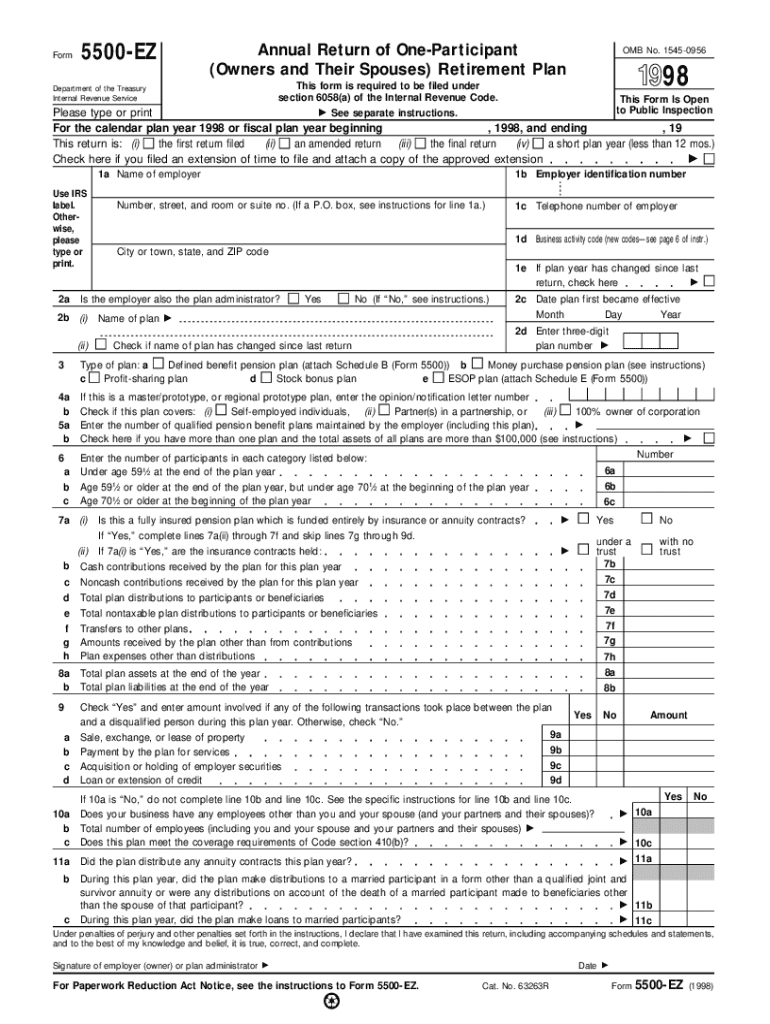

Get the free Instructions for Form 5500-EZ, annual return of one-participant ...

Get, Create, Make and Sign instructions for form 5500-ez

How to edit instructions for form 5500-ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form 5500-ez

How to fill out instructions for form 5500-ez

Who needs instructions for form 5500-ez?

Instructions for Form 5500-EZ: A Comprehensive Guide

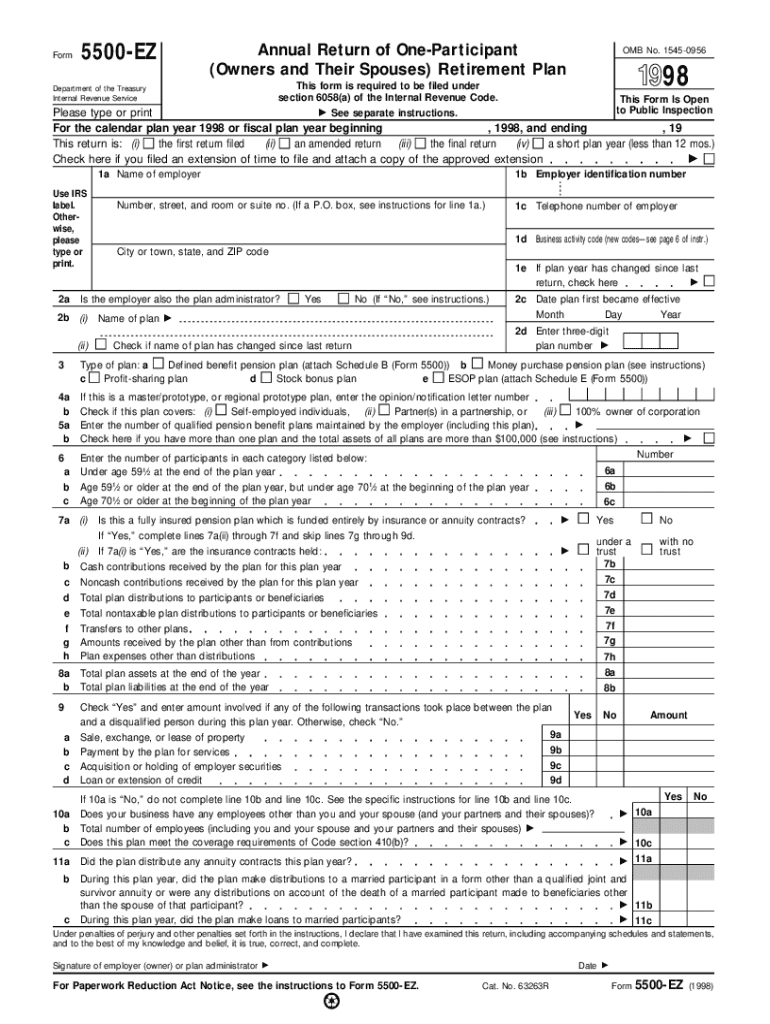

Overview of IRS Form 5500-EZ

IRS Form 5500-EZ is a crucial document for plan administrators of one-participant retirement plans and small businesses. It is utilized for reporting information about employee benefit plans to the Department of Labor and the IRS, providing transparency and compliance with federal regulations. Understanding its necessity is vital for employers and plan administrators to ensure they remain compliant with the Employee Retirement Income Security Act (ERISA).

