Get the free Utah Fiduciary Income Tax Return. Forms & Publications

Get, Create, Make and Sign utah fiduciary income tax

How to edit utah fiduciary income tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out utah fiduciary income tax

How to fill out utah fiduciary income tax

Who needs utah fiduciary income tax?

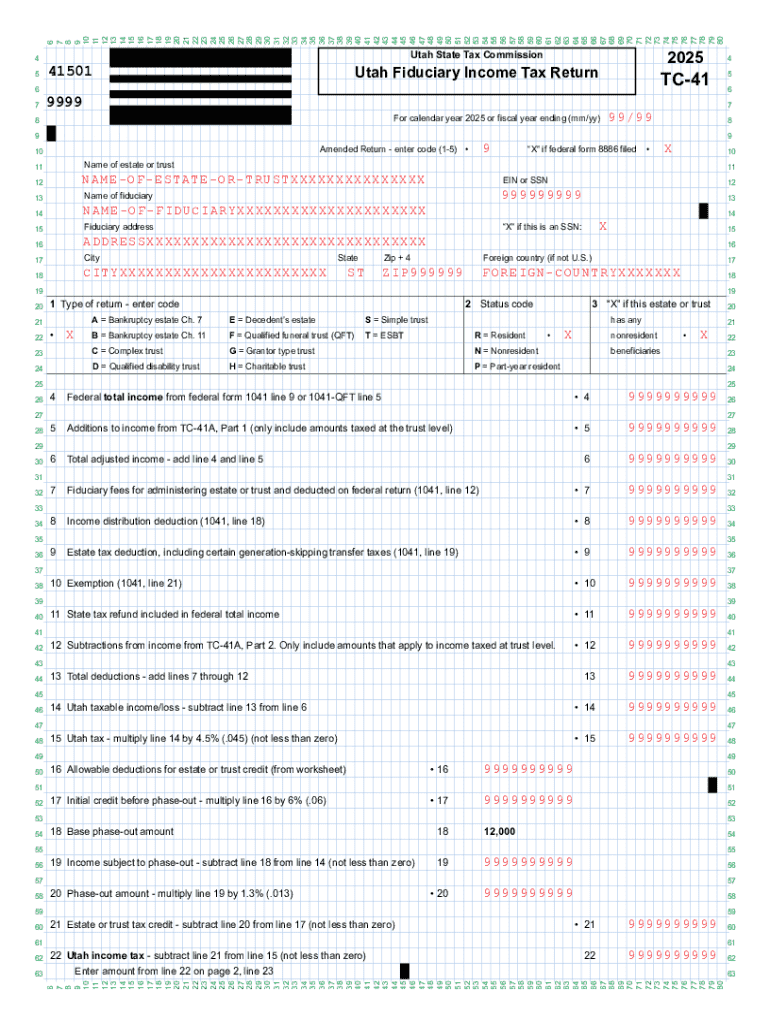

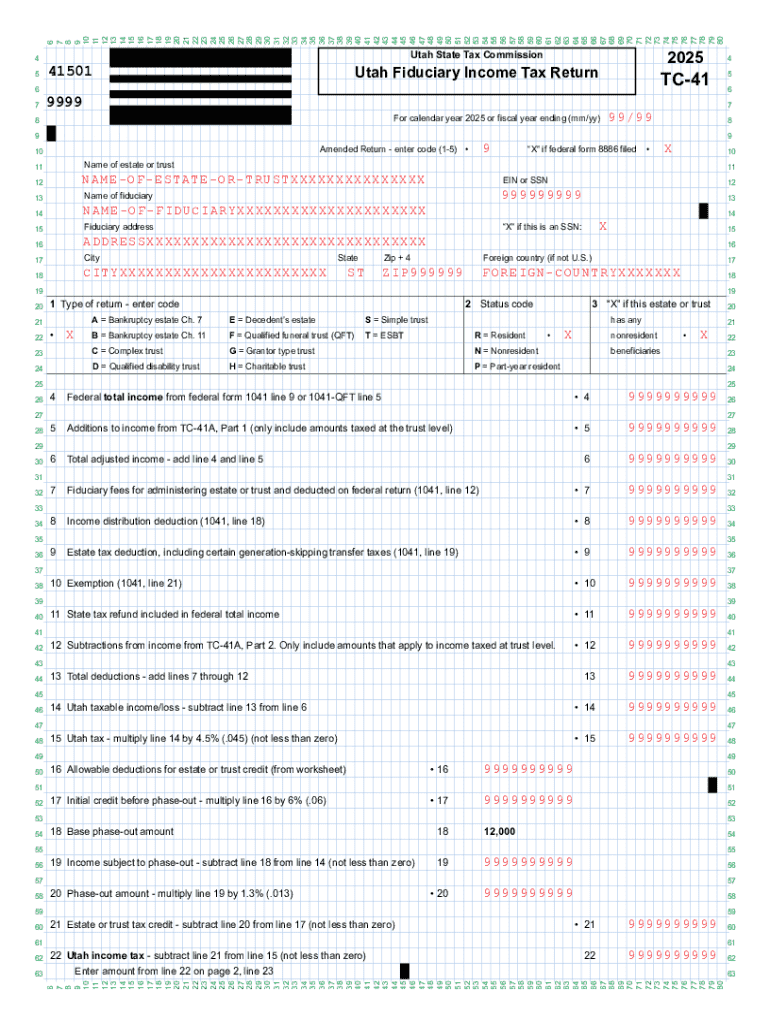

Comprehensive Guide to Utah Fiduciary Income Tax Form

Understanding the Utah Fiduciary Income Tax Form

The Utah Fiduciary Income Tax Form is a crucial document for managing tax obligations associated with estates and trusts in Utah. This form is designed to calculate and report income generated by these entities, ensuring compliance with state tax laws.

Its primary purpose is to allow fiduciaries—like trustees or executors—to accurately report income generated by the trust or estate. This reporting is essential not only for regulatory compliance but also for ensuring that the beneficiaries receive their rightful distributions in a tax-efficient manner.

Overview of fiduciary income tax in Utah

Fiduciary responsibility extends beyond just managing assets; it encompasses the accurate reporting of income, which has significant tax implications. In Utah, fiduciaries must adhere to specific tax obligations tied to the income generated from the managed estates or trusts.

Timely filing of the Utah Fiduciary Income Tax Form is pivotal. Failure to file by the deadline can incur penalties and interest on any unpaid taxes, adding to the fiduciary's responsibility to ensure proper adherence to deadlines.

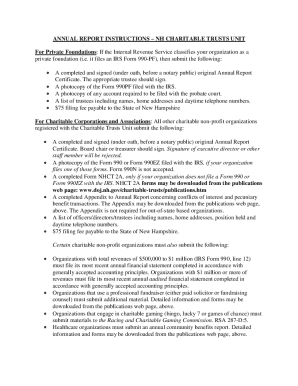

Step-by-step instructions for completing the form

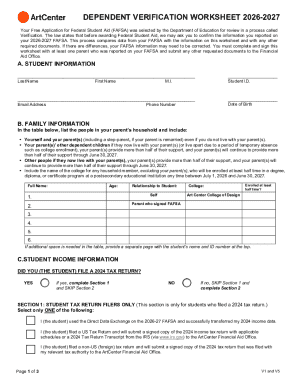

Completing the Utah Fiduciary Income Tax Form requires meticulous attention to detail. The process begins by gathering all necessary documentation that reflects the income and expenses associated with the trust or estate.

Required documents include financial statements, income records, and any prior tax filings, which provide a comprehensive view of the fiduciary's financial management.

Finally, it's essential to double-check all information to prevent errors that could delay processing or lead to penalties.

Common mistakes to avoid

