Get the free 2025 RI-1065 - Rhode Island Partnership Income Tax Return - tax ri

Get, Create, Make and Sign 2025 ri-1065 - rhode

How to edit 2025 ri-1065 - rhode online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 ri-1065 - rhode

How to fill out 2025 ri-1065 - rhode

Who needs 2025 ri-1065 - rhode?

2025 RI-1065 - Rhode Form: A Comprehensive Guide

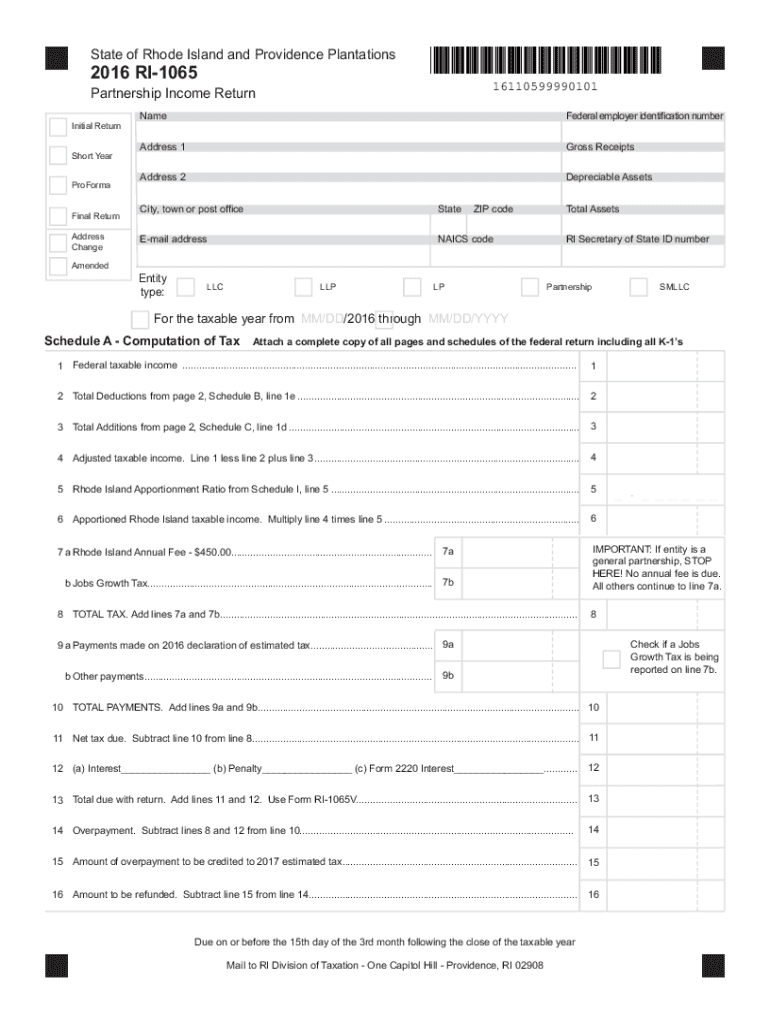

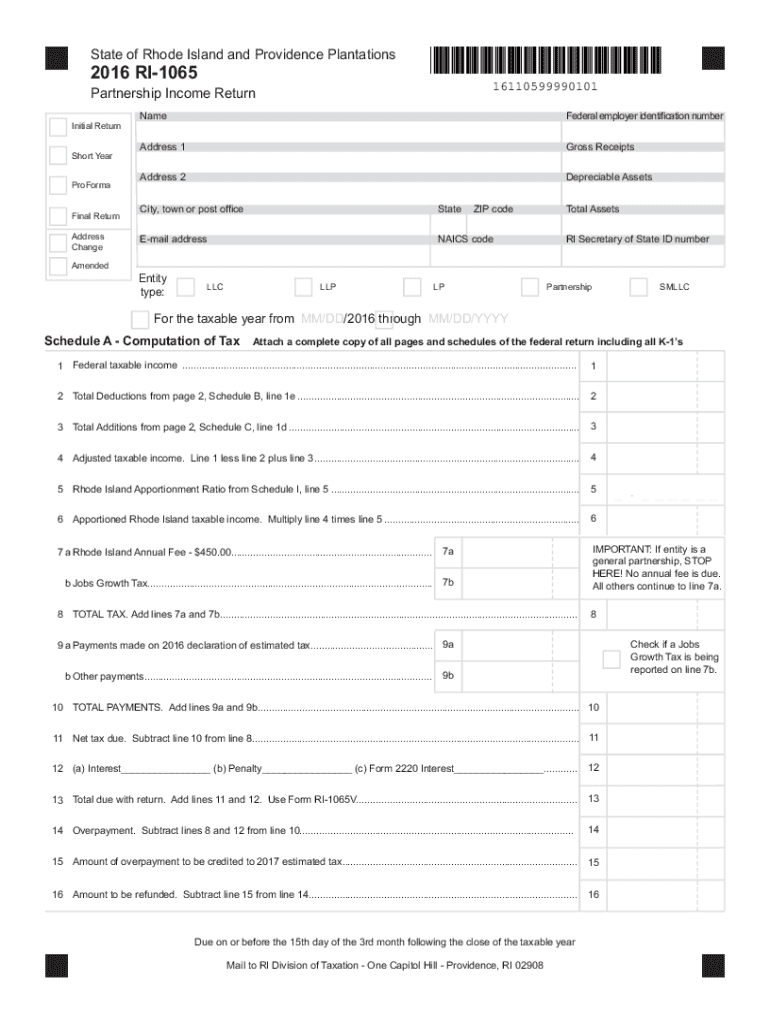

Overview of the 2025 RI-1065 form

The 2025 RI-1065 form is pivotal for pass-through entities operating in Rhode Island, including partnerships and limited liability companies (LLCs). This form is specifically designed to report the income, deductions, and credits of the entity, ensuring compliance with state tax regulations. Understanding its significance is essential for any business navigating Rhode Island's tax landscape, as failure to file can lead to penalties and legal issues.

Particular entities are mandated to file the RI-1065; including all partnerships and certain LLCs that are classified as pass-through entities. By collectively reporting their income, these entities allow the individual partners or members to report their shares of income on their personal tax returns.

Key features of the 2025 version

The 2025 version of the RI-1065 includes several key updates aimed at clarifying reporting requirements and improving the overall user experience. Notably, the form has streamlined sections to enhance accuracy in data entry and reduce administrative burdens on filers. This edition also incorporates new guidelines reflecting Rhode Island's evolving tax landscape, ensuring that all businesses can remain compliant with current regulations.

Using the latest version of the form is critical not only for compliance but for maximizing potential tax benefits. Features such as improved clarity on income categorization are designed to assist taxpayers in accurately documenting their financial activities.

