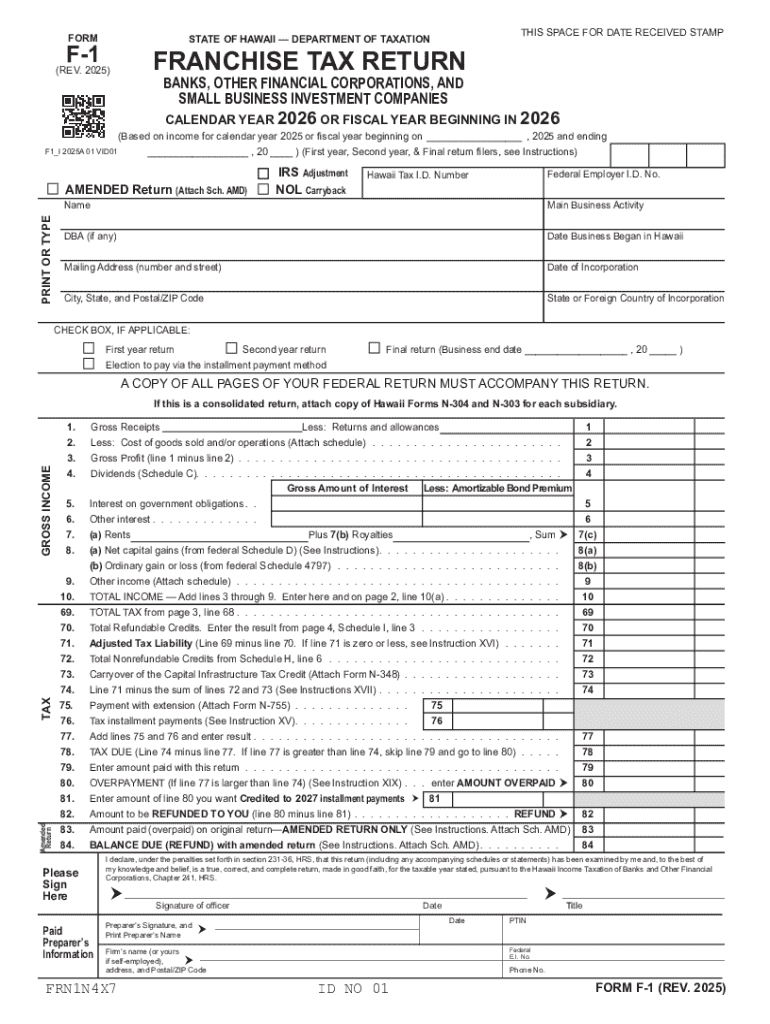

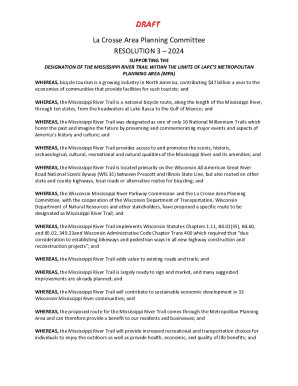

Get the free Tax Year Information2025 - Hawaii Department of Taxation

Get, Create, Make and Sign tax year information2025

How to edit tax year information2025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax year information2025

How to fill out tax year information2025

Who needs tax year information2025?

Tax year information 2025 form: A comprehensive guide

Overview of tax year 2025

Tax year 2025 refers to the period in which taxpayers will report their income and expenses for tax purposes. Understanding tax year designation is crucial, as it determines the applicable legislation and potential deductions available to individuals and businesses. The tax year in the United States is generally based on the calendar year, running from January 1st through December 31st.

Key dates for filing and payment are important for taxpayers to note: the deadline for filing individual income tax returns for the 2025 tax year will most likely fall on April 15, 2026, unless it falls on a weekend or holiday. Additionally, any taxes owed will also be due by this same date. It's crucial to stay updated on any potential changes to these deadlines by the IRS.

Impacts of changes in tax laws for 2025 might include adjustments in tax rates, thresholds for deductions, and modifications to credits. Taxpayers need to be aware of these changes, as they can greatly influence their tax obligations and potential refunds.

