Get the free Can credit card statement showing an available limit be ...

Get, Create, Make and Sign can credit card statement

How to edit can credit card statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out can credit card statement

How to fill out can credit card statement

Who needs can credit card statement?

Can Credit Card Statement Form: A Comprehensive Guide

Understanding credit card statement forms

A credit card statement is an essential document that summarizes all transactions made during a billing cycle. This statement serves not only to provide account holders with a clear record of their spending but also plays a crucial role in managing personal finances. By reviewing monthly credit card statements, individuals can track their expenses, ensure timely payments, and maintain their credit health.

The importance of these statements extends beyond simple accounting; they aid in fostering financial responsibility. Credit card holders must understand their statements to avoid late fees and high-interest payments, as misunderstandings can lead to serious financial consequences.

Components of a credit card statement

A credit card statement comprises several key components that provide a snapshot of your financial activity. The primary elements include a list of transactions, your account balance, due dates, and minimum payment amounts. Additionally, terms such as the Annual Percentage Rate (APR), credit limit, and any applicable fees are also outlined.

The importance of managing credit card statements

Regularly reviewing your credit card statements is fundamental to effective financial management. One of the primary benefits is the ability to track your expenses and budget accordingly. Having visibility into your spending habits allows you to make informed decisions about future purchases and savings.

Moreover, monitoring your statements can help identify unauthorized transactions and potential fraud. In an age where financial security is paramount, ensuring all charges are accurate is vital for maintaining both your finances and peace of mind.

Transitioning to paperless statements

Many individuals are moving towards paperless statements, finding them not only more convenient but also beneficial for financial tracking. E-statements allow for quicker access and organization without the clutter of physical paperwork.

In addition to convenience, this transition supports environmentally friendly practices. By reducing paper usage, consumers contribute to a more sustainable future while simplifying their financial organization.

How to access your credit card statement

Accessing your credit card statement can typically be done through your bank's online portal. Most financial institutions offer a straightforward process for account holders to log in and retrieve their statements.

To navigate this process efficiently, follow these steps:

Setting up account alerts

Setting up account alerts can enhance your financial management by notifying you when your credit card statements are available. These notifications serve as helpful reminders to review your spending and pay bills on time, thereby avoiding late fees.

To customize your alert settings, access the notifications section within your online banking portal. You can often choose from various alert types, such as balance thresholds, payment due dates, and statement availability. Tailoring these alerts can provide a personalized experience, helping you manage your finances proactively.

