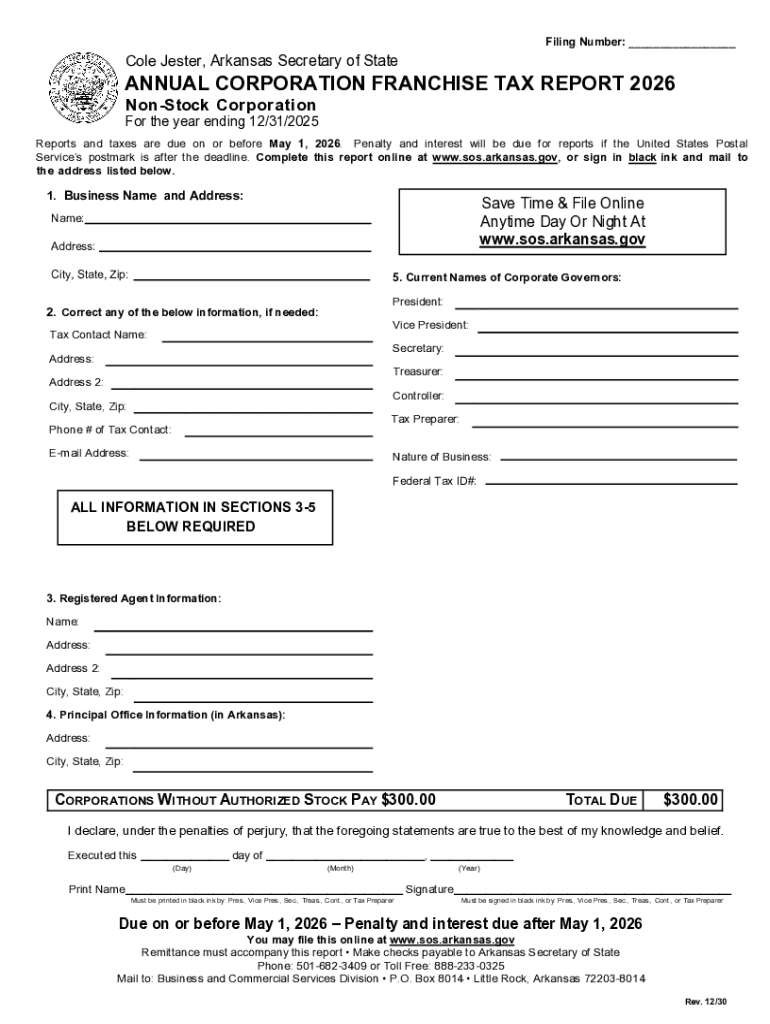

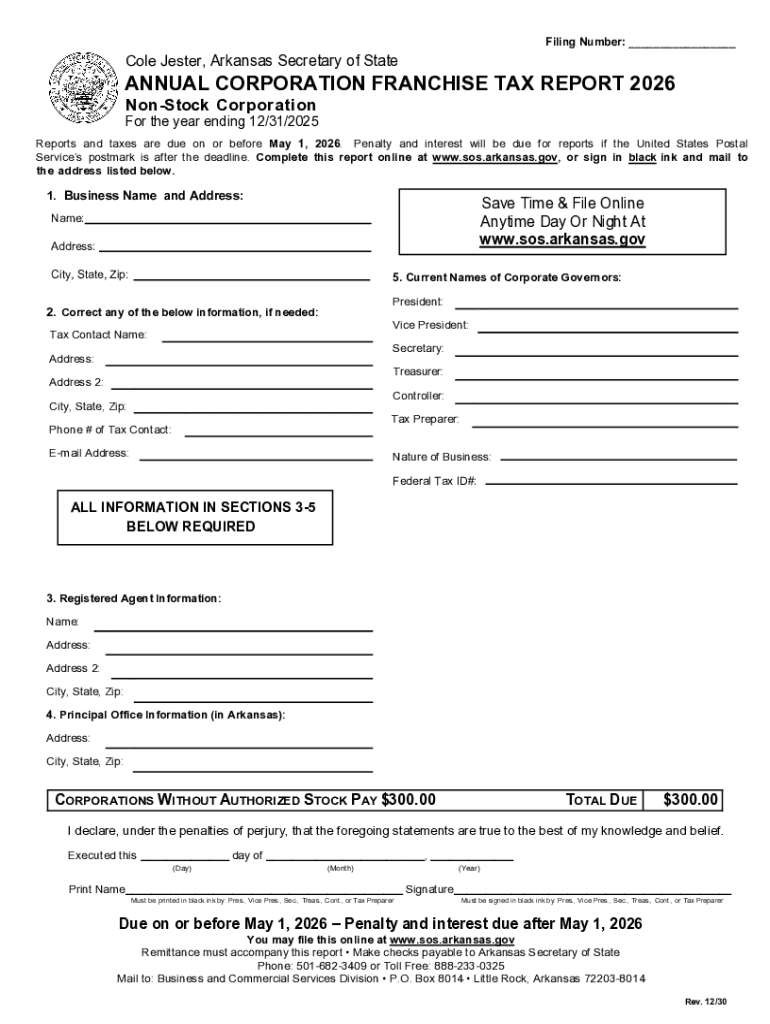

Get the free ANNUAL LLC FRANCHISE TAX REPORT 2026

Get, Create, Make and Sign annual llc franchise tax

Editing annual llc franchise tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annual llc franchise tax

How to fill out annual llc franchise tax

Who needs annual llc franchise tax?

