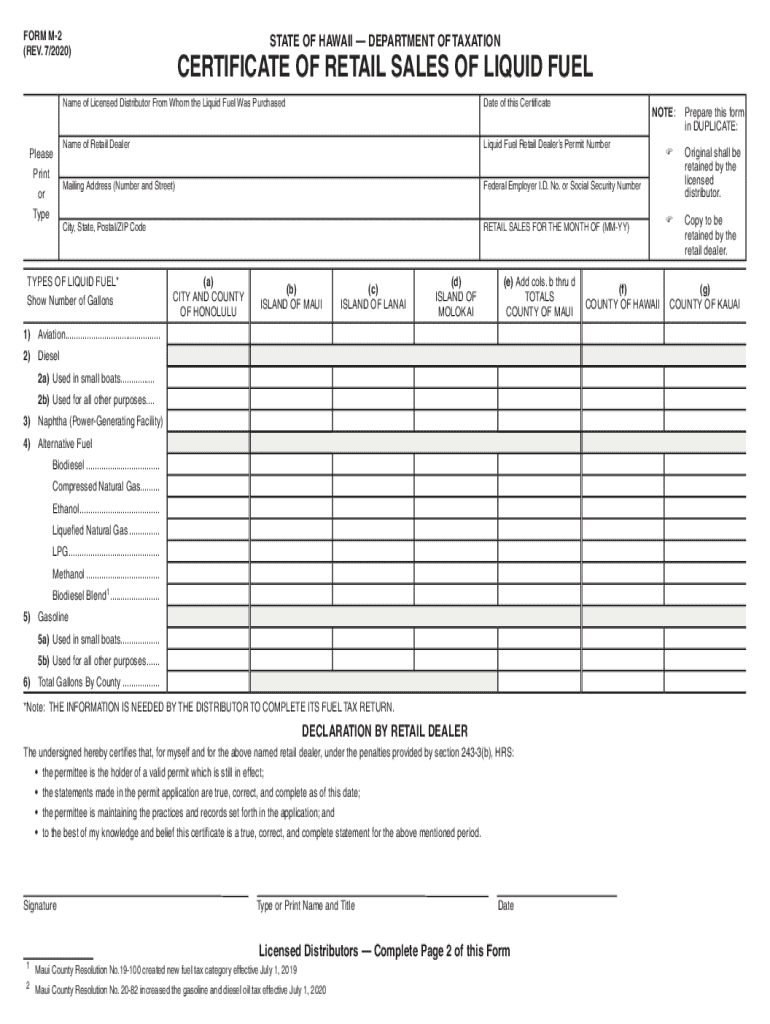

Get the free Fuel Tax Forms - Hawaii Department of Taxation

Get, Create, Make and Sign fuel tax forms

How to edit fuel tax forms online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fuel tax forms

How to fill out fuel tax forms

Who needs fuel tax forms?

