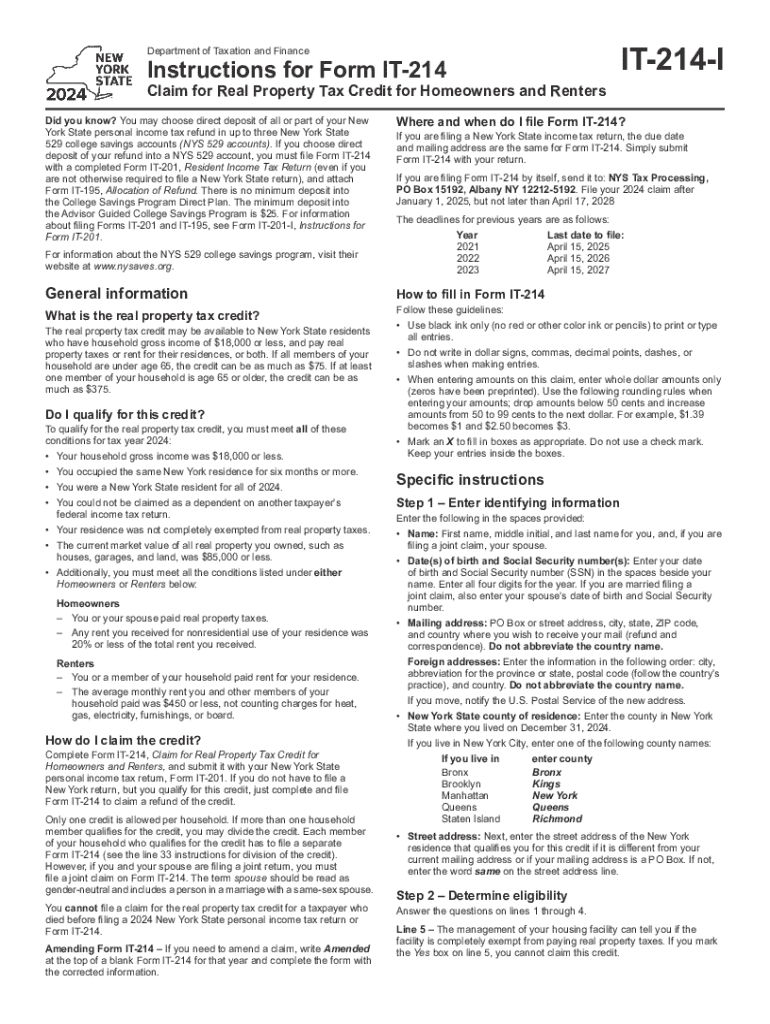

Get the free Instructions for Form it 214 "Claim for Real Property Tax

Get, Create, Make and Sign instructions for form it

Editing instructions for form it online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form it

How to fill out instructions for form it

Who needs instructions for form it?

Instructions for Form IT Form: A Comprehensive Guide for New York Residents

Overview of Form IT

Form IT is a crucial component of the income tax filing process for residents of New York State. Designed to cater to a diverse range of taxpayers, this specific form enables individuals to report their income and calculate their tax liability efficiently. The importance of Form IT lies not only in ensuring compliance with state laws but also in facilitating access to potential refunds and credits that can alleviate tax burdens.

Residents filling out Form IT play a pivotal role in the state's revenue collection system. Accurate completion of this form contributes to local services and amenities, impacting community well-being. Thus, understanding who needs to use Form IT is essential.

Who needs to use Form IT?

Form IT is primarily meant for individuals residing in New York State who have an income that meets specific thresholds. This includes all adult residents who earn income from various sources, such as wages, investments, or self-employment. Eligibility is particularly relevant for those whose gross income exceeds the minimum thresholds set by the state tax guidelines.

Getting started with Form IT

To begin with Form IT, the first step is to access and download the appropriate version of the form. This form can be found on the New York State Department of Taxation and Finance website or through pdfFiller, which offers ease of access and editing capabilities. Users can choose between completing the form online using pdfFiller's tools or downloading it to fill out offline.

Before diving into the filling process, it is essential to gather all the necessary information. Commonly required documents include Social Security numbers, income details such as W-2s or 1099 forms, and relevant deductions. Having this information ready will streamline the process and reduce the likelihood of errors.

Step-by-step instructions for completing Form IT

Completing Form IT can be daunting, but understanding each section can simplify the process. The form is divided into several key sections, including personal information, income reporting, and deductions. Each section serves a specific purpose and requires accurate and thorough responses.

