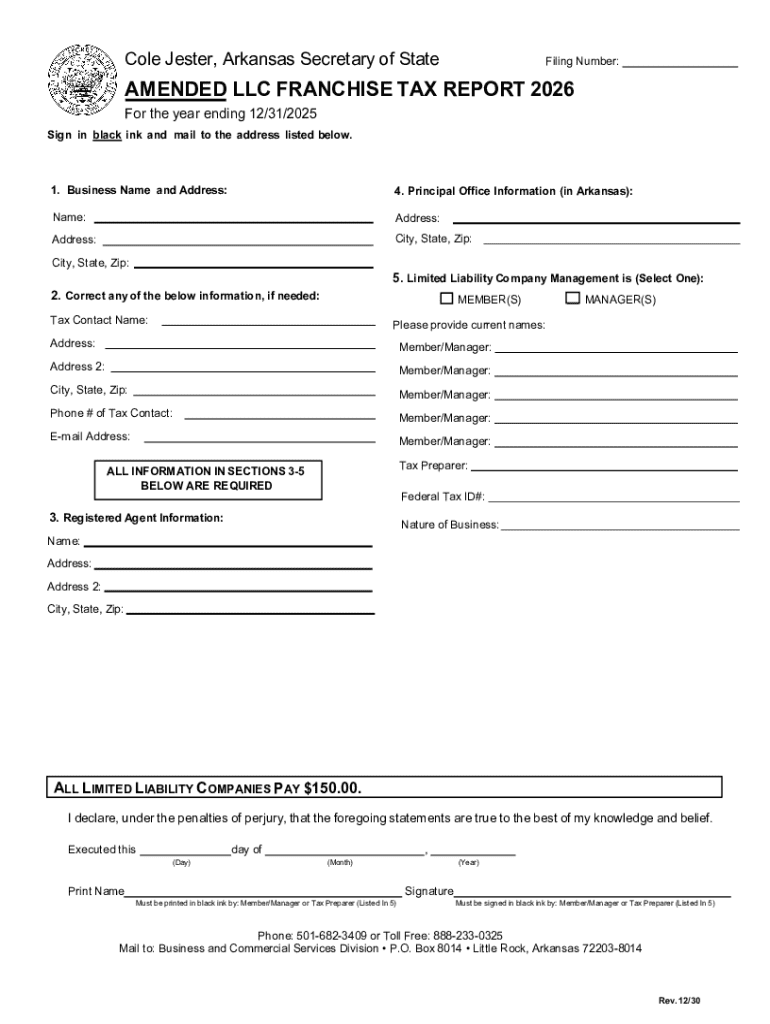

Get the free annual bank franchise tax report 2026

Get, Create, Make and Sign annual bank franchise tax

How to edit annual bank franchise tax online

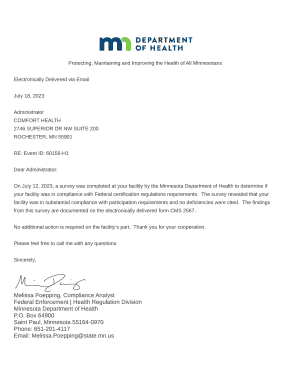

Uncompromising security for your PDF editing and eSignature needs

How to fill out annual bank franchise tax

How to fill out annual bank franchise tax

Who needs annual bank franchise tax?

Comprehensive Guide to the Annual Bank Franchise Tax Form

Overview of the annual bank franchise tax

The annual bank franchise tax is a critical revenue-raising mechanism implemented by various states to capture a fair share from banks and financial institutions operating within their jurisdictions. This tax system is designed to fund essential state services and maintain economic stability.

The purpose of the annual bank franchise tax extends beyond revenue generation; it ensures that banking institutions contribute to the communities they serve. This tax is typically calculated based on the institution's net worth or revenue, thereby reflecting the financial health and operational scale of the bank.

Who needs to file the annual bank franchise tax?

Typically, all chartered banks and financial institutions operating in the state are required to file the annual bank franchise tax. This includes both national and state-chartered institutions as well as savings banks and credit unions. However, smaller community banks or institutions that do not generate enough taxable revenue may qualify for exemptions.

Exemptions can vary by state, and it's essential for banks to consult their local revenue agency for specific guidelines. A common misconception is that only large banking institutions are subject to this tax; in reality, even smaller entities must be vigilant to avoid penalties or non-compliance.