Eligibility criteria for filing RI-1065

To determine eligibility for filing the RI-1065, one must first appreciate what constitutes a pass-through entity. Generally, any partnerships or LLCs with taxable income must file this form. Importantly, single-member LLCs are excluded unless they choose to be taxed as partnerships.

If you're considering filing, you should recognize a few essential criteria: - Your business structure must qualify as a partnership or LLC. - The entity must have operations within Rhode Island and generate income, whether through sales, services, or taxation.

Step-by-step instructions for completing the RI-1065 form

Completing the RI-1065 form requires meticulous attention to detail. Begin by gathering all relevant documents such as partnership agreements, previous tax returns, and financial statements. This foundational data is crucial for accurately filling out the form and ensuring compliance.

Each section of the RI-1065 serves a unique purpose in capturing the complete financial picture of the entity. Here's a breakdown of how to approach each section: - **Section 1: Basic Information**: Fill out entity details, including name, address, and Federal EIN. - **Section 2: Income Calculation**: Report total income, incorporating all revenue streams. - **Section 3: Deductions and Credits**: List all operational deductions to reduce taxable income. - **Section 4: Partner Information**: Provide details for each partner, including their share of income. - **Section 5: Summary and Signatures**: Ensure that an authorized partner signs to certify the accuracy of the report.

Common mistakes to avoid when filling out the RI-1065 form

When completing the RI-1065, several common pitfalls can lead to issues with state tax authorities. Misreporting income or intentionally overlooking certain deductions can jeopardize the entity's compliance status. Therefore, ensuring accurate income reporting and a thorough understanding of eligible deductions is crucial.

