Comprehensive Guide to the Georgia Bill of Sale Form

Understanding the Georgia bill of sale

A Georgia bill of sale is a crucial legal document that records the transfer of ownership of an item from a seller to a buyer. This document serves multiple purposes, including proof of purchase, tax purposes, and establishing the rights of ownership over the sold item. While often associated with vehicle transactions, a bill of sale can also be relevant for various personal property sales, providing clarity and protection for both parties involved.

In Georgia, a bill of sale is particularly necessary for transactions involving motor vehicles since it helps in the proper registration and transfer of title. Additionally, when personal property is involved, having a bill of sale can facilitate exchanges in a transparent manner. Understanding the key terms — such as buyer, seller, item description, and conditions of sale — is essential for anyone intending to enter into a sale in Georgia.

Types of bills of sale in Georgia

Georgia recognizes several types of bills of sale tailored to specific transactions. The primary categories include:

Vehicle bill of sale: This type includes specific requirements for vehicle sales, such as VIN numbers, odometer readings, and vehicle descriptions to ensure that registration is seamless and accurate.

Personal property bill of sale: This general form is utilized when transferring any other goods, including furniture, appliances, or electronics. It highlights the condition and specifics of the sold items.

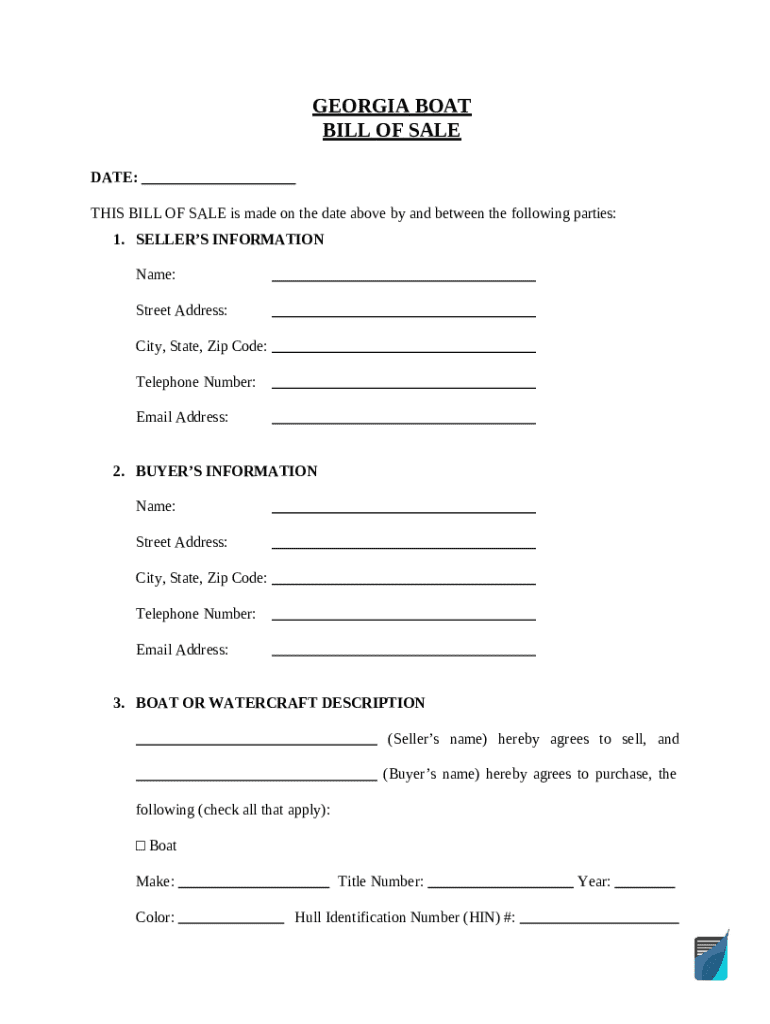

Boat and marine bill of sale: Transactions involving boats must meet specific regulations, often requiring details about the boat's make, model, and hull identification number.

Essential components of a Georgia bill of sale

A complete Georgia bill of sale must include several critical components to ensure it's legally valid and serves its intended purpose. These components encompass:

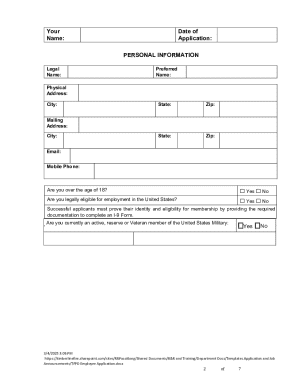

Seller and buyer information: Clearly state the names and addresses of all parties involved in the transaction.

Description of the item: Include detailed specifications, such as make, model, year, and any unique identifying information.

