Get the free Form 1040, U.S. individual income tax return - 01IOWA

Get, Create, Make and Sign form 1040 us individual

How to edit form 1040 us individual online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 1040 us individual

How to fill out form 1040 us individual

Who needs form 1040 us individual?

Comprehensive Guide to Form 1040: U.S. Individual Income Tax Return

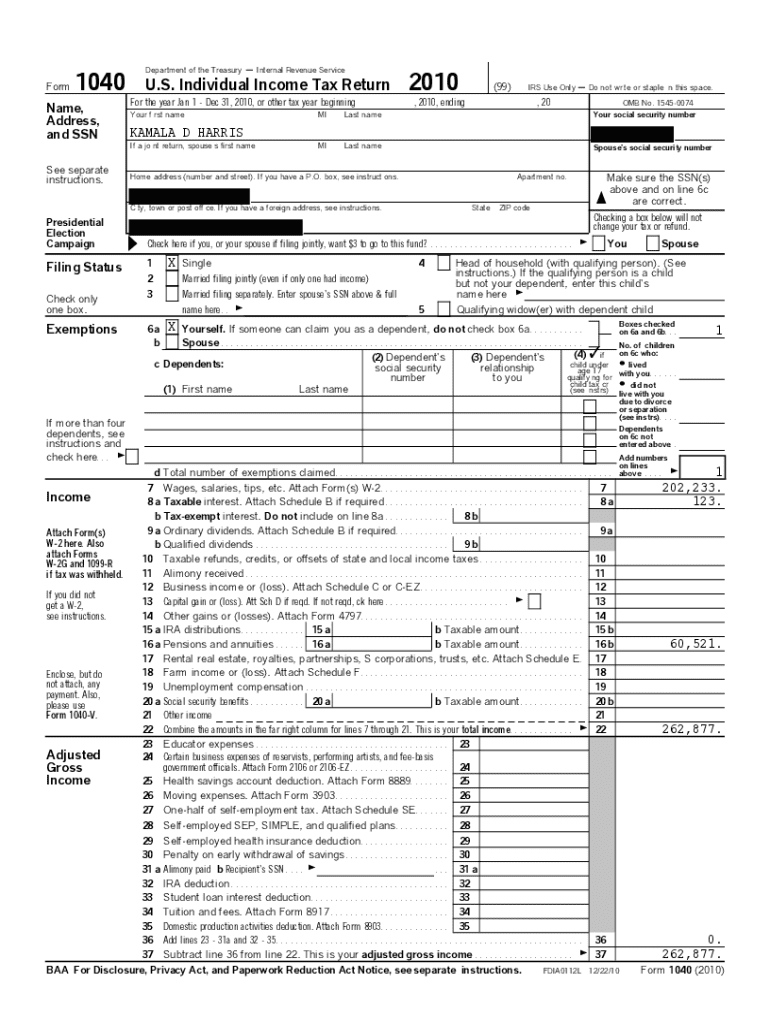

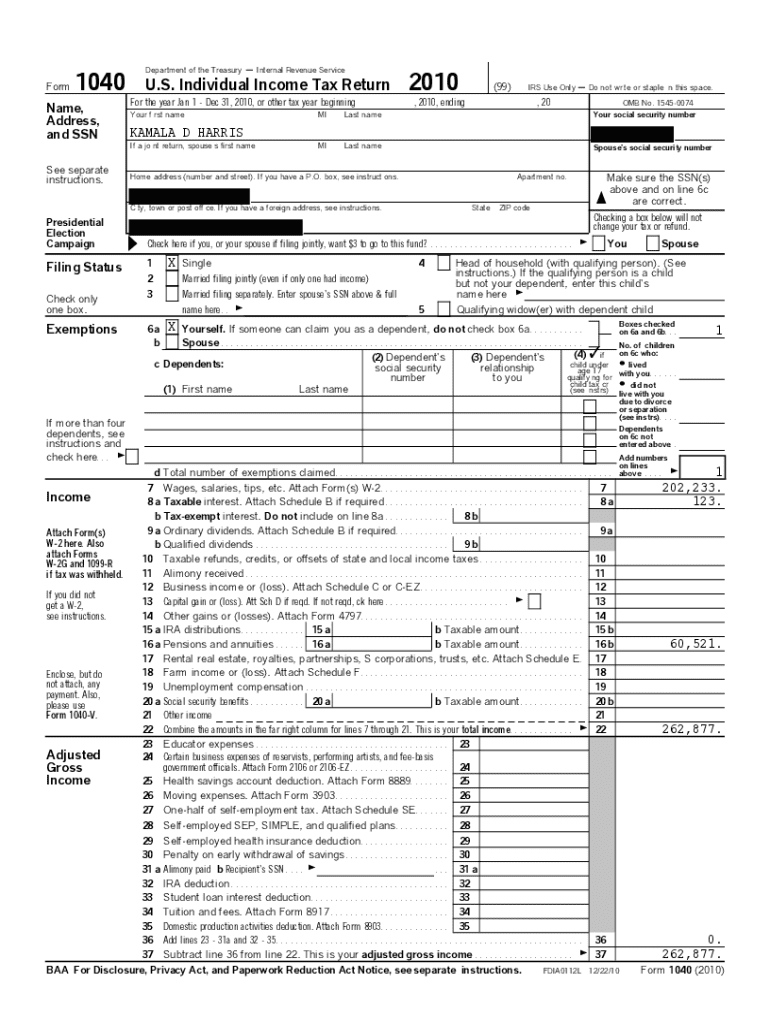

Understanding Form 1040

Form 1040 is the standard income tax return form that U.S. citizens and residents use to report their annual income to the Internal Revenue Service (IRS). This essential document serves as a comprehensive summary of an individual taxpayer's earnings, tax liabilities, and credits applicable for a given tax year. Accurate filing of Form 1040 is critical because it directly impacts the amount of tax owed or the refund received.

In recent years, Form 1040 has undergone key changes that simplify the filing process for many taxpayers. The IRS often updates the form to reflect tax law changes, including modifications in rates or deductions. Staying informed about these updates ensures compliance with current tax laws and maximizes your potential for refunds.

Who should file Form 1040?

Most U.S. citizens and tax residents are required to file Form 1040 if their income exceeds a specified threshold set by the IRS, which varies based on filing status, age, and type of income. For example, a single filer under 65 must file if they earn more than $12,550 in tax year 2021.

However, specific scenarios present exceptions to these requirements. Individuals below the threshold may still need to file if they owe special taxes or want to claim a refund for withheld taxes. Additionally, self-employed individuals, including freelancers and gig economy workers, should generally file Form 1040, as their income may exceed the threshold once various deductions are factored in.

