Get the free MO-PTEAP Pass-through Entity Anticipated Tax Payment ... - dor mo

Get, Create, Make and Sign mo-pteap pass-through entity anticipated

How to edit mo-pteap pass-through entity anticipated online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mo-pteap pass-through entity anticipated

How to fill out mo-pteap pass-through entity anticipated

Who needs mo-pteap pass-through entity anticipated?

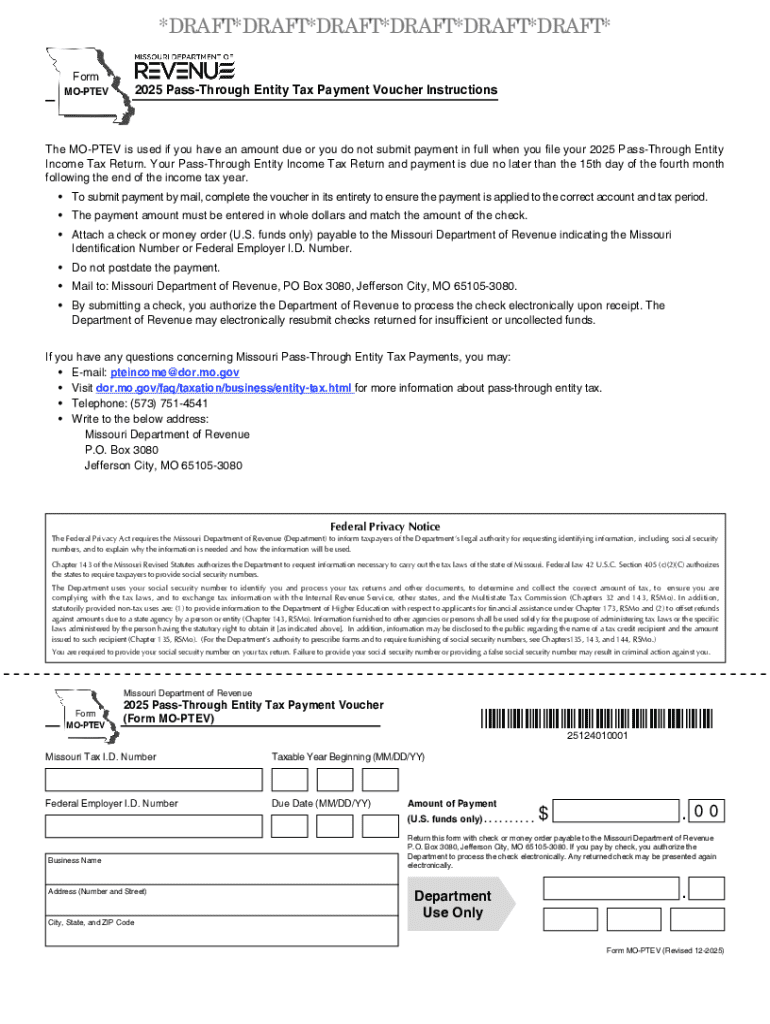

Understanding the mo-pteap Pass-Through Entity Anticipated Form

What is the mo-pteap pass-through entity anticipated form?

