Get the free Supplemental Pay: Tax Implications for Hourly Teams

Get, Create, Make and Sign supplemental pay tax implications

Editing supplemental pay tax implications online

Uncompromising security for your PDF editing and eSignature needs

How to fill out supplemental pay tax implications

How to fill out supplemental pay tax implications

Who needs supplemental pay tax implications?

Supplemental pay tax implications form: A comprehensive guide

Understanding supplemental pay

Supplemental pay refers to any earnings that an employee receives in addition to their regular wages. It's essential for both employers and employees to grasp the concept of supplemental pay, as it varies by type and has specific tax implications. Understanding how supplemental pay impacts tax reporting can prevent financial headaches at tax time.

Common examples of supplemental pay include bonuses, commissions, overtime pay, and severance payments. These additional forms of compensation can significantly increase an employee's total income, leading to different tax obligations than regular wages. Properly reporting supplemental pay ensures compliance with IRS guidelines, thereby minimizing the risk of penalties or audits down the line.

Tax implications of supplemental pay

Understanding the tax implications of supplemental pay is crucial for both employees and employers. When supplemental pay is received, it can complicate tax obligations due to varying withholding rates compared to regular income. Employees should be aware that supplemental wages often face a flat federal withholding rate—currently 22% as of 2023—which may differ from the progressive rates applied to their regular earnings.

Failure to accurately report supplemental pay can lead to severe consequences, including audits and monetary penalties imposed by the IRS. Incorrect reporting can also affect an employee's future tax returns, leading to challenges with tax credits or deductions. It's vital to file any supplemental tax forms promptly and accurately to avoid these pitfalls.

