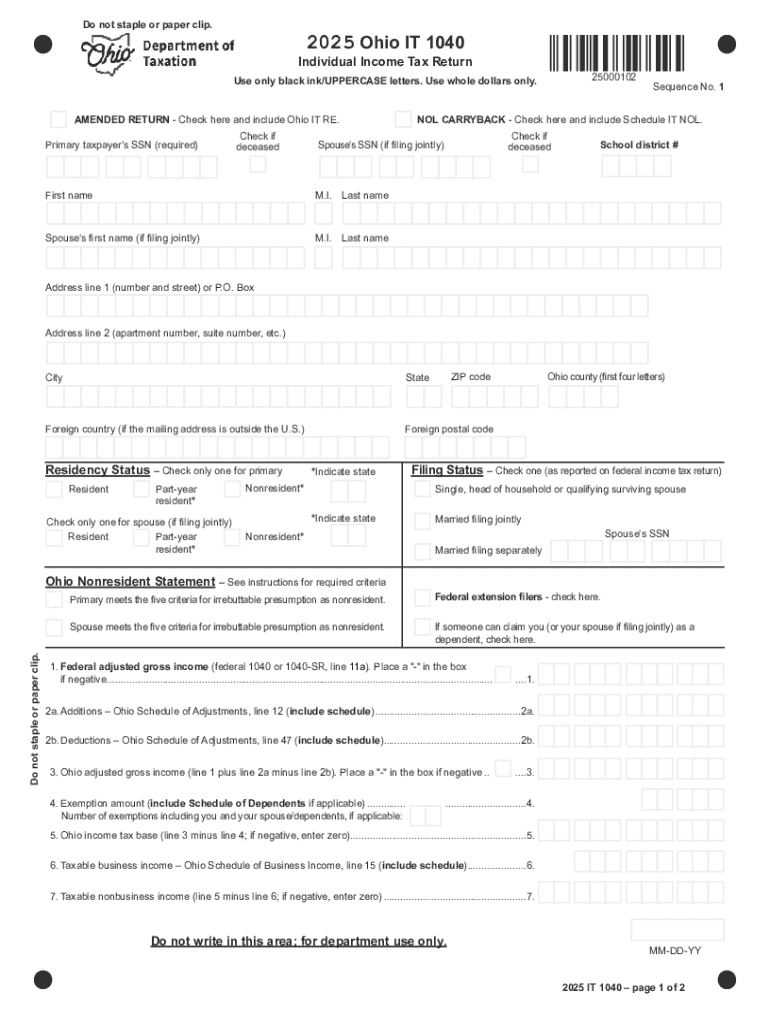

Get the free Form IT-1040 (2025) - Ohio Individual Income Tax Return

Get, Create, Make and Sign form it-1040 2025

Editing form it-1040 2025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form it-1040 2025

How to fill out form it-1040 2025

Who needs form it-1040 2025?

Form IT-1040: A Comprehensive Guide for the 2025 Tax Year

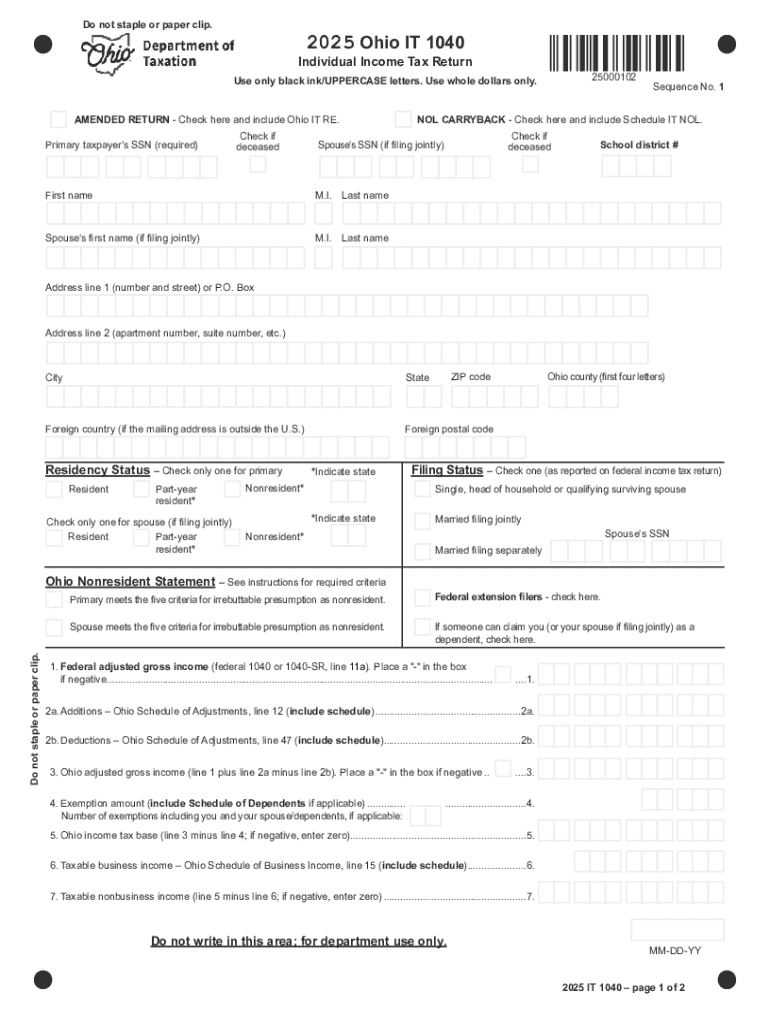

Understanding Form IT-1040 for the 2025 tax year

Form IT-1040 is crucial for taxpayers in Ohio as it serves as the state's individual income tax return. This form allows residents to report their income, calculate tax liabilities, and claim any eligible deductions and credits. The Form IT-1040 needs to be filed annually by Ohio residents to determine their tax obligations accurately.

