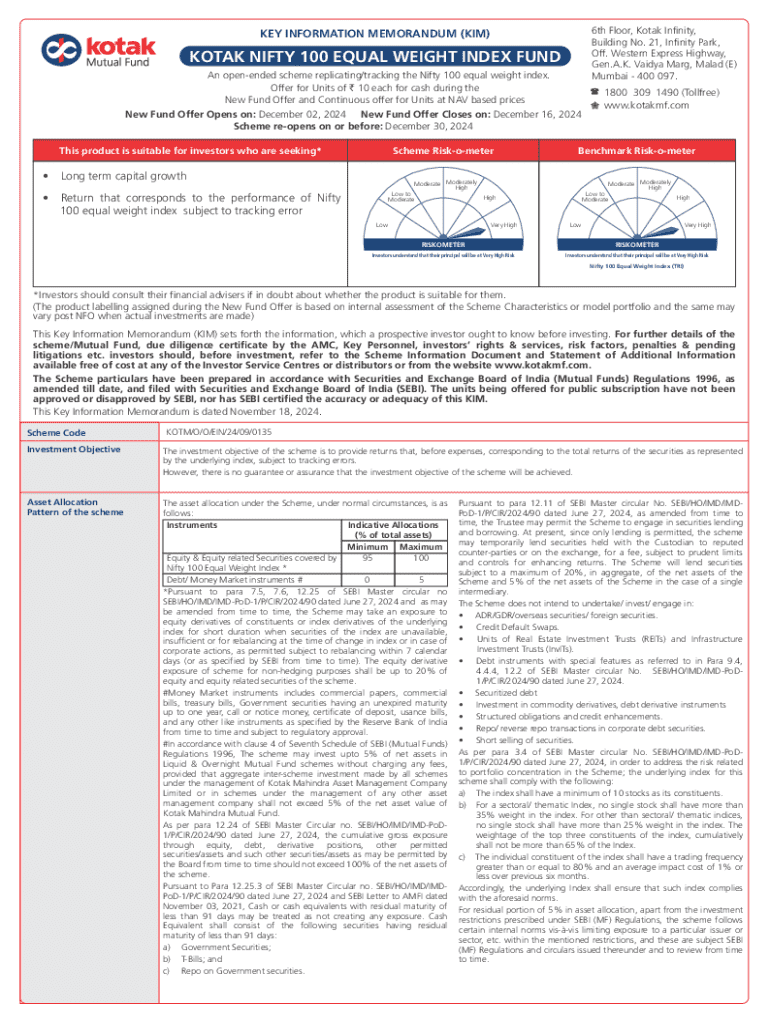

Get the free Kotak Nifty 100 Equal Weight Index Fund KIM.cdr

Get, Create, Make and Sign kotak nifty 100 equal

How to edit kotak nifty 100 equal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out kotak nifty 100 equal

How to fill out kotak nifty 100 equal

Who needs kotak nifty 100 equal?

A comprehensive guide to Kotak Nifty 100 Equal Form

Overview of the Kotak Nifty 100 Equal Form

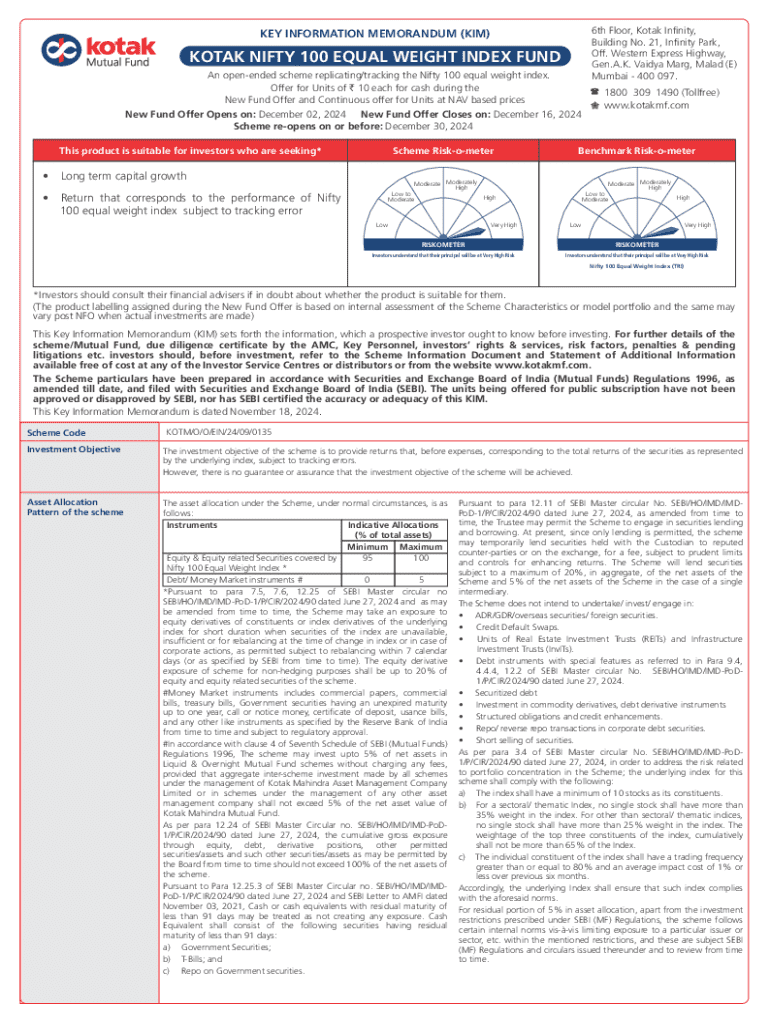

The Kotak Nifty 100 Equal Form is a specialized investment vehicle designed explicitly for those looking to diversify their portfolio. By investing in an equal-weighted scheme of the top 100 companies listed on the Nifty, this form offers a unique approach compared to market-capitalization strategies. This method emphasizes equal allocation among the top firms, thereby instilling a sense of equal opportunity across various sectors.

