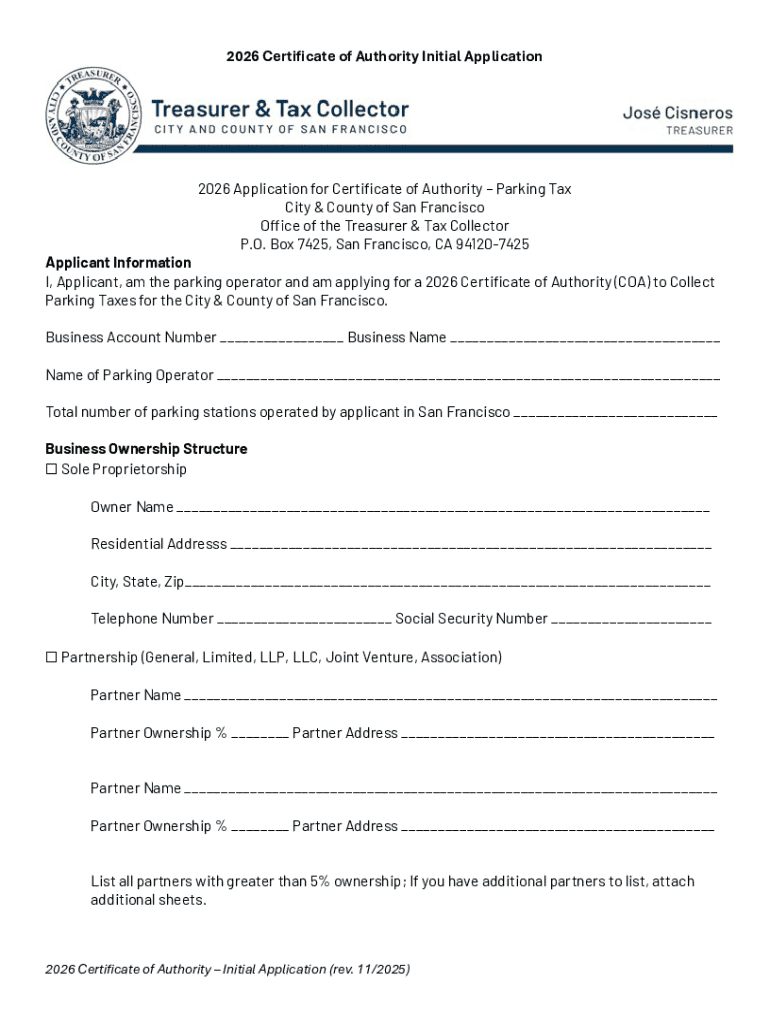

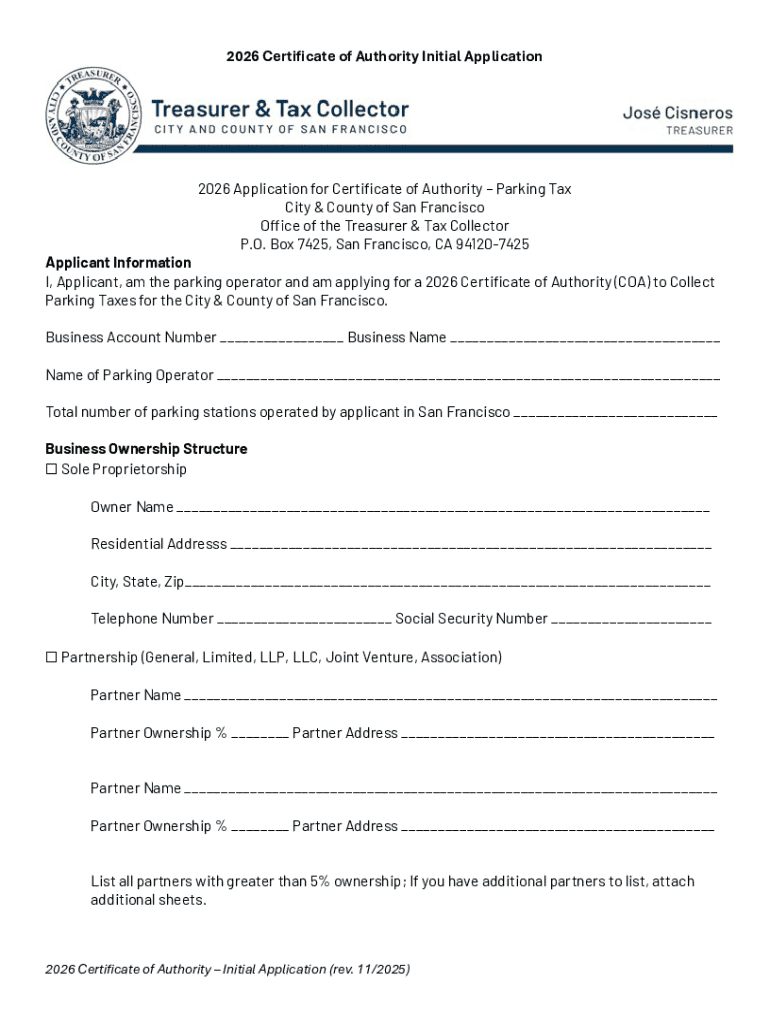

Get the free Certificate of Authority to Collect Parking Taxes (COA) ...

Get, Create, Make and Sign certificate of authority to

Editing certificate of authority to online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of authority to

How to fill out certificate of authority to

Who needs certificate of authority to?

Certificate of Authority to Form: A Comprehensive Guide

Understanding the Certificate of Authority

A certificate of authority to form is a critical legal document that authorizes a business entity to operate in a state where it is not incorporated. This is especially crucial for companies looking to expand their operations beyond their original state of incorporation or where they were formed. Without this certificate, businesses may face legal hurdles, fines, or restrictions that can impede their ability to conduct commerce.

The importance of a certificate of authority cannot be understated, as it legitimizes business operations, enabling companies to engage in contracts, gain access to financial services, and protect the owners from personal liability. Moreover, the lack of such authority could lead to trouble with state regulations which may hinder growth or new investments.

When is a Certificate of Authority Required?

Certain situations demand obtaining a certificate of authority to form, primarily when a business expands its operations beyond its home state. Companies that establish physical locations, employees, or significant transactions in another state will generally need this certification. Specific industries, such as financial services and healthcare, often have stringent regulations requiring such documentation to protect consumers and ensure compliance with local laws.

However, there are limitations and exceptions to this requirement. A business operating solely online or without establishing a physical presence in the state may not require certification. Ignoring compliance regulations and continuing operations without the necessary authority can lead to serious risks, including steep fines or the inability to enforce contracts within the state.

