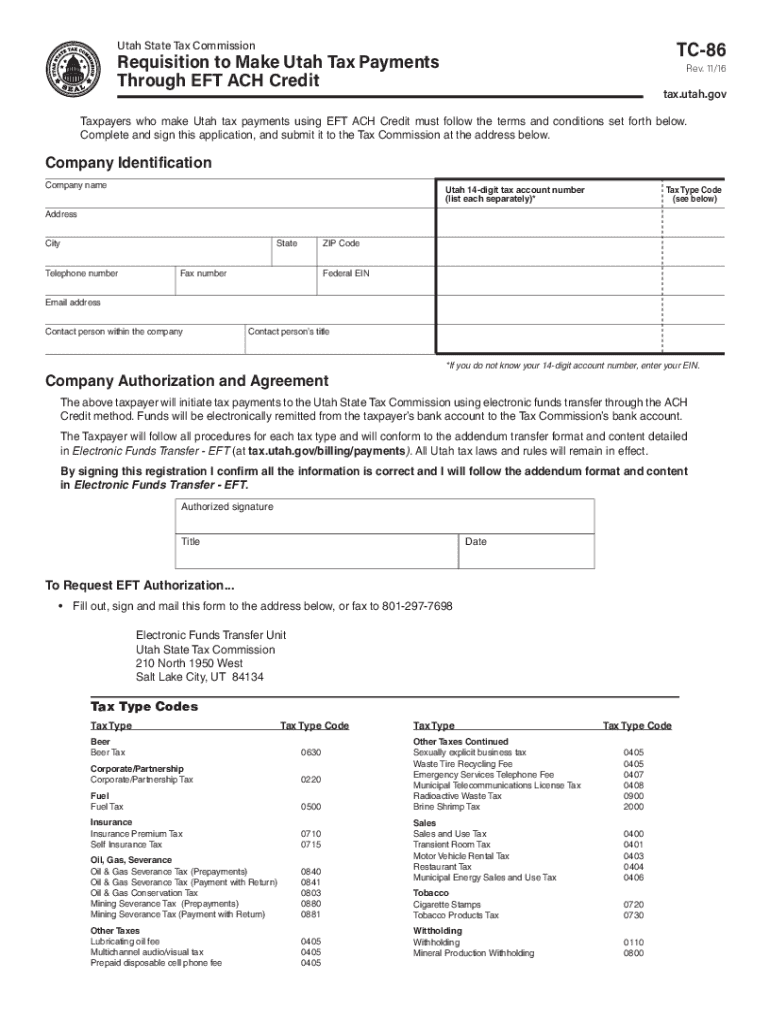

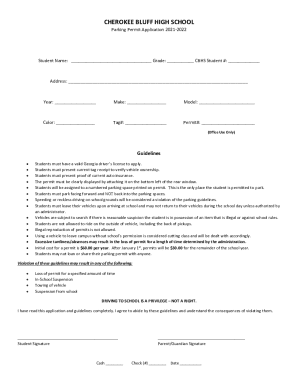

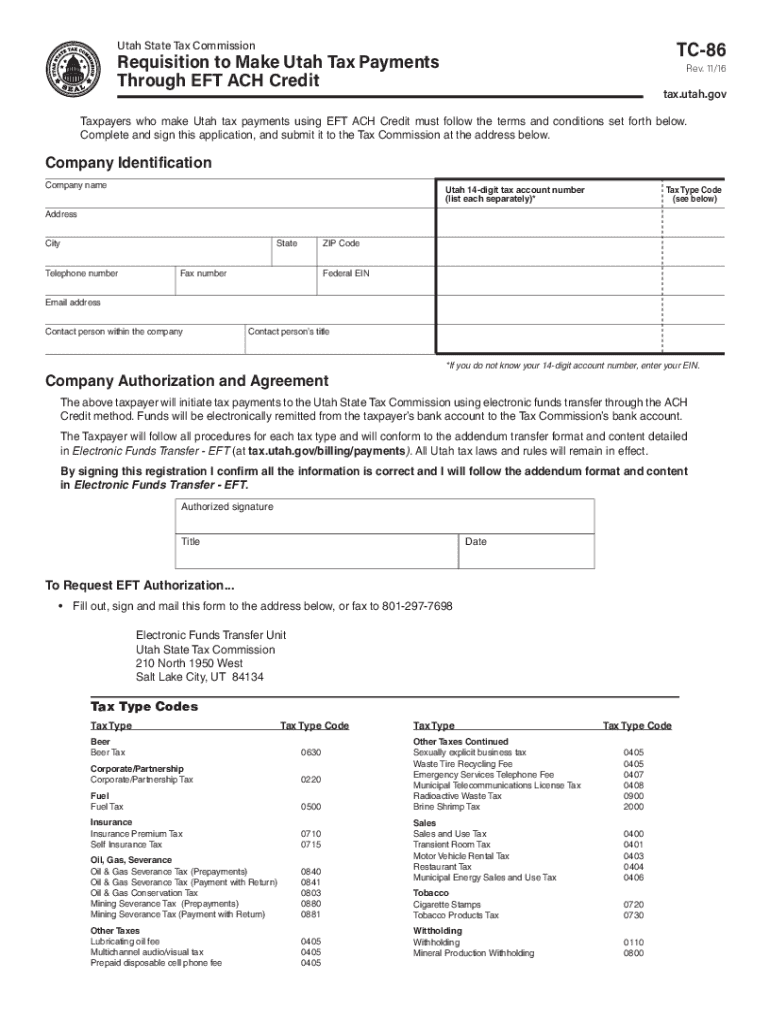

Get the free Taxpayers who make Utah tax payments using EFT ACH Credit must follow the terms and ...