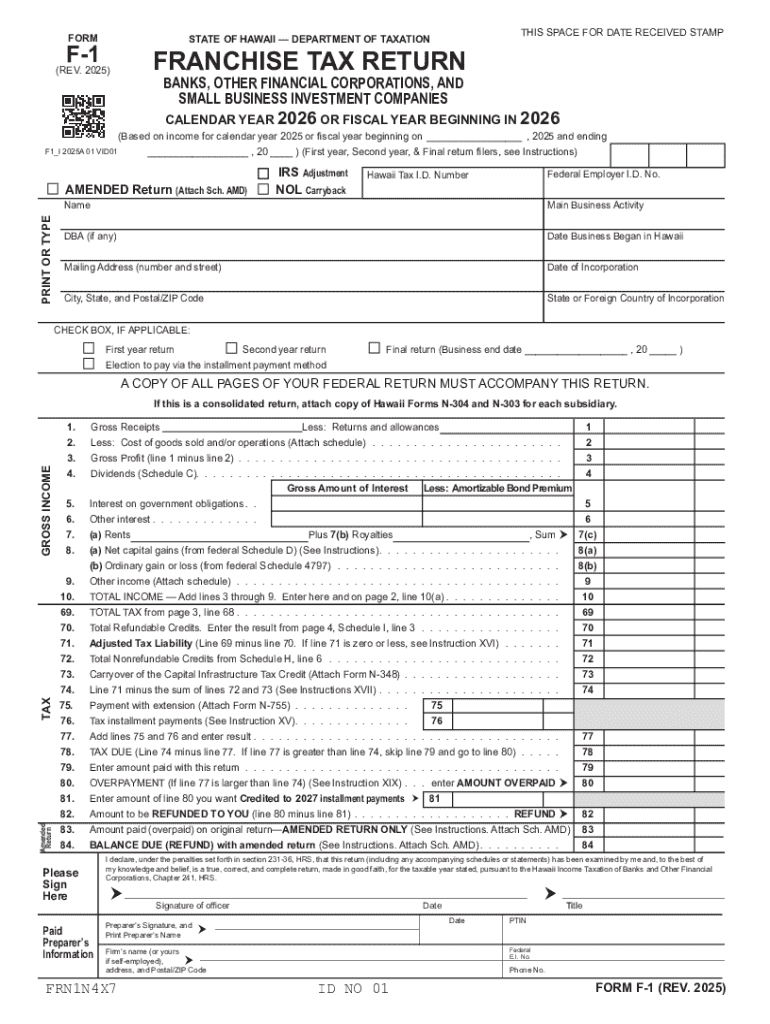

Important federal tax forms for 2025

For the year 2025, several essential federal tax forms will be used to file taxes. The most commonly used form is Form 1040, the Individual Income Tax Return, which almost all individual taxpayers will need to complete. For seniors, Form 1040-SR is specifically designed to ease the filing process for those aged 65 and over.

Different schedules allow taxpayers to report various types of income and deductions. Schedule A is used for itemizing deductions, while Schedule C caters to those reporting profit or loss from their business. Understanding eligibility criteria for each form is vital to ensure correct filing and avoiding penalties.

Key changes in federal forms for 2025 may include alterations in the layout, additional instructions for claiming deductions, or new requirements that adjust how taxpayers verify income.

Schedules for tax year 2025

In addition to primary forms, various schedules are essential for detailed reporting of specific financial situations. Each tax situation may require different schedules based on income sources or eligible deductions.

Major schedules for tax year 2025 include Schedule B, which reports interest and ordinary dividends; Schedule D, designated for reporting capital gains and losses; and Schedule E that focuses on supplemental income and loss. Being familiar with what each schedule entails will help taxpayers prepare accurate and complete returns.

Determining which schedules to use involves considering your sources of income and whether you will take the standard deduction or itemize. Taking the time to review each requirement will save you frustration later on when preparing your tax return.

