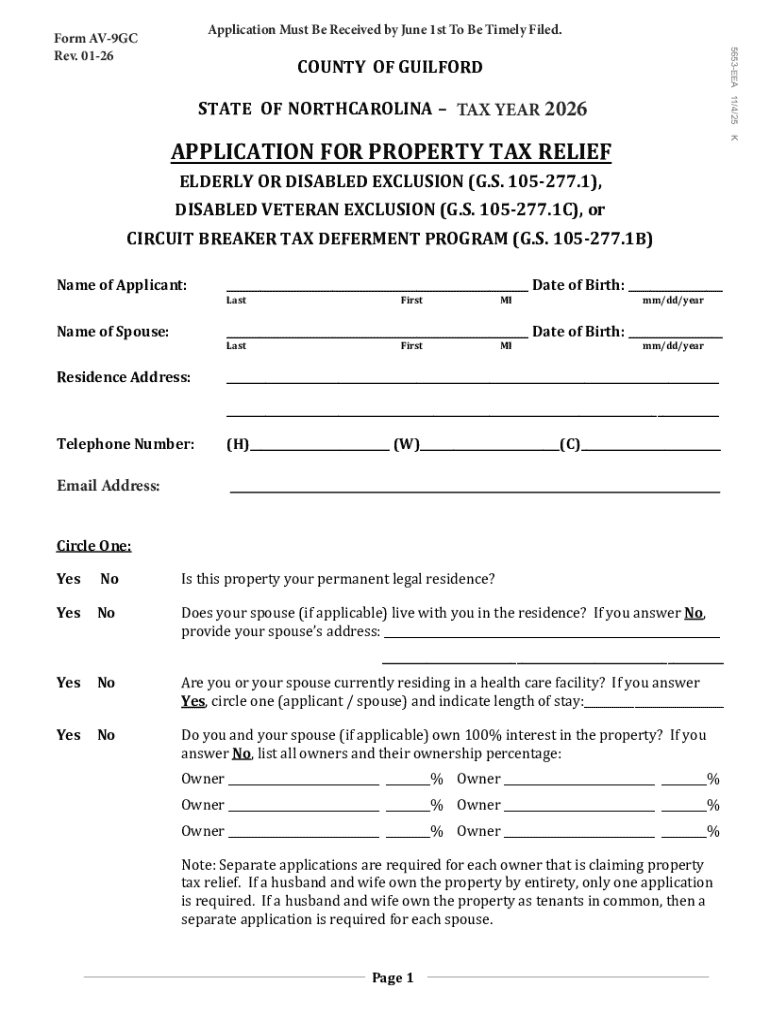

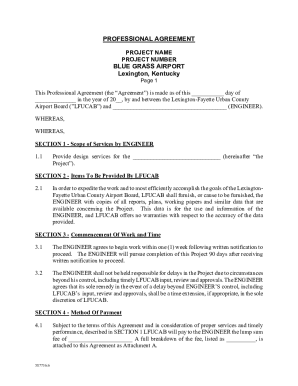

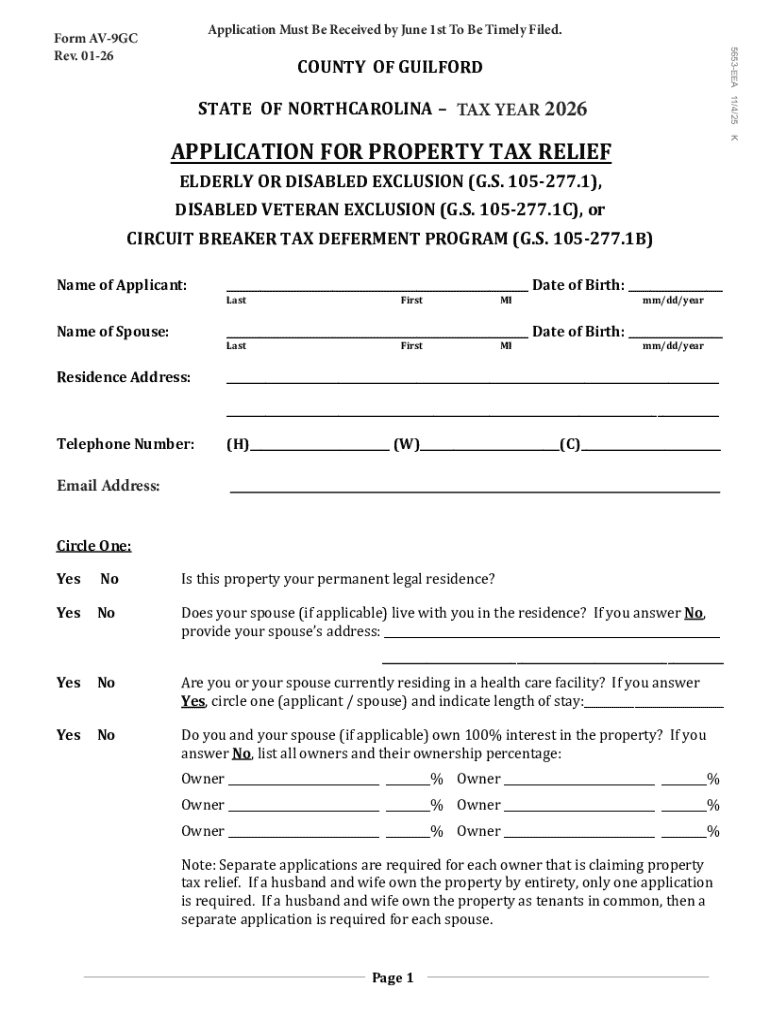

Get the free Application for Property Tax Relief - Guilford County

Get, Create, Make and Sign application for property tax

Editing application for property tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for property tax