Get, Create, Make and Sign taxpayers who make utah

Editing taxpayers who make utah online

Uncompromising security for your PDF editing and eSignature needs

How to fill out taxpayers who make utah

How to fill out taxpayers who make utah

Who needs taxpayers who make utah?

Taxpayers Who Make Utah Form: A Comprehensive Guide

Understanding the Utah tax form landscape

Navigating the landscape of tax forms in Utah requires familiarity with various state requirements. Utah taxpayers must complete specific forms governed by unique tax laws, designed for individuals and businesses alike. Knowing the framework of these forms and the obligations tied to them is crucial for ensuring compliance and avoiding penalties.

Accurate completion of these forms is essential. A single error can lead not only to unwanted financial consequences but potentially trigger audits or additional scrutiny from the Utah tax commission. Thus, it’s important for taxpayers to pay attention to detail and double-check entries before submitting forms.

Types of tax forms for Utah taxpayers

Utah has a variety of tax forms catered to different taxpayer needs, starting with individual income tax forms. Most individuals file the TC-40, which is crucial for reporting personal income accurately. Understanding the differences between federal and state requirements can save you from making mistakes that could cost you in taxes or refunds.

For business owners, specialized forms dictate how different business structures report their income. Limited Liability Companies (LLCs), Corporations, and Partnerships each have distinct reporting requirements outlined by Utah tax laws. Awareness of these nuances is vital for business compliance.

Step-by-step guide to completing Utah tax forms

Completing tax forms begins with gathering necessary information. This initial step is critical—provide accurate personal details, including your full name, current address, and Social Security Number. Additionally, secure income documentation like W-2s and 1099s, as they are crucial for validating your earnings and determining your tax obligations.

Next, determine your filing status, a key factor influencing your tax calculation. Whether you're single, married filing jointly, or head of household, this status dictates allowable deductions and credits. Understanding how your filing status impacts your returns can lead to significant tax savings.

Filling out the Utah tax form

When filling out the Utah tax form, specific instructions must be followed to complete each section accurately. The income section typically requires detailing all sources of income, including wages, dividends, and any miscellaneous income. Paying close attention to this section can help you maximize deductions and minimize taxes.

Deductions and credits represent another critical area of the form. Carefully document any eligible expenses, such as mortgage interest, student loan interest, or medical expenses, as these can significantly reduce taxable income. Double-checking this information ensures nothing valuable is overlooked.

Utilizing interactive tools for form management

Interactive tools play a significant role in simplifying tax form management. Online PDF editors, like those offered by pdfFiller, allow users to edit, fill out, and sign forms directly in a browser, streamlining the tax preparation process. This functionality is crucial for taxpayers who prefer a digital approach to form completion.

For instance, pdfFiller provides intuitive tools that can significantly reduce the time spent editing forms. Users can highlight areas that need input, add digital signatures, and even collaborate on documents with other stakeholders in real time, all within a cloud-based platform.

Submitting your Utah tax form

Filing your Utah tax form can be done through multiple methods: e-filing and paper filing. E-filing is often recommended for its speed and efficiency, allowing taxpayers to submit their forms electronically and receive confirmation of receipt instantaneously. On the other hand, paper filing can be slower and increases the risk of forms being lost in transit.

It is crucial to be mindful of important deadlines. For personal income taxes, the typical deadline is April 15. However, if you are unable to meet this deadline, it is essential to file for an extension to avoid hefty penalties. Tracking submission status post-filing is also available on the Utah Tax Commission website; knowing where your submission stands can provide peace of mind.

Post-submission considerations

After submitting your Utah tax form, you may find yourself needing to amend it. It’s common for taxpayers to realize errors after submission, so understanding how to file an amended return is crucial. The process generally involves filling out Form TC-40A and providing a clear explanation of each error that needs correcting.

Additionally, be prepared for potential notices from the Utah Tax Commission. These notices can arise for various reasons, such as discrepancies in reported income or missing information. The best response is to address them promptly, gather necessary documentation, and respond comprehensively.

Resources for Utah taxpayers

To aid your tax filing process, leverage the myriad of resources available to Utah taxpayers. The official Utah Tax Commission's website is a goldmine of information and offers e-services to facilitate online interactions and filings. Utilizing customer support options provided by the state can clarify any lingering questions or issues.

Additionally, consider online communities and forums dedicated to tax advice. Engaging with other taxpayers can provide unique insights, tips, and experiences that enhance your understanding of the tax landscape. Whether you’re in Salt Lake City or elsewhere in Utah, these resources are invaluable.

Best practices for efficient document management

Organizing and storing tax forms is critical before, during, and after the filing process. Establish a system that allows easy access to necessary documentation at any given moment. Digital storage solutions like pdfFiller can simplify this task by allowing you to store all your tax forms in one secure location, accessible anywhere.

Developing a tax document calendar can further enhance organization. Mark key dates relevant to your taxes, such as deadlines for submission, expected refund arrival, and dates when supporting documents must be gathered. This proactive approach not only keeps you on track but ensures that you never miss an important deadline.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find taxpayers who make utah?

Can I create an eSignature for the taxpayers who make utah in Gmail?

Can I edit taxpayers who make utah on an Android device?

What is taxpayers who make utah?

Who is required to file taxpayers who make utah?

How to fill out taxpayers who make utah?

What is the purpose of taxpayers who make utah?

What information must be reported on taxpayers who make utah?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.