Consider these tips for filling out each schedule effectively: always double-check the instructions when completing a schedule, ensure that all applicable income sources are reported, and consult with a tax expert if you have uncertainties regarding what needs to be included.

E-filing help for 2025

E-filing is increasingly popular among taxpayers for its convenience. The advantages of e-filing versus paper filing include quicker processing times, faster refunds, and built-in error checking that can catch mistakes before submission. Taxpayers often prefer e-filing because it simplifies the submission process while still ensuring compliance with IRS regulations.

To e-file your 2025 taxes, follow this step-by-step guide: First, select a suitable e-filing platform, like pdfFiller, that provides interactive tools for completing your forms. Next, gather all necessary tax documents and input your income and deductions into the respective forms. Review your information, check for errors, and finally, submit electronically.

Common errors to avoid while e-filing include inputting incorrect Social Security numbers, miscalculating income or deductions, and failing to sign your return electronically. Utilizing pdfFiller's platform can greatly reduce these errors through its user-friendly interface.

Platforms and tools can facilitate the e-filing process by offering integrated solutions that manage document preparation and submission. pdfFiller, for example, empowers users to effortlessly edit PDFs, e-sign forms, and organize documents from a single cloud-based platform, enhancing the overall experience.

Understanding deductions and credits in 2025

Deductions and credits play a pivotal role in reducing taxable income and, consequently, tax liability. Taxpayers can choose between standard deductions and itemized deductions. Standard deductions provide a flat reduction in taxable income, while itemized deductions require a detailed accounting of expenses such as mortgage interest, donations, and medical costs.

Among the major tax credits available for tax year 2025 are the Child Tax Credit, Earned Income Tax Credit, and education credits. These credits can significantly lower your tax bill, making it essential to evaluate your eligibility status.

The impact of deductions and credits on your tax liability can be significant. By maximizing these benefits, taxpayers can maximize their tax refunds. Using pdfFiller's platform simplifies the documentation process related to deductions and credits, ensuring you have all necessary forms ready for submission while enhancing accuracy.

Managing your tax documentation

Effective management of tax documentation is vital for a smooth tax filing experience. Preparing your financial records for tax submission involves gathering all relevant documents, including income statements, bank records, and receipts for deductible expenses.

Keeping accurate records is crucial, as it substantiates your tax claims and safeguards against potential audits. It's recommended that you create a tax folder, both physical and digital, to keep your documents organized and easily accessible.

Utilizing pdfFiller for document management and storage aids in securely signing and sharing your tax documents. With its integrated features, users can store all necessary forms in one place, minimizing the risk of misplacing critical paperwork.

Common challenges and FAQs for tax year 2025

Tax filing can often come with its own set of challenges. Common tax filing challenges in 2025 might include understanding new tax laws, managing receipts for deductions, or dealing with complex income scenarios such as investment income.

Here are some frequently asked questions for tax year 2025: How to handle tax changes for self-employed individuals? Self-employed individuals should maintain detailed records of income and expenses to ensure accurate reporting. What to do if you miss the tax filing deadline? You can file for an extension, but any taxes owed are still due on the original deadline. How to amend a tax return for errors? You can file Form 1040-X to amend a previously filed return.

For further support, taxpayers can refer to IRS resources or consult a tax professional to navigate complexities.

Contacting support for tax year assistance

Knowing when to seek professional help is crucial when dealing with taxes. If you're facing challenges you can't resolve on your own, such as significant changes in income or tax law, it's advisable to consult a tax professional.

For specific queries about federal tax forms, taxpayers can contact the IRS support line or access their online resources. Community forums and groups can be great sources of advice, offering insights from fellow taxpayers who have faced similar situations.

Utilizing pdfFiller support can assist you with tax forms and queries, leveraging their expert knowledge and tools to simplify the filing process and ensure your documentation is complete.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete tax year information2025 online?

How do I edit tax year information2025 straight from my smartphone?

How do I edit tax year information2025 on an iOS device?

What is tax year information 2025?

Who is required to file tax year information 2025?

How to fill out tax year information 2025?

What is the purpose of tax year information 2025?

What information must be reported on tax year information 2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.