For the 2025 tax year, there are significant changes that taxpayers should be aware of. Adjustments in tax rates or thresholds can impact the overall amount owed or refunded. Therefore, it's essential for taxpayers to stay updated with these changes to ensure compliance.

Who should use Form IT-1040?

Residents of Ohio who have earned income or are otherwise required to file a tax return should use Form IT-1040. This includes individuals with traditional wages, self-employment income, and even certain investment earnings. Generally, anyone who meets the eligibility criteria set by the Ohio Department of Taxation should file.

Specific scenarios where Form IT-1040 is applicable include working households, retirees receiving Social Security benefits, or individuals investing in stocks and bonds. If your total income exceeds Ohio's filing requirement threshold, you must file this form regardless of your employment status.

Preparing to fill out Form IT-1040

Before filling out Form IT-1040, it's critical to gather necessary documents and information. This preparation will streamline the process and ensure accuracy. Key pieces of information needed include your Social Security number, personal identification details, and documentation of all income received throughout the year.

Additionally, you’ll need to compile documentation for deductions and credits you plan to claim. Such records might include 1099 forms for freelance work, W-2s from employers, and receipts for deductible expenses. Consider organizing these documents electronically using a platform like pdfFiller, which simplifies document management.

Step-by-step guide to filling out Form IT-1040

Filling out Form IT-1040 can seem daunting, but breaking it down into manageable sections can simplify the process. Start with the Personal Information section, where accuracy is paramount. Ensure all names and identification numbers are correct to avoid delays or issues during processing.

Next, move to the Income Sections. Report all sources of income accurately, whether it be wages, self-employment, or dividends. It's important to document each source clearly, as this will substantiate your claims in case of audits.

In the Deductions and Credits area, you'll want to carefully assess what applies to your situation. Common deductions include those for educational expenses or medical bills. It's essential to keep the required documentation organized and accessible.

Calculating tax liability involves applying the state's tax rates to your taxable income. Understanding Ohio's tax brackets will assist in accurate calculations. Finally, determine if you're owed a refund or if you have a balance due. This final number will guide your next steps.

Common mistakes to avoid

While filling out Form IT-1040, several common mistakes can lead to unnecessary IRS delays or audits. One of the most frequently overlooked details is failing to report all sources of income. Omitting even a small amount can raise red flags for tax authorities.

Another common error is incorrectly calculating deductions or credits. Make sure to double-check eligibility and documentation for each deduction claimed. Errors could lead to penalties, interest on unpaid taxes, or underpayment fees, all of which can be easily avoided with careful attention to detail.

Revisions and corrections

Mistakes can happen when filling out Form IT-1040. If you realize you need to amend your return, filing an amended return is essential. This can be done using Form IT-1040X if an error is discovered after your original submission.

pdfFiller can facilitate the amendment process by helping you edit your existing forms quickly. Simply upload your initial submission, amend your information, and file the revised return through the platform for a smoother experience.

Filing Form IT-1040

Once you’ve completed your Form IT-1040, it’s time to submit it. There are two main methods for filing: electronic submission or mailing a physical copy. Electronic filing has been endorsed by the Ohio Department of Taxation for its speed and efficiency, often leading to quicker refunds.

Choosing to e-file through pdfFiller can simplify this process significantly. The platform provides an intuitive interface that allows direct submission to the Ohio tax office, ensuring that all forms are filed correctly and on time.

Post-filing actions

After you've filed your Form IT-1040, it's crucial to keep track of your return. You can monitor your refund status on the Ohio Department of Taxation website. Having all relevant paperwork organized can help you navigate any inquiries or issues that may arise after submission.

Moreover, establishing solid record-keeping practices ensures that you have all relevant documents for future audits. Using digital document management tools like pdfFiller allows for efficient storage and retrieval, which is essential during tax season.

Frequently asked questions (FAQs) about Form IT-1040

Many taxpayers have similar questions regarding Form IT-1040. Common concerns include eligibility requirements as well as how to navigate seasonal changes in tax laws. Taxpayers often want clarification on what qualifies as taxable income and how different tax credits apply based on income brackets.

Utilizing resources like pdfFiller can answer many of these queries, as the platform offers comprehensive user guides and support channels for form management. This empowers users to approach filing with confidence, knowing they have accurate information at their fingertips.

Embracing comprehensive document solutions

Utilizing pdfFiller for tax preparation not only enhances efficiency but also ensures accuracy in managing your tax forms. The platform's user-friendly interface accommodates individual users and teams, fostering collaboration in document creation and submission.

With capabilities like e-signing and sharing documents, pdfFiller improves the overall workflow for tax preparation. It allows individuals to manage their paperwork seamlessly while providing robust tools for those in professional settings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form it-1040 2025 from Google Drive?

Can I sign the form it-1040 2025 electronically in Chrome?

Can I edit form it-1040 2025 on an Android device?

What is form it-1040 2025?

Who is required to file form it-1040 2025?

How to fill out form it-1040 2025?

What is the purpose of form it-1040 2025?

What information must be reported on form it-1040 2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.