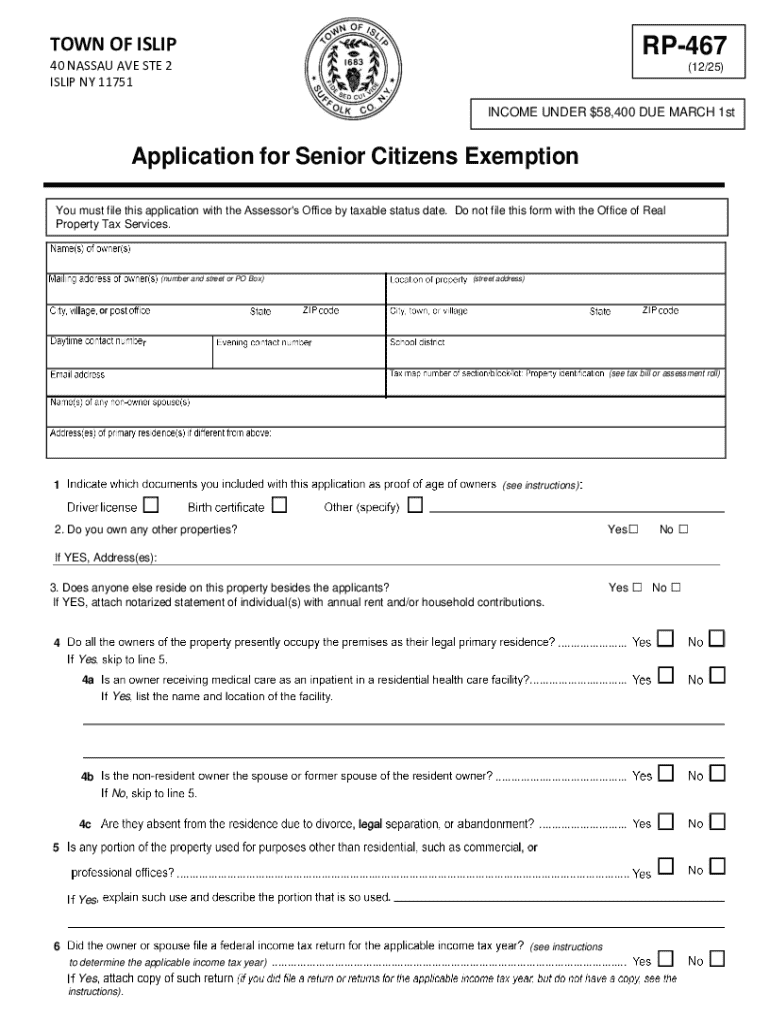

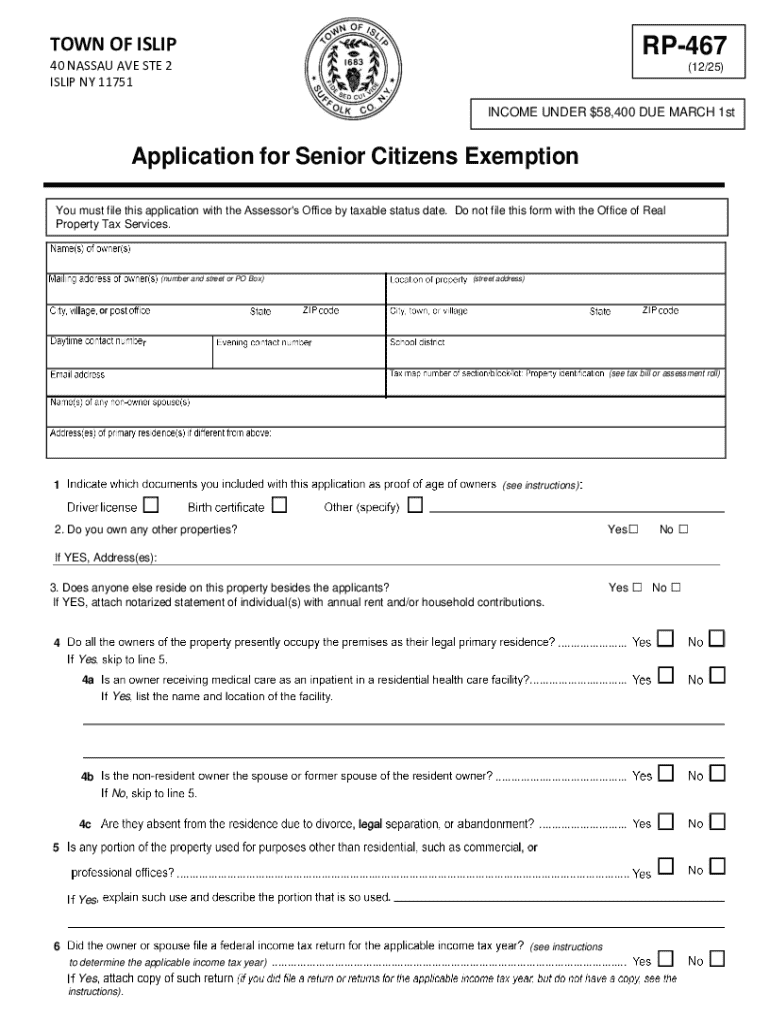

Get the free Form RP-467 Application for Partial Tax Exemption for Real Property of Senior Citize...

Get, Create, Make and Sign form rp-467 application for

How to edit form rp-467 application for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form rp-467 application for

How to fill out form rp-467 application for

Who needs form rp-467 application for?

