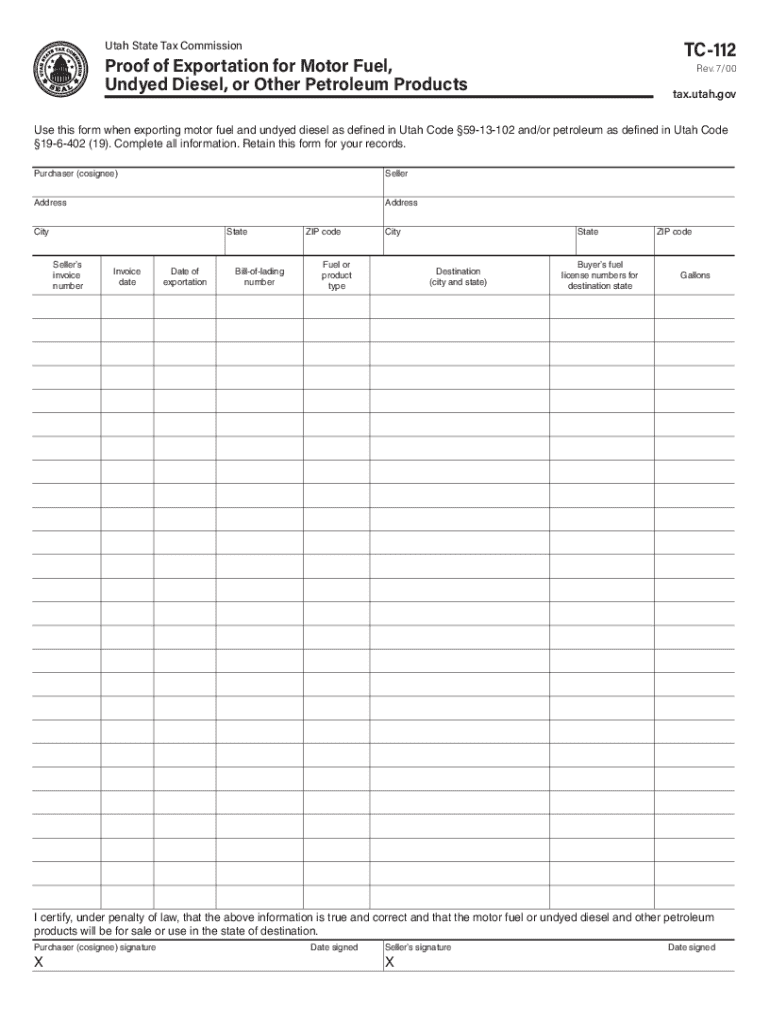

Get the free Fuel Tax Forms and Pubs - Utah State Tax Commission

Get, Create, Make and Sign fuel tax forms and

How to edit fuel tax forms and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fuel tax forms and

How to fill out fuel tax forms and

Who needs fuel tax forms and?

Understanding Fuel Tax Forms and Form

Understanding fuel tax forms

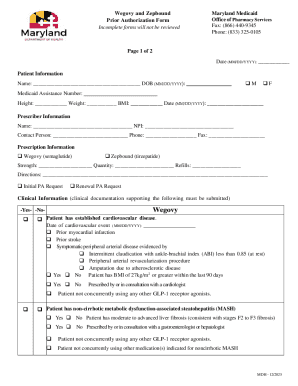

Fuel tax forms are legal documents required for reporting fuel tax liabilities to federal and state authorities. These forms are primarily used by businesses and individuals who consume or distribute fuel, such as those in the trucking and agricultural sectors. The main purpose of fuel tax forms is to ensure compliance with regulations and facilitate the accurate collection of taxes associated with fuel usage.

Filing fuel tax forms is essential for maintaining legal operations within your industry. Tax authorities require these forms to track fuel consumption, assess tax liabilities, and monitor pollutants, confirming that companies and individuals contribute appropriately based on their fuel-related activities.

