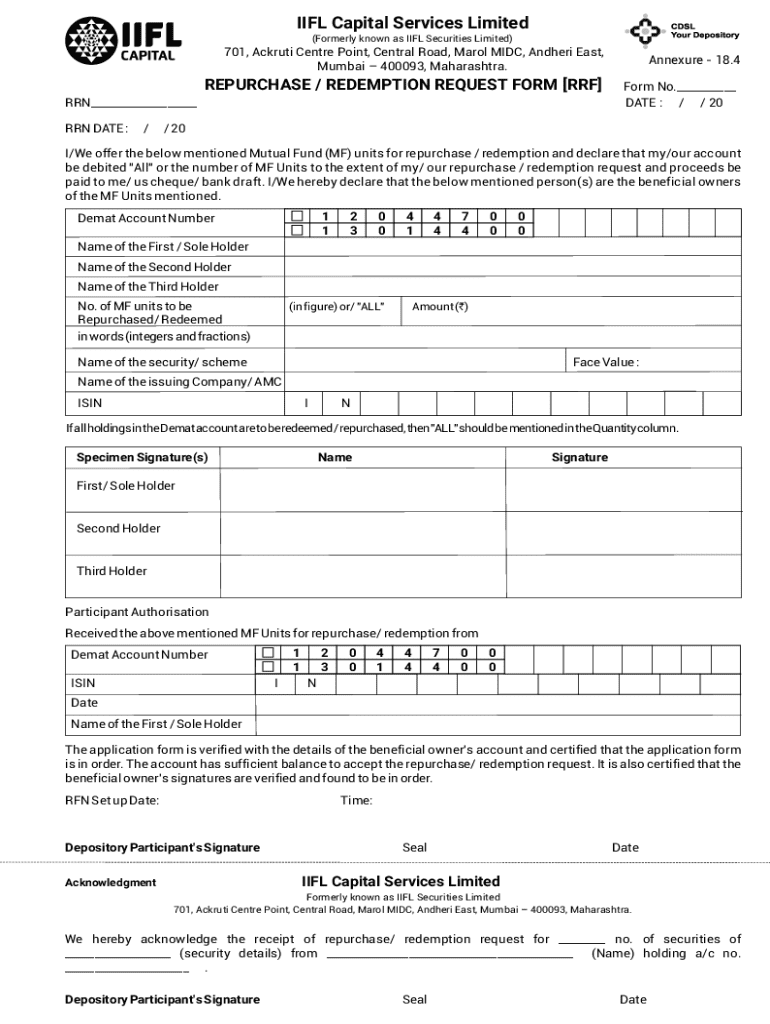

Get the free Mutual Fund Repurchase / Redemption Form

Get, Create, Make and Sign mutual fund repurchase redemption

Editing mutual fund repurchase redemption online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mutual fund repurchase redemption

How to fill out mutual fund repurchase redemption

Who needs mutual fund repurchase redemption?

Understanding the Mutual Fund Repurchase Redemption Form

Understanding the mutual fund repurchase redemption process

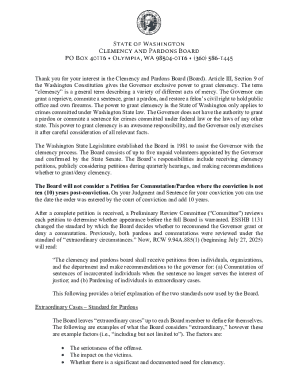

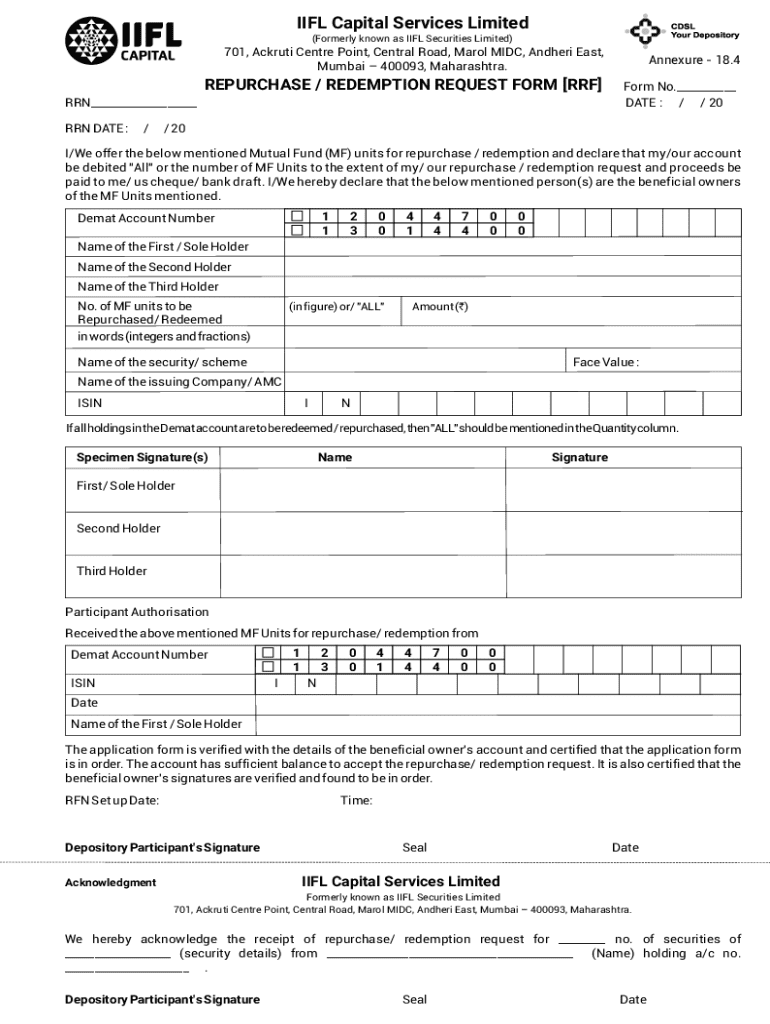

A mutual fund repurchase redemption form is an essential document that allows investors to redeem their shares in a mutual fund. This process is pivotal for investors looking to liquidate their investments, either fully or partially. By submitting this form, you effectively request the fund to sell your holdings back to them at the current Net Asset Value (NAV), reflecting the market value of the fund's assets.

