Get the free Student/Spouse Non-Filer Statement - Financial Aid Office

Get, Create, Make and Sign studentspouse non-filer statement

Editing studentspouse non-filer statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out studentspouse non-filer statement

How to fill out studentspouse non-filer statement

Who needs studentspouse non-filer statement?

Studentspouse Non-Filer Statement Form: A Comprehensive Guide

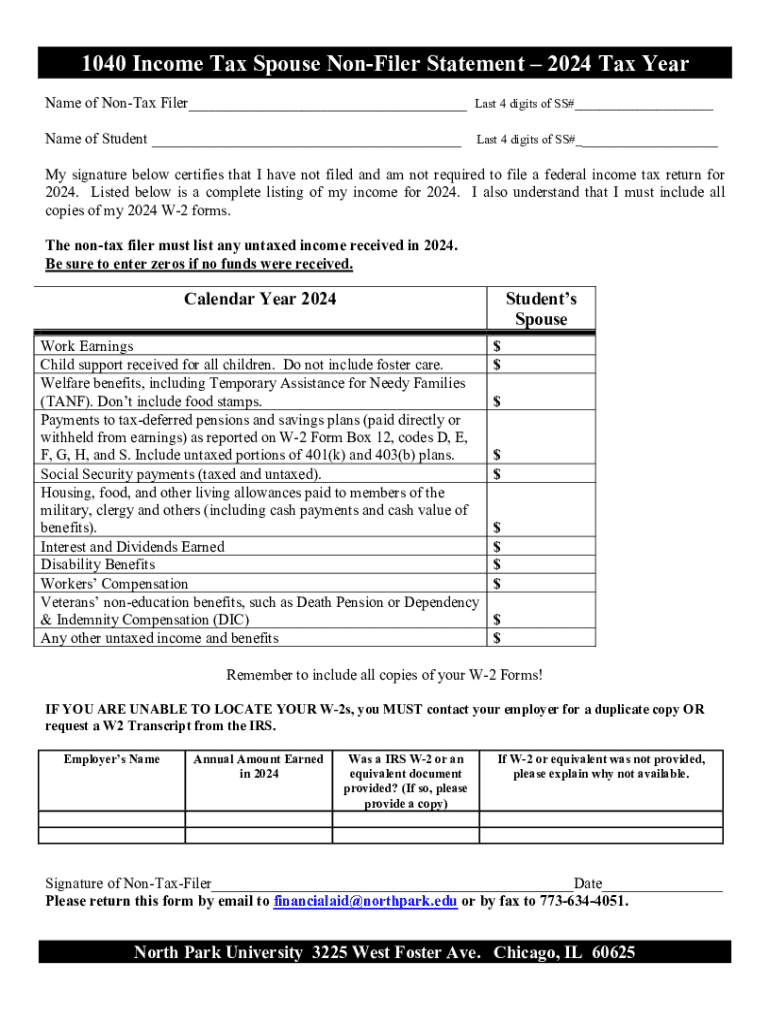

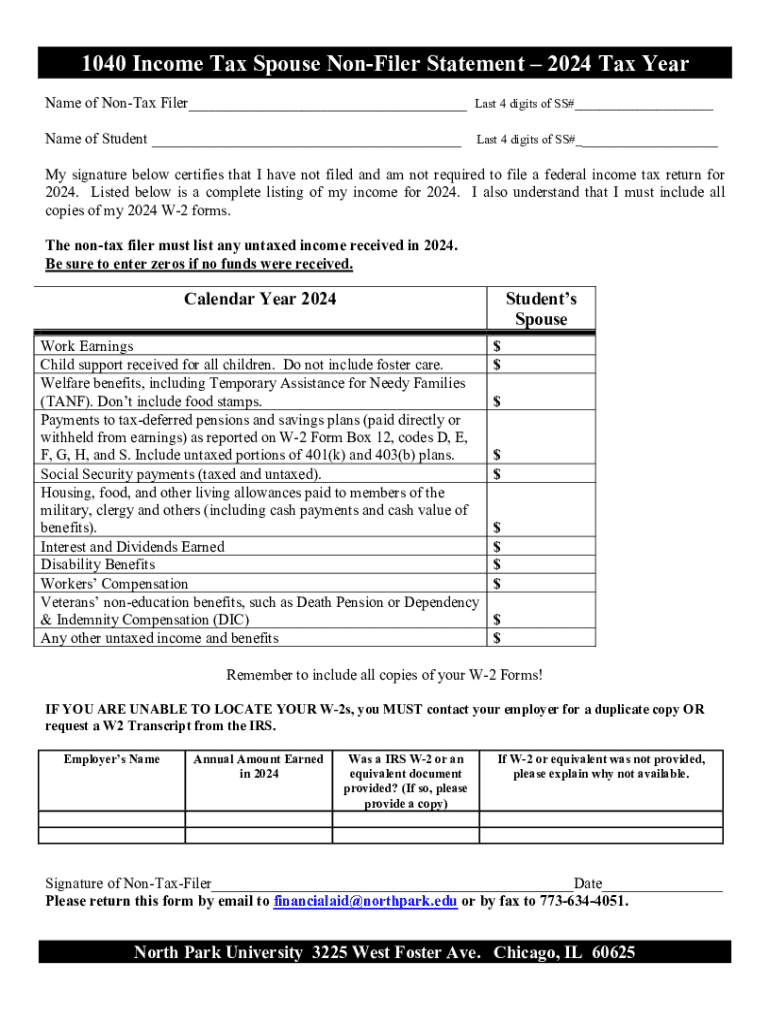

Understanding the studentspouse non-filer statement form

The studentspouse non-filer statement form serves as a critical document for individuals, particularly students and their spouses, who do not file federal income tax returns. This form allows them to declare their non-filing status, which is essential for determining eligibility for various financial aid programs, including federal student aid.

Its significance cannot be understated; without this documentation, students may struggle to obtain necessary funding for their education. The simplicity of the form belies its importance – it helps streamline the financial aid process for families who meet specific criteria.

Eligibility criteria

Understanding whether you are required to submit the studentspouse non-filer statement form is vital. Generally, this form is necessary for students whose parents or spouses earn below a certain income threshold set by federal guidelines. Typically, those earning below $15,000 per year, varying by family size and income composition, might find themselves needing to fill out this form.

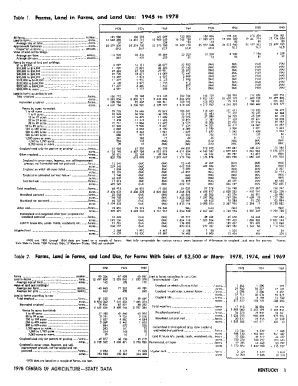

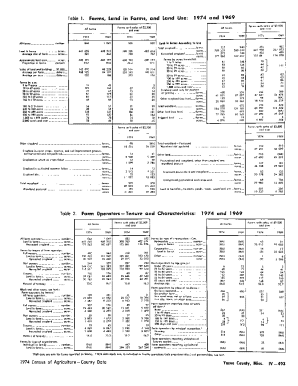

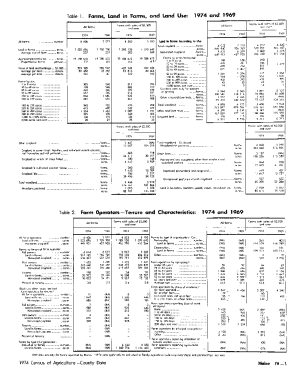

Key components of the form

The studentspouse non-filer statement form consists of several sections that need to be carefully filled out to ensure accuracy and compliance with federal requirements. Let’s break down these key components.

Step-by-step guide to filling out the form

Filling out the studentspouse non-filer statement form can be a straightforward process if approached systematically. Before you begin, it's essential to check that you have all required documents on hand.

Now, let’s go through the filling process step-by-step.

Section 1: Personal Information

Begin by accurately filling in your personal details. This section requires precise information because discrepancies can lead to delays in your financial aid application.

Section 2: Income Information