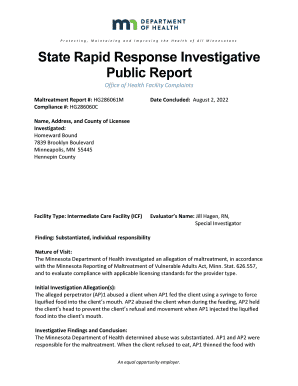

Understanding the Annual Franchise Tax Form: A Comprehensive Guide

Understanding the annual franchise tax

The annual LLC franchise tax is a fee that most states require limited liability companies (LLCs) to pay to maintain their legal status. This tax is not technically a tax on income but rather a charge for the privilege of doing business as an LLC within the state. Understanding this tax and complying with state requirements is critical for LLC members and owners to avoid penalties.

The importance of the annual franchise tax cannot be overstated. It’s essential for keeping your business in good standing with the state. Noncompliance could lead to administrative dissolution of your LLC, loss of limited liability protections, and personal liabilities for debts incurred by the company. Essentially, staying on top of franchise taxes is part of responsible business management.

Variances in franchise tax requirements among states can create confusion. For instance, California has one of the highest annual LLC franchise tax fees, whereas some states do not impose any franchise tax at all. Therefore, it’s important to be well-informed about the specific requirements and costs associated with your state of formation to effectively manage your LLC's tax obligations.

Key components of the annual franchise tax form

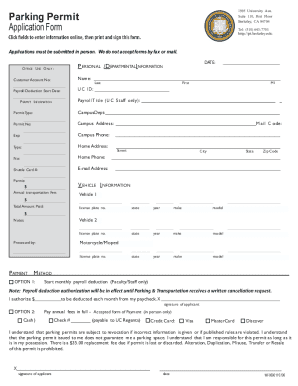

Filling out the annual LLC franchise tax form accurately is crucial to avoid penalties and ensure compliance. Generally, this form will require certain essential information about your LLC.

In addition to basic identification details, you will also be required to provide important financial information, including any revenue reporting requirements, asset valuations, and available deductions or exemptions. Ensure accuracy as errors can result in audits or penalties.

Lastly, don’t forget to complete the signature and certification section. This is crucial, as it affirms the authenticity of the information provided on the form.

Step-by-step guide to filling out the annual franchise tax form

To begin the process, gather all necessary documents related to your LLC’s financial status and prior tax filings. This preparation will streamline the completion of the tax form. Start by reviewing the requirements of your specific state to ensure your subsidiaries comply with local rules.

It is paramount to avoid common pitfalls when filling out the form. Misinterpretation of tax liability definitions and calculation of your LLC's financials can lead to significant issues. Always consider consulting a tax professional if you have uncertainties.

eSigning and submitting the annual franchise tax form

Many states now allow electronic signatures for the submission of tax documents. Using pdfFiller, you can easily eSign your annual LLC franchise tax form, saving time and ensuring your submission is secure.

Utilizing pdfFiller’s cloud-based tools ensures that users can conveniently manage the submission process from anywhere, providing a significant advantage over traditional methods.

Managing your ’s franchise tax obligations with pdfFiller

Keeping track of upcoming due dates and tax obligations can be challenging, especially for entrepreneurs managing multiple LLCs. pdfFiller offers solutions to streamline this process.

By leveraging the features offered by pdfFiller, LLC owners can effectively manage their tax responsibilities without becoming overwhelmed by deadlines and details.

Dealing with franchise tax issues

Missing a deadline for the annual LLC franchise tax can lead to serious consequences. It's not just about the tax owed; penalties can escalate quickly, and your LLC could face dissolution if filings are repeatedly neglected.

Being proactive, understanding the potential ramifications, and using tools like pdfFiller to manage documentation can mitigate risks associated with franchise tax obligations.

FAQ: Common questions about the annual franchise tax form

Understanding the nuances of the annual LLC franchise tax form can create confusion. Here are some common questions that arise among LLC owners.

Understanding these common questions can help alleviate concerns and ensure better compliance with franchise tax obligations.

Conclusion: Simplifying your annual franchise tax filing

Filing the annual LLC franchise tax form does not need to be a daunting experience. With the right resources, such as the tools provided by pdfFiller, managing these responsibilities becomes a streamlined process.

Staying proactive with your document management and consistently monitoring your tax obligations will help you maintain the good standing of your LLC. Leverage the features of pdfFiller to simplify your annual filings and enhance your overall operational efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute annual llc franchise tax online?

Can I create an eSignature for the annual llc franchise tax in Gmail?

How do I fill out annual llc franchise tax using my mobile device?

What is annual llc franchise tax?

Who is required to file annual llc franchise tax?

How to fill out annual llc franchise tax?

What is the purpose of annual llc franchise tax?

What information must be reported on annual llc franchise tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.