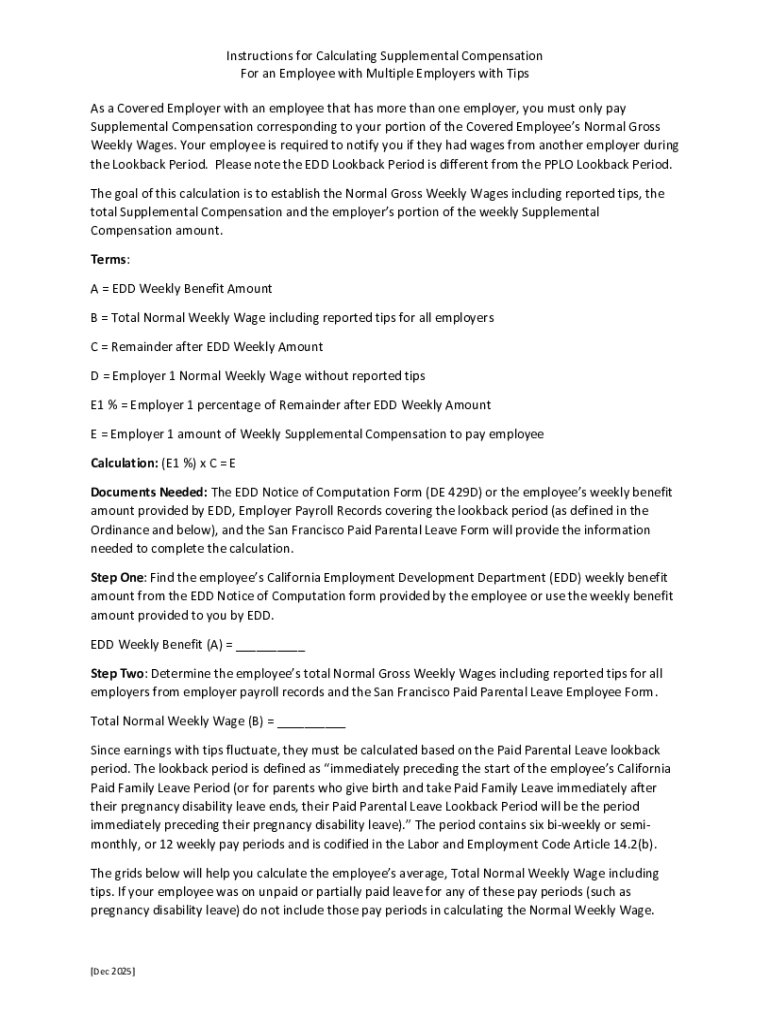

Filling out the supplemental pay tax implications form

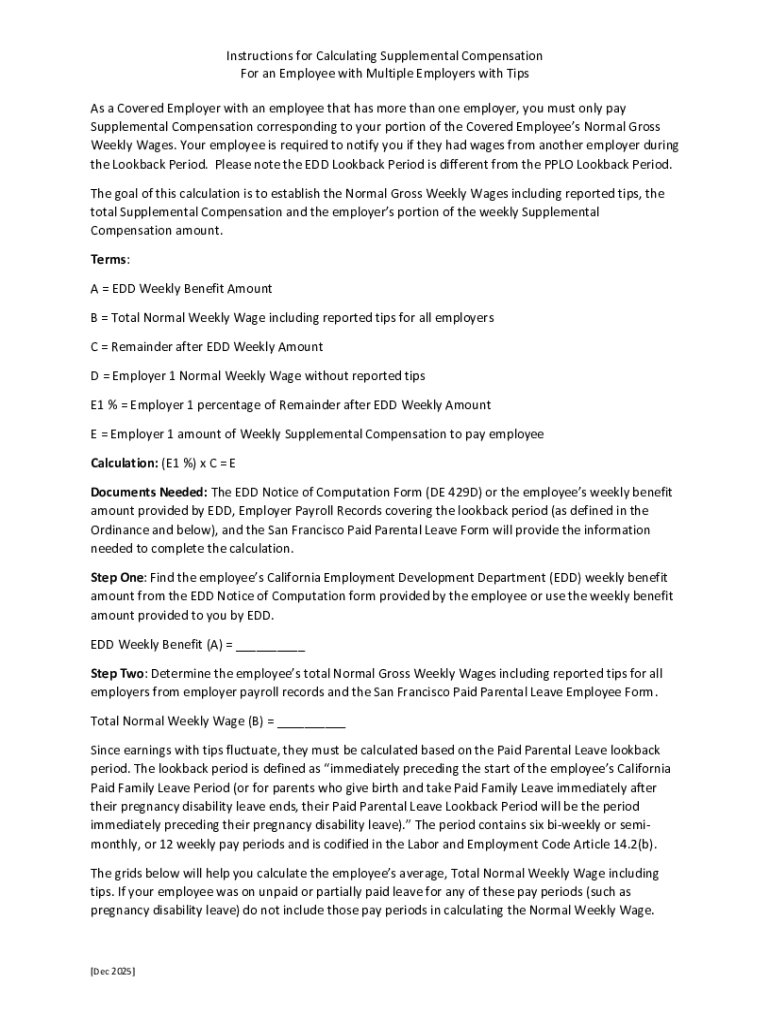

Completing the supplemental pay tax implications form requires precise attention to detail. While it may seem daunting, following a step-by-step approach can simplify the process significantly. Start by gathering all necessary documentation, including W-2 forms and recent pay stubs, which provide essential information about your earnings and withholding.

Next, differentiate between taxable and non-taxable income. Not all supplemental pay is taxable; for instance, some severance packages may include tax-free components. As you move forward, accurately complete the relevant sections of the form, ensuring that personal information and the specific type of supplemental pay are correct.

Avoiding common mistakes during this process is crucial. Errors such as incorrect calculation of withholding or misclassification of income types can lead to significant reporting problems later. Prioritize accuracy to ensure compliance with IRS standards.

IRS-approved methods for withholding taxes on supplemental pay

Employers must be familiar with IRS-approved methods for withholding taxes on supplemental pay. The two primary methods are the Percentage Method and the Aggregate Method. Each method presents distinct implications for payroll processing, and understanding these differences is vital for compliance and effective financial planning.

The Percentage Method applies a flat withholding rate on supplemental pays, like bonuses or commissions. Conversely, the Aggregate Method involves combining the supplemental pay with the employee's most recent wage for withholding calculations. Each method impacts payroll deductions differently and should be chosen based on the specific situation at hand.

Correcting errors in supplemental pay tax withholding

Errors in withholding supplemental pay can lead to complications. If you notice that wrong amounts were withheld—either too much or too little—it's essential to take swift action. Identifying the issue is the first step; whether it's a calculation error or a misclassification of income, understanding the source can help address the situation appropriately.