Recognizing the significance of balance in investing, the Kotak Nifty 100 Equal Form provides investors a potent tool for mitigating risks associated with over-concentration in large-cap stocks. As part of the Kotak Mutual Fund ecosystem, it reflects Kotak’s commitment to innovative investment solutions that cater to diverse investor needs.

Key features of the Kotak Nifty 100 Equal Form

The distinctive attributes of the Kotak Nifty 100 Equal Form set it apart from traditional investment forms. Unlike typical funds that may focus heavily on a few large-cap stocks, this equal form emphasizes an equal allocation strategy. This means that not only the heavyweight stocks receive attention, but every company in the top 100 is treated equally, mitigating the risk typically associated with unevenly-weighted strategies.

Key metrics included within this form typically consist of the current NAV (Net Asset Value), historical performance data, and risk assessment indicators. Investors benefit by gaining insights into how their investments are distributed across sectors and companies, allowing for enhanced portfolio diversity.

Understanding the investment strategy

Equal-weighted index strategies operate on the principle that every stock should contribute equally to the portfolio’s performance. This contrasts with traditional market-cap strategies where larger companies significantly skew the returns. The Nifty 100 Equal index incorporates this model, which allows investors to capture the growth potential of both large and mid-cap companies without being overly reliant on the biggest players.

The primary benefits of employing a strategy centered on the Nifty 100 Equal index include enhanced diversification and reduced risk. By distributing investments equally among the top 100 companies, investors effectively minimize the impact of any single stock's poor performance. Studies indicate long-term performance analyses can exhibit more stable growth patterns over time, making this a compelling option for both new and seasoned investors.

Step-by-step instructions for filling out the Kotak Nifty 100 Equal Form

Filling out the Kotak Nifty 100 Equal Form requires specific preparation and information. Investors should first gather all necessary documentation, including personal identification, bank details, and any previous investment records. Planning these details in advance leads to a smoother filling process.

Here’s a detailed walkthrough of the form:

Editing and customizing your form with pdfFiller

pdfFiller equips users with robust editing tools to customize the Kotak Nifty 100 Equal Form seamlessly. To access pdfFiller’s editing features, simply upload your form to the platform and initiate your modifications. The intuitive user interface allows for quick adjustments, ensuring you can highlight important notes or comments effectively.

For instance, you can make changes to investment amounts as necessary without starting from scratch. Additionally, saving templates can streamline future submissions, allowing for quick repetitions of common scenarios.

Collaborating with your team on investment decisions

pdfFiller enhances teamwork through its collaboration tools. When filling out the Kotak Nifty 100 Equal Form, you can invite colleagues for input or co-signing, allowing for a more comprehensive decision-making process. This cooperative approach is particularly beneficial for teams managing large investment portfolios.

Tracking changes and comments made by different team members can significantly improve clarity and strategy formation, ensuring everyone is aware of updates and decisions made collectively.

Signing your Kotak Nifty 100 Equal Form digitally

Digital signing offers convenience over traditional signing methods. By utilizing pdfFiller, the process of eSigning your Kotak Nifty 100 Equal Form becomes straightforward. You can choose various signature options to suit your preference, be it a typed signature, a drawn signature, or an uploaded image of your signature.

To eSign your form, follow these steps:

Managing your completed Kotak Nifty 100 Equal Form

Storing and retrieving your Kotak Nifty 100 Equal Form should be managed with care. pdfFiller allows easy access to your documents across multiple devices, ensuring that your form is always within reach. Proper management post-submission is equally critical; investors should regularly review their investment options to align with shifting market trends.

Annual reviews of investment portfolios can help ensure the strategy remains relevant and potent, adjusting for any changes in your financial goals or market conditions.

FAQs about the Kotak Nifty 100 Equal Form and investment

Investors often have numerous queries surrounding the Kotak Nifty 100 Equal Form. Addressing these common concerns can help demystify the investment process.

Some frequent questions include, but are not limited to:

Additional tools and resources

To complement the Kotak Nifty 100 Equal Form, a multitude of interactive tools and resources are available. For instance, use investment calculators to explore potential earnings based on different investment scenarios and timelines. You can also find links to additional forms and applications within the Kotak Mutual Fund platform for seamless navigation.

Market trends play a crucial role in shaping investment decisions, so access to the latest news surrounding the Nifty 100 Index can bolster strategic planning and enhance investment outcomes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send kotak nifty 100 equal for eSignature?

How do I edit kotak nifty 100 equal online?

How do I complete kotak nifty 100 equal on an iOS device?

What is kotak nifty 100 equal?

Who is required to file kotak nifty 100 equal?

How to fill out kotak nifty 100 equal?

What is the purpose of kotak nifty 100 equal?

What information must be reported on kotak nifty 100 equal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.