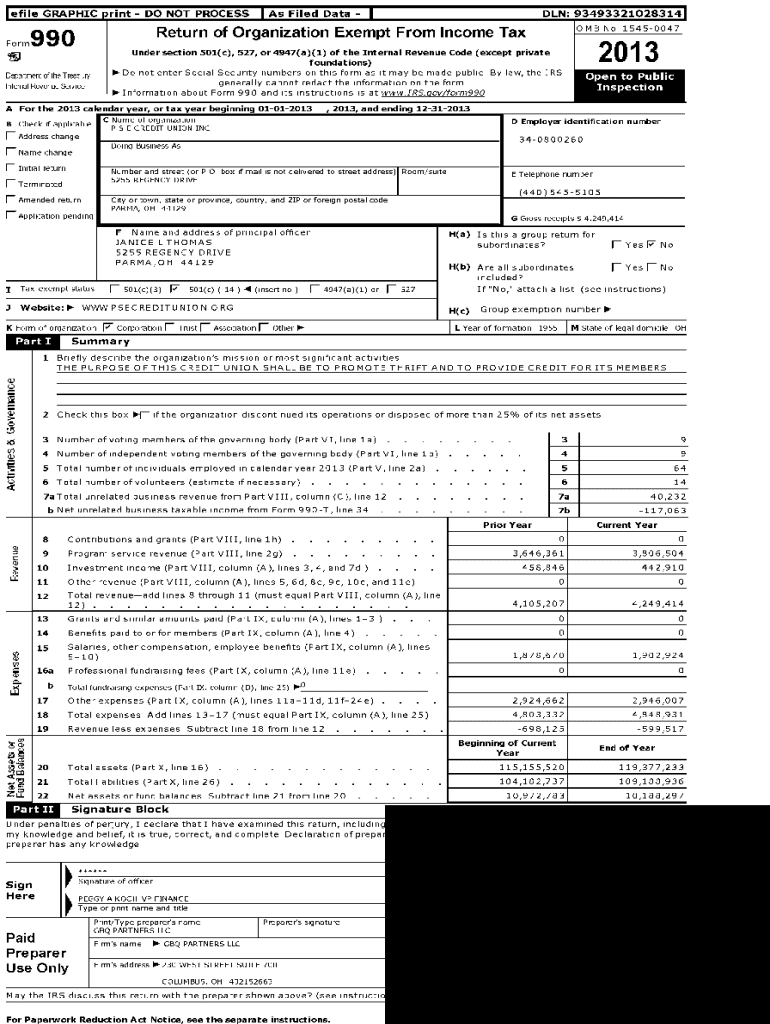

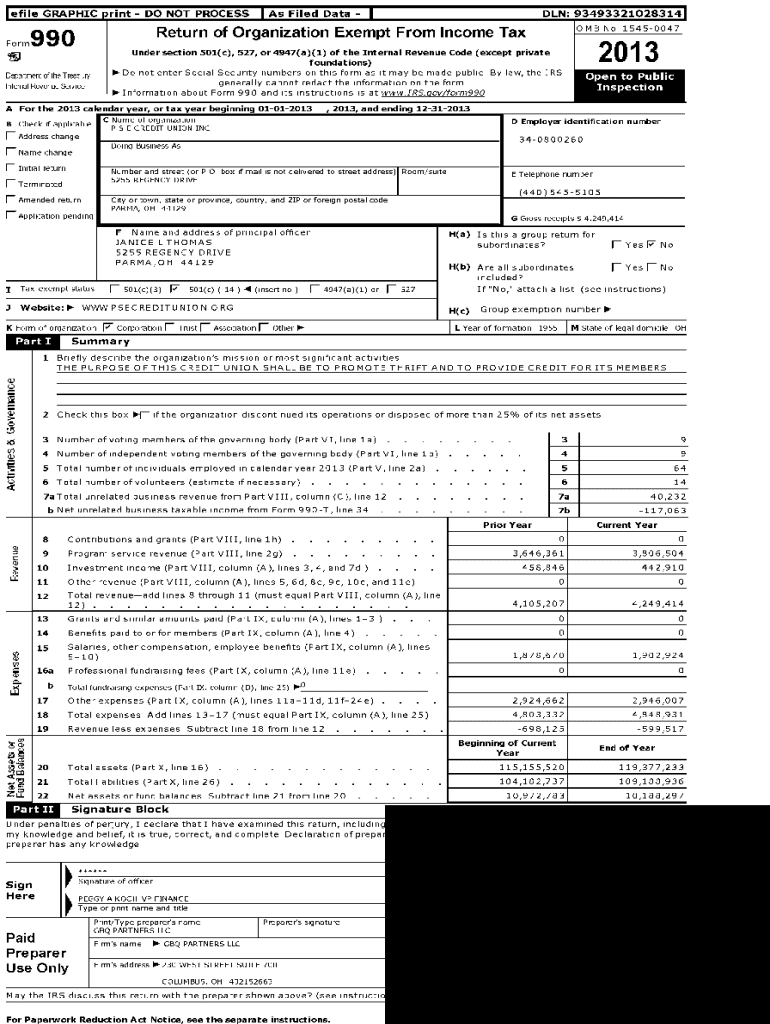

Get the free P S E CREDIr UNION INC

Get, Create, Make and Sign p s e credir

How to edit p s e credir online

Uncompromising security for your PDF editing and eSignature needs

How to fill out p s e credir

How to fill out p s e credir

Who needs p s e credir?

PSE Credit Form: A How-to Guide

Understanding the PSE Credit Form

The PSE Credit Form is a vital component for individuals looking to secure financing or loans through local government programs, tax credits, or energy efficiency initiatives. This document allows applicants to provide essential information that lenders, contractors, or tax professionals need to assess eligibility for various financial incentives, including equipment improvements and home enhancements.

Its role in financial transactions cannot be understated; it serves as the bridge between applicants and institutions, often determining the terms of approval, loan rates, and overall access to funds necessary for home improvements. Given the increasing focus on sustainability and energy efficiency, completing the PSE Credit Form becomes pivotal for those aiming to take advantage of tax incentives and rebates.

Key features of the PSE Credit Form include interactive tools designed to simplify the filling process. Many platforms, like pdfFiller, provide cloud-based access, allowing users to edit, save, and share their forms from anywhere. Digital solutions enhance user experience and ensure the documents remain up-to-date and compliant with any changes in local energy efficiency programs.

Preparing to fill out the PSE Credit Form

Before diving into the PSE Credit Form, it's essential to gather all necessary documentation. Applicants should have their income statements, proof of identification, and necessary details regarding prior credit history readily available. Understanding one’s credit score is equally important, as it plays a significant role in qualifying for financing options. A higher credit score can lead to better loan terms and approved applications.

Identifying the correct version of the PSE Credit Form is also crucial. Variations of this form might exist based on the specific financial program or incentive you are applying for. Users can easily find and download the appropriate version of the PSE Credit Form from pdfFiller, which provides multiple templates tailored to different financial contexts and requirements.

Step-by-step instructions to complete the PSE Credit Form

Completing the PSE Credit Form involves several sections that require careful attention. First, in the Personal Information Section, applicants must provide accurate contact details and identification numbers. Ensuring the accuracy of this information is crucial, as discrepancies can delay the application or hinder approval.

Next is the Financial Information Section, where applicants declare their income and financial history. This section often includes details on existing debts and assets, so honesty is important— lenders will verify this information during the approval process. Finally, the Credit History Section requires a summary of any previous credit activities, including loans, credit cards, and payment history, which helps in determining creditworthiness.