What income needs to be reported on Form 1040?

When completing Form 1040, taxpayers must report several categories of income, including:

For U.S. citizens living abroad or expat taxes, reporting foreign income requires careful consideration. The Foreign Tax Credit may come into play, allowing U.S. expatriates to avoid double taxation. It's vital to report all income accurately to prevent common mistakes to avoid in income reporting, such as failure to report foreign accounts or misclassifying income types.

Deductions and credits available on Form 1040

Taxpayers can reduce their taxable income through deductions and credits. Form 1040 offers two main types of deductions: standard and itemized. Choosing between these two depends on an individual's financial situation. The standard deduction for 2021, for instance, is $12,550 for single filers, while itemized deductions encompass various expenses such as mortgage interest, state taxes, and medical expenses, potentially leading to greater tax savings for some.

Furthermore, numerous tax credits can also be claimed to lower an overall tax liability. Notable examples include:

Understanding how to choose between standard and itemized deductions helps optimize tax savings. Using a tax calculator could also assist in deciding which option offers greater benefits.

Filling out Form 1040: Step-by-step instructions

Completing Form 1040 efficiently involves meticulous preparation. Before starting, gather required documents such as W-2 forms, 1099s for various income sources, and receipts for deductible expenses. Understanding one’s tax liability, including the deductions and credits applicable, is crucial for accurate filing.

