Get the free Customs and Excise Enforcement Procedures Manual

Get, Create, Make and Sign customs and excise enforcement

Editing customs and excise enforcement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out customs and excise enforcement

How to fill out customs and excise enforcement

Who needs customs and excise enforcement?

Customs and Excise Enforcement Form - How-to Guide

Understanding customs and excise enforcement forms

Customs and excise enforcement forms are essential documents that facilitate the compliance and regulation of goods moving across borders. These forms ensure that all customs duties and excise taxes are accurately calculated and paid, which is vital for maintaining the integrity of international trade. Without proper documentation, shipments can face significant delays, penalties, or even seizure, emphasizing the importance of understanding these forms.

The purpose of these enforcement forms extends beyond just taxation; they also play a crucial role in the enforcement of trade regulations designed to protect national security, public health, and safety. Compliance ensures that goods entering or leaving the country meet all required standards and legal guidelines.

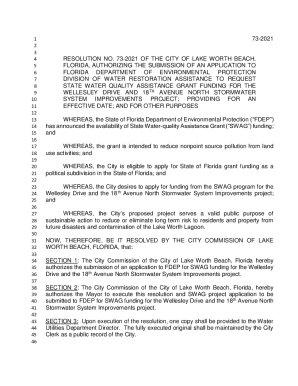

Overview of relevant regulations

Understanding the regulations governing customs and excise is critical for anyone involved in international trade. Several key laws, including the Customs Act and various excise tax statutes, outline the requirements for documentation, reporting, and payment. The enforcement of these regulations varies by country, but their role remains consistent globally—ensuring that trade is conducted legally and fairly.

Compliance with customs and excise regulations is not merely a recommendation but a legal obligation. Non-compliance can lead to severe penalties, loss of goods, and legal ramifications. Thus, understanding these regulations is paramount for anyone looking to navigate the complexities of international shipping.

Types of customs and excise enforcement forms

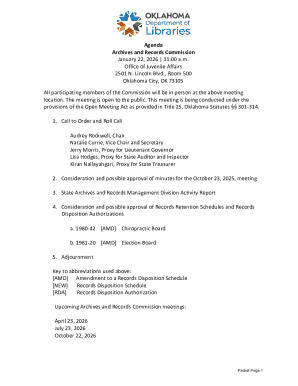

Customs and excise enforcement forms can be categorized based on their specific functions. Here are some of the commonly used forms within this domain:

Each of these forms serves a distinct purpose in the enforcement process, providing the necessary information for customs authorities to assess duties, taxes, and compliance with trade regulations.

Specific forms breakdown

Focusing more specifically on critical forms, the Import Declaration Form is crucial for the clearance of goods entering a country. It provides unique identifiers for shipments and details about the nature of the goods. On the other hand, the Export Declaration Form monitors goods leaving the country, which is vital for ensuring that trade regulations and laws are adhered to. Lastly, the Excise Tax Return Form captures unique information related to the consumption of goods that are subject to excise taxes, ensuring accurate reporting and payment.

Step-by-step guide to filling out customs and excise enforcement forms

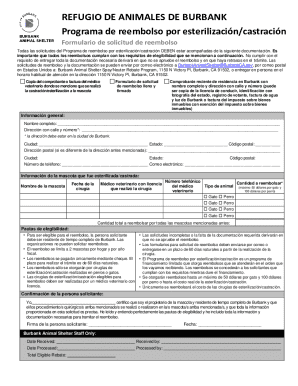

Filling out customs and excise enforcement forms requires attention to detail and careful consideration of the information required. Before starting the process, it’s essential to gather all necessary documentation, including identification, business registration details, and any previous customs documents that may apply.

Each type of form has specific informational requirements. For example, the Import Declaration Form typically requires:

Similarly, when completing the Excise Tax Return Form, there are important aspects to consider, such as the reporting periods for which the tax is due and the specific tax rates applicable to the products being reported. Detailed instructions should be provided within the form, guiding users through each section.

Editing and managing documents related to customs and excise forms

Managing customs and excise enforcement forms effectively can streamline the process significantly. Using a tool like pdfFiller can vastly improve document management efficiency. Users can upload and edit forms online, ensuring that all information is up-to-date and accurate.

The benefits of using cloud-based solutions like pdfFiller include enhanced accessibility—allowing team members to collaborate and access documents from anywhere—and improved organization. This leads to greater efficiency during the often time-sensitive customs processes.

Collaborating with teams

Collaboration is key in ensuring that all customs forms are completed accurately and on time. pdfFiller offers features that enable team collaboration, allowing multiple users to work on documents simultaneously. Team members can share options, leave comments, and track changes through version control, making it easier to manage forms collaboratively and ensuring that no vital information is overlooked.

eSigning customs and excise enforcement forms

Electronic signing (eSigning) plays a crucial role in modernizing the customs process, providing legal validity and streamlining workflows. With eSigning, users can quickly finalize customs and excise enforcement forms without the need for physical signatures, which often delay the process.

To add eSignatures to enforcement forms using pdfFiller, follow these steps:

Best practices to ensure compliance include verifying the identity of all signers and maintaining a secure electronic record of signed documents.

Common mistakes to avoid when completing customs and excise enforcement forms

When dealing with customs and excise enforcement forms, attention to detail is paramount. Common mistakes include incomplete fields, which can lead to delays in processing. Miscalculations regarding duties and taxes can result in penalties and compliance issues, while submitting incorrect or missing documentation can amplify these challenges.

To minimize errors, it’s advisable to create a checklist for verifying form completion. Include points to double-check such as compliance with regulations, accuracy of numerical data, and all required signatures. Utilizing tools that assist in form management can also help alleviate these complications.

Troubleshooting and FAQs

Even with the best preparation, issues can arise during the completion and submission of customs and excise enforcement forms. Common user challenges include technical problems with online submission portals and dealing with rejected forms due to insufficient or erroneous data.

To prevent these issues, familiarize yourself with the submission guidelines and requirements for your specific form. It is also beneficial to know the stakeholders involved in customs processes, as they can provide support in resolving complex issues.

Frequently asked questions

Users often have inquiries regarding specific forms and submission timelines. Questions may include:

Contact and support information

Having access to assistance and support can alleviate the stress of managing customs and excise enforcement forms. Contact information for customs offices is typically available on government websites, providing access to the necessary support for submitting forms correctly.

Additionally, pdfFiller users can benefit from dedicated customer support. They offer useful resources and assistance with document-related queries. Engaging in community forums related to customs processes can also provide insights and shared experiences that can guide users in navigating these complex forms.

Enhancing document management with pdfFiller

Beyond just managing customs and excise enforcement forms, pdfFiller offers additional features that enhance overall document management. Its integration capabilities with other platforms mean users can streamline their processes further, making transitions easier between different tasks and forms.

Features such as advanced search functionalities, data storage, and accessibility options make working with customs and excise documents more manageable, enabling users to stay organized and focused on compliance and regulation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get customs and excise enforcement?

How do I make edits in customs and excise enforcement without leaving Chrome?

Can I create an electronic signature for the customs and excise enforcement in Chrome?

What is customs and excise enforcement?

Who is required to file customs and excise enforcement?

How to fill out customs and excise enforcement?

What is the purpose of customs and excise enforcement?

What information must be reported on customs and excise enforcement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.