Filing this form is mandatory for any plan with significant asset holdings or benefiting participants. Conversely, failing to file can result in hefty penalties and complications in managing retirement plans, underscoring the importance of understanding how to fill it out correctly.

Eligibility for using Form 5500-EZ

Not every plan administrator can utilize Form 5500-EZ; specific criteria must be met. This form is primarily designated for single-employer plans that cover only the business owner, their spouse, or their partners. The eligibility criteria stipulate that the plan should not have more than 100 participants at the beginning of the plan year, making it suitable for smaller entities.

It's essential to recognize circumstances where Form 5500 or Form 5500-SF may be more appropriate. For larger plans with numerous participants or complex structures, these alternative forms provide the required reporting mechanisms, ensuring compliance with deeper regulatory standards.

Required information for Form 5500-EZ

When preparing to fill out Form 5500-EZ, comprehensive information about the plan must be gathered. This includes characteristics like the plan's name, type, and identifying plan number, essential for accurate reporting. Plan administrator details, including contact information, are equally vital, as this individual serves as the primary contact for inquiries.

In addition to these basic identifiers, key financial data reflects the health of the plan. This includes total contributions for the plan year, current account balances, and investment returns, providing a complete picture during the filing process.

Step-by-step guide on how to fill out IRS Form 5500-EZ

Before initiating the filing process, it's paramount to prepare your documents. Begin by gathering all pertinent information, ensuring you possess accurate figures and contact information. A well-structured checklist can facilitate this preparation, helping you to streamline the filing process.

Next, fill out each part of the form step by step. Start with Part I: Basic Plan Information, where you’ll input primary details about the plan. In Part II: Financial Information, ensure you comprehensively report on contributions and account status. Finally, in Part III: Compliance Information, address questions about adherence to ERISA requirements. Be vigilant to avoid common mistakes such as misreporting participant numbers or financial figures, which can lead to complications down the line.

Electronically submitting your Form 5500-EZ

Submitting Form 5500-EZ can be done easily via electronic means, which not only streamlines the process but also leaves a digital footprint for your records. Various platforms like pdfFiller offer online filing options that facilitate the completion and submission of the form electronically. This is pivotal for busy plan administrators who require an efficient, access-from-anywhere solution.

The advantages of using a cloud-based service extend to features like interactive editing and e-signing, simplifying collaboration among team members and ensuring all necessary parties can be involved in the submission process seamlessly.

Filing deadlines and payment information

Filing Form 5500-EZ does not come without deadlines. Plan administrators must be aware of the key submission dates—typically due seven months after the end of the plan year, with extensions available in some circumstances. Staying updated on these deadlines is critical to avoid penalties, which can accumulate quickly for late or non-filing.

Understanding the fee structures for any late filings and the associated penalties can be beneficial, helping you avoid unnecessary expenses. When preparing the form, also educate yourself on the payment procedures, which vary based on approach—whether manual or electronic.

Post-filing considerations

After filing Form 5500-EZ, acknowledging what happens next is essential. You will typically receive a confirmation from the IRS regarding the reception of your filing. Being aware of processing times helps manage expectations and ensures transparency in maintaining your plan’s status.

Equally important is maintaining records. It's advisable for plan administrators to retain copies of filings and any supplementary documents for several years. Establish a structured document retention policy to ensure compliance and readiness for any inquiries or audits that might arise in the future.

FAQ about Form 5500-EZ

After digesting the information, questions often remain. Common inquiries include whether one must file if there are no participants in the plan. The answer is typically yes, as even inactive plans must report annually to maintain their compliant status. Similarly, many wonder if multiple plans can be reported on one form; generally, that is not permissible as each plan should be reported individually.

Amendments to previously filed forms are also a standard concern among plan administrators. If corrections are needed, the IRS has specific guidelines detailing the process for amending filings, emphasizing the importance of accuracy in your reports over time.

Benefits of using pdfFiller for form management

One significant advantage of utilizing pdfFiller in managing IRS Form 5500-EZ involves streamlined document management. The robust platform allows users to not only create and fill out forms but also edit and manage them effectively from anywhere. Such tools enhance efficiency, particularly for small business owners juggling multiple administrative responsibilities.

Being able to access your document from different devices ensures that plan administrators can remain productive, regardless of their location. This flexibility ultimately streamlines the process of managing employee benefit plans, ensuring compliance while simplifying operations.

User testimonials

Real experiences of users highlight the effectiveness of pdfFiller for Form 5500-EZ management. Many users express appreciation for the intuitive interface that enables efficiency in filing, stating that the platform simplifies an otherwise complex process. Users routinely highlight how collaborative features help their teams work together, making the task of paperwork smoother and faster, ultimately enhancing productivity.

These testimonials reinforce pdfFiller’s reputation in transforming the way individuals and teams approach document management and compliance, boosting confidence in the accuracy and timeliness of their filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in instructions for form 5500-ez without leaving Chrome?

Can I create an electronic signature for the instructions for form 5500-ez in Chrome?

How do I edit instructions for form 5500-ez on an iOS device?

What is instructions for form 5500-ez?

Who is required to file instructions for form 5500-ez?

How to fill out instructions for form 5500-ez?

What is the purpose of instructions for form 5500-ez?

What information must be reported on instructions for form 5500-ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.