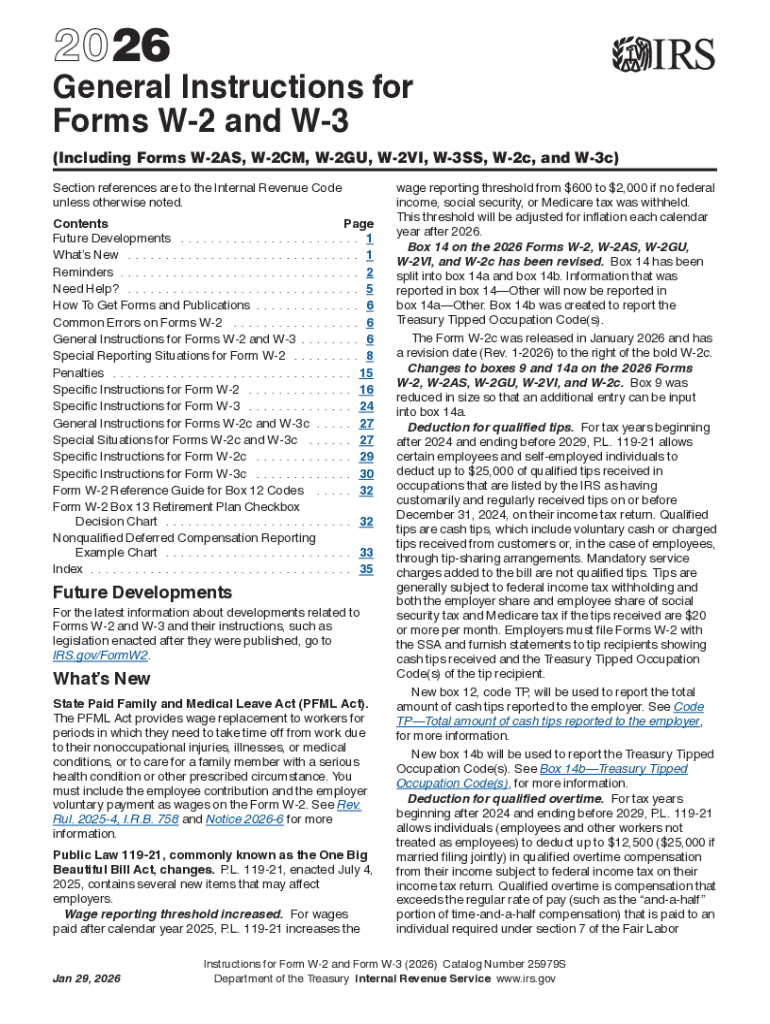

Get the free IRS Releases 2025 General Instructions for Forms W-2 and W-3

Get, Create, Make and Sign irs releases 2025 general

How to edit irs releases 2025 general online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs releases 2025 general

How to fill out irs releases 2025 general

Who needs irs releases 2025 general?

IRS releases 2025 general form: Your comprehensive guide

Overview of the IRS 2025 general form

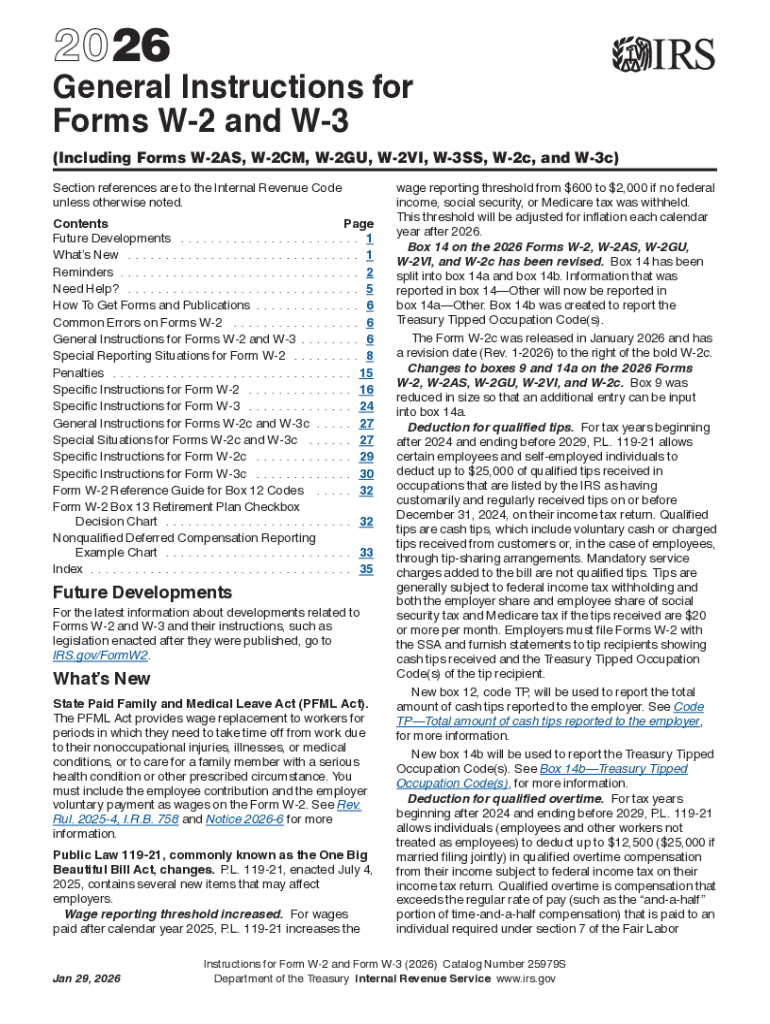

The IRS has officially released the 2025 General Form, which is crucial for taxpayers to understand as it dictates how individuals and businesses report their income and claim deductions. This form is fundamental for facilitating the tax compliance process across the United States. Its primary purpose is to consolidate various tax-related information, ensuring that all individuals can accurately report their earnings and claim applicable credits. An overview of the changes introduced in this new version is essential for tax filers to adapt effectively.

This year's updates emphasize the necessity of remaining informed about revisions, especially given that tax laws continually evolve. Regularly updating yourself on these forms can mitigate errors, reduce audits, and ultimately save money. Ignoring the changes may lead to oversights that could affect your tax refunds or increase your liabilities.

Major changes and additions for 2025

The 2025 General Form features significant updates and additions that reflect ongoing shifts in tax policy. One of the major changes involves updates to tax credits, notably the Permanent Child Tax Credit. Under this revision, eligible families may notice an increase in the amount of credit available per qualifying child. This change seeks to alleviate some financial pressures on families and enhance child welfare, marking a progressive step in U.S. tax law.

Additionally, the Refundable Adoption Credit has seen increases, which will benefit families seeking to adopt. By expanding the scope of refundable credits, this 2025 General Form aims to provide vital support for families transitioning through adoption processes.

Moreover, eligible deductions have experienced modifications, specifically in relation to contributions made to governmental paid family leave programs. Taxpayers can now expect more clarity and potential benefits in their deductions under this