A Comprehensive Guide to Fuel Tax Forms Form

Understanding fuel tax forms

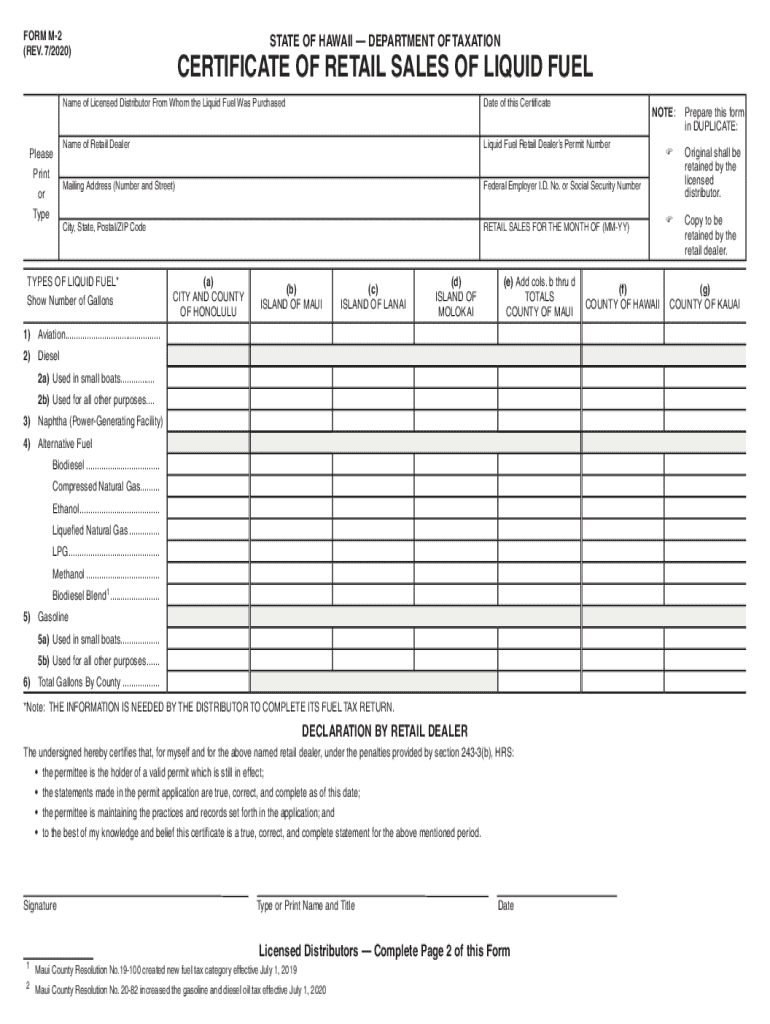

Fuel tax forms are essential documents used by taxpayers to report their fuel-related transactions to state or federal revenue authorities. They serve the purpose of tracking the usage, purchase, and taxes associated with various types of fuels, ensuring compliance with applicable fuel tax regulations. Accurate reporting is crucial, as it helps avoid fines, penalties, and allows taxpayers to benefit from any eligible refunds.

Accurate fuel tax reporting not only aids in meeting legal obligations but also enhances tax planning, allowing businesses to make informed decisions regarding fuel consumption. The regulations governing fuel taxes can vary significantly from one jurisdiction to another, making it vital for taxpayers to stay updated with local laws to ensure adherence.

Types of fuel tax forms

There are several types of fuel tax forms designed to address various fuel types and user categories. Understanding the specific forms required for your operations is essential to avoid delays and potential compliance issues.

Each type of fuel tax form has distinct requirements and is used based on specific circumstances related to fuel usage. The key differences include what fuel types they cover and what specifics are needed for proper filing. Knowing when to utilize each form is crucial to ensure accurate and timely reporting.

How to fill out fuel tax forms

Completing fuel tax forms correctly is vital for compliance and avoiding penalties. Here’s a step-by-step guide to simplify the process.

These steps are designed to help taxpayers navigate the complexities of filling out fuel tax forms, including practical examples that bolster understanding. Additionally, frequent questions about filling out these forms can clarify common misunderstandings, making the process smoother.

Editing and managing fuel tax forms

With online platforms like pdfFiller, managing fuel tax forms becomes an organized and straightforward process. Whether correcting a mistake or updating business details, pdfFiller’s capabilities enhance your document management experience.

After editing, it's essential to save and store completed forms securely. Using cloud storage solutions ensures your fuel tax forms are accessible from anywhere, allowing for better document management and retrieval.

eSigning fuel tax forms

The eSigning of fuel tax forms adds an additional layer of security and convenience. Implementing electronic signatures streamlines the process and speeds up approvals.

Using eSigning not only makes transactions faster but also ensures compliance with legal requirements, safeguarding the integrity of submitted documents.

Collaborative features for teams

Effective teamwork on fuel tax forms can reduce errors and enhance productivity. pdfFiller provides features that streamline collaboration among team members.

These collaborative tools in pdfFiller enhance teamwork efficiency for fuel tax form management, ensuring that everyone is on the same page and contributing effectively to the process.

Filing fuel tax forms

Filing fuel tax forms is the next crucial step after completing them. There are various options for submission, depending on jurisdiction.

Being aware of deadlines for filing fuel tax forms is imperative, as late submissions can incur penalties. Understanding consequences can inform your filing strategy, helping to ensure compliance and avoid unnecessary expenses.

Additional tools and resources

Utilizing tools for fuel tax calculations can ease the burden of determining tax liability. Online platforms offer interactive tools that can estimate taxes based on fuel usage.

These tools and resources can support taxpayers in effectively managing their fuel tax responsibilities while enhancing confidence in their filings.

FAQs about fuel tax forms

As with any tax-related topic, questions frequently arise regarding fuel tax forms. Addressing these common queries can clarify important aspects of the process.

Providing answers to these FAQs can enhance understanding and preparedness among taxpayers, ensuring they are well-equipped to handle their fuel tax obligations.

Getting help with fuel tax forms

Navigating the intricacies of fuel tax forms can be challenging. Seeking expert assistance can provide clarity and resolve any uncertainties.

Leveraging support resources ensures a smoother experience in creating and filing fuel tax forms, empowering users to meet their obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit fuel tax forms from Google Drive?

How do I make changes in fuel tax forms?

Can I edit fuel tax forms on an iOS device?

What is fuel tax forms?

Who is required to file fuel tax forms?

How to fill out fuel tax forms?

What is the purpose of fuel tax forms?

What information must be reported on fuel tax forms?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.