To rectify these mistakes, employees must file an amended tax return. This involves using Form 1040-X to correct information from the original return. Additionally, if too much tax was withheld, submitting a request for a refund to the IRS can reclaim those overpaid taxes. Responsive and proactive measures are critical to ensuring accurate reporting and maintaining a smooth tax filing process.

State-specific rules and considerations

When managing supplemental pay, it’s important to understand that tax regulations can differ significantly across states. Each state has its own rules regarding the taxation of supplemental income, which can affect how employers withhold or report taxes. This variability requires both employees and employers to stay informed about their specific state tax laws.

For instance, states like California maintain a higher tax withholding rate on supplemental income compared to states like Texas, which has no state income tax. Specific state tax forms may also be required for reporting such pay. Being proactive about understanding and complying with these state-specific rules can save individuals and businesses from unexpected tax liabilities.

Interactive tools for simplifying tax reporting

Leveraging interactive tools can greatly simplify the process of reporting supplemental pay and managing associated taxes. Users can benefit from tax calculators that aid in calculating withholding amounts based on various inputs. These tools offer a user-friendly approach to understanding potential tax liabilities, making compliance less daunting.

pdfFiller’s cloud-based solutions enhance accessibility and collaboration when managing tax forms. Features include easy-to-use templates for various tax documents, eSignature options for seamless approvals, and secure cloud storage for keeping tax records organized and readily accessible. Using such tools can significantly streamline tax reporting processes.

Recent trends and changes in taxation of supplemental pay

Staying abreast of recent trends and changes in the taxation of supplemental pay is crucial for compliance. As tax laws evolve, the IRS frequently updates guidelines affecting supplemental wages. It’s important for both employees and employers to remain informed about these changes to best prepare for their tax obligations.

For instance, recent updates may involve adjustments to withholding rates or changes in reporting requirements. Identifying new compliance guidelines will ensure that individuals and teams do not incur additional liabilities or face unforeseen tax issues. Monitoring these updates through reputable sources, or consulting with a CPA, can facilitate a smoother tax experience.

Best practices for employers and employees

Employers play a crucial role in communicating tax obligations associated with supplemental pay to their employees. Clear communication regarding tax responsibilities ensures that employees are aware of potential withholdings, facilitating smoother tax filing processes. Offering educational resources or one-on-one consultations can demystify the complexities of supplemental pay.

For employees, understanding their tax responsibilities is pivotal. Keeping thorough records of all supplemental payments received and maintaining documentation helps in easily referencing this information during tax season. Transparent communication between employers and employees fosters a productive environment where tax reporting is less burdensome.

Frequently asked questions (FAQs)

Understanding supplemental pay and its accompanying tax implications can raise numerous questions. Many individuals often wonder what qualifies as supplemental pay. Common answers include any earnings over standard wages, like bonuses or overtime. Determining correct withholding amounts is another common question, which generally involves utilizing IRS guidelines or consulting a tax professional to ensure compliance.

In cases where an employee receives a corrected form after filing, they should act quickly to report the changes appropriately. Consulting a CPA can help navigate these corrections effectively. Individuals should feel empowered to seek help or clarification on issues surrounding supplemental pay to avoid complications.

Utilizing pdfFiller for efficient document management

Managing tax-related documents can often be a cumbersome task, but pdfFiller provides an effective solution. The platform allows users to create, edit, sign, and store documents all in one place, making tax management incredibly efficient. Its user-friendly interface enables easy navigation through documents, streamlining the process of filling out tax forms like the supplemental pay tax implications form.

With features like eSignature functionality and collaborative capabilities, individuals and teams can manage tax documents more effectively than ever. pdfFiller encourages proactive tax management and helps users avoid common pitfalls associated with manual document handling. Case studies have shown successful implementation of pdfFiller's solutions, leading to improved productivity and organization in managing tax forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in supplemental pay tax implications without leaving Chrome?

How do I edit supplemental pay tax implications on an iOS device?

How can I fill out supplemental pay tax implications on an iOS device?

What is supplemental pay tax implications?

Who is required to file supplemental pay tax implications?

How to fill out supplemental pay tax implications?

What is the purpose of supplemental pay tax implications?

What information must be reported on supplemental pay tax implications?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.