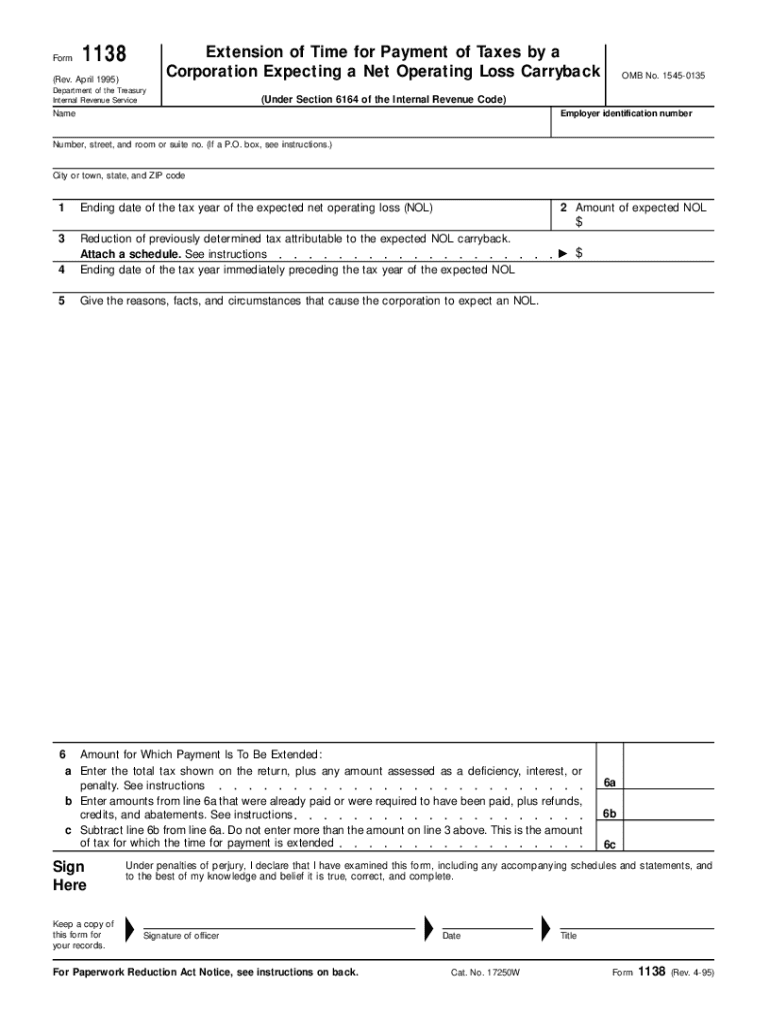

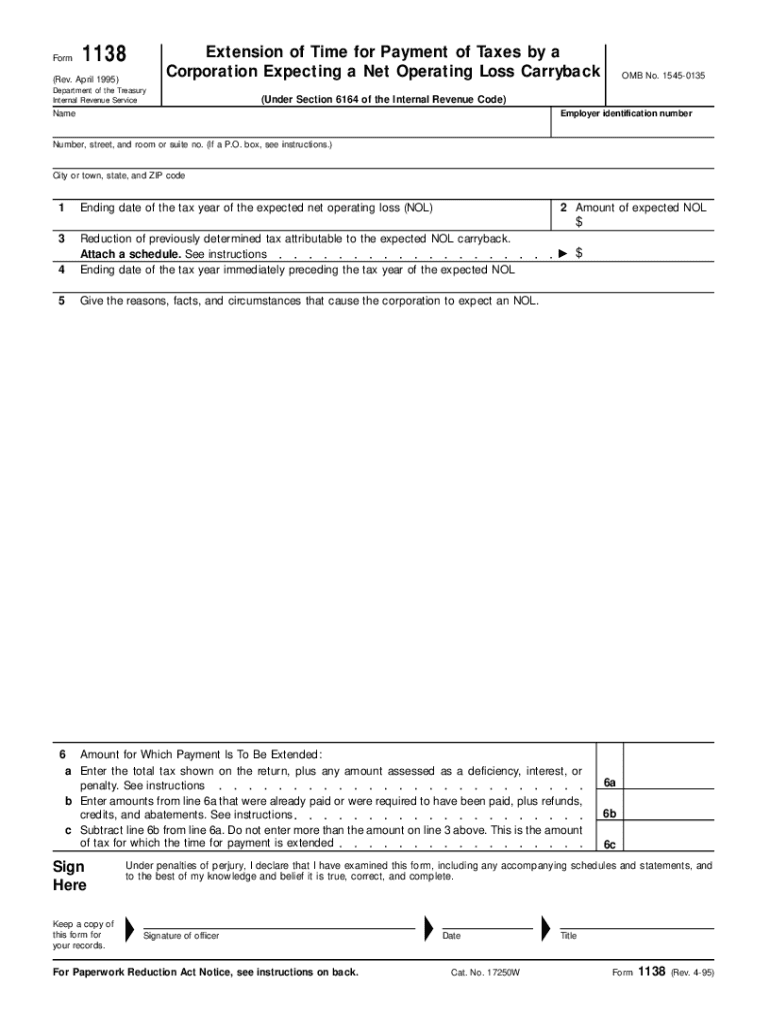

Get the free 0495 Form 1138. Extension of Time For Payment of Taxes By a Corporation Expecting a ...

Get, Create, Make and Sign 0495 form 1138 extension

Editing 0495 form 1138 extension online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 0495 form 1138 extension

How to fill out 0495 form 1138 extension

Who needs 0495 form 1138 extension?

