Get the free Paying for College: Who is Eligible to Submit the FAFSA?

Get, Create, Make and Sign paying for college who

How to edit paying for college who online

Uncompromising security for your PDF editing and eSignature needs

How to fill out paying for college who

How to fill out paying for college who

Who needs paying for college who?

Paying for College Who Form: A Comprehensive Guide

Understanding the college payment process

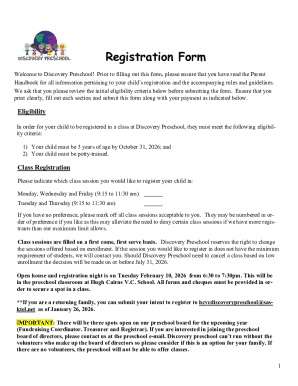

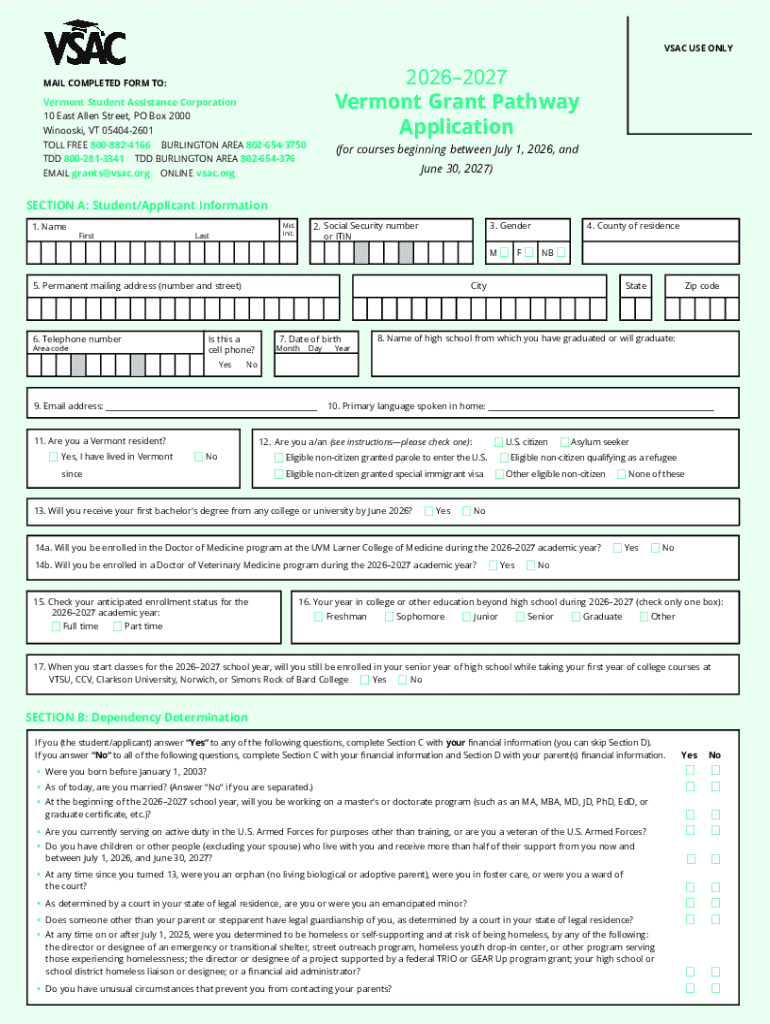

Planning for college expenses is crucial for families and students alike. The rising cost of tuition and related fees can often be overwhelming. Understanding how to navigate the financial landscape of higher education is essential for future success. Knowing the different financial aid options available, such as scholarships, grants, and federal student loans, can help alleviate the financial burden many face.

Key deadlines and important dates associated with the college payment process cannot be overlooked. Every year, numerous families miss out on financial aid simply because they were not aware of the deadlines for submitting the FAFSA or other necessary documentation. Early planning can make a significant difference in the amount of aid students receive.

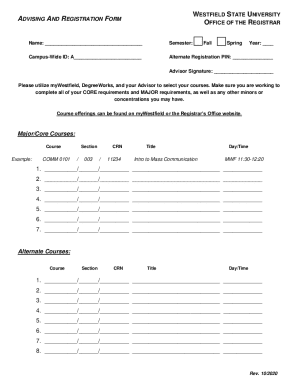

Who needs to fill out the paying for college form?

Filling out the paying for college form is not just for traditional college students; it’s a critical step for anyone looking to finance their education. The eligibility criteria for inputting financial information can vary based on individual circumstances, making it important for various types of students to understand their unique needs.

