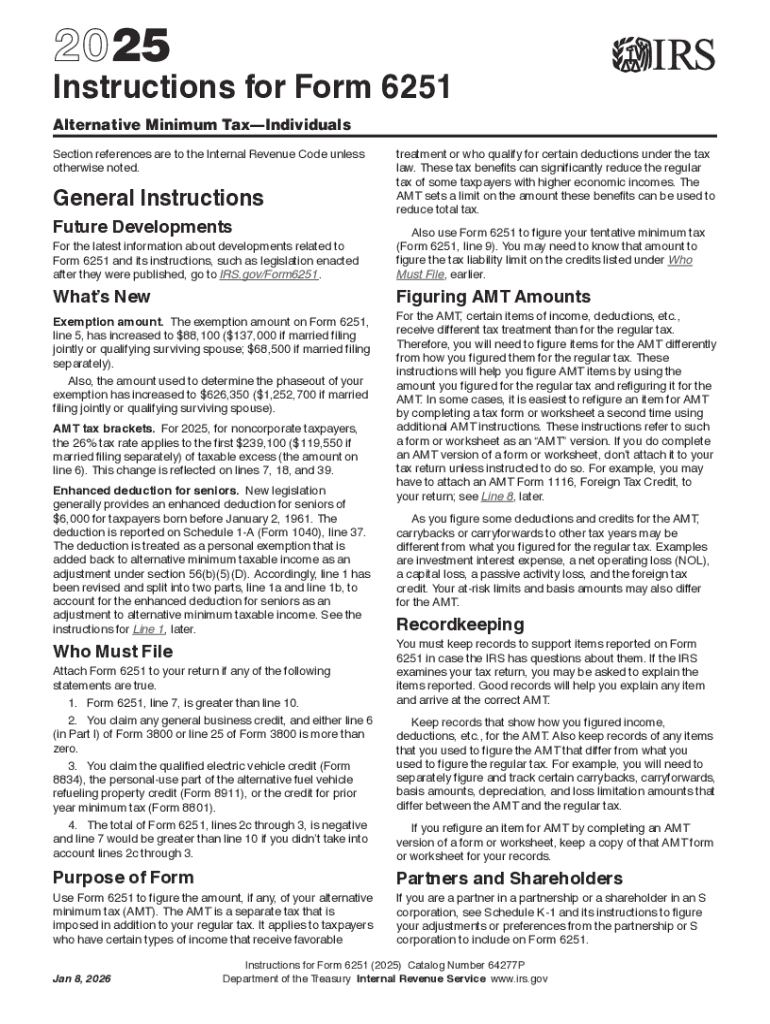

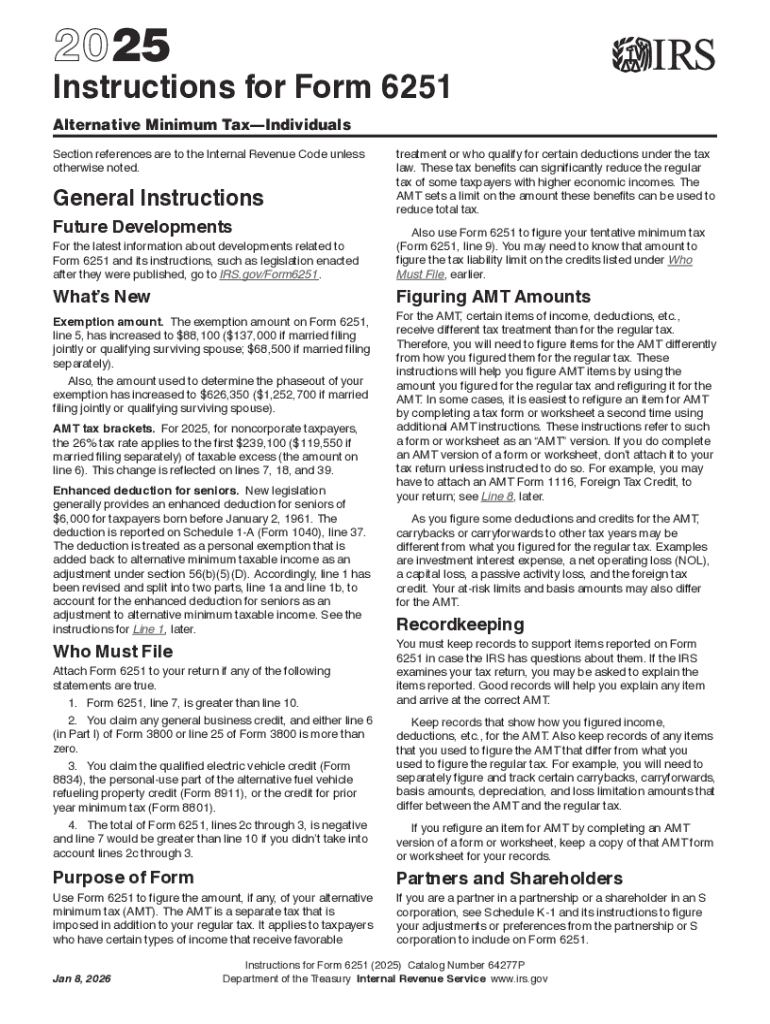

Get the free 2025 Instructions for Form 6251. Instructions for Form 6251, Alternative Minimum Tax...

Get, Create, Make and Sign 2025 instructions for form

Editing 2025 instructions for form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 instructions for form

How to fill out 2025 instructions for form

Who needs 2025 instructions for form?

2025 Instructions for Form: A Comprehensive Guide to Completing Your Forms with pdfFiller

Overview of the 2025 instructions for form

The 2025 instructions for form aim to provide users with clear guidance on how to effectively fill out their forms related to real estate transactions. Ensuring your forms are correctly completed is crucial, as inaccuracies can lead to delays or complications in processing your requests. Here, we will explore the various aspects of these instructions and highlight how pdfFiller can simplify the process, allowing you to focus on what’s essential.

Key features of the 2025 form

The 2025 form encompasses a range of unique characteristics tailored to specific filing scenarios, particularly in the realm of real estate transactions. This form is widely used in various situations, from conventional sales to installment sales, ensuring that all necessary information regarding the transferor, transferee, and property involved is accurately documented. Depending on your situation, you may also need to reference related forms and documentation that accompany the 2025 filing, creating a cohesive documentation experience.

Step-by-step instructions for filling out the 2025 form

Filling out the 2025 form can be broken down into several key steps that ensure accuracy and completeness. By following these guidelines, you can prepare holistic documentation and enhance your submission. Let's delve into the detailed breakdown and necessary preparations.

Detailed breakdown of each section of the 2025 form

