Get the free Instructions for Form 8991, Tax on Base Erosion Payments of ...

Get, Create, Make and Sign instructions for form 8991

Editing instructions for form 8991 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form 8991

How to fill out instructions for form 8991

Who needs instructions for form 8991?

Instructions for Form 8991

Understanding Form 8991

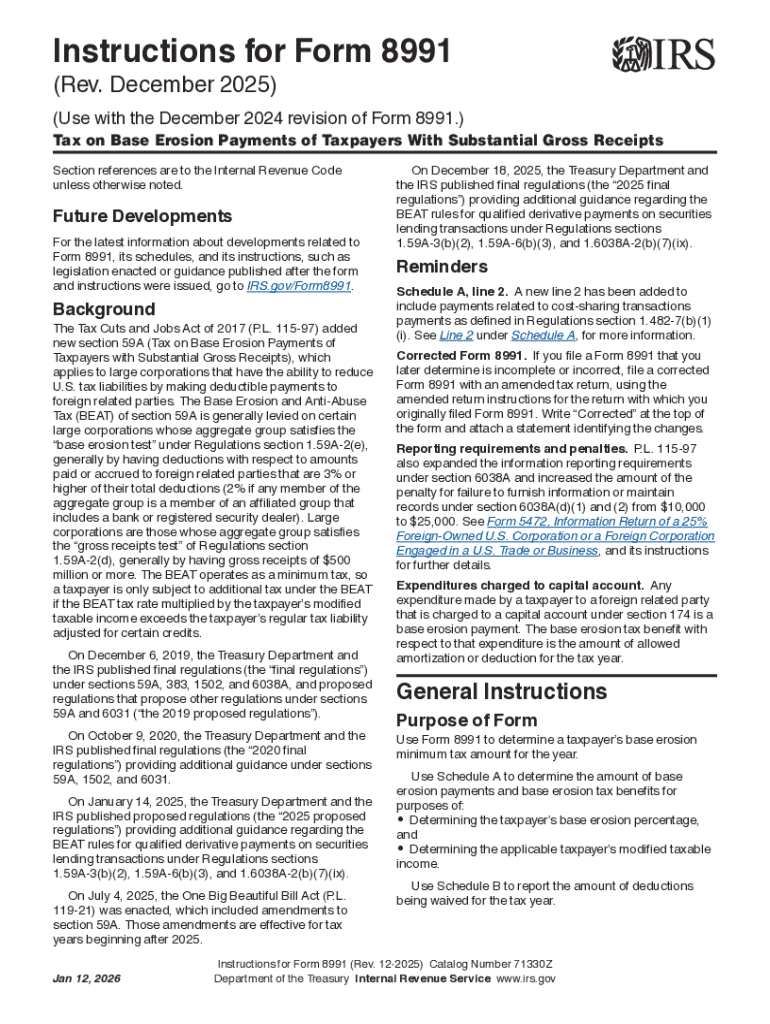

Form 8991, formally known as the 'Tax on Base Erosion Payments of Taxpayers with Significant Operations in the United States,' is a crucial document for corporations subject to the base erosion and anti-abuse tax (BEAT). This tax applies to corporations that make base erosion payments to related foreign parties, impacting how these entities calculate their minimum tax obligations. For taxpayers involved in cross-border transactions, understanding and completing Form 8991 accurately is essential to ensure compliance with the Internal Revenue Code.

The primary purpose of Form 8991 is to determine the minimum tax amount that a corporation must pay when it has base erosion payments. Corporations subject to this tax must file Form 8991 with their annual tax return if their annual gross receipts exceed a certain threshold. Understanding this form is not only important for meeting IRS requirements but also for efficient tax planning and avoiding potential penalties associated with non-compliance.

Preparing to complete Form 8991

Before diving into Form 8991, there are prerequisites that taxpayers need to fulfill to ensure a smooth filing process. First and foremost, you must gather necessary documentation, which typically includes financial statements, records of transactions with foreign affiliates, and general corporate tax records. The IRS requires that the information you provide is precise and substantiated. Missing or incorrect documentation can lead to delays or penalties in tax processing.