The Intersection of Certificate of Authority and Tax Identification

While a certificate of authority to form and a tax identification number (TIN) are both essential to operating a business, they serve different purposes. A TIN is used primarily for tax reporting and obligations, while the certificate of authority pertains to legal recognition to operate in a state. Businesses often confuse the two; however, it’s crucial to understand that both documents play distinct roles in maintaining compliance.

Obtaining a TIN is generally required concurrently with acquiring a certificate of authority, especially if you plan to hire employees or collect sales tax in that state. Misalignment between these documents can lead to tax complications and potential penalties, making it crucial to ensure they complement one another within your business structure.

Obtaining a Certificate of Authority: The Step-by-Step Process

The process of obtaining a certificate of authority involves several critical steps. The first step is thorough research to understand the specific requirements for each state, as regulations can vary significantly. States often have unique documentation requirements, application procedures, fees, and processing times.

Preparation is key. Necessary documents such as the application form, identification of business owners, and proof of good standing in the home state must be assembled. After securing the documentation, the application can be filled out meticulously and submitted either online or via mail, depending on state regulations.

Processing times can vary, typically ranging from a few business days to several weeks, and costs often include application fees and potential legal assistance. Following up on the application status is vital, as issues can arise. If an application is denied, understanding the reasons is crucial to address them for future submission.