Filling out personal information

Accurate completion of personal information is crucial for effective processing of the tax return. Taxpayers must ensure that names, addresses, and Social Security numbers match official documents. An error in this section can lead to significant delays in processing returns or, worse, jeopardize eligibility for credits.

Reporting income

When it comes to reporting income, taxpayers should include all relevant sources. This includes wages from employment, dividends from investments, and any self-employment earnings. It's wise to double-check the amounts on all forms, ensuring that each category of income is accurately reported. Failure to report all income could trigger an audit.

Claiming deductions and credits

Deductions and credits play a vital role in lowering a taxpayer's overall liability. Common deductions include those for student loan interest, medical expenses, and mortgage interest. Each deduction has specific eligibility criteria, and taxpayers must ensure they qualify before claiming them. Instructions for calculating and accurately reporting these deductions are outlined on the form, making this step straightforward for most residents.

E-filing your Form IT

One of the modern conveniences available to taxpayers is the option to e-file Form IT. E-filing offers numerous advantages over traditional paper filing. It's faster, generally more secure, and provides instant confirmations upon submission, reducing anxiety about whether the form was received.

To e-file Form IT through pdfFiller, follow these step-by-step instructions: First, create or log into your pdfFiller account. Next, select Form IT from the template library. Complete the form using the online editor, ensuring that all sections are accurate. After thoroughly reviewing the information, submit the form electronically. You will receive a confirmation email indicating that your return has been submitted successfully.

Common mistakes to avoid

Many taxpayers encounter issues due to common mistakes when completing Form IT. Frequently misreported categories include income from side jobs or freelance work, often because individuals do not realize this income must be documented on their returns. Additionally, incomplete sections can lead to delays in processing or the need for further clarification from the tax office.

To minimize errors and ensure a smooth filing process, utilize a checklist for reviewing your work. This checklist should include a review of all entered amounts, ensuring all forms are signed, and confirming that both names and Social Security numbers match your official documents.

Managing your submitted Form IT

Once your Form IT has been submitted, it's important to know what to expect next. Taxpayers can typically expect an acknowledgment from the state within a few weeks. To check the status of your return, you can use online platforms provided by the New York State Department of Taxation and Finance, which allows for real-time updates on your submitted form.

In addition, keeping your records organized is essential. Ensure that you save copies of your submitted forms and any supporting documentation in a dedicated folder. This practice not only helps in case of an audit but also makes future tax seasons easier as you’ll already have substantial documentation ready.

Security tips for handling tax forms

Protecting your personal information during the tax filing process cannot be overstated. It is crucial to implement best practices to safeguard sensitive data, especially when filling out Form IT online. Avoid using public Wi-Fi networks, ensure strong passwords for any accounts used, and be cautious of phishing attempts that may seek to steal your information.

Understanding the risks related to identity theft is also vital. Tax-related identity theft is particularly prevalent during tax season, and attackers often use stolen information to file fraudulent returns. To reduce these risks, never share your personal details unless you are certain of the recipient's identity and legitimacy.

Additional forms and resources

In conjunction with Form IT, there are several related forms and documents you may need to complete your tax return effectively. Common forms include W-2 for reporting wages, 1099 for miscellaneous income, and Schedule C for business income, among others. Having these forms readily available ensures a smoother tax preparation process.

For further assistance, you can access resources directly from the IRS website as well as other local tax assistance programs. These resources can provide critical insights into the requirements necessary to enhance your filing accuracy and ease, especially for new taxpayers unfamiliar with the system.

Insights on recent changes for 2025

Tax laws are subject to change, and it’s crucial for residents to stay informed about updates that could impact the filing of Form IT. For the 2025 tax season, key updates may include adjustments to income thresholds for tax credits, changes in deductions available to taxpayers, and modifications in filing procedures aimed at minimizing processing times.

Preparing for future tax seasons can involve tracking these updates through trusted resources. Regularly checking the New York State Department of Taxation and Finance website or subscribing to updates can ensure you stay on top of any changes that impact your responsibilities as a taxpayer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my instructions for form it in Gmail?

How can I edit instructions for form it from Google Drive?

How can I edit instructions for form it on a smartphone?

What is instructions for form it?

Who is required to file instructions for form it?

How to fill out instructions for form it?

What is the purpose of instructions for form it?

What information must be reported on instructions for form it?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.