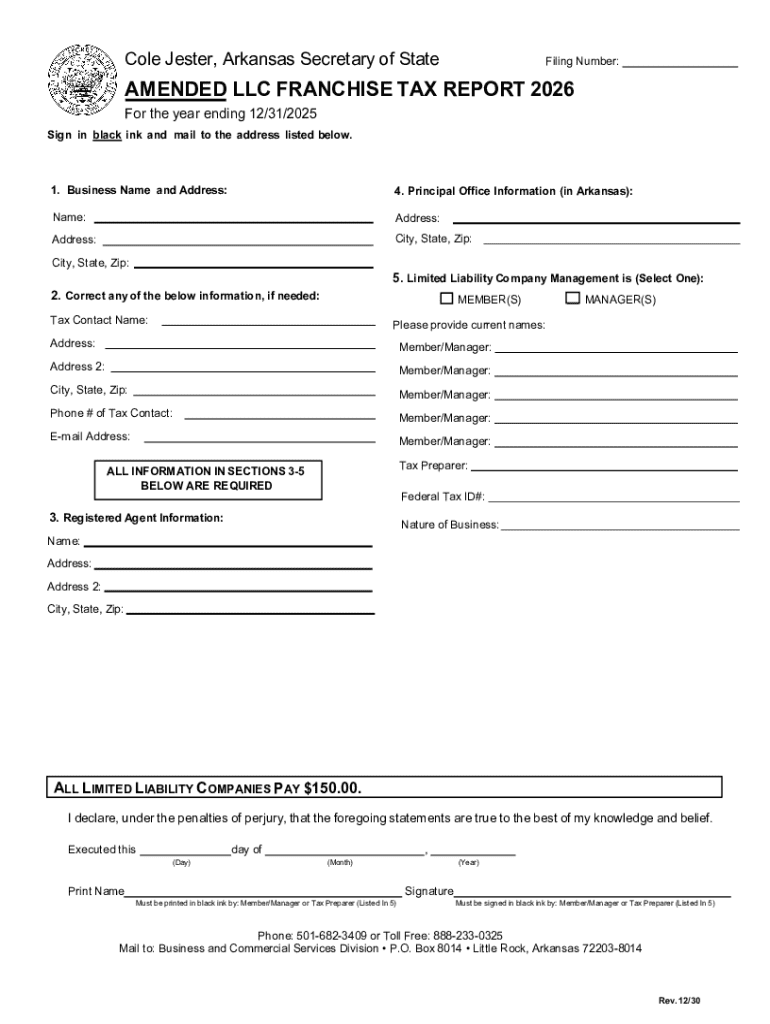

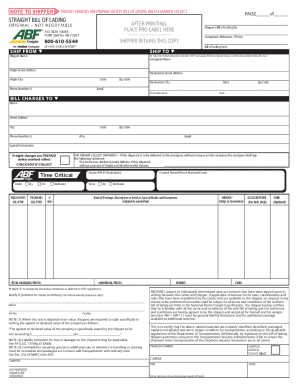

Understanding the annual bank franchise tax form

The specific form used for filing the annual bank franchise tax varies by state. However, most states utilize a standardized form named the 'Annual Bank Franchise Tax Return,' which often has a unique identifier depending on the state. It includes crucial sections dedicated to bank identification, revenue calculations, and deductions.

The key sections usually found within this form are:

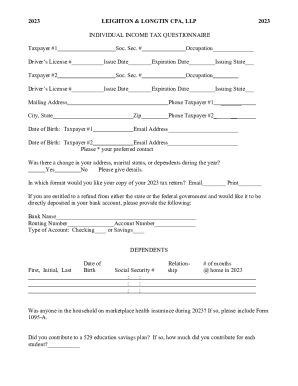

Step-by-step instructions for filling out the form

Filling out the annual bank franchise tax form can seem daunting, but following a structured approach simplifies the process. Here are the detailed steps to guide you.

Step 1: Gather required information

Before diving into the form, compile all necessary financial statements, including balance sheets, and income statements. These documents provide accurate figures for your taxable revenue and deductions.

Step 2: Complete the identification section

In this section, it’s crucial to ensure that the bank's name, address, and federal ID number are accurate to avoid discrepancies. Even minor errors can lead to significant complications down the line.

Step 3: Calculate taxable revenue

To calculate taxable revenue, refer to the total revenues reported in your financial statements. Be cautious as this section might require adjustments for non-taxable items or special considerations outlined by your state.

Step 4: Fill out deductions and credits

Deductions can substantially reduce your tax liability. Carefully review the allowable deductions listed in your state's guidelines. Common examples include operating expenses, bad debt write-offs, and contributions to local community projects.

Step 5: Review and confirm information

Before submitting the form, rigorously review all entries. Cross-reference your documents to ensure accuracy, as errors can lead to delays or penalties.