Form RP-467 Application for Form: A Comprehensive Guide

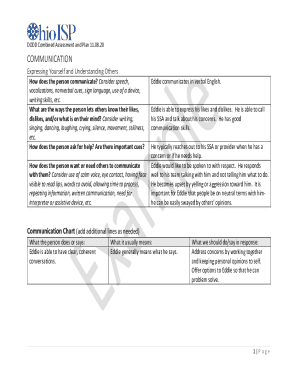

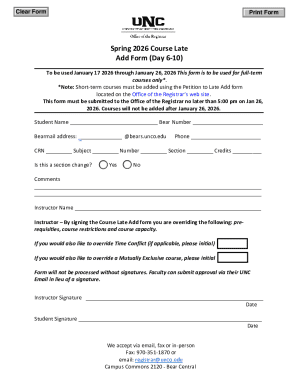

Understanding Form RP-467

Form RP-467 serves as a crucial instrument in securing property tax exemptions. Specifically designed for property owners, this form allows individuals to apply for exemptions that can significantly reduce their property tax liabilities. You may find that this form is particularly beneficial for those who qualify under specific categories such as senior citizens, disabled individuals, or veterans.

Usage of Form RP-467 is widespread among homeowners looking to alleviate their financial burdens. By submitting this form, eligible property owners can take advantage of state-approved exemptions aimed at reducing their overall property tax responsibilities, thus making homeownership more accessible and affordable.

Importance of RP-467 in property tax exemptions

Obtaining an exemption through Form RP-467 can have a significant impact on an individual's financial standing. Depending on the exemption type applied for, the property’s assessed value may be reduced, leading to lower tax bills. Several exemptions are available, including those for veterans, the elderly, and persons with disabilities, each of which plays a vital role in community support.

The successful application of Form RP-467 allows property owners not only to reduce their tax burden but also to reinvest savings into their home or community, promoting overall economic stability. This highlights the form's importance in ensuring that eligible individuals receive the financial reprieve for which they qualify.

Who qualifies to use Form RP-467?

Eligibility for using Form RP-467 is primarily determined by specific criteria established by state guidelines. Basic qualifications include ownership of the property, residency in the property, and meeting age or disability requirements as applicable. This means that various types of properties, such as single-family homes and dual-family homes, may qualify for exemption under specific conditions.

Common scenarios for applying include homeowners who are elderly or disabled. Veterans who have served in the military and their surviving spouses also commonly utilize this form. This broad spectrum of eligibility reflects the form's designed purpose to assist those facing financial challenges due to age, disability, or military service.

Step-by-step guide to completing Form RP-467

Completing Form RP-467 is made easier with thorough preparation and understanding of required documentation. Firstly, it’s essential to gather necessary documents, which include proof of identity, age verification, residency documentation, and any relevant medical records for disability exemptions. Organizing these documents efficiently can streamline the application process.

Gathering necessary documents

Navigating each section of the form

Each section of Form RP-467 serves a specific purpose. Begin with the personal information section, where accurate details about yourself and the property are essential. When outlining the exemptions requested, ensure you thoroughly understand the various options available and select those that apply to your situation. Lastly, verifying and signing the form correctly is crucial; any misrepresentation or omittance could lead to delays or denial.

Tips for a successful application

To ensure a smooth application process, it’s beneficial to keep a checklist of common mistakes to avoid. Errors such as incorrect property details, missing signatures, or failing to attach required documentation are frequent issues that can jeopardize your application. Verify all entries rigorously and consider having a third party review the form for clarity and completeness.

Best practices for submission

After submission: What to expect

Once Form RP-467 is submitted, you can expect to receive a confirmation of receipt from the local tax office. This confirmation is vital as it reassures you that your application is under review. The review process involves a thorough examination of the submitted information, including documentation supporting the eligibility claims.

Typically, processing times may vary based on your local tax office's workload, but it’s wise to be prepared for a waiting period. In the event of approval, you’ll receive an adjustment to your property tax assessment. Conversely, if your application is denied, you will typically receive an explanation and, importantly, instructions on how to appeal or rectify any issues identified during the review.

Additional resources and support

Navigating the requirements for Form RP-467 can be challenging, which is why several resources are available for assistance. Local tax offices often have personnel trained to help individuals complete the form and understand the nuances related to their specific situations. Additionally, many online platforms, including pdfFiller, provide step-by-step guides through the application process.

Utilizing interactive tools offered on pdfFiller, such as document management and eSigning, can vastly simplify the process of filling out Form RP-467. With these tools, you can access your forms anywhere, collaborate with others if needed, and manage your document submissions seamlessly.

Real-life applications of Form RP-467

Many property owners have successfully navigated the application process of Form RP-467, resulting in substantial tax savings. For instance, a senior couple may have applied for an exemption based on their age, eventually resulting in yearly savings that allow them to allocate funds for home repairs or medical expenses instead.

Testimonials

Feedback from users highlights that using pdfFiller simplifies their experience. One user noted, 'I was overwhelmed with paperwork, but pdfFiller helped me get my Form RP-467 filled out and submitted without a hitch, and the customer support was invaluable!' This reflects the ease of using a dedicated platform to manage crucial documents.

Connect with pdfFiller

Getting started with pdfFiller for your Form RP-467 application is straightforward. Simply access the pdfFiller website, where you can find specific resources tailored to this form. Their intuitive interface allows for easy and efficient document completion, even for those less tech-savvy.

For personalized support, you can reach out to their customer service team through various channels listed on their website. They are dedicated to assisting you with all your document management needs, ensuring that your experience is as smooth as possible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form rp-467 application for to be eSigned by others?

How can I fill out form rp-467 application for on an iOS device?

How do I complete form rp-467 application for on an Android device?

What is form rp-467 application for?

Who is required to file form rp-467 application for?

How to fill out form rp-467 application for?

What is the purpose of form rp-467 application for?

What information must be reported on form rp-467 application for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.