A Comprehensive Guide to the 0495 Form 1138 Extension Form

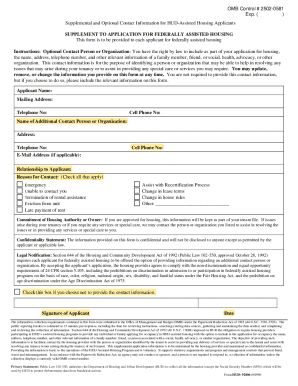

Understanding the 0495 Form 1138 Extension Form

The 0495 Form 1138, also known as the 1138 extension form, serves as an integral document in the tax filing process. This form is crucial for individuals and businesses seeking an extension on their tax returns. By filing this form, taxpayers can gain additional time to prepare and submit accurate tax returns, thereby avoiding potential penalties for late submissions.

It's important to note the significance of the 0495 form for extensions, as it can provide taxpayers with the breathing room needed to ensure their financial obligations are met. Any missteps in filing or failure to use this form could lead to increased scrutiny from tax authorities, making it essential for individuals to familiarize themselves with its requirements.

Who should use the 0495 Form 1138?

The 0495 Form 1138 is primarily designed for individuals and teams who require an extension on their tax obligations. This includes freelancers, small business owners, tax professionals, and anyone with complex tax scenarios that may necessitate more time. Situational factors such as unexpected life events, missing documents, or changes in income can warrant the need for this extension.

Additionally, if you are in the midst of gathering necessary financial information or are awaiting documentation like retirement plans, the 0495 form is your shield against penalties for filing late. Understanding your eligibility and the relevant conditions for using this form can save you both time and resources.

Detailed breakdown of the 0495 Form 1138

The structure of the 0495 Form 1138 features key sections that need careful attention. The main sections typically include identifying information, which might Encompass your name, address, and Social Security number, along with extension details indicating the period for which you are requesting additional time.

In this form, some fields may be optional, while others are mandatory, making it critical to able understand the requirements clearly. Additionally, ensuring that no sections are left blank can minimize the risk of processing delays.

Common errors to avoid

When filling out the 0495 Form 1138, it's easy to make common mistakes that could complicate the process. Frequent errors involve providing incorrect information, forgetting to include necessary signatures, or neglecting to check the filing status. Even simple typos can lead to significant headaches down the line.

To avoid these pitfalls, here are some tips: double-check all entries for accuracy, ensure all required fields are filled out, and don’t hesitate to review the completed form against available guidelines before submission. By following these practices, you can ensure a smoother processing experience.

Step-by-step instructions for completing the 0495 Form 1138

Before you start filling out the form, gathering the necessary information is critical. Make sure you have your tax identification, details of your income, and any other relevant financial data on hand. Having accurate data gathered prior to completion can save significant time and reduce frustration.

Here’s a step-by-step guide for completing the 0495 form:

Precision is key; ensure that each entry is clear and legible, helping to avoid confusion when the IRS processes your request.

Editing and signing the 0495 Form 1138

Utilizing pdfFiller allows you to easily edit the 0495 Form 1138. The platform provides a straightforward method to upload and modify the form. With its interactive tools, you can add text, annotations, or even highlight necessary sections, ensuring clarity in your entries.

Moreover, signing the document electronically enhances convenience and expedites the process. The platform provides seamless options for electronically signing the document, giving you a modern alternative to traditional physical signatures.

Submitting the 0495 Form 1138

Once you've completed the 0495 form, you need to submit it. There are several submission options available: you can e-file it directly through tax preparation platforms or mail it to the required IRS address. Depending on your preference, pdfFiller offers capabilities to assist with both methods.

Consult the IRS guidelines for the specific address for mailing or the online platforms available to accurately submit your extension request. Additionally, keeping a close eye on submission deadlines is crucial to ensure your extension request is accepted on time.

Managing your 0495 Form 1138 and future extensions

Properly managing your submitted 0495 Form 1138 is just as important as filling it out accurately. Keeping a record of submitted forms can help you track and reference past filings. Consider storing these documents in pdfFiller for easy access and organization, allowing you to track the status of your submissions without hassle.

Furthermore, preparing for future extensions can be beneficial. Strategies such as setting aside funds for anticipated tax liabilities or consistently updating your financial records can ease the pressure come tax season. Utilizing tools like pdfFiller can greatly improve your financial planning processes for subsequent years.

Interactive tools and resources

pdfFiller provides an array of interactive tools that facilitate form management. Its collaborative features allow multiple users to work on the same document, making it easier for teams to coordinate on submissions. The cloud-based storage ensures that all your documents, including the 0495 Form 1138, are readily available, offering convenient access from anywhere.

Additionally, many users encounter common questions or issues while filling out the 0495 form. pdfFiller offers readily available FAQs and troubleshooting resources that address common problems, providing essential support to ensure your experience is as seamless as possible.

User testimonials and success stories

Real-world applications of the 0495 Form 1138 highlight its value. Individuals and teams who utilized the form through pdfFiller have shared their success stories of stress-free tax seasons. Users appreciate not only the form's structure but the ease with which they can navigate the process online.

The satisfaction of seamless digital document management through pdfFiller demonstrates its role in enhancing the user experience, reaffirming the significance of both the form and the platform in easing tax-related burdens.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 0495 form 1138 extension without leaving Google Drive?

How do I complete 0495 form 1138 extension on an iOS device?

How do I fill out 0495 form 1138 extension on an Android device?

What is 0495 form 1138 extension?

Who is required to file 0495 form 1138 extension?

How to fill out 0495 form 1138 extension?

What is the purpose of 0495 form 1138 extension?

What information must be reported on 0495 form 1138 extension?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.