Electronic filing options for the annual bank franchise tax

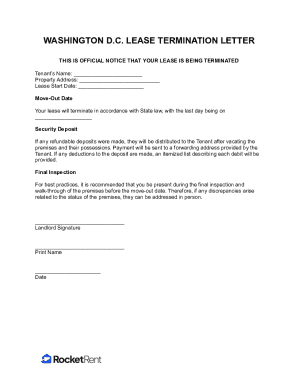

Filing your annual bank franchise tax electronically can significantly streamline the process. Utilizing platforms like pdfFiller offers numerous advantages, including easy document management and secure submission.

Here’s a brief guide to electronic filing using pdfFiller:

Step 1: Uploading the form to pdfFiller

Visit pdfFiller’s website and upload your completed form directly onto the platform. This allows for easy editing and signing.

Step 2: Editing and eSigning the form

Use pdfFiller’s features to edit any information that requires adjustment. After making changes, you can securely eSign the document, providing a legally binding signature.

Step 3: Submission process

Finally, follow the prompts to submit your form electronically, ensuring you receive a confirmation of submission, which is crucial for future reference.

Managing and storing your annual bank franchise tax documentation

Proper record-keeping is vital for compliance and auditing purposes. Utilizing pdfFiller’s cloud storage capabilities, you can store your annual bank franchise tax documentation securely and access it from anywhere.

Best practices for management include:

Establishing a systematic approach towards documentation will facilitate smoother audits and ensure you have all necessary files at your fingertips.

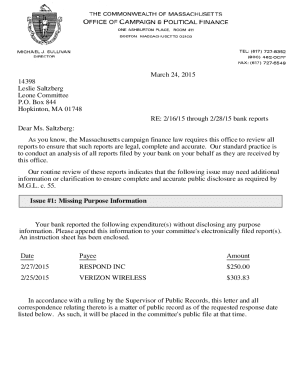

Common mistakes to avoid when filing

Filing the annual bank franchise tax form can be straightforward, but errors can easily occur. Recognizing common pitfalls can prevent future headaches.

Leveraging resources, like pdfFiller's tools, can assist in identifying and correcting these mistakes, enhancing your filing process.

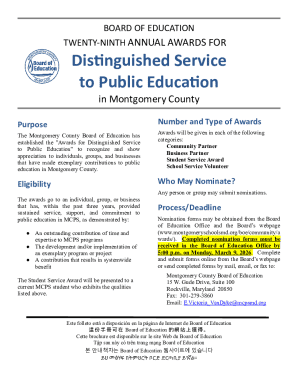

Key deadlines and important dates

Staying aware of filing deadlines for the annual bank franchise tax is crucial to avoid penalties. Most states require the tax to be filed annually, typically by a specified date in the first quarter.

Regularly review regulations to ensure compliance and timely submissions.

Frequently asked questions (FAQs)

Many inquiries arise regarding the annual bank franchise tax form. Addressing the most common questions can prove beneficial for filers.

Support and resources available

Navigating the intricacies of the annual bank franchise tax form can be complex, which is where pdfFiller comes into play. The platform offers various customer support options to assist users during the tax filing process.

Users can benefit from community forums where experts and peers exchange advice. Additionally, pdfFiller provides accessible templates for effective document management, catering to all user needs.

Case studies: Successful filing examples

Examining real-life scenarios where organizations successfully navigated the annual bank franchise tax can provide valuable insights. Many financial institutions have streamlined their processes by adopting effective strategies.

For instance, one community bank leveraged pdfFiller to enhance their filing accuracy by utilizing the platform's editing tools and secure eSigning capabilities. This reduced their submission process time significantly.

Testimonials reveal that institutions that prioritize thorough documentation and embrace digital solutions often experience fewer errors and increased efficiency.

Updates and changes in the annual bank franchise tax filing process

Being aware of recent changes in tax law or filing requirements is crucial for effective compliance. Many states periodically update their regulations regarding the annual bank franchise tax, affecting how institutions should file.

New reforms are likely introduced with incentives for timely filing or penalties for discrepancies. Financial institutions should stay updated by consulting their local tax authorities and leveraging platforms like pdfFiller to remain compliant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get annual bank franchise tax?

Can I edit annual bank franchise tax on an iOS device?

How do I fill out annual bank franchise tax on an Android device?

What is annual bank franchise tax?

Who is required to file annual bank franchise tax?

How to fill out annual bank franchise tax?

What is the purpose of annual bank franchise tax?

What information must be reported on annual bank franchise tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.