Many fiduciaries make common errors when completing the Utah Fiduciary Income Tax Form, which can complicate tax obligations and lead to financial penalties. One frequent mistake is misclassifying income types, such as failing to recognize capital gains as taxable income.

Additionally, fiduciaries sometimes overlook taxable income entirely, impacting both the estate's tax situation and beneficiaries' distributions.

Utilizing pdfFiller for your tax needs

pdfFiller provides an excellent platform for managing the Utah Fiduciary Income Tax Form with ease and efficiency. By allowing users to edit documents directly in the cloud, pdfFiller enhances the accuracy and usability of tax-related paperwork.

Key features such as document editing, templates specific to Utah's fiduciary tax form, and collaboration tools provide fiduciaries with a comprehensive solution for completing necessary paperwork.

Frequently asked questions (FAQs)

Mistakes can happen, and knowing how to correct them after submission is essential. If a fiduciary realizes an error post-filing, they must take steps to amend the return to ensure compliance and avoid penalties.

Additionally, fiduciaries should be aware that the fiduciary income tax can impact the beneficiaries receiving distributions, potentially leading to tax liabilities that require careful planning.

Additional considerations

Fiduciaries in Utah may also benefit from specific state tax strategies designed to optimize tax liabilities. Understanding how state-specific rules differ from federal regulations can significantly affect tax outcomes.

By forming effective strategies and knowing the interplay between federal and Utah fiduciary income tax obligations, fiduciaries can better manage their responsibilities and provide for their beneficiaries in the most beneficial way possible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get utah fiduciary income tax?

Can I edit utah fiduciary income tax on an iOS device?

Can I edit utah fiduciary income tax on an Android device?

What is utah fiduciary income tax?

Who is required to file utah fiduciary income tax?

How to fill out utah fiduciary income tax?

What is the purpose of utah fiduciary income tax?

What information must be reported on utah fiduciary income tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.