Additionally, inaccurate partner information can lead to confusion regarding each member's share of liability or refund. Late submissions can incur significant penalties; thus, adhering to deadlines is not merely a formality but a critical practice. Key mistakes to watch for include: - Missing essential financial documents that support reported figures. - Incorrect partner percentages leading to inaccurate tax liabilities.

Interactive tools for managing your RI-1065 filing

Utilizing modern interactive tools can greatly enhance your experience managing the RI-1065 filing. PDF editing platforms such as pdfFiller provide robust capabilities; allowing users to edit, sign, and securely share documents with ease. For those who prefer electronic submissions, leveraging these tools ensures a seamless process from preparation to filing.

For instance, pdfFiller offers PDF editing features that simplify complex forms and eliminate unnecessary paperwork. Users can fill out fields directly online, reducing room for human errors. Moreover, eSigning capabilities expedite approvals and signatures, ensuring your form is submitted timely without the hassles of inconvenient in-person meetings.

Filing options for the RI-1065 form

Filing your RI-1065 can be done either online or via traditional mail. Online filing through the state’s Department of Revenue website is recommended due to its efficiency and reduced processing time. This method allows for immediate confirmation of receipt, which is invaluable for time-sensitive filings.

For those opting for paper filing, ensure you send the completed form to the appropriate address provided by the Rhode Island Department of Revenue. It’s critical to send your form well before deadlines to avoid potential penalties or delays. Here’s a quick checklist for paper filing: - Use a reliable mailing method to confirm delivery. - Include all necessary documentation. - Keep copies of everything submitted.

Post-filing checklist

Once the RI-1065 form has been filed, confirming the successful submission is crucial. Many filers can check their filing status through the state’s online portal. Maintaining records and documentation is essential, not just for tracking your tax obligations but also for preparing for any potential audits by the Rhode Island Division of Taxation.

Keeping complete and organized records serves as your first line of defense during an audit. Key documents to retain include: - The filed RI-1065 form with confirmation of submission. - Partner agreements and any amendments that could impact tax treatments. - Supporting financial documentation that backs reported figures.

Frequently asked questions about RI-1065 form

Individuals may have varying questions regarding the RI-1065 form, especially concerning deadlines and amendments. If a taxpayer misses the filing deadline, they can typically request an extension; however, it's essential to be aware that this does not excuse late payments. Understanding the specifics surrounding amendments is equally crucial—if you need to correct previously submitted data, a clear process exists for filing an amendment to the RI-1065.

Additionally, resources provided by the Rhode Island Department of Revenue and affiliations such as your CPA can help navigate unique situations regarding the RI-1065 form, keeping you compliant with state tax regulations.

Conclusion on the importance of accurate filing

Accurate filing is integral to maintaining compliance and minimizing issues with the Rhode Island tax authorities. Whether you're a new business or a seasoned partnership, staying informed about shifts in tax regulations and utilizing tools like pdfFiller can enhance your filing experience, reduce errors, and provide peace of mind.

By enabling users to edit documents, electronically sign forms, and manage submissions through a single cloud-based platform, pdfFiller effectively removes barriers to compliance. This ensures that businesses remain focused on their operations rather than stressing over paperwork.

About pdfFiller

pdfFiller stands out as a premier platform for document management, tailored for individuals and teams seeking efficient solutions for form handling. With a rich array of features, users can easily navigate tax forms such as the RI-1065, enhancing their filing capabilities and allowing for streamlined collaboration throughout their team.

User testimonials frequently highlight the convenience of using pdfFiller for tax-related forms, underscoring its efficiency and user-friendly design. From intuitive interfaces to comprehensive editing tools, pdfFiller empowers clients to overcome the nuances of form submission, thereby amplifying their operational productivity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2025 ri-1065 - rhode in Chrome?

How do I edit 2025 ri-1065 - rhode straight from my smartphone?

Can I edit 2025 ri-1065 - rhode on an Android device?

What is 2025 ri-1065 - rhode?

Who is required to file 2025 ri-1065 - rhode?

How to fill out 2025 ri-1065 - rhode?

What is the purpose of 2025 ri-1065 - rhode?

What information must be reported on 2025 ri-1065 - rhode?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.