to file the annual corporation franchise tax form

Preparation is key when it comes to filing your annual corporation franchise tax form. Gathering the necessary documentation allows for a smoother filing process. Key documents include the corporation's financial statements, income reports, previous tax returns, and any relevant supporting paperwork regarding income, deductions, and credits.

Understanding your tax responsibilities is equally essential. Each state has different tax rates and calculation methods, making it crucial to familiarize yourself with these aspects specific to your corporation’s state of operation. Generally, franchise taxes can be calculated based on various criteria, including gross receipts, net income, or a flat-rate fee. Distinguishing between estimated and actual taxes is vital for accurate financial reporting and compliance.

Step-by-step guide to completing the annual corporation franchise tax form

Completing the annual corporation franchise tax form requires diligence and attention to detail. Follow this step-by-step guide to ensure accuracy and compliance with your state’s regulations.

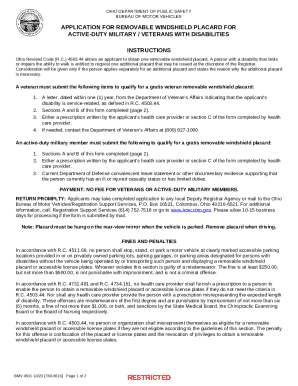

Step 1: Gather necessary information

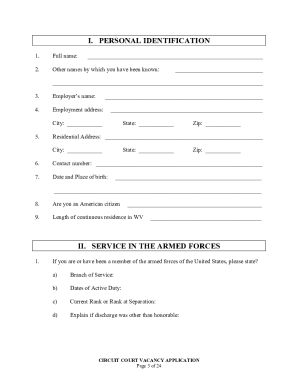

Begin by collecting essential information such as the company’s name, registered address, and tax identification numbers. This data forms the foundation for your franchise tax form.

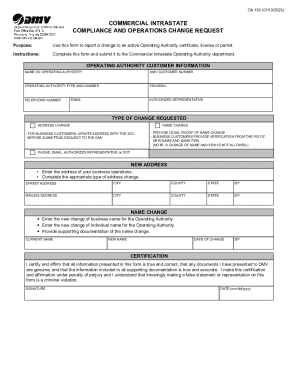

Step 2: Choose the correct form

Select the appropriate form required by your state for filing the annual corporation franchise tax. States may offer multiple forms based on corporation type, size, and revenue.

Step 3: Fill out the form

Carefully fill out the form, section by section. Key areas required generally include gross receipts, deductions, and credits that apply to your business. Pay close attention to accuracy, as errors can lead to unnecessary complications or financial penalties.

Step 4: Review the form for accuracy

Before submitting, take the time to review the completed form for any mistakes. Common errors can include miscalculations, inaccurate employee information system details, or missing signatures. A checklist of necessary components can help streamline this process.

Ensure you have all relevant data, and double-check that the calculations are correct—this will save valuable time and resources in the long run.

Step 5: Submit the form

Lastly, submit the completed annual corporation franchise tax form through the designated method: e-filing or paper filing. E-filing is often quicker as it allows for immediate confirmation of submission, ensuring your documents are processed efficiently.

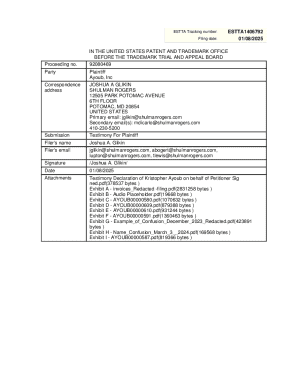

Editing and managing your annual corporation franchise tax form

Once your annual corporation franchise tax form is prepared, utilizing pdfFiller tools can assist in editing and managing the document efficiently. pdfFiller offers users the ability to edit PDF forms online, allowing for easy adjustments or updates to figures before submission.

Additionally, the collaborative features allow team members to work together on the form, enhancing accuracy and ensuring that all necessary parties contribute their input. This is particularly beneficial for companies that rely on multiple representatives to fulfill payroll or tax-related queries.

eSigning the annual corporation franchise tax form

Obtaining digital signatures is also streamlined through pdfFiller. After editing, the process of eSigning is simple and secure, allowing you to invite relevant parties to sign the document online effortlessly. This feature adds an additional layer of convenience while maintaining a solid record of compliance.

After filing: what comes next?

After successfully filing your annual corporation franchise tax form, tracking the submission status is essential. Most states provide a method to check whether your form has been received and accepted, allowing corporations to confirm compliance.

Additionally, preparing for potential audits or follow-up questions from tax authorities is prudent. Ensuring that all relevant documentation is organized and accessible can significantly streamline the inquiry process, enabling a quick, smooth response to any questions posed.

Exploring additional resources

Various state-specific tax resources exist to help companies navigate their annual corporation franchise tax responsibilities. Most states provide comprehensive information about tax rates, filing procedures, and additional requirements on their official tax agency websites.

In addition, interactive tools and tax calculators available online can provide assistance in estimating tax obligations, simplifying the often-complicated process of calculating dues based on revenue or gross receipts.

Frequently asked questions (FAQs)

Understanding common queries regarding the annual corporation franchise tax can clarify many uncertainties. One question frequently asked is what happens if the deadline is missed. Generally, filing a late return can result in penalties and late fees, so it is advisable to address this as soon as possible. If you realize you’ve made an error in a submitted form, states usually provide a process for amending the filing. This typically involves filling out a separate amendment form.

Additionally, those concerned about the financial implications of non-compliance often inquire about potential penalties. States can impose significant fines, so understanding the stakes is vital for all business owners to establish sound practices for timely compliance.

Customer support and help

If you need assistance with the annual corporation franchise tax form, reaching out to pdfFiller support can provide invaluable help. Customer support can guide you through any challenges associated with editing, eSigning, or submitting your forms.

Additionally, community forums offer the opportunity to engage with other users, allowing you to share tips and advice about tax filing. Establishing a connection with fellow users enhances your learning experience as you navigate the complexities of corporation taxes in collaboration.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in annual corporation franchise tax?

Can I create an electronic signature for the annual corporation franchise tax in Chrome?

Can I create an electronic signature for signing my annual corporation franchise tax in Gmail?

What is annual corporation franchise tax?

Who is required to file annual corporation franchise tax?

How to fill out annual corporation franchise tax?

What is the purpose of annual corporation franchise tax?

What information must be reported on annual corporation franchise tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.