How to fill out application for property tax

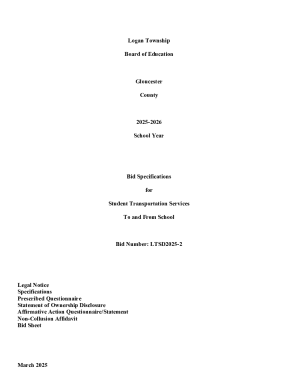

Who needs application for property tax?

Application for Property Tax Form: Your Ultimate Guide

Understanding property tax forms

Property tax forms are essential documents used by tax authorities to determine property values for taxation purposes. These forms play a crucial role in property ownership, ensuring that property owners are correctly assessed and taxed according to their holdings. Without accurate property tax forms, discrepancies in tax assessments can lead to unfair taxation and confusion among property owners.

Every property owner must be familiar with the various types of property tax forms, as these documents can significantly impact tax liabilities. Understanding which forms apply to your property type is vital for compliance and financial planning. This includes residential property tax forms for personal homes, commercial property tax forms for business properties, and exemption applications designed for specific demographics such as seniors and veterans.

The application process for property tax forms

Filing the application for property tax forms might seem daunting, but it can be simplified through a step-by-step approach. The first step requires gathering all necessary information, such as property ownership documents, previous tax assessments, and identification details like a driver’s license or Social Security number. This groundwork is essential for a smooth application process.

Next, access the relevant form tailored to your locality and property type. Many local tax office websites offer downloadable PDFs or online fillable forms. Additionally, platforms like pdfFiller can streamline this process by allowing you to find and showcase the correct forms.

Filling out the form requires careful attention to detail. Ensure you provide thorough information regarding property details like address, size, type, and your contact information. If you are requesting any tax exemptions, it is crucial to specify these requests clearly to avoid delays in processing your application.

Utilizing pdfFiller for your property tax form

pdfFiller is a powerful solution for managing your property tax form efficiently. Users can enhance their document editing experience with features that allow for seamless PDF modifications, electronic signatures, and collaborative efforts for teams coordinating on tax submissions. It provides a user-friendly approach that caters specifically to individuals and teams seeking cloud-based document management solutions.

To utilize pdfFiller effectively, start by uploading your property tax form to the platform. Once uploaded, you can easily edit the document using various tools—adding text, checking boxes, or inserting signatures. After completing your form, saving and sharing it is straightforward. pdfFiller offers multiple options to share your form for review or signature via email or cloud storage.

Troubleshooting common issues

Even with careful preparation, issues can arise during the application process for property tax forms. Common concerns include missed submission deadlines and discrepancies in property information. It’s wise to familiarize yourself with local deadlines as each appraisal office varies. If you find that your property information is incorrect in the tax records, contact your local assessor's office to initiate corrections swiftly.

For frequently asked questions, resources are readily available online. Many local tax authority websites also provide extensive FAQs, guiding you through common challenges. If further assistance is needed, reaching out to your local tax authority office is advisable. pdfFiller’s support can also help troubleshoot document-related inquiries, ensuring you have the needed information at your fingertips.

Language assistance and accessibility

For non-English speakers, it's crucial to have access to property tax forms in multiple languages. Many local authorities are now providing translated forms, thereby increasing accessibility for diverse populations. pdfFiller's platform also supports different languages, ensuring you can easily navigate, fill out, and manage your property tax forms regardless of your primary language.

If language support is needed, check with your local tax authority regarding available resources. Utilizing pdfFiller can further streamline the process, as it adapts to different language requirements, enabling users to focus on completing their property tax forms efficiently without language barriers.

About pdfFiller’s document solutions

pdfFiller is at the forefront of document management, offering a robust platform designed for seamless interaction with PDFs. Users appreciate the ease of use, from document editing to electronic signature capabilities, making it a preferred choice for individuals managing property tax forms. Quick uploads, intuitive navigation, and reliable customer support further cement pdfFiller’s reputation as a leader in the document solutions sector.

Customer testimonials highlight the positive experiences of users who have navigated the complexities of property tax forms successfully. With pdfFiller, property owners can manage their documents with confidence, knowing they have a multifaceted tool at their disposal.

Connect with pdfFiller

Engaging with pdfFiller is straightforward, with various contact options available for support and inquiries. The pdfFiller website offers several resources, including live chat and email support, ensuring users can receive timely assistance when needed. Additionally, following pdfFiller on social media platforms provides updates on new features, tips for using the platform, and insights from the community.

By staying connected, users can enhance their experience with the document management platform, utilizing all available features to optimize their application for property tax form processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send application for property tax to be eSigned by others?

Can I sign the application for property tax electronically in Chrome?

Can I create an eSignature for the application for property tax in Gmail?

What is application for property tax?

Who is required to file application for property tax?

How to fill out application for property tax?

What is the purpose of application for property tax?

What information must be reported on application for property tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.