Financial records are paramount when completing Form 8991. You will want to compile data regarding all base erosion payments, which can include amounts paid to foreign entities for services rendered or goods purchased. This includes directly correlating these amounts to your overall financial performance.

When it comes to completing Form 8991, electronic platforms can significantly streamline the process. pdfFiller offers intuitive features that cater to the nuances of the form, such as automated calculations, interactive completion tools, and easy export options. Compared to traditional methods such as paper filing, pdfFiller provides a more organized and time-efficient solution, especially for those who frequently manage multiple forms.

Step-by-step instructions for filling out Form 8991

To get started, you’ll need to download Form 8991 from the IRS website or access it through pdfFiller. The form is designed with different parts that require specific information, so it's crucial to familiarize yourself with its layout. Ensure you have the most updated version of the form to avoid any discrepancies due to tax code changes.

Once you've accessed Form 8991, you will find interactive features on pdfFiller that guide you through the form. This includes helpful prompts and tooltips that clarify what data is needed for each section. Let's break down the form into its essential components:

Common mistakes include neglecting to double-check the EIN or omitting critical payment information that could affect your tax calculations. That's why it’s recommended to review every entry with care, potentially involving a second set of eyes in the process.

Tips for successfully completing Form 8991

Thorough preparation is key to completing Form 8991 successfully. Best practices include organizing your inputs clearly before filling out the form. This means categorizing your financial records according to sections in Form 8991. By having relevant data readily available, you minimize the likelihood of errors and omissions.

Another critical tip is to double-check your entries for accuracy. When your financial standing is at stake, it’s worth the time invested to verify each figure. Many taxpayers overlook the importance of proofreading, leading to costly mistakes that could have been easily avoided.

If you encounter issues or have questions while filling out the form, pdfFiller provides support resources, including FAQ sections and customer service options. Don't hesitate to reach out for guidance.

E-signing and submitting Form 8991

Once your Form 8991 is complete, you’ll need to sign and submit it. pdfFiller’s e-signature feature provides a seamless way to sign documents electronically, saving time and enhancing convenience. To use this feature, navigate to the e-sign option within the pdfFiller interface and follow the prompts to apply your signature securely.

The platform incorporates robust security measures, ensuring that your electronic submissions are kept confidential and compliant with IRS regulations. After signing, consider your submission options. You can choose to e-file your return through approved electronic channels or submit a physical copy via postal mail.

Post-submission guidelines

After submitting Form 8991, tracking is essential. Verify receipt of your submission with the IRS by checking their online resources or contacting them directly. Staying proactive can help catch any potential issues early. Knowing how to check the status of your form ensures you're informed about any further actions needed.

Once filed, it's crucial to understand the potential outcomes. You may receive confirmation, prompt compliance queries, or even audits. If Notices are issued regarding your filing, addressing them promptly is vital. Taxpayers should always follow IRS guidance and maintain detailed records of their communications.

Leveraging pdfFiller for future filings

pdfFiller goes beyond Form 8991 by offering features that make future filings easier and more organized. With document management tools, users can store, edit, and share tax documents seamlessly from a single platform. The availability of templates for various tax forms ensures that you are never starting from scratch and can focus on accuracy and compliance.

Moreover, pdfFiller continuously updates its platform to align with ongoing changes in tax regulations. Staying informed through the provided tutorials and webinars can enhance your understanding of current tax laws and requirements, making you better prepared for subsequent filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit instructions for form 8991 from Google Drive?

How do I make edits in instructions for form 8991 without leaving Chrome?

Can I edit instructions for form 8991 on an iOS device?

What is instructions for form 8991?

Who is required to file instructions for form 8991?

How to fill out instructions for form 8991?

What is the purpose of instructions for form 8991?

What information must be reported on instructions for form 8991?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.