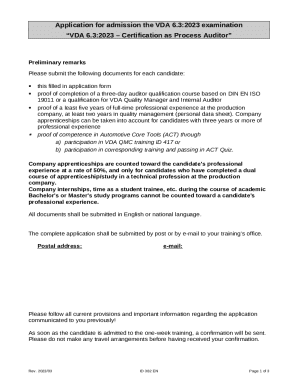

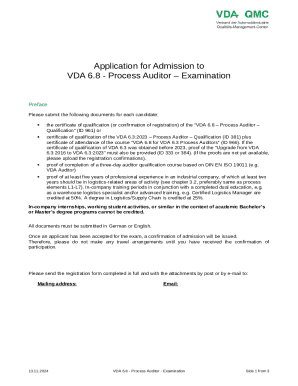

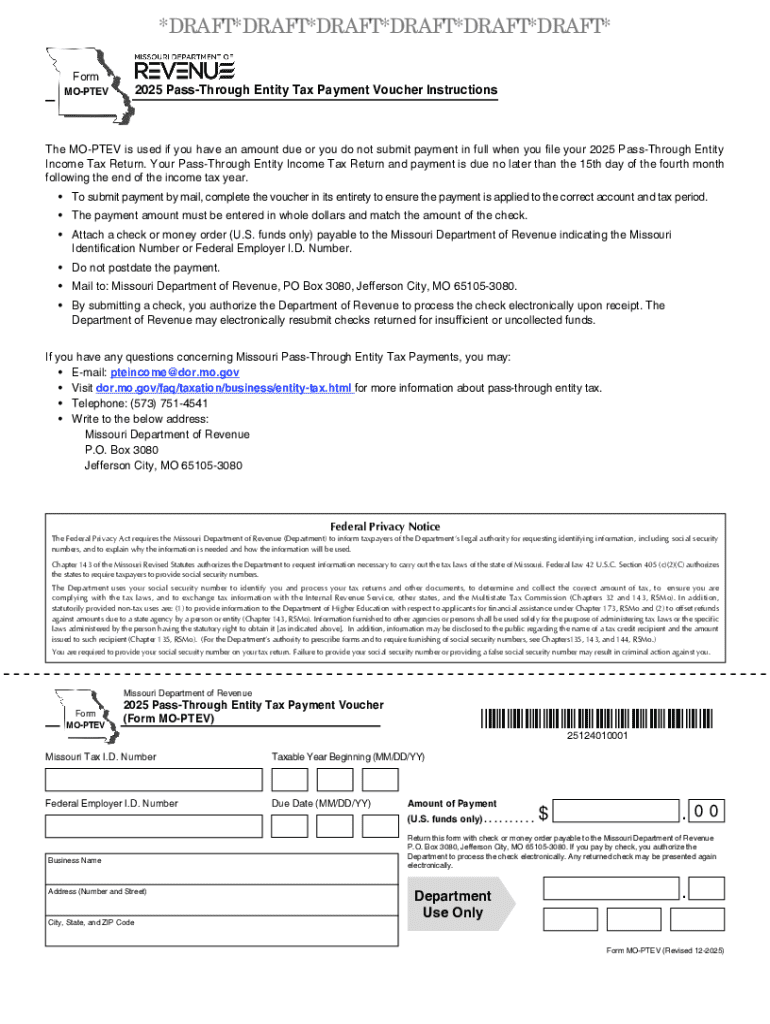

The mo-pteap pass-through entity anticipated form is a crucial document that allows pass-through entities, such as partnerships and S corporations, to communicate anticipated tax liabilities to the Missouri Department of Revenue. This form is essential for ensuring compliance with state tax regulations, helping entities fulfill their tax obligations efficiently. The importance of this form lies in its role as a bridge between the entity's financial activities and the state tax system.

By filing the mo-pteap form, entities provide the necessary information that informs the state about their expected income, deductions, and credits for the upcoming tax period. This proactive approach enables better tax planning and mitigates the risk of unexpected liabilities during the tax season.

Key features of the mo-pteap form

The mo-pteap form has a structured layout that guides users through the necessary information required for submission. Key sections include an overview of the entity, income details, deductions, and any credits that can be claimed. Each of these sections is designed to capture specific aspects of the entity’s financial situation.

Unlike standard tax forms, the mo-pteap is tailored specifically for pass-through entities. This means it includes unique compliance requirements that reflect the nature of income reporting for these types of organizations. For example, while typical tax forms may focus more heavily on individual income, the mo-pteap emphasizes entity-level data, ensuring accurate reporting of distributed earnings.

Step-by-step guide to completing the mo-pteap form

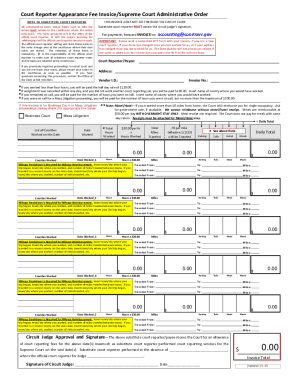

To effectively complete the mo-pteap form, gather the following necessary information: financial statements, prior year tax returns, and documentation of income and expenses. This foundational data is critical – it lays the groundwork for accurately filling out the form.

1. **Gathering Necessary Information:**)

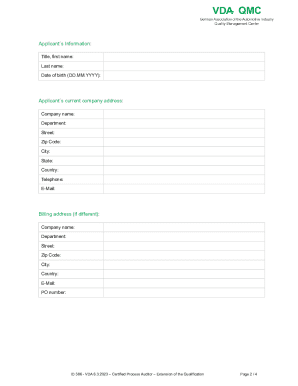

2. **Filling Out the Form:** Section-by-section breakdown begins by entering information about the entity at the top, including the legal name, tax ID, and date of formation. Next, report expected income and list deductions that will be claimed.

