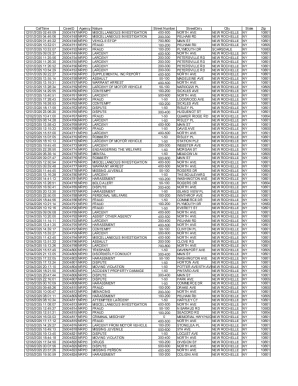

Get the free Schedule D Form N-20 Rev 2012 Capital Gains and Losses

Get, Create, Make and Sign schedule d form n-20

How to edit schedule d form n-20 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule d form n-20

How to fill out schedule d form n-20

Who needs schedule d form n-20?

A comprehensive guide to Schedule Form N-20 Form

Understanding Schedule Form N-20

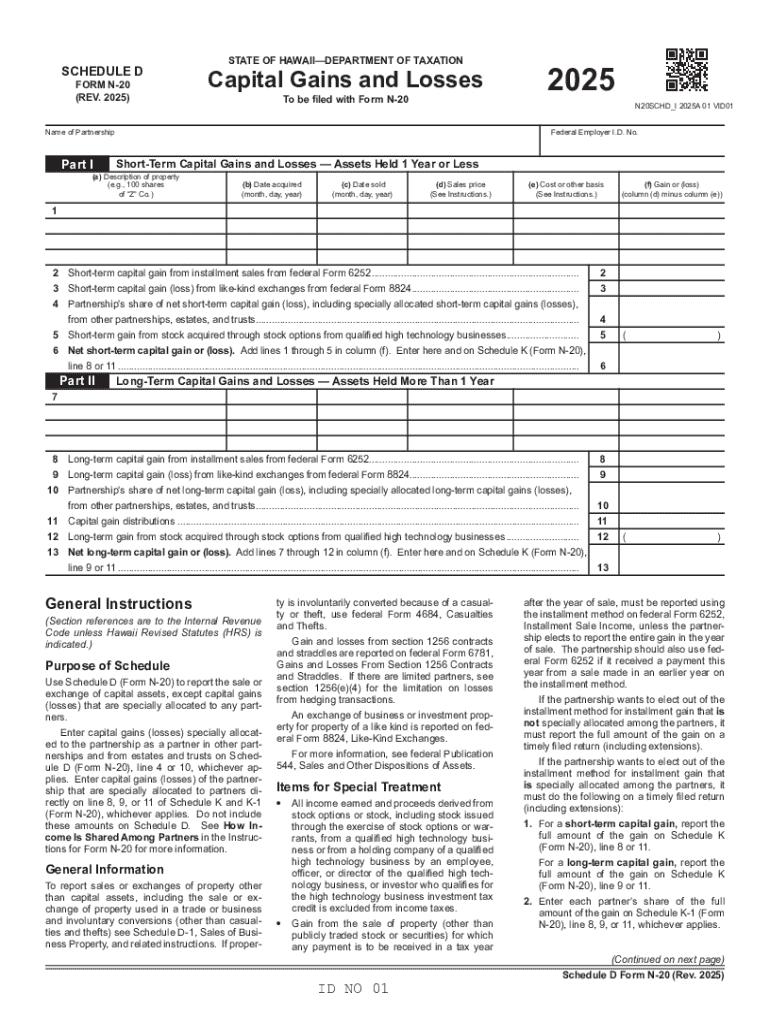

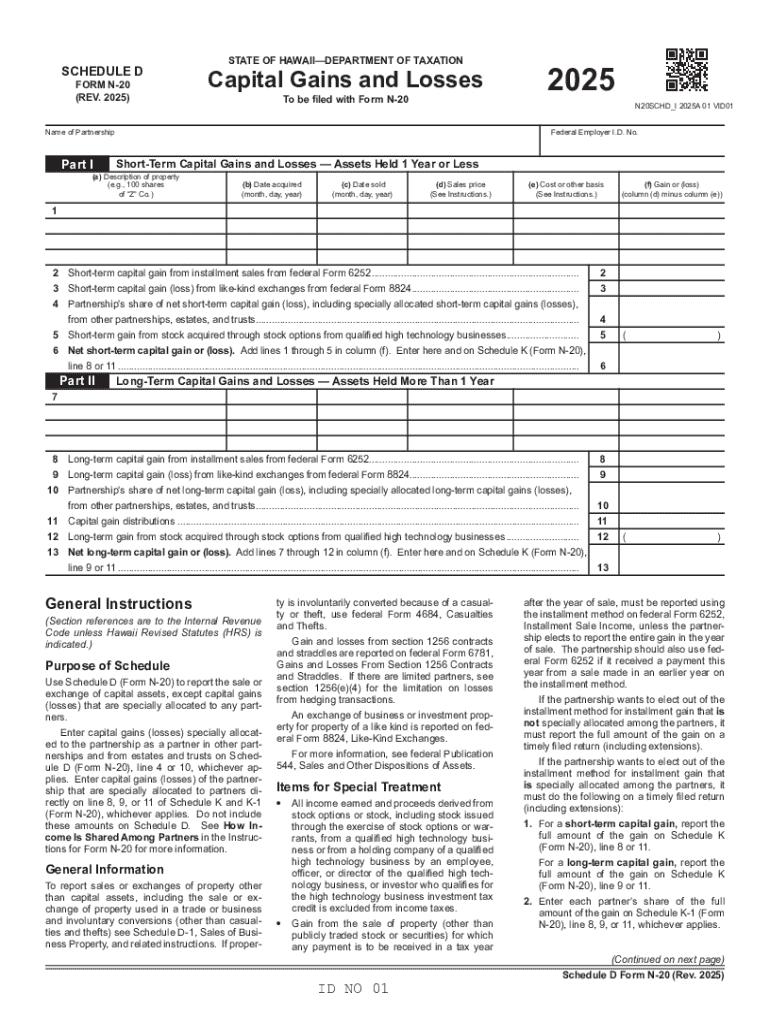

Schedule D Form N-20 is a crucial document used to report capital gains and losses from the sale of various assets. This form is specifically designed for taxpayers in jurisdictions like Hawaii and is part of the Internal Revenue Service's (IRS) requirements for accurate reporting of tax obligations. The importance of filing this form cannot be overstated; it ensures that taxpayers correctly calculate their taxable income while adhering to federal tax regulations.

Filing Schedule D Form N-20 serves several purposes: it provides transparency in reporting investment income, facilitates income tax assessment, and prevents potential penalties for underreporting. However, not everyone needs to file it. It primarily targets individuals and entities who have engaged in capital transactions, such as investments in stocks, bonds, or real estate.

Key components of Schedule Form N-20

The Schedule D Form N-20 is divided into distinct sections, each serving a unique purpose in the reporting process. The first section is primarily focused on identification information, including your name, address, and taxpayer identification number. This is essential as it helps the IRS accurately process your form.