In this part, clarify your non-filing status by stating your income level. It's crucial to be honest and clear here; common mistakes include incorrect income reporting or failing to provide adequate documentation.

Section 3: Certification

Finally, you must sign and date the form to certify its accuracy. This validates your submission and is a critical step in maintaining compliance.

Editing and customizing your form

Once you have completed the form, using tools like pdfFiller can streamline the editing process. This platform allows you to make adjustments directly to the form without hassle.

Managing your form versions effectively is also important. Keep track of changes and ensure you save updates appropriately, which helps avoid confusion in future submissions.

Signing and submitting the form

An essential aspect of the studentspouse non-filer statement form is signing it, particularly if you are submitting electronically. pdfFiller makes this process simple with its eSignature capabilities.

Common FAQs about the studentspouse non-filer statement form

Questions regarding the studentspouse non-filer statement form are common. Here are some frequent inquiries and the corresponding answers.

Troubleshooting tips

While filling out the studentspouse non-filer statement form, you may encounter certain issues. Noticing and addressing these issues early can save you from complications later.

If problems arise, it’s helpful to reach out to support. pdfFiller’s customer service can assist with form-related questions.

Appendix

As an additional resource, here are key definitions and examples related to the studentspouse non-filer statement form.

Glossary of terms

Understanding the terminology associated with this form can help clarify the submission process.

Examples of completed forms

Visually understanding how to fill out the studentspouse non-filer statement form can provide clarity. Reference templates or sample completed forms to avoid common pitfalls.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my studentspouse non-filer statement in Gmail?

How can I modify studentspouse non-filer statement without leaving Google Drive?

How do I edit studentspouse non-filer statement in Chrome?

What is studentspouse non-filer statement?

Who is required to file studentspouse non-filer statement?

How to fill out studentspouse non-filer statement?

What is the purpose of studentspouse non-filer statement?

What information must be reported on studentspouse non-filer statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.