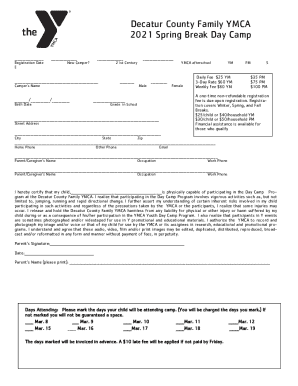

Purchase price: Explicitly state the agreed-upon amount and the payment terms.

Conditions of sale: Mention any warranties or as-is clauses to clarify the conditions under which the sale takes place.

Date and signatures: Include the transaction date and obtain signatures from both parties to validate the document.

Notarization: While not required for all transactions, notarizing the bill of sale can add an extra layer of authenticity.

How to fill out a Georgia bill of sale form

Filling out a Georgia bill of sale form involves several steps to ensure accuracy and compliance with state requirements. Here’s a step-by-step guide:

Gather necessary information: Collect all personal details of the buyer and seller along with the item details.

Choosing the right form: Use a specific type of bill of sale template that corresponds to your transaction (vehicle, personal property, or marine).

Filling in seller and buyer details: Ensure the form accurately captures the full names and addresses of both parties.

Describing the item accurately: Provide a detailed description of the item being sold, including any relevant identification numbers.

Specifying the transaction details: State the purchase price, the payment method, and any specific conditions tied to the sale.

Review for accuracy: Double-check all entries to avoid mistakes that could complicate future transactions.

Signing the document: Both parties should sign and date the document to affirm their agreement.

Notarization process (if applicable): If desired, take the signed form to a notary public to authenticate the signatures.

Special considerations for Georgia bill of sale

When dealing with sales involving multiple parties or complex items, there are special considerations that both buyers and sellers should keep in mind. For instance, transactions involving multiple parties need clarity to ensure each party's rights are documented accurately to avoid disputes.

Additionally, be cautious when handling liens and titles. Ensuring that there are no outstanding liens on a vehicle before the sale is critical. Buyers should also understand their responsibilities regarding tax implications, like the sales tax that could be owed after purchasing motor vehicles.

Editing and customizing your bill of sale

With pdfFiller, users can easily edit and customize a Georgia bill of sale form. Using online tools, templates can be modified to fit specific needs without requiring complicated software. The process involves:

Accessing pdfFiller: Start by navigating to pdfFiller’s document library to find the right Bill of Sale template.

Editing the form: pdfFiller allows users to input pertinent information directly into the template, such as names, item descriptions, and conditions of sale.

Adding interactive features: Users can implement checkboxes or digital signatures to enhance the functionality of the document.

eSigning and sharing your bill of sale

The role of electronic signatures is increasing in Georgia, where eSigning a bill of sale is recognized as legally binding. Using pdfFiller, users can guide themselves through the eSigning process, ensuring the bill of sale is executed without delay. This streamlined approach not only reduces paper waste but also speeds up transaction times.

eSigning process: Create your document in pdfFiller, fill in necessary details, and then proceed to add digital signatures from all involved parties.

Securely sharing: pdfFiller provides options for sending the completed bill of sale via secure email systems or sharing links, preserving document confidentiality.

Common mistakes to avoid

When creating a Georgia bill of sale, avoid common pitfalls that could jeopardize the transaction or its legal standing. For instance, incomplete information is a frequent error that can lead to misunderstandings and complications later on. Be sure to include all necessary components outlined above.

Misunderstanding state-specific requirements could also pose issues; always ensure compliance with local regulations by referencing state government websites. Lastly, retaining copies for personal records is crucial. Failure to keep a copy could lead to issues down the line if discrepancies arise.

Frequently asked questions

Many individuals have questions about the necessity or implications of a bill of sale. Common inquiries include:

What if I lose my bill of sale? In Georgia, retaining a copy is paramount, but if lost, you can create a new one with how the transaction was conducted.

Do I need to have a bill of sale notarized? It’s not mandatory but can add credibility, particularly for vehicle transactions.

How do I cancel a bill of sale in Georgia? A bill of sale cannot typically be canceled; rather, documentation of mutual agreement between parties is necessary.

Interactive tools and features on pdfFiller

Utilizing pdfFiller’s interactive tools allows users to create, edit, and manage bills of sale more effectively. With its suite of document creation tools, pdfFiller empowers users to customize forms aligned with their needs seamlessly.

Accessing a cloud-based platform makes it easier to collaborate with teams or other involved parties while allowing for real-time edits. These features enhance workflow and streamline document management, ultimately reducing errors and saving time.

Next steps after creating a bill of sale

Once a Georgia bill of sale is completed and signed, it’s essential to address the next steps concerning the transfer of ownership. For vehicle transactions, registering the vehicle with state authorities must follow to ensure proper title transfer.

Furthermore, buyers should familiarize themselves with any additional documentation required for registration, such as emissions compliance or proof of insurance. Staying informed on these next steps ensures smoother transitions and compliance with state regulations.