Get the free Form FP-1 Franchise Tax or Public Service Company ...

Get, Create, Make and Sign form fp-1 franchise tax

Editing form fp-1 franchise tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form fp-1 franchise tax

How to fill out form fp-1 franchise tax

Who needs form fp-1 franchise tax?

Form FP-1 Franchise Tax Form: A Comprehensive Guide

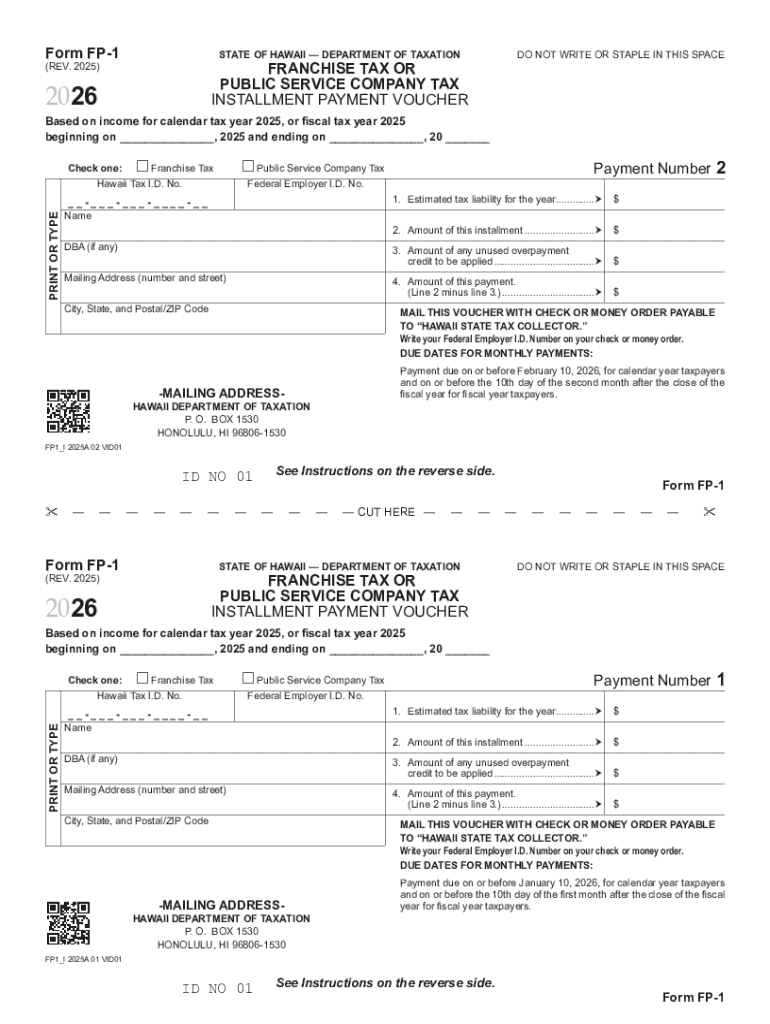

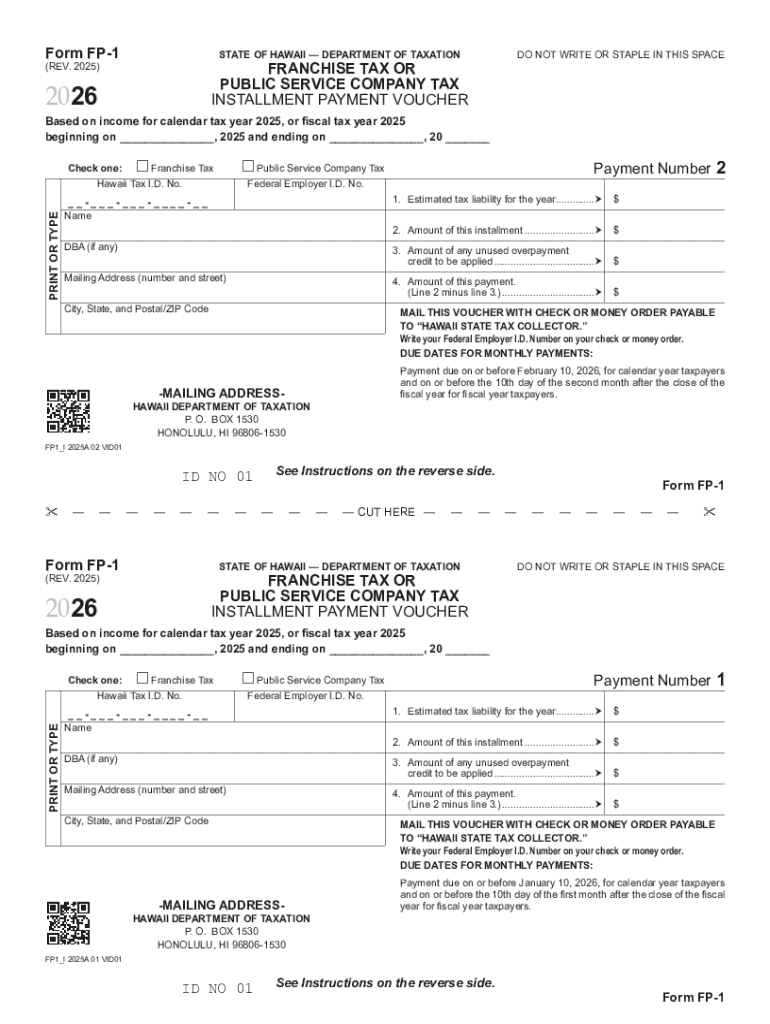

Understanding the form FP-1 franchise tax form

Franchise taxes are crucial elements of business taxation that ensure entities operating within a jurisdiction contribute to the community's resources and infrastructure. The FP-1 form serves as a key instrument for reporting these taxes, making it essential for compliance and operational transparency. Primarily, franchise taxes are levied on businesses for the privilege of operating in a specific state, thus providing state administrative agencies with a source of revenue necessary for public services and economic development.

Various types of entities are required to file the FP-1 form, including corporations, limited liability companies (LLCs), and partnerships. Each of these entity types has unique considerations and requirements under state law, which must be adhered to diligently to prevent complications.

Key components of the form FP-1

The FP-1 franchise tax form includes several key components that businesses must complete accurately to adhere to tax regulations. The first part of the form addresses entity information, where essential details about the business, such as its legal name, business address, and federal employer identification number (FEIN), must be provided.

Additionally, businesses must attach supplementary documents such as schedules that specify revenue details or offer flexibility for tax credits and deductions, helping to mitigate the overall tax burden.

Step-by-step instructions for completing form FP-1

Completing the FP-1 form efficiently requires a structured approach. Begin by gathering all necessary documentation, including financial records and previous tax returns to ensure accurate reporting. Having this data ready simplifies the process and enhances accuracy.

Common challenges and how to overcome them