The Consequences of Non-Compliance

Failure to obtain a certificate of authority can lead to severe penalties and legal ramifications. Businesses may incur fines that can vary significantly based on state policies. Moreover, the inability to pursue legal action against clients or suppliers due to non-compliance can severely affect business operations and relationships.

Real-life case studies show that many businesses that disregarded compliance faced longstanding repercussions, including loss of business reputation and the inability to operate effectively. For example, companies that continued operating in states without the necessary certificate often saw steep fines along with legal fees that accumulated in remedial actions, illustrating the importance of proactive compliance.

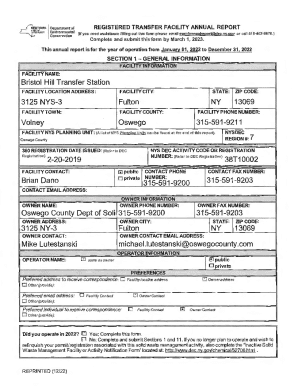

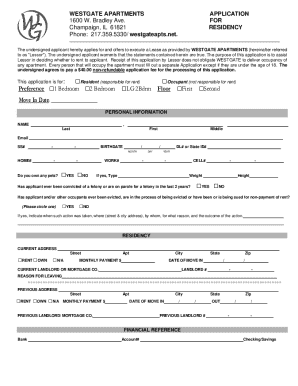

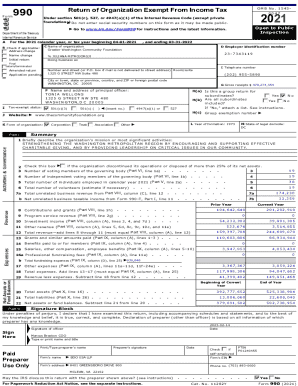

What Information is Typically Included on a Certificate of Authority?

A certificate of authority generally includes essential data points, such as the official name of the business entity, the nature of business conducted, and the physical location of its operations. This information is vital for maintaining transparency and ensuring that all documentation aligns with state regulations.

Additionally, businesses may be required to provide related registration documents, such as proof of their formation in the home state and identification details of the business owners. This comprehensive information helps state authorities verify the legitimacy of the business and its compliance with local laws.

Costs Associated with a Certificate of Authority

The cost of obtaining a certificate of authority varies widely by state and can impact the budget of a small business significantly. Typically, application fees may range from as low as $50 to over $500 depending on the complexity of the application and the state’s pricing structure. Additional costs for legal services or document preparation may also arise, further complicating budgeting.

Preparing for these expenses in advance is essential for managing cash flow effectively. It’s advisable to consult with accounting professionals or utilize performance management software for a clear view of upcoming fees and financial commitments related to compliance, ensuring that businesses remain prepared for licensing and operational needs.

Managing Your Certificate of Authority Post-Obtainment

Once obtained, it’s crucial to keep your certificate of authority updated. Changes in ownership, location, or business structure may necessitate an update to maintain compliance. Regular reviews of business documents are essential to ensure continued legality across all states of operation.

Tracking expiration dates and compliance deadlines can easily slip a business owner's mind, potentially leading to non-compliance situations. Utilizing document management solutions like pdfFiller can streamline this process, allowing for reminders and organized access to business documentation.

Explore Related Document Management Solutions

Document management is a vital component of running an effective business. Using services like pdfFiller can significantly enhance your approach to managing important documents, including your certificate of authority. With robust features for editing, storing, and accessing documents, pdfFiller empowers users to maintain organization and compliance from anywhere.

Moreover, the platform’s eSignature capabilities support the seamless signing of documents, making it easier for teams to collaborate efficiently. By streamlining your document management process with effective tools, businesses can focus more on their operations rather than getting bogged down by paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my certificate of authority to in Gmail?

Can I create an electronic signature for signing my certificate of authority to in Gmail?

How do I fill out certificate of authority to using my mobile device?

What is certificate of authority to?

Who is required to file certificate of authority to?

How to fill out certificate of authority to?

What is the purpose of certificate of authority to?

What information must be reported on certificate of authority to?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.