Using pdfFiller’s interactive editing tools can streamline this process significantly. Users can take advantage of inline comments for clarification and utilize collaboration features to work with family members or financial advisers on form completion. The included eSignature tool allows for secure online signing, ensuring your application is both accurate and ready for submission.

Common mistakes to avoid while filling out the PSE Credit Form

One of the most common pitfalls applicants face is providing misleading information. Inaccuracies, whether intentional or not, can have severe consequences, including denial of credit or legal repercussions. It’s critical to ensure each section reflects true and current information.

Another frequent mistake is ignoring required documentation. Many applicants overlook the necessity of attaching supporting documents, which can significantly boost the credibility of their application. Essential attachments include proof of income, previous tax returns, and any additional information that demonstrates financial stability.

Leaving sections blank is another area where applicants commonly go wrong. Each part of the PSE Credit Form plays a vital role in painting a complete picture of the applicant's financial situation. Essential fields should be filled out meticulously to avoid delays or complications with the application review process.

Submitting the PSE Credit Form

Once the PSE Credit Form is complete, it’s time to submit it for processing. Submissions can typically be made through electronic methods or physical mail, depending on the issuing authority’s preferences. Utilizing electronic submission can speed up processing times, as many agencies prioritize these applications.

Tracking the status of your application is also crucial. Most service providers offer a way to follow up on submitted forms, either through direct contact or an online tracking tool. Being proactive about monitoring your application enhances your chance of a timely response and keeps you informed of any additional steps needed.

The relevance of the PSE Credit Form in financial decisions

The completion of the PSE Credit Form plays a significant role in credit approval, influencing whether an individual will receive funding for home improvements or energy-efficient upgrades. Accurate and comprehensive information on this form effectively communicates an applicant’s financial standing, which can lead to favorable outcomes in loan decisions.

Moreover, understanding how your credit activities influence loan rates and terms is crucial. Filling out the PSE Credit Form correctly can lead to better offers, with lower interest rates and more favorable repayment terms. For anyone considering home improvements or energy-efficient installations, the PSE Credit Form serves as a critical gateway to available tax incentives and rebates.

Managing your PSE Credit Form and documents

Once you've filled out the PSE Credit Form, securing it digitally ensures your sensitive information is protected. Best practices for digital storage include using encrypted cloud services or reputable PDF management platforms like pdfFiller. This way, you not only secure your personal data but also maintain easy access for future reference or updates.

Additionally, applicants working in teams can leverage pdfFiller for collaborative purposes. By setting permissions and sharing links, team members can access, edit, and stay informed about ongoing projects related to the PSE Credit Form. This collaborative environment fosters efficient communication and streamlined management of financial documents.

FAQs about the PSE Credit Form

A common question regarding the PSE Credit Form is, 'What if I make a mistake after submission?' If errors are detected post-submission, promptly contacting the respective office is essential. Most agencies allow applicants to correct mistakes through a supplementary document or update process.

Another frequently asked question is about approval timelines. While this can vary based on the jurisdiction and workload, many agencies provide general timeframes for processing applications. Staying informed through their communication channels can help set realistic expectations.

For those facing issues with filling the form, solutions often exist through customer support channels. Practicing patience and reaching out for help can resolve most technical difficulties or questions about form specifics.

Enhancing your document management skills with pdfFiller

Beyond the PSE Credit Form, pdfFiller offers a suite of additional tools that simplify document creation and management. Users have access to templates for various forms, including different financial and legal documents. This variety ensures adaptability catered to specific requirements, enhancing productivity.

Best practices for document collaboration involve establishing clear communication channels. Sharing documents via pdfFiller's cloud-based system allows for real-time edits and feedback among team members, leading to optimal outcomes in projects that require multiple inputs and approvals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find p s e credir?

How do I fill out the p s e credir form on my smartphone?

How do I edit p s e credir on an Android device?

What is p s e credir?

Who is required to file p s e credir?

How to fill out p s e credir?

What is the purpose of p s e credir?

What information must be reported on p s e credir?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.