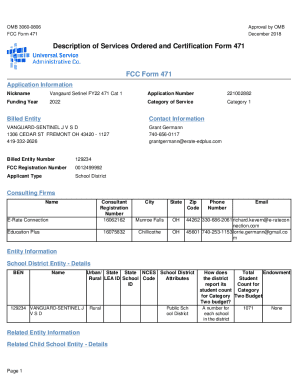

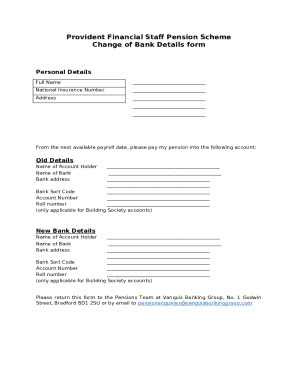

Types of forms related to college payments

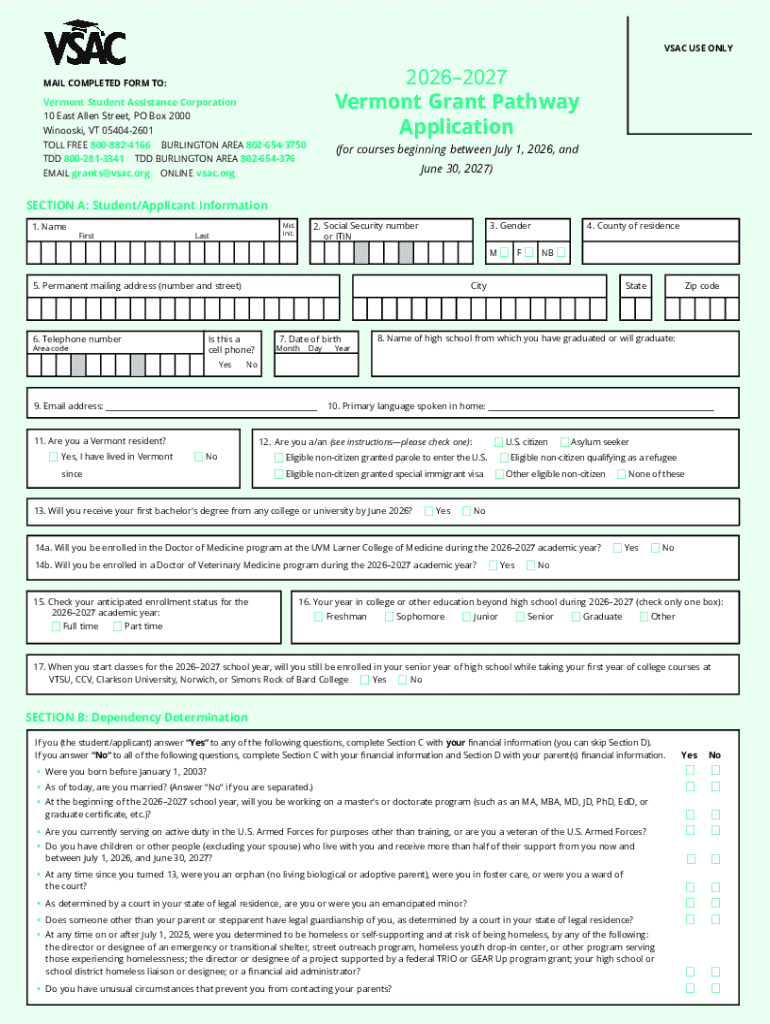

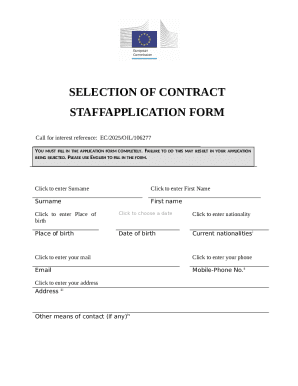

When it comes to paying for college, several forms are crucial for securing financial assistance. The most commonly known is the Federal Application for Financial Student Aid (FAFSA), which allows students to apply for federal grants, work-study opportunities, and loans.

Another important form is the CSS Profile, which some colleges require to assess non-federal financial aid grants. Each institution may also have its own institutional forms that students must complete. Knowing what is required can save time and avoid potential pitfalls.

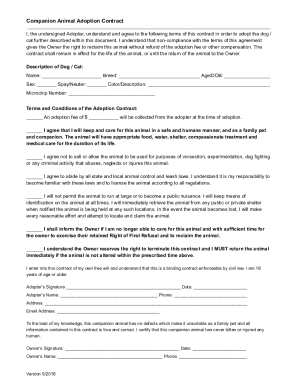

A step-by-step guide to completing the paying for college form

Completing the paying for college form can feel daunting, but breaking it down into manageable steps can simplify the process. Start with gathering necessary documentation such as tax returns, W-2 forms, and other financial statements. This preparation will ensure that all required information is at your fingertips.

