Get the free Kotak Nifty Top 10 Equal Weight Index Fund KIM.cdr

Get, Create, Make and Sign kotak nifty top 10

Editing kotak nifty top 10 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out kotak nifty top 10

How to fill out kotak nifty top 10

Who needs kotak nifty top 10?

Understanding the Kotak Nifty Top 10 Form: A How-To Guide

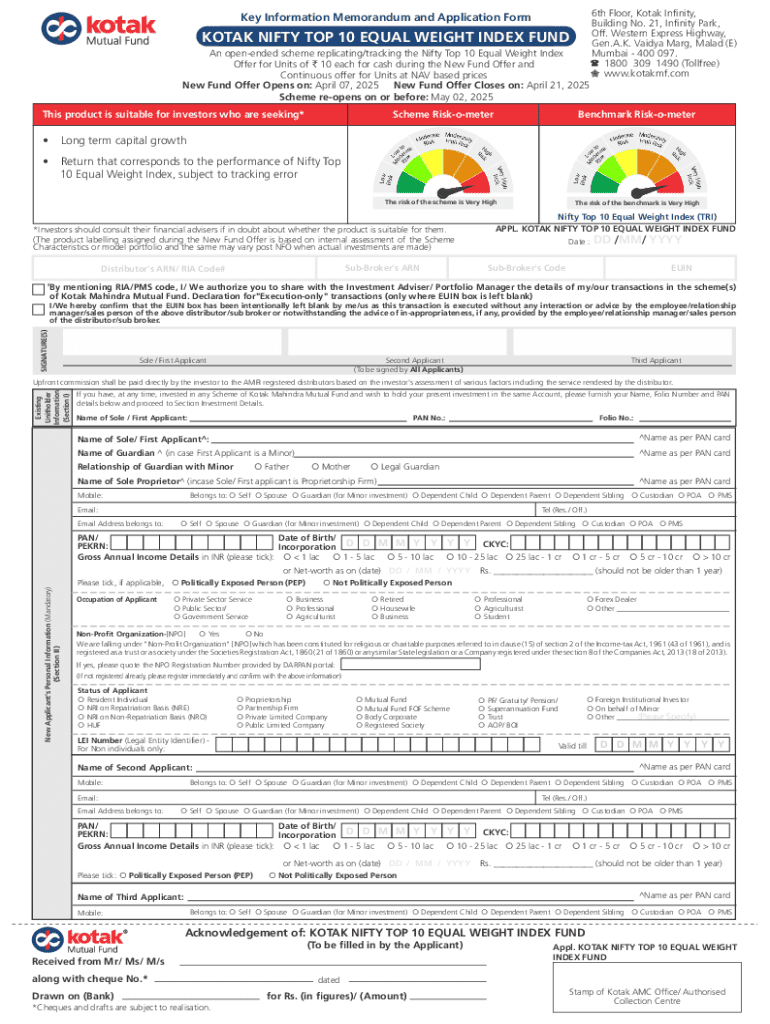

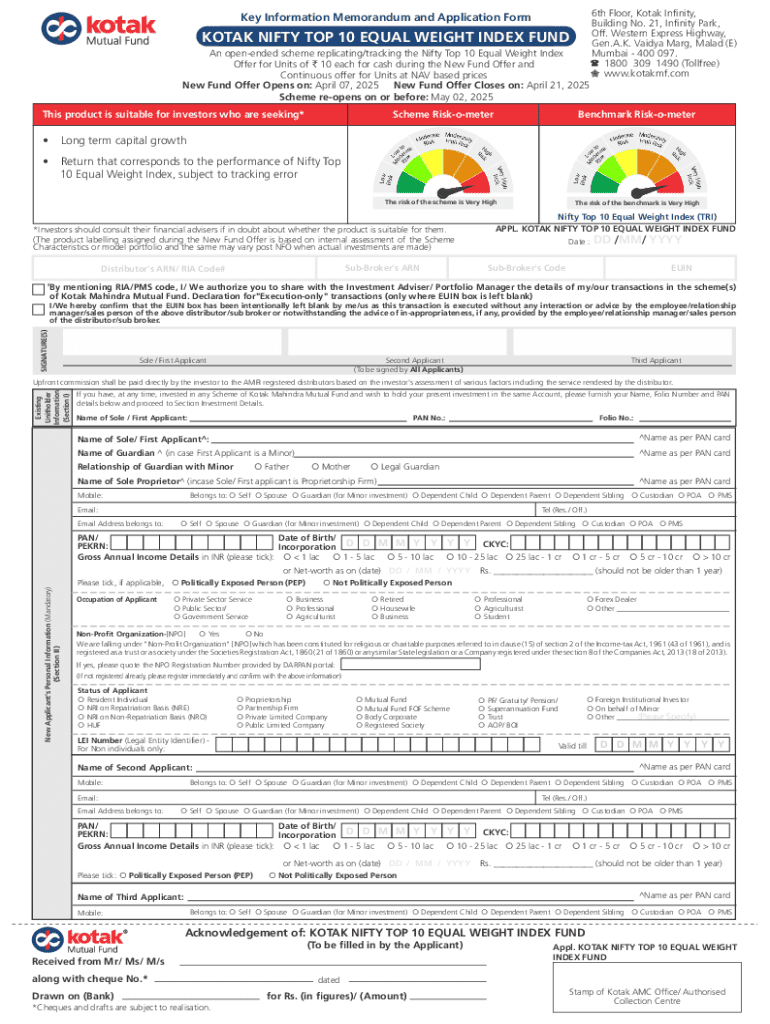

Overview of the Kotak Nifty Top 10

The Kotak Nifty Top 10 is a mutual fund that focuses on the top ten companies within the Nifty 50 index, which represents the 50 largest and most liquid stocks on the National Stock Exchange of India. This fund provides investors with exposure to the best-performing stocks in a robust and dynamic market, making it a valuable addition to any investment portfolio. By concentrating on these leading companies, the Kotak Nifty Top 10 aims to generate superior returns while leveraging the fundamental strengths of the selected stocks.

Kotak Mutual Fund, a subsidiary of Kotak Mahindra Bank, is known for its diverse range of investment solutions tailored for various investor profiles. The Kotak Nifty Top 10 form is crucial in facilitating investments into this fund. This form not only streamlines the application process but also serves to inform potential investors about the fundamental aspects of the fund and its investment philosophy.

Understanding the Kotak Nifty Top 10 Form

Filling out the Kotak Nifty Top 10 form involves several specific components and terminologies that are essential for effective investment management. At its core, the form is structured to gather critical investor information and the desired investment parameters. Key components include personal details, investment preferences, and compliance documentation, all of which facilitate a seamless investment process.

