Get the free Form MO-PTE Opt-Out - dor mo

Get, Create, Make and Sign form mo-pte opt-out

Editing form mo-pte opt-out online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form mo-pte opt-out

How to fill out form mo-pte opt-out

Who needs form mo-pte opt-out?

Complete Guide to the MO-PTE Opt-Out Form: Everything You Need to Know

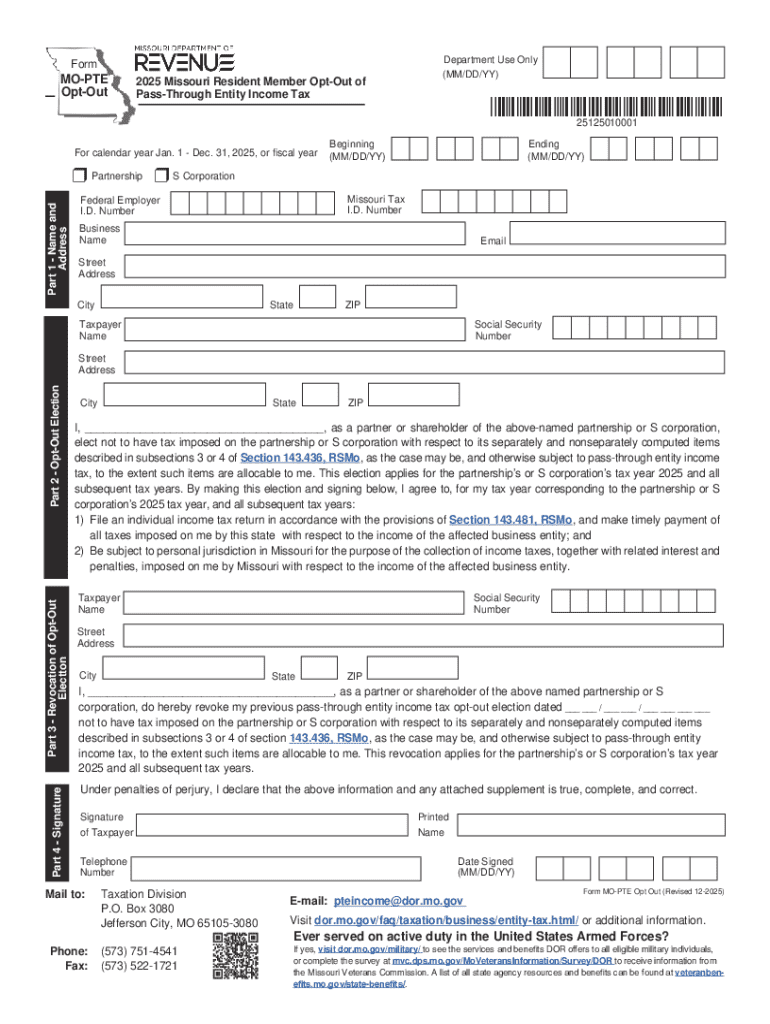

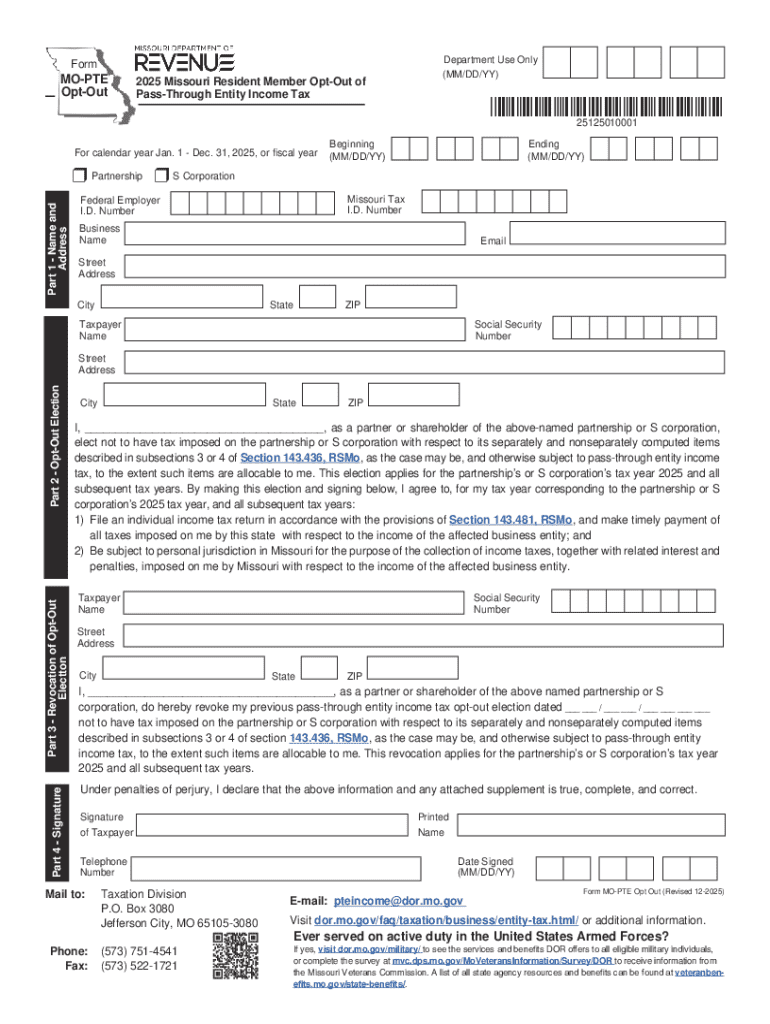

Understanding the MO-PTE opt-out form

The MO-PTE opt-out form is a crucial document that allows individuals and organizations in specific scenarios to decline participation in the Missouri Pass-Through Entity (PTE) tax regime. This regime impacts how certain types of income are taxed, and opting out can have significant implications for the tax obligations of both individuals and businesses.

The primary purpose of the MO-PTE opt-out form is to enable taxpayers to formally choose not to be taxed under the provisions that affect pass-through entities. By submitting this form, individuals or entities decide to manage their tax liabilities differently, allowing for strategic financial planning.

Key features of the MO-PTE opt-out form

The MO-PTE opt-out form is designed with specific sections that cater to both individuals and organizations, ensuring clarity and thoroughness in the application process. Key features include sections for personal identification, tax identification numbers, and the specific reasons for opting out, among others.

The required information typically includes details such as your name, address, tax identification number, and any relevant documentations proving your eligibility to opt out. Ensuring that all fields are accurately completed is essential to avoid delays or denials.

Step-by-step guide to accessing the MO-PTE opt-out form

To begin, accessing the MO-PTE opt-out form is quite straightforward. Start by navigating to the pdfFiller website, which offers an extensive repository of templates and forms. An intuitive user interface allows users to locate documents quickly.

Utilizing search and filter tools on pdfFiller, users can enter keywords like 'MO-PTE opt-out form' to hone in on the specific document required without cumbersome scrolling through unrelated forms.

Filling out the MO-PTE opt-out form

Filling out the MO-PTE opt-out form correctly is crucial to ensure acceptance by the tax authorities. The first section generally requests personal information, such as your name and contact details. It’s important to be precise here, as inaccuracies can lead to automatic rejections.

Another vital part of the form is the opt-out criteria. Understanding your eligibility helps in completing this section correctly. Most individuals for whom the taxation would cause adverse financial implications can provide justifiable reasons for opting out.

Editing the MO-PTE opt-out form efficiently

Using pdfFiller's suite of editing tools transforms the experience of managing the MO-PTE opt-out form. After accessing the form, you can upload any necessary documents for easy reference, maintaining a streamlined editing process. The platform offers various functionalities such as text editing, scaling, and annotation that make adjustments easy.