Navigating the sections of Form 1040 includes key areas:

For added convenience, using pdfFiller to fill out Form 1040 not only streamlines the process but also ensures that you can utilize interactive tools and templates. This application provides a secure environment for these tax documents, ensuring they are electronically signed and properly shared where necessary.

Managing and submitting your completed Form 1040

Once you've completed Form 1040, managing the submission is the next critical step. There are two primary submission methods: e-filing or mailing a paper return. E-filing is typically faster and often results in quicker refunds compared to traditional mailing methods.

It's essential to adhere to the IRS deadlines, usually falling on April 15th of each year. However, extensions may be granted if applied for in advance. Regardless of the method chosen, it's a best practice to keep copies of all filed documents for your records, should you need them for future reference or to respond to any inquiries.

Addressing common issues with Form 1040

Mistakes in tax filings are not uncommon. If you realize you've made an error on your Form 1040 after submission, it is recommended to amend the return as soon as possible by filing Form 1040-X. Responding promptly to IRS notices regarding your Form 1040 is crucial as well. It’s advisable to approach any request for clarification or audit with preparedness and documentation.

Dealing with audits can be stressful, but understanding that the IRS typically selects returns randomly or based on inconsistencies can help alleviate concerns. Gathering necessary documentation and being organized is vital in handling such inquiries efficiently.

Frequently asked questions about Form 1040

Many taxpayers have questions specific to their Form 1040 filing. Clarifications on particular lines of the form, updates on recent tax law changes, and essential resources for further assistance can significantly aid the process. Taxpayers often wonder about which documents are necessary for specific deductions or credits and how changes in income or life circumstances can impact their tax return.

It's also advisable to consult tax professionals or reliable resources to stay updated on tax rulings affecting your filings. Utilizing platforms like pdfFiller provides access to comprehensive support and interactive tools that can guide taxpayers through complex scenarios.

How pdfFiller enhances your Form 1040 experience

pdfFiller empowers users to streamline document management by offering unique features for filling, editing, and signing tax forms. The platform allows users to collaborate effectively with tax professionals or team members, ensuring everyone's input is seamlessly integrated into the final return.

Additionally, the secure cloud-based management of tax documents ensures that all sensitive information is accessible yet protected. This approach not only alleviates stress during tax season but fosters an organized and efficient filing experience.

Interactive tools and resources

With pdfFiller, users have access to interactive tools like tax calculators that help estimate potential refunds or amounts owed. These resources can be invaluable in planning for the tax season. Alongside, step-by-step video guides are available to navigate through the complexities of Form 1040.

A checklist for filling out Form 1040 is particularly helpful for ensuring that all needed documents are accounted for, and no details are overlooked. These tools enhance the filing experience and help to clarify the often daunting tax process.

Best practices for organizing your tax documents

Keeping records throughout the year can alleviate much of the stress associated with tax preparation. Developing a system for organizing receipts, W-2s, and other important documents ensures that nothing is forgotten as tax season approaches.

Choosing the right tools for document management, such as pdfFiller, could save time and resources during busy periods. This preparation not only aids in timely and efficient filing for the current year but also sets a solid foundation for future tax seasons.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

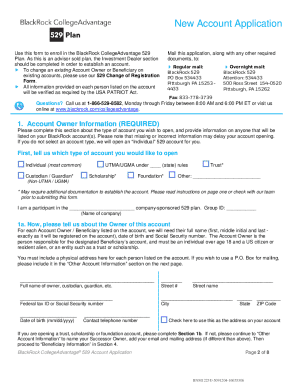

How do I complete form 1040 us individual online?

How do I edit form 1040 us individual in Chrome?

How do I complete form 1040 us individual on an Android device?

What is form 1040 us individual?

Who is required to file form 1040 us individual?

How to fill out form 1040 us individual?

What is the purpose of form 1040 us individual?

What information must be reported on form 1040 us individual?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.