The 2025 form typically consists of several critical sections, including Personal Information, Financial Information, and Additional Information. Thoroughly understanding each subsection will better equip you to avoid pitfalls in form completion.

Review and verification process

After completing the 2025 form, it's imperative to conduct a thorough review to ensure accuracy. Flaws or discrepancies in your submission can lead to complications, affecting timelines and outcomes. Take advantage of pdfFiller's proofreading tools to facilitate this process.

Utilizing pdfFiller for the 2025 form

pdfFiller enhances the completion of the 2025 form through various tools designed for easy editing, electronic signing, and collaboration. Employing these tools enables a smoother and more efficient filling process.

Troubleshooting common issues

Occasionally, you may encounter discrepancies or technical issues while filling out the 2025 form. Being proactive and familiar with common problems and their solutions can save you significant time and headaches.

Final steps before submission

Having prepared and reviewed your 2025 form meticulously, it's time for final submission. This step is critical, and knowing the right procedures will ensure timely processing of your request.

Additional tips for efficient form management

Efficient management of your forms goes beyond just filling them out. Leveraging pdfFiller for storage and organization can streamline future transactions, saving you time and effort.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 2025 instructions for form online?

How can I fill out 2025 instructions for form on an iOS device?

How do I edit 2025 instructions for form on an Android device?

What is 2025 instructions for form?

Who is required to file 2025 instructions for form?

How to fill out 2025 instructions for form?

What is the purpose of 2025 instructions for form?

What information must be reported on 2025 instructions for form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.