Key terminologies such as the Nifty 50 Index, asset allocation, and the distinction between equity and debt instruments play important roles. The Nifty 50 Index is the benchmark for measuring the performance of the top 50 stocks in India. Asset allocation refers to how an investor distributes their investments among different asset categories, which can include equities, debt instruments, and more. Understanding these terms is crucial as they influence investment decisions related to risk and return balances.

Steps to fill out the Kotak Nifty Top 10 form

Filling out the Kotak Nifty Top 10 form requires essential details that ensure compliance and help in processing your investment efficiently. The basic personal details required include your name, PAN (Permanent Account Number), and address. Additionally, KYC (Know Your Customer) compliance information is mandatory; this may require documents that verify identity and address, such as a government-issued ID or utility bill.

When it comes to specifying the investment amount, it’s important to decide whether you are investing as an individual or representing a corporate entity. For individual investors, the form requests personal details without complexities associated with organizational structures. Conversely, corporate investors must provide additional information related to the company's registration. It's critical to avoid common mistakes like mismatching signatures or submitting incomplete documents, as these could lead to delays or rejections.

Managing your investment with Kotak Nifty Top 10

To fully leverage your investment in the Kotak Nifty Top 10, understanding your financial goals is pivotal. Assessing whether you aim for short-term gains or long-term wealth accumulation will dictate how you approach your investment. Regularly tracking performance metrics, including the expense ratio, can provide insight into how management fees might affect your overall returns. Lower expense ratios often correlate with higher net returns on your investment.