Collaboration features allow individuals to invite team members or tax professionals for review, ensuring all aspects of the form are checked. This not only enhances the accuracy of the final submission but also captures collective input for better decision-making.

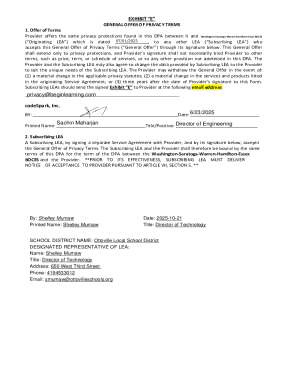

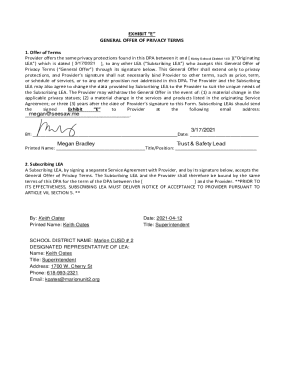

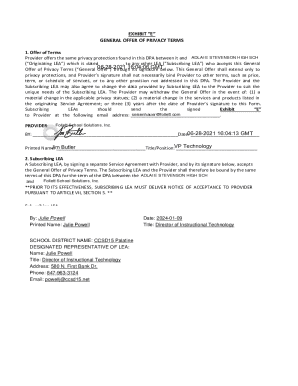

Signing the MO-PTE opt-out form

Understanding eSignatures is pivotal when completing the MO-PTE opt-out form through pdfFiller. An electronic signature, once added, has the same legal validity as a handwritten one, provided that it adheres to state regulations regarding electronic signing.

To sign the MO-PTE opt-out form in pdfFiller, users can easily add their electronic signature, initials, or additional markings. Authenticity is paramount; hence, make sure to follow the given prompts correctly to ensure your signature is recognized.

Submitting the MO-PTE opt-out form

Upon completing the MO-PTE opt-out form, the submission process can vary. Users have the option to submit online directly through the pdfFiller platform or mail in a hard copy. When choosing to submit electronically, ensure that all final documents are properly saved and that you adhere to the platform’s designated steps.

For those opting for traditional mail, ensure that you are aware of any deadlines and that you have the correct addresses for submission. Tracking your submission after sending is recommended to confirm that it has been received and processed.

Managing your MO-PTE opt-out form after submission

After submitting the MO-PTE opt-out form, managing its status is essential. pdfFiller provides users with tools for tracking document statuses, helping you stay informed about where your application stands in the review process. Maintaining a record of all documents submitted is also recommended, as it assists in any potential follow-up actions.

If circumstances change and you need to amend or revoke your opt-out status, knowing how to navigate this process is vital. The ability to make adjustments promptly can save both time and potential financial consequences.

Frequently asked questions (FAQs)

Among the common concerns that arise regarding the MO-PTE opt-out form are questions about possible denials. If your form is denied, it’s important to request clarification from the tax office to understand the reasons behind the decision, facilitating corrective action when necessary.

Maintaining awareness of your rights and options post opt-out is equally as important. Individuals have the right to dispute decisions made by the tax authorities should they feel that they were not rightfully processed.

Best practices for document management

Leveraging cloud-based solutions such as pdfFiller offers benefits that go beyond forms management. Users have access to a comprehensive suite of tools that help in the organization, editing, and sharing of documents, making it easy to retain oversight over compliance matters.

Additionally, adopting sound practices for document security is paramount. Ensuring sensitive information is protected by using encrypted connections and understanding privacy regulations related to submissions can prevent data breaches and enhance trust.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form mo-pte opt-out online?

Can I create an electronic signature for the form mo-pte opt-out in Chrome?

Can I create an eSignature for the form mo-pte opt-out in Gmail?

What is form mo-pte opt-out?

Who is required to file form mo-pte opt-out?

How to fill out form mo-pte opt-out?

What is the purpose of form mo-pte opt-out?

What information must be reported on form mo-pte opt-out?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.