Get the free Form-1023.pdf - 1 TLS have you transmitted all R text...

Get, Create, Make and Sign form-1023pdf - 1 tls

How to edit form-1023pdf - 1 tls online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form-1023pdf - 1 tls

How to fill out form-1023pdf - 1 tls

Who needs form-1023pdf - 1 tls?

Comprehensive Guide to Form 1023: Filling Out the Form with pdfFiller

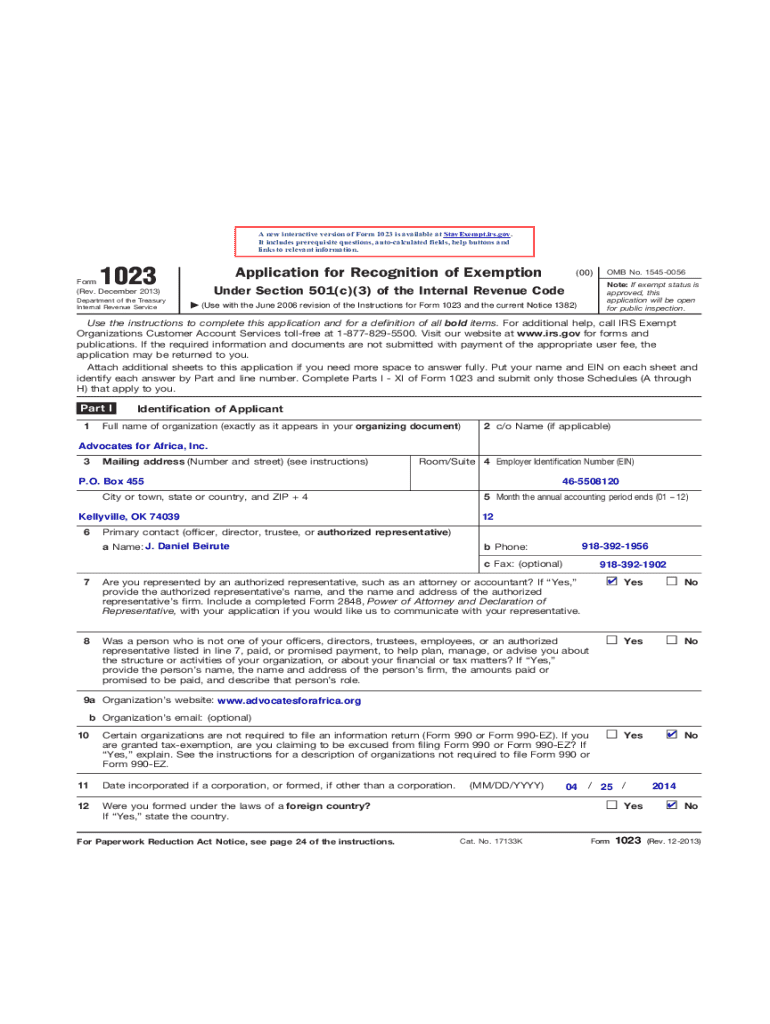

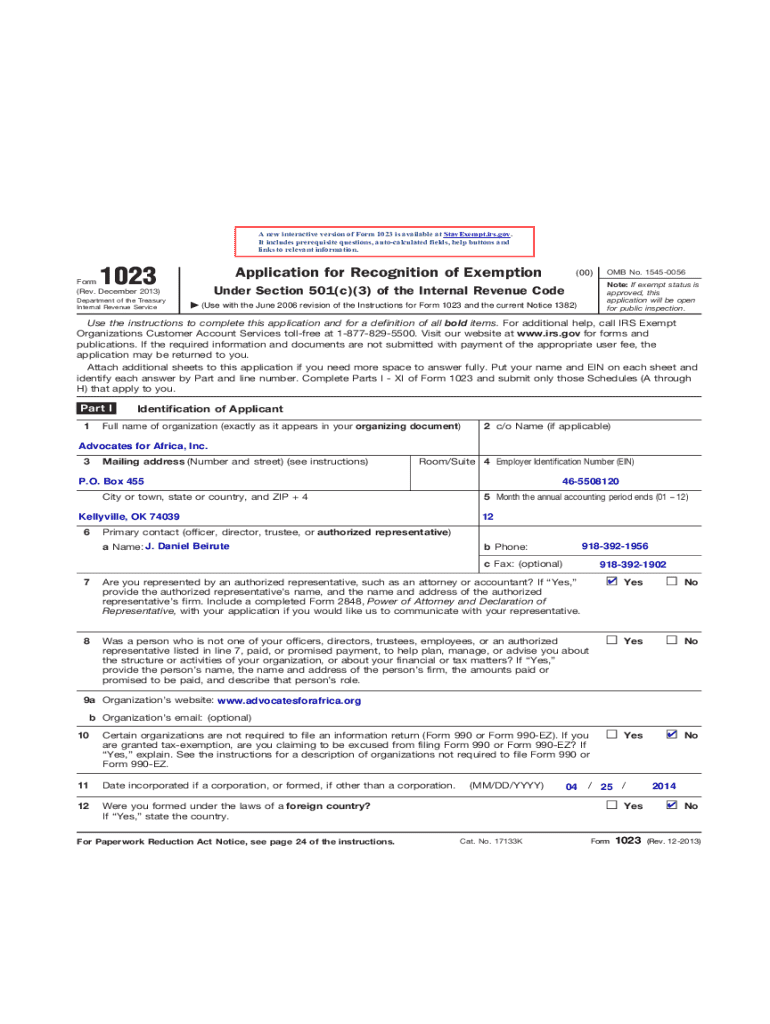

Understanding Form 1023: The essentials

Form 1023 is a pivotal document for nonprofit organizations seeking tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. This form serves to demonstrate the organization’s purpose, structure, and activities to qualify for federal tax exemption. The exemption process starts with this form, highlighting its significance in establishing a legal foundation for nonprofits.

Filing Form 1023 not only provides necessary IRS recognition but also unlocks various benefits such as eligibility to receive tax-deductible contributions and access to grants. Nonprofit organizations that fail to file may miss out on vital funding opportunities and face ongoing tax liabilities that could jeopardize their mission.

Preparing to fill out Form 1023

Before diving into the form, organizations must determine their eligibility by ensuring they meet the specific criteria for exemption under Section 501(c)(3). This usually involves serving charitable purposes like relief for the poor, advancement of education, or other activities serving the public good. Understanding what qualifies as a charitable organization is vital as it lays the groundwork for filling out the form correctly.

After confirming eligibility, gathering the required documentation is the next step. This documentation may include:

These documents will not only assist in the completion of Form 1023 but also provide a solid foundation for the organization itself. Ensuring that everything is well-organized and reviewed ahead of time can save considerable stress later in the process.

Step-by-step guide to filling out Form 1023

Filling out Form 1023 involves several distinct sections, each requiring careful attention to detail. These sections include:

To avoid common mistakes, it’s essential to double-check information for accuracy and completeness. For instance, many applicants overlook certain documentation, or they fail to precisely detail their activities. Addressing these pitfalls in advance can significantly smooth the application process.

Tips for editing and finalizing your Form 1023

Once you've completed your form, using tools like pdfFiller can streamline the editing process. This platform offers extensive editing tools that make modifying forms simple, allowing users to integrate signatures and add additional notes where necessary.

Additionally, collaborating with team members can enhance the accuracy and quality of the final submission. Utilizing cloud-based features allows for real-time collaboration, ensuring that everyone involved can review changes and manage feedback effectively.

Filing your Form 1023: What you need to know