Additionally, it is beneficial to conduct a historical performance review regularly. Understanding how the fund has performed in varying market conditions can inform future investment decisions. Utilizing tools and resources like pdfFiller helps streamline document management, allowing you to edit, customize, and securely send your forms while keeping all investment documents organized.

Key considerations before investing

Before proceeding with the Kotak Nifty Top 10 investment, understanding minimum investment requirements is essential. Typically, mutual funds have a minimum threshold – thorough knowledge of this can help avoid common pitfalls. Investors should also be cognizant of any potential exit loads, which could impact the overall net returns if shares are sold within a predefined period after investment.

Tax implications are another critical aspect to take into account. Capital gains tax, which applies to the profits made from selling units of the fund, varies between short-term and long-term holdings. It’s imperative to stay informed about the applicable tax rules and state-specific stamp duties, as these could significantly affect your net returns on investment.

Enhancing your investment strategy

Employing best practices for investing in equity funds is paramount for optimizing long-term returns. One fundamental principle is diversification – spreading investments across various sectors and asset types reduces risk. Failing to diversify can leave an investment portfolio vulnerable to market fluctuations.

Moreover, understanding the difference between long-term and short-term investment strategies is vital. Long-term strategies often take advantage of compounding returns over extended periods, while short-term strategies may involve higher risks but can yield quicker returns. Building a well-rounded investment strategy that combines elements of both can cater to varying investment goals.

Troubleshooting common issues

In the investment process, encountering issues with your Kotak Nifty Top 10 form is not uncommon. If your form is rejected, the first step is to review the notifications received carefully. Common reasons for rejection include incomplete information, mismatches in KYC details, or signature discrepancies. Addressing these promptly can help minimize delays and resubmit your form without complications.

For modifications or re-submissions, provide clear explanations of the changes made in the re-application. Familiarizing yourself with frequently asked questions related to the Kotak Nifty Top 10 form can help streamline the process and avoid missteps, ensuring a smoother investment experience.

Leveraging pdfFiller for enhanced document management

pdfFiller stands out as a comprehensive solution that supports users in effortlessly managing their Kotak Nifty Top 10 forms. This cloud-based document management platform offers several features that enhance both form filling and overall investment management. Accessing your documents from anywhere means you can easily stay on top of your investment transactions without being tied to a specific location.

Collaboration features empower teams to work together seamlessly. Whether you're an individual investor or part of a corporate team, pdfFiller’s functionalities enable real-time collaboration. Sharing forms and interactive discussions further streamline the investment process, providing an effective infrastructure for managing investment documentation.

Next steps after form submission

Once you have submitted your Kotak Nifty Top 10 form, the next logical step is monitoring your investment's performance over time. This involves keeping track of significant milestones, such as dividend announcements or fund performance reviews, which can impact your investments. A proactive approach will enable you to make informed decisions when market conditions warrant.

If changes to your investment are necessary, documentation of these alterations must be submitted accordingly – be it a change in investment amount or switching funds. Engaging with customer support provided by Kotak is also advisable for any queries, ensuring you have the latest information on fund performance or additional investment opportunities.

Keeping your documents organized

Maintaining organized documentation is essential in managing your investment effectively. pdfFiller offers robust storage solutions that facilitate proper archiving and access to important forms and documents, ensuring nothing is misplaced. Good document management practices can alleviate stress and provide quick retrieval of important information whenever needed.

Establishing best practices for digital document management is vital, such as categorizing documents and ensuring regular backups. The importance of backing up important documents cannot be overstated; it ensures that critical investment information remains safe and accessible. Consistent organization and secure storage are key to a successful investment journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find kotak nifty top 10?

Can I create an electronic signature for signing my kotak nifty top 10 in Gmail?

How do I edit kotak nifty top 10 on an Android device?

What is kotak nifty top 10?

Who is required to file kotak nifty top 10?

How to fill out kotak nifty top 10?

What is the purpose of kotak nifty top 10?

What information must be reported on kotak nifty top 10?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.