Businesses often face challenges when it comes to navigating the complexities of the FP-1 process, especially in scenarios involving multi-state operations. In such cases, understanding the different tax laws in each state is crucial. For those under audit, staying organized with documentation and seeking professional advice can significantly ward off potential penalties.

Some frequently asked questions about the FP-1 process can help demystify the filing process. For instance, businesses commonly wonder about which deductions they are eligible for or how to calculate their total revenue correctly.

Utilizing technology for form FP-1 management

Leveraging technology can significantly enhance the experience of filing the FP-1 franchise tax form. Platforms like pdfFiller offer interactive tools that streamline the completion of the form. Users can fill out the form efficiently while also utilizing electronic signature capabilities for seamless submission, saving time and effort.

Moreover, pdfFiller enhances collaboration by allowing team members to share and discuss the form, facilitating a smoother process and ensuring everyone involved is on the same page.

Post-filing steps after submitting form FP-1

Once businesses have filed the FP-1, it’s essential to track the submission status. This helps confirm receipt by tax authorities and ensures timely notification of any discrepancies. Users can typically check their status online on the tax authority's website.

Understanding these post-filing obligations is key, as they will help businesses maintain compliance with state regulations and avoid future complications.

Additional information and resources

Businesses can find relevant forms and publications related to the franchise tax on the pdfFiller website. Additionally, direct links to state-specific guidelines ensure that users access up-to-date information tailored to their home state, enhancing their compliance capabilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form fp-1 franchise tax?

Can I create an electronic signature for signing my form fp-1 franchise tax in Gmail?

How do I fill out form fp-1 franchise tax on an Android device?

What is form fp-1 franchise tax?

Who is required to file form fp-1 franchise tax?

How to fill out form fp-1 franchise tax?

What is the purpose of form fp-1 franchise tax?

What information must be reported on form fp-1 franchise tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.