3. **Review and Verification of Information:** After filling out the form, take time to verify your entries. Ensure that all the figures match your financial documents. Accuracy is paramount to avoid penalties or delays.

4. **Finalizing the Form:** Finally, the form must be signed by an authorized representative of the entity. It can then be filed either online or on paper, depending on the preferences and capabilities of the entity.

Editing and managing your mo-pteap form

Once the mo-pteap form is drafted, editing may be necessary. Tools like pdfFiller offer intuitive editing capabilities that allow users to make changes easily without hassle. Whether you need to update figures or add additional sections, pdfFiller provides a user-friendly interface for seamless modifications.

For optimal management of your forms, consider digital storage practices. Utilizing cloud storage solutions enables you to access your documents from anywhere. Organizing your forms in folders can simplify future retrieval when you need to reference past submissions.

eSigning the mo-pteap form

Electronic signatures offer convenience and speed when finalizing the mo-pteap form. The integration of eSigning features within pdfFiller allows users to apply their signature instantly, avoiding the delays associated with traditional ink signatures.

The benefits of eSigning include enhanced security and faster turnaround times. To apply an eSignature, select the designated spot in the form, and follow the on-screen prompts to add your signature securely.

Collaborating on the mo-pteap form

Collaboration becomes effortless with cloud-based tools. When using pdfFiller, multiple team members can work on the mo-pteap form simultaneously. This feature streamlines communication and ensures that all stakeholders can contribute their expertise, ultimately leading to a more accurate submission.

Additionally, the platform allows for tracking changes and comments, enhancing the review process. Utilize comment features to annotate specific sections for further discussion, and maintain version control to avoid confusion over which document is the latest.

Frequently asked questions (FAQs) about the mo-pteap form

Understanding who needs to file the mo-pteap form is straightforward: any entity in Missouri classified as a pass-through entity must complete it. This includes corporations that pass their income through to their owners for tax purposes.

Should a mistake occur after filing, it's crucial to understand the procedures for amendments. Filing an amended form with corrected information ensures compliance and avoids penalties. Additionally, staying updated on any changes to the form or filing requirements is essential for smooth tax reporting.

Leveraging pdfFiller for document management

pdfFiller enhances the document creation process, particularly regarding the mo-pteap form. Its suite of features, tailored specifically for tax forms, includes options for easy editing and collaboration. Users can create, edit, and even securely store their forms without overwhelming complexity.

The cloud-based nature of pdfFiller means that forms are accessible anywhere, at any time. This flexibility allows for continuous compliance, even when on the move. Ensure you stay organized and up-to-date regardless of your location.

State-specific considerations for the mo-pteap form

When filing the mo-pteap form, understanding Missouri's specific tax regulations is paramount. Each state has unique requirements that can affect how taxes are calculated and reported. Familiarizing yourself with state-level regulations, including local tax incentives or additional documentation may be necessary, further aligning your filings with statutory obligations.

Resources available from the Missouri Department of Revenue can provide crucial insights about any recent changes or updates in tax laws affecting the mo-pteap form. Engaging in such research helps to further alleviate compliance challenges.

Additional tools and templates related to the mo-pteap form

Alongside the mo-pteap form, other related documents can assist pass-through entities during the tax reporting process. Essential tax forms, such as the IRS Schedule K-1 or the Missouri Form 1040, may also be relevant.

Accessing templates through pdfFiller ensures that you have the most current and relevant forms at your fingertips. This readiness is crucial when preparing for tax season, allowing for streamlined document management and compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit mo-pteap pass-through entity anticipated straight from my smartphone?

Can I edit mo-pteap pass-through entity anticipated on an iOS device?

How do I complete mo-pteap pass-through entity anticipated on an Android device?

What is mo-pteap pass-through entity anticipated?

Who is required to file mo-pteap pass-through entity anticipated?

How to fill out mo-pteap pass-through entity anticipated?

What is the purpose of mo-pteap pass-through entity anticipated?

What information must be reported on mo-pteap pass-through entity anticipated?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.