Next is Section 2, where taxpayers report their capital gains and losses in detail. This section typically includes pertinent details, such as the date of acquisition, date of sale, sale price, and the cost basis for each asset sold. By documenting these elements accurately, you ensure that your reported gain or loss reflects the true financial condition during the specified tax period.

Finally, Section 3 summarizes all your capital gains and losses, allowing for a clear view of your net capital gain or loss. This section also determines whether your net gain is taxed at the short-term or long-term capital gains rate, which can lead to significant tax savings.

Step-by-step instructions for completing Schedule Form N-20

Completing Schedule D Form N-20 may seem daunting at first, but it can be simplified by following a clear process. Before you begin, gather necessary documentation such as transaction confirmations and financial statements from your investments. These documents are critical for determining the correct amounts to report.

The first step involves gathering necessary documentation. Required documents include your brokerage statements and any other records related to asset sales. Having previous year’s tax returns is also beneficial for consistency in reporting.

Next, fill out each section of the form. Use real-life examples to clarify numbers; for instance, if you sold stock for $2,000 that you initially purchased for $1,500, your gain would be $500. Pay close attention to common errors, such as transposing numbers or misclassifying assets, as these can lead to incorrect reporting.

Finally, double-check your entries. Review your calculations to ensure they align with your financial documents. Simple mathematical errors can cause significant issues when filing. Using tools like excel can help in making accurate calculations and generating summaries.