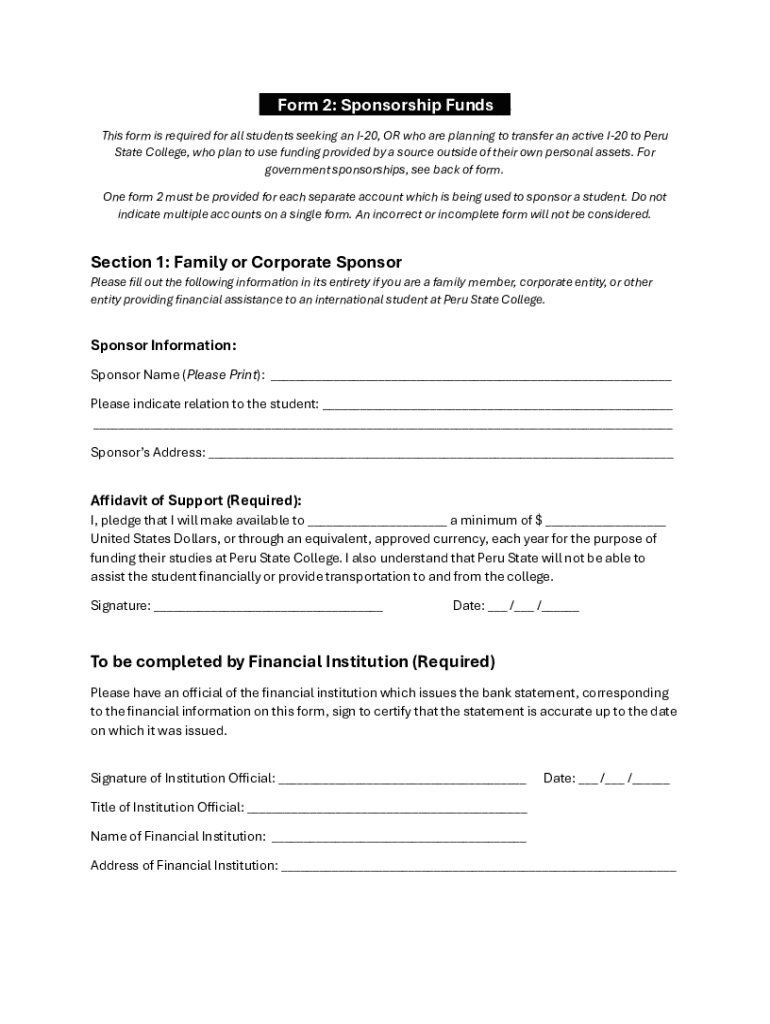

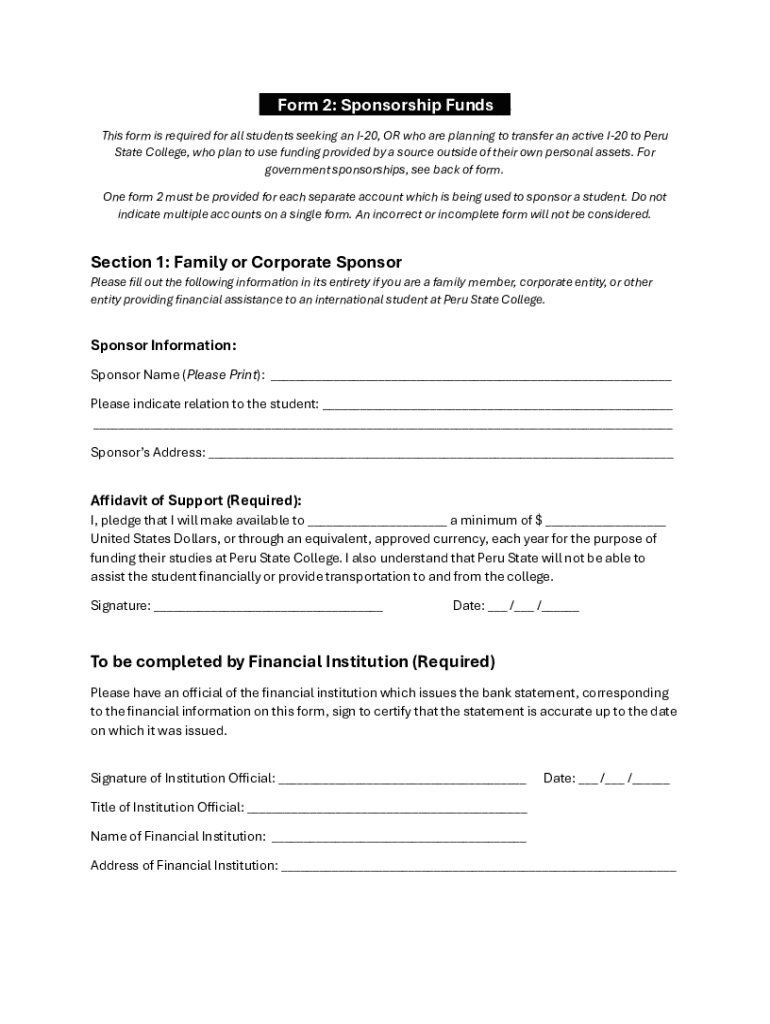

How to fill out a credit card statement form

Filling out a credit card statement form may seem daunting, but with the right preparation, it can be straightforward. You’ll need your account number, personal details, and specifics of any transactions you're reporting.

Before beginning, gather your essential information and ensure you have access to tools like pdfFiller, which can streamline the editing process.

What you need before filling out the form

Step-by-step guide to filling out the form

1. Open the credit card statement form on pdfFiller. 2. Enter your personal details in the appropriate fields. 3. Fill in your account number to ensure proper identification. 4. List transaction details accurately; double-check for accuracy before moving on. 5. Review your entries for completeness. 6. Save your changes and submit as required. In this process, attention to detail is paramount to ensure accuracy.

Editing and signing credit card statements

Editing your credit card statement is made easy with tools like pdfFiller. Whether you need to add information or correct errors, utilizing online tools allows you to modify a PDF statement efficiently.

When editing, it’s crucial to maintain clarity and ensure accuracy in your adjustments. Always double-check your revisions to avoid miscommunication or misunderstandings with your financial institution.

eSigning your credit card statement

The importance of a digital signature cannot be overstated, especially when it comes to official documentation like a credit card statement. By adding your eSignature using platforms like pdfFiller, you can finalize your documents quickly and securely.

To add your eSignature, log into pdfFiller, open the document, and select the option to add a signature. Follow the prompts to create or upload your signature, ensuring your documentation is complete and professional.

Managing your credit card documents

Organizing your credit card statements for easy access is essential for effective financial management. Digital filing systems can enhance your efficiency, allowing you to categorize and retrieve documents as needed.

Best practices include:

Using pdfFiller, users can further organize documents digitally and collaborate easily. Secure sharing options allow you to work with accountants or family members without compromising sensitive information.

Common issues and FAQs related to credit card statements

Occasionally, credit card holders may encounter challenges, such as difficulties locating specific statements. In these cases, it's important to understand the steps to retrieve older statements.

If you can't find a statement, try the following:

Understanding your rights related to credit card statements is equally important. Consumers have protections against incorrect charges and the right to dispute any discrepancies. Familiarizing yourself with the relevant resources and procedures can enhance your confidence when managing your accounts.

Future trends in credit card statements

As technology evolves, the landscape of managing credit card statements is also changing. Digital innovations are paving the way for more efficient document management and analysis. Automated tools that analyze statements for spending patterns are likely to become more widespread, empowering consumers to make informed financial decisions effortlessly.

Moreover, the shift toward comprehensive financial management platforms is becoming evident. Integrating credit card statements with broader financial planning tools will ease the burdens of financial oversight, thus enhancing overall financial health.

The role of pdfFiller in this evolution

pdfFiller is well-positioned to lead in this evolution of credit card document management. By empowering users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform, pdfFiller offers a comprehensive solution tailored to today’s digital consumers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my can credit card statement directly from Gmail?

How can I fill out can credit card statement on an iOS device?

Can I edit can credit card statement on an Android device?

What is a credit card statement?

Who is required to file a credit card statement?

How to fill out a credit card statement?

What is the purpose of a credit card statement?

What information must be reported on a credit card statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.