Deciding on the right filing method is crucial when it comes to submitting Form 1023. Organizations can choose between electronic and paper submissions, each method having specific requirements. For electronic filings, ensure you are using IRS-approved software that meets all guidelines, while paper forms may need to be sent via certified mail for tracking purposes.

After filing, expect a waiting period for IRS processing, typically ranging from three to six months. During this time, the IRS may contact you with inquiries regarding the application, so being prepared to respond promptly to their questions can facilitate a quicker resolution.

Managing your tax-exempt status

After receiving tax-exempt status, organizations must comply with ongoing requirements such as annual reporting through Form 990. This is crucial not only for legal compliance but also for maintaining transparency with donors and the public.

Record-keeping is also essential for nonprofits to track income, expenses, and activities. Understanding potential challenges that could arise post-approval, such as fluctuations in funding or compliance issues, prepares the organization for sustainable operations.

Interactive tools for a streamlined experience

pdfFiller offers interactive features that can simplify the experience of filling out Form 1023. Tools for eSignature and document management enhance the application process and allow for efficient handling of documents. By utilizing these resources, organizations can improve the quality and accuracy of their submissions.

Moreover, accessing customer service and support through pdfFiller provides significant back-up during the filing process. Engaging in community forums can also offer valuable insights and experiences shared by other users navigating similar challenges.

Case studies: Successful Form 1023 submissions

Real-world examples of nonprofits who have successfully obtained tax-exempt status can serve as valuable learning tools. Each organization's submission experience offers insights into best practices and the importance of a well-prepared application.

For instance, the ABC Charity implemented strict documentation processes before applying for recognition, which significantly boosted their chances of approval. This highlights the importance of thorough preparation in navigating the complexities of Form 1023.

Advanced considerations for complex organizations

For organizations with more complicated structures or varied revenue streams, it’s essential to know when to use Form 1023-EZ versus Form 1023. The EZ version is streamlined for smaller nonprofits with basic needs, while the standard Form 1023 is necessary for larger or more complex organizations.

Handling unique situations effectively, such as organizations that engage in both charitable and non-charitable activities, may require additional documentation and explanation. Understanding these nuances in advance can prepare organizations for a smoother filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form-1023pdf - 1 tls for eSignature?

How do I complete form-1023pdf - 1 tls online?

How do I make edits in form-1023pdf - 1 tls without leaving Chrome?

What is form-1023pdf - 1 tls?

Who is required to file form-1023pdf - 1 tls?

How to fill out form-1023pdf - 1 tls?

What is the purpose of form-1023pdf - 1 tls?

What information must be reported on form-1023pdf - 1 tls?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.