Interactive tools for Schedule Form N-20

To ease the process of reporting capital gains and losses via Schedule D Form N-20, numerous interactive tools are available. Online calculators specifically designed for capital gains and losses can significantly simplify the process, helping taxpayers accurately compute their taxable amounts.

In addition, templates for document preparation can streamline the data entry process. Users can create a draft of their form before entering final numbers, which reduces human error. Tools for eSigning and document management are also instrumental in moving the process along efficiently, particularly for those managing multiple forms or needing collaboration.

Editing and managing your Schedule Form N-20

Editing your Schedule D Form N-20 is made simpler with platforms like pdfFiller. The process starts with ensuring that you have the correct version of the form. Once you've completed your data entry, you can easily edit any section of the form using their intuitive interface. The platform provides various tools to modify existing text, add new information, or remove data as necessary.

After editing, saving and exporting your completed form is straightforward. Users can choose from multiple formats, such as PDF or image files, depending on what works best for their needs. Navigating the eSigning feature on pdfFiller’s cloud platform further simplifies the signing process, allowing for easy collaboration and document sharing with relevant parties or tax advisors.

Filing Schedule Form N-20 with the IRS

Key deadlines for submitting Schedule D Form N-20 should be noted to avoid penalties. Generally, these deadlines align with tax filing deadlines, which can vary based on specific circumstances, such as if you are filing individually or as part of a business. Ensure you are aware of any extensions that may be available.

Filing methods vary, with e-filing generally preferred for its speed and accuracy. However, some taxpayers may choose to mail their completed forms. If you opt for mail-in submission, ensure that you use the correct address provided by the IRS. After submission, tracking your filing status is essential. You can do this by contacting the IRS or using their online tools for confirmation.

Common FAQs about Schedule Form N-20

Understanding common questions regarding Schedule D Form N-20 can clarify any confusion taxpayers may face. A frequently asked question involves when to actually file the form. If you’ve sold capital assets during the tax year, it’s often necessary to report gains or losses, requiring the completion of this form.

Tax professionals frequently emphasize the importance of maintaining accurate records throughout the year to ease the filing process. Other common challenges include calculating basis and distinguishing between short-term and long-term capital gains, which can affect tax rates.

Navigating state-specific regulations

While Schedule D Form N-20 is an IRS form, it is crucial to understand state-specific implications as tax regulations can vary widely. Some states may have their requirements for reporting capital gains or might require additional forms. Staying informed about these regulations can prevent potential pitfalls and ensure compliance during tax filing.

Resources for state tax guidelines include state tax websites and financial advisors familiar with local laws. It’s beneficial to note adjustments required for different jurisdictions, especially if you move or invest across state lines, as this can complicate your tax situation.

Support and community resources

Utilizing pdfFiller provides users access to real-time guidance when filling out Schedule D Form N-20. The platform not only offers comprehensive tools for editing and signing documents but also includes educational materials to enhance understanding of the filing process. This ensures that users can confidently navigate their tax obligations.

Community forums are invaluable for exchanging experiences and advice related to tax filing. Here, individuals can discuss challenges, share tips, and seek assistance. Additionally, links to professional tax assistance services available for consult can guide users through complex tax scenarios.

Additional considerations when filing Schedule Form N-20

Filing Schedule D Form N-20 needs careful consideration to avoid mistakes that may lead to penalties. One common consequence of incorrect filing is audit risk, which could result in fines or additional taxes owed. Thus, double-checking your work and ensuring all figures are correct is essential.

If you find mistakes in your previously submitted Schedule D Form N-20, understand how to amend it correctly. The IRS provides specific procedures for filing an amended return, often requiring detailed explanations for adjustments. Moreover, coordinating with other tax forms helps streamline your overall filing experience, ensuring adherence to tax obligations across various documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send schedule d form n-20 for eSignature?

How do I complete schedule d form n-20 on an iOS device?

How do I edit schedule d form n-20 on an Android device?

What is schedule d form n-20?

Who is required to file schedule d form n-20?

How to fill out schedule d form n-20?

What is the purpose of schedule d form n-20?

What information must be reported on schedule d form n-20?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.