Next, focus on filling out the form accurately. Each section of the form corresponds to specific financial information, and it’s vital to be as truthful and precise as possible. Additionally, take note of common mistakes to avoid, such as entering incorrect Social Security numbers or failing to sign the document.

Finally, submitting the form is just as important as completing it. Utilize online submission procedures to ensure that the form arrives on time. Keeping track of your application status can provide peace of mind and allow you to address any issues promptly.

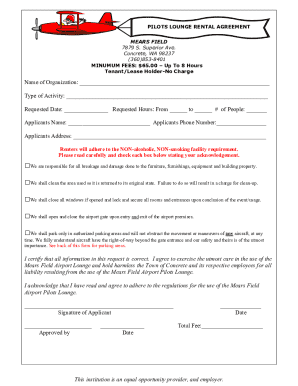

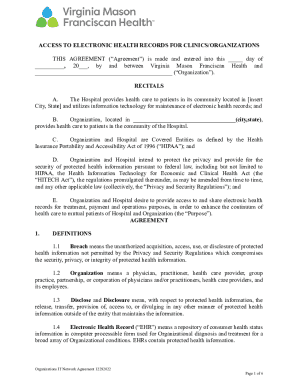

Using interactive tools for form management

Interactive tools can significantly ease the process of managing college payment forms. Platforms like pdfFiller offer document preparation features that allow users to create and customize forms with ease. Whether you're filling out the FAFSA or any other financial forms, these tools streamline the process.

Editing and customizing forms is easy, enabling you to make necessary adjustments quickly. E-signatures provide further convenience, allowing secure submissions without the need for printouts. These functionalities ensure you can access and manage your documents from anywhere, making the daunting tasks of financial planning more manageable.

Managing financial aid offers and next steps

Once the forms are submitted and financial aid offers start rolling in, the next step is to review and compare those packages carefully. Understanding what is offered, including grants, scholarships, loans, and work-study opportunities, enables families to make informed decisions about which college to attend.

If you're offered less aid than expected, don’t panic. It’s essential to reach out to financial aid offices to discuss your situation and explore reconsiderations. Accepting or declining aid offers should be based on a thorough understanding of what each offer entails, empowering students and families to make strategic choices.

Resources for navigating financial aid and tuition costs

Numerous resources are available that can help students and families estimate college costs accurately. This includes online calculators, tuition indices, and tools that assess the potential financial aid application outcome. Scholarships and grants can also significantly reduce the overall cost of college, and utilizing scholarship matching services can uncover opportunities tailored to specific needs.

Furthermore, maintaining financial literacy is paramount. Resources and workshops that focus on budgeting, understanding student loans, and managing student debt can equip families with the knowledge they need to navigate the financial aspects of education successfully.

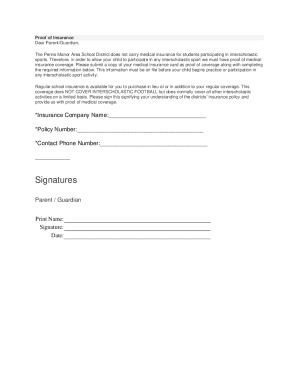

Information for parents and guardians

Parents and guardians play a crucial role in the financial aid process. Understanding your responsibilities regarding financial information and involvement can make the submitting of the paying for college form smoother. It’s essential to maintain open communication with your student about financial matters, ensuring they feel supported while navigating this complex system.

Additionally, parents should be aware of tax implications that come with financial aid packages. Knowing how various forms of assistance can impact your tax situation is crucial for effective planning and budgeting, ultimately helping families understand the full scope of financing a college education.

Special considerations

Filling out forms can be particularly challenging for divorced or separated families. Understanding which parent’s information needs to be included is vital for accurate reporting. Moreover, understanding dependency status is crucial, especially for students living independently or supporting themselves financially.

Unique scenarios, such as returning to college after years in the workforce or having multiple siblings in college, require distinct planning strategies. Each case demands specific attention to detail when filling out financial forms to maximize aid opportunities while addressing the distinct circumstances of the student.

Frequently asked questions

Navigating the paying for college form can lead to numerous questions. For example, many families are unsure about what financial information should be included or how changes in financial status after submission may affect their application. Understanding these aspects can ease anxiety surrounding the process and ensure families are adequately prepared.

If you find yourself stuck, numerous resources are available for assistance. Financial aid offices, educational consultants, and online forums can provide helpful guidance. The key is to seek help when needed, as the nuances of financial aid applications can be confusing but are navigable with the right information and support.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send paying for college who for eSignature?

Where do I find paying for college who?

Can I create an eSignature for the paying for college who in Gmail?

What is paying for college who?

Who is required to file paying for college who?

How to fill out paying for college who?

What is the purpose of paying for college who?

What information must be reported on paying for college who?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.