Get the free IRS Form 4684 walkthrough (Casualty & Theft Losses)

Get, Create, Make and Sign irs form 4684 walkthrough

Editing irs form 4684 walkthrough online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs form 4684 walkthrough

How to fill out irs form 4684 walkthrough

Who needs irs form 4684 walkthrough?

IRS Form 4684 Walkthrough Form: Your Comprehensive Guide

Understanding IRS Form 4684

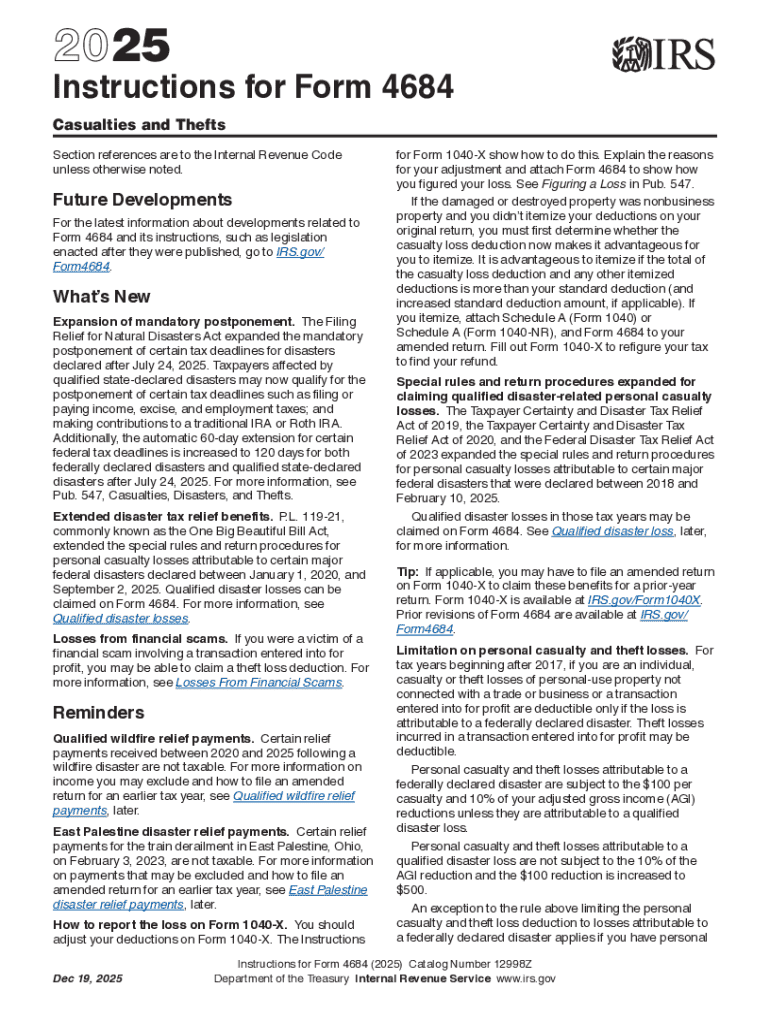

IRS Form 4684 is crucial for taxpayers who need to report casualty and theft losses when filing their taxes. This form serves as the official means of documenting losses due to unforeseeable events like natural disasters or theft. Understanding its purpose ensures that individuals can navigate the reporting process efficiently.

Key terms associated with Form 4684 include 'casualty loss,' which refers to losses from sudden or unexpected events such as fire, storm, or vandalism, and 'theft loss,' which relates to property stolen due to criminal activity. Familiarizing yourself with these terms can streamline the application process, enabling you to file with confidence.

When you need to file Form 4684

Not every taxpayer will need to file IRS Form 4684. You are required to file when you experience significant losses in your personal property due to various situations. For instance, if your property suffers damage from a natural disaster such as a flood or fire, this form becomes essential. Similarly, theft incidents requiring documentation will necessitate its submission.

Understanding the tax implications of these losses could provide substantial financial relief through eligible deductions. Keeping accurate records will significantly aid in your filing efforts and ensure compliance with IRS requirements.

Who must file Form 4684?

Filing Form 4684 is dictated by specific requirements. Typical criteria include the nature of the loss and whether it’s above a certain threshold. Taxpayers must determine if their financial losses result from a casualty event or theft as per IRS guidelines.

Additionally, special taxpayer scenarios demand careful consideration, such as losses related to rental properties or partnerships. Filing in these situations can involve more complex regulations; thus, consulting a tax professional might be beneficial.

Essential documents for IRS Form 4684

Gathering the right documentation is quintessential for accurately completing IRS Form 4684. You’ll need legal proof of loss, primarily through photographs, police reports, and written accounts. Providing appropriate ownership verification, such as appraisals or purchase receipts, will also strengthen your submission.

Organizing these documents allows for a smoother filing experience. Consider creating a dedicated folder—both physical and digital—where all related documentation can be easily accessed when needed.

Filing timeline: Deadlines for Form 4684

Meeting filing deadlines is a critical aspect of tax preparation. Typically, Form 4684 is due when you file your annual tax return, which is primarily April 15th for individual taxpayers. However, in certain scenarios, you may be eligible for extensions.

In circumstances where disasters affect your ability to file on time, the IRS often provides relief by extending deadlines. It’s crucial to stay informed and adhere to protocols if you find yourself missing the original deadline.

Completing IRS Form 4684: Section-by-section walkthrough

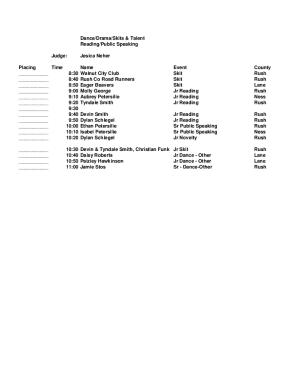

Completing Form 4684 involves understanding its structure. The form is split into several sections that require specific information regarding your losses. The first major segment is for personal-use property losses and the second for other types of casualty or theft losses.

Each section requires different data points, including descriptions of the lost items, the loss amount, and details supporting your claim. Make sure to also double-check for accurate calculations to minimize errors.

Frequent filing errors to avoid

Errors on your Form 4684 can lead to complications, including audit risks or penalties. Common mistakes include misreporting loss amounts, neglecting to provide sufficient documentation, and overall calculation errors. It's vital to meticulously review your form before submission.

Being aware of how to remedy these mistakes can save time. In the event of an error, you can file an amended return or provide additional information as requested by the IRS.

What happens after filing Form 4684?

Once you’ve submitted your Form 4684, you might wonder about the next steps. The IRS will process your submission as part of your tax return, typically within a timeframe of 21 days if filed electronically. Depending on your situation, you could expect a refund or an inquiry regarding additional information.

If you receive correspondence from the IRS, it’s important to respond promptly and maintain a clear dialogue, as it may contain requests for further information regarding your losses.

Leveraging pdfFiller for a smooth filing experience

Using pdfFiller for completing IRS Form 4684 can considerably expedite your document management experience. The platform offers interactive tools designed for efficient form filling, along with eSignature capabilities that allow you to submit documents quickly, all from a single cloud-based platform.

Moreover, pdfFiller enhances collaboration, enabling users to share documents for team input during preparation. Real-time editing and commenting features make it easy to communicate effectively, ensuring that even complex tax situations can be tackled collaboratively.

Final tips for mastering your IRS Form 4684 submission

To maximize your efficiency when filing IRS Form 4684, adopting best practices is essential. Organize your approach by creating a detailed checklist summarizing required information and documentation. Additionally, setting reminders for deadlines can help keep the process from overwhelming you.

Staying informed about changes in tax laws, especially relating to Form 4684, will also serve you well. Monitoring updates ensures you’re aware of any new rules or regulations affecting your filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify irs form 4684 walkthrough without leaving Google Drive?

Can I sign the irs form 4684 walkthrough electronically in Chrome?

How do I edit irs form 4684 walkthrough on an Android device?

What is irs form 4684 walkthrough?

Who is required to file irs form 4684 walkthrough?

How to fill out irs form 4684 walkthrough?

What is the purpose of irs form 4684 walkthrough?

What information must be reported on irs form 4684 walkthrough?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.