This redemption process is a fundamental aspect of mutual fund investment strategies, allowing flexibility for changes in financial circumstances or investment goals. Understanding when and how to use this form can greatly impact your overall investment experience and outcomes.

When to use a mutual fund repurchase redemption form

Deciding when to redeem shares via a mutual fund repurchase redemption form can be driven by various factors. It may be beneficial in situations such as needing immediate cash for emergency expenses, rebalancing your investment portfolio, or taking advantage of better investment opportunities. Market conditions can also influence this decision, especially if you believe the mutual fund is underperforming compared to others.

However, before you proceed with redemption, it's critical to evaluate alternative options. Sometimes, holding onto your investment during market fluctuations may yield better returns in the long run. Additionally, consider switching funds if you find more promising investment opportunities within the same mutual fund family.

Preparing to fill out the repurchase redemption form

Before you start filling out your mutual fund repurchase redemption form, it’s essential to gather the necessary information. You will need specific account details including the fund name and your account number to facilitate a smooth transaction. Additionally, personal identification information, such as your Social Security number or tax ID, may be required.

Understanding your investment statement is also crucial. Familiarize yourself with how to read it — pay particular attention to the current NAV, the number of shares you hold, and any charges that may apply during the redemption process. This knowledge will empower you to make informed decisions as you complete your form.

Step-by-step guide to completing the form

Navigating the mutual fund repurchase redemption form may initially seem daunting; however, breaking it down into manageable sections can simplify the process. First, you will need to provide your contact information, including your name, address, and phone number. Next, clearly indicate which fund you are redeeming from and specify the amount of shares or dollar value you wish to redeem.

It’s crucial to avoid common mistakes when filling out the form. Ensure that all information provided is complete and accurate to prevent delays in processing your request. Familiarize yourself with the fund's policies regarding redemption, as discrepancies could lead to unexpected issues during the transaction.

Editing and customizing your mutual fund repurchase redemption form

Once you have filled out your mutual fund repurchase redemption form, utilizing tools like pdfFiller can significantly enhance your experience. With features that allow you to upload and manage your form directly within the platform, you can streamline the entire process. Editing options provide flexibility to make last-minute changes or correct any errors you might find before submission.

Moreover, ensuring compliance with required regulations is critical. pdfFiller maintains high document standards, helping you meet necessary guidelines related to your mutual fund redemption. Be mindful of signature requirements to avoid any hiccups in the submission process.

Submitting your form: What you need to know

When it comes to submitting your mutual fund repurchase redemption form, being aware of your options is vital. Many mutual fund providers offer online submission, which is often the fastest and most efficient method. Alternatively, you may choose to mail your form in, but consider the time it may take for processing, especially if there are market fluctuations during that period.

Regardless of the method you choose, tracking your submission status should be a priority. This will ensure you are updated on the processing of your request and can confirm when the funds have been credited back to you.

Post-redemption considerations

After successfully redeeming your mutual fund shares, it’s essential to understand the timeline regarding when to expect your funds. Typically, mutual funds process redemptions at the close of business on the day the form is submitted, although this can vary based on the fund’s specific policies.

Post-redemption, this is a great opportunity to reevaluate your investment portfolio. Consider how the redemption impacts your overarching financial goals and explore strategies for reinvesting your redeemed funds. Being proactive and reassessing can help ensure your investments align with your objectives moving forward.

Frequently asked questions (FAQs)

Addressing common queries about the mutual fund repurchase redemption process is crucial, especially for first-time investors. A frequent point of discussion includes whether one can redeem part of an investment. The answer is typically yes; most mutual funds allow partial redemptions, enabling a flexible approach to fund management.

Another common worry involves what happens if you change your mind after submitting the form. Once submitted, most mutual funds process the redemption promptly, making it challenging to reverse. Therefore, careful consideration before submission is essential.

Leveraging interactive tools for better decision making

Utilizing tools like pdfFiller’s Resource Center can significantly enhance your decision-making process regarding mutual fund investments. The platform provides access to a variety of guides, templates, and calculators that can aid in evaluating your investment strategies.

Having access to interactive tools also allows investors to assess their financial positions effectively. Whether you need to create documents or run comparisons, you can do so from anywhere, making it easier to track your investments on the go.

The benefits of using pdfFiller for document management

pdfFiller offers seamless document creation and management, particularly beneficial for handling mutual fund documents like the repurchase redemption form. Features tailored to mutual fund transactions streamline the process, ensuring that everything from creation to signing is efficient.

Additionally, for teams managing multiple mutual fund transactions, pdfFiller provides collaborative options that enhance communication and reduce the chance of errors. This means that shared access can lead to improved decision-making and fewer delays due to document inconsistencies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mutual fund repurchase redemption to be eSigned by others?

How do I fill out mutual fund repurchase redemption using my mobile device?

Can I edit mutual fund repurchase redemption on an iOS device?

What is mutual fund repurchase redemption?

Who is required to file mutual fund repurchase redemption?

How to fill out mutual fund repurchase redemption?

What is the purpose of mutual fund repurchase redemption?

What information must be reported on mutual fund repurchase redemption?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.