Who needs to file fuel tax forms?

Both individuals and businesses in various sectors need to file fuel tax forms. Primarily, companies that engage in the transportation of goods using diesel fuel or gas must report their fuel tax contributions. This includes trucking companies, taxi services, and agricultural enterprises that rely on powered equipment. Additionally, government-owned or funded entities in Florida and other states may also need to file specific forms, reflecting fuel usage and contributions.

Understanding the specific requirements for your industry is critical. For instance, trucking companies may need to adhere to Interstate regulations, while agricultural businesses might benefit from specific exemptions related to fuel use in farming activities. Staying informed about the obligations within your sector helps to ensure compliance and avoid potential legal issues.

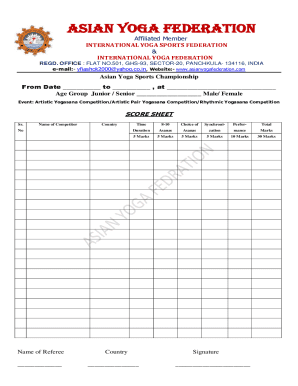

Types of fuel tax forms

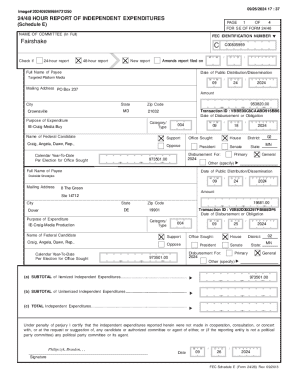

When it comes to fuel tax forms, several documents exist for different reporting purposes. At the federal level, the Fuel Tax Reporting Form (Form 720) is commonly utilized. This form allows individuals and businesses to report their fuel usage and related taxes efficiently. Usually, the form integrates information surrounding fuel purchases made throughout the reporting period.

In addition to federal requirements, states have various specific forms that cater to local regulations. For example, Florida has its own fuel tax return forms, addressing state-specific fuel tax obligations. Each form caters to particular users, often including sections for detailed calculations and credits related to tax expenditures. Filling out these forms accurately is pivotal to avoiding discrepancies and ensuring proper tax compliance.

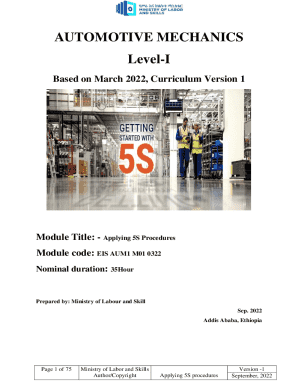

Step-by-step guide to completing fuel tax forms

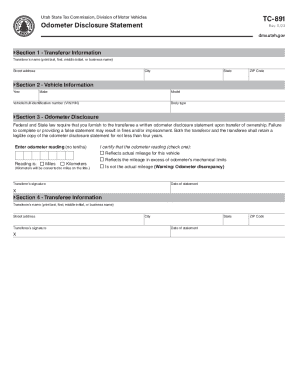

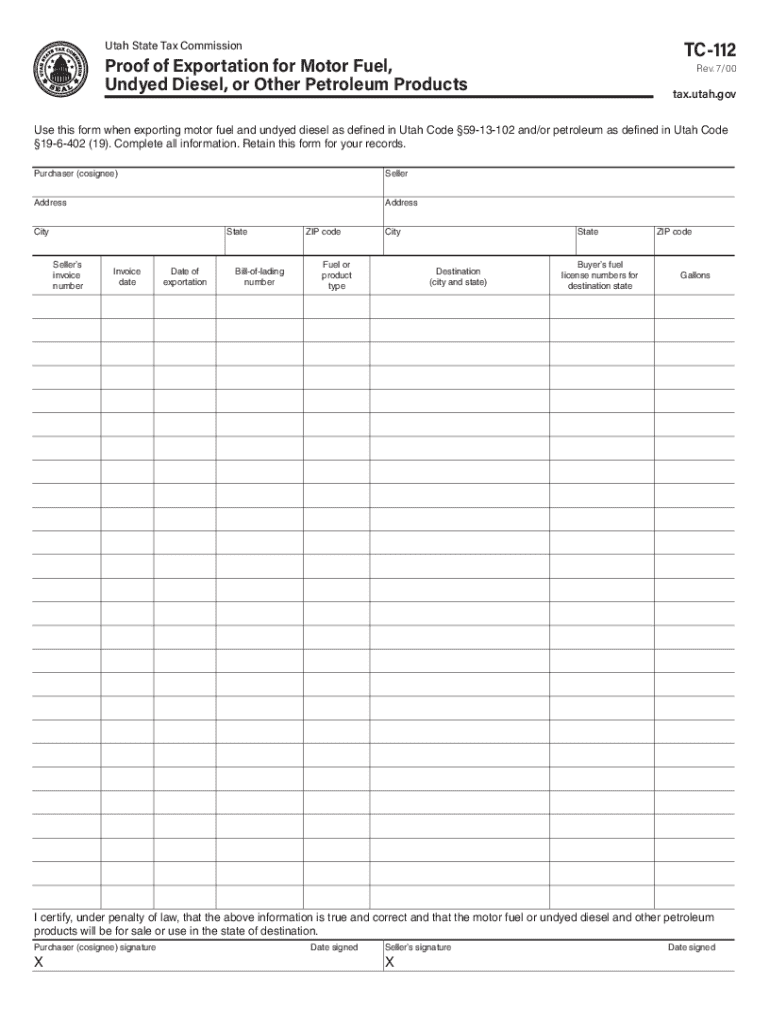

Completing fuel tax forms involves several steps that ensure accuracy and compliance. Begin by gathering all necessary information, which typically includes proof of fuel purchases, fuel licenses, and any previous tax filings. Additionally, having access to receipts, shipment manifests, and invoices can assist in collecting the correct figures.

Next, start filling out the forms by stating your general identification details, including your tax identification number and contact information. Be diligent when entering fuel purchase details such as the type of fuel, gallons purchased, and the total cost incurred. Tax calculations are a critical aspect—go through each line meticulously to confirm the accuracy of your entries. Good practice involves double-checking your entries before submission to avoid common pitfalls.

Some common mistakes to avoid include neglecting to report all fuel purchases, not keeping adequate records, or miscalculating tax liabilities. Implementing a system for keeping documents organized and up-to-date may save you from facing unwanted audits or re-filings.

Submitting fuel tax forms

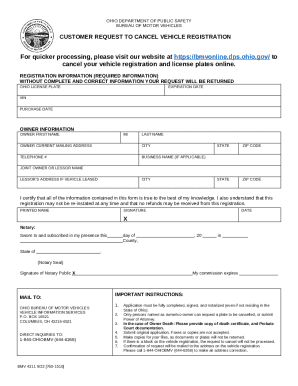

Once you have completed your fuel tax forms, the next step is submission. There are generally two methods available: digital and paper submission. Many jurisdictions nowadays encourage the use of online portals to facilitate quicker processing of forms, where you can upload documents directly and track their statuses.

For those opting for paper submissions, ensure that you mail the documents to the correct address, keeping proof of postage. It’s prudent to check with your state’s tax authority for specific guidelines on submission, as processes can vary across different states. If you utilize pdfFiller, you can conveniently eSign and submit your forms directly from the interface, eliminating the delays associated with physical mail.

Tracking your submission is crucial. Most state tax agencies offer online services to confirm the receipt of your forms. Keeping a copy of the confirmations or any submitted documents will protect you against discrepancies.

Managing fuel tax documents with pdfFiller

Utilizing pdfFiller to manage fuel tax forms streamlines the document creation, editing, and e-signing process. Users can create digital copies of necessary forms, modify them as needed, and apply electronic signatures through a hassle-free, cloud-based solution. Whether you are working from Florida or elsewhere, pdfFiller ensures that your fuel tax forms are managed efficiently and securely.

The advantages of cloud-based document management are numerous. Cloud platforms allow users to access their documents from any location, making it easier for teams to collaborate seamlessly. pdfFiller's features support team communication by allowing users to share forms instantly, enabling quick amendments when necessary, and improving overall document accuracy.

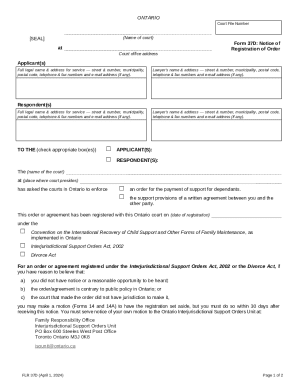

Overcoming challenges in fuel tax filing

Navigating fuel tax regulations can be daunting, particularly when facing audits or inquiries from tax agencies. Implementing best practices for documentation and record-keeping is crucial for effective management. Keeping track of all fuel purchases and retaining relevant invoices or receipts not only simplifies filing but also prepares you for any potential audits.

Moreover, if any information on your filed fuel tax forms requires updates, it’s essential to understand the process for submitting amendments. This may involve filling out specific forms to correct previously entered data. Consulting local tax authority resources can aid in ensuring you follow the appropriate steps for making these changes correctly.

Frequently asked questions (FAQs)

Fuel tax forms can prompt numerous questions. One common query is what to do if you miss a filing deadline. In such cases, promptly contacting the relevant tax authority to discuss late filing procedures is vital. Transparency can often lead to reduced penalties. Another frequent question pertains to handling discrepancies noticed on filed forms. Here, diligent record-keeping plays a significant role; always be prepared to provide evidence regarding fuel purchases or usage.

Additionally, those seeking to understand more about state fuel tax regulations can benefit from various online resources, including state tax office websites and user forums. Ensuring you are educated about fuel tax regulations can significantly ease the filing process.

Interactive tools and resources

Several interactive tools can assist you in managing fuel tax filings. For instance, online calculators can help you estimate fuel tax liabilities based on your fuel usage and state regulations. Taking advantage of these tools aids in maximizing accuracy and ensuring you remain compliant with federal and state tax laws.

Helpful links and downloads are also available through state tax office websites. These often include downloadable forms, guidelines, and FAQs specific to individual states. Having access to state-specific pdfs ensures you understand precise filing requirements, preventing issues unique to different jurisdictions.

User testimonials and success stories

Many users have discovered the advantages of utilizing pdfFiller for managing their fuel tax filings. One trucking company reported a significant decrease in the time taken to prepare and submit their forms. By leveraging pdfFiller’s tools, they simplified their documentation processes and achieved greater accuracy in reporting their fuel consumption figures.

Another success story comes from an agricultural entity that needed to monitor its diesel fuel usage closely. They utilized pdfFiller to maintain standardized forms across all departments. This consistency allowed for seamless audits and compliance, ultimately paving the way for enhanced operational efficiency.

Upcoming changes and trends in fuel tax regulations

Understanding upcoming changes in fuel tax regulations is pivotal for both individuals and businesses. Legislative changes often emerge that affect the rates, exemptions, and filing guidelines. For example, current trends indicate a general push towards more stringent reporting requirements, particularly concerning the documentation of pollutants linked to fuel use.

Staying informed about these regulatory shifts allows businesses and individuals to adapt their filing practices accordingly. Regularly checking updates from tax authorities and industry sources can ensure that you remain compliant and avoid potential legal repercussions associated with non-compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send fuel tax forms and to be eSigned by others?

Can I create an eSignature for the fuel tax forms and in Gmail?

Can I edit fuel tax forms and on an iOS device?

What is fuel tax forms?

Who is required to file fuel tax forms?

How to fill out fuel tax forms?

What is the purpose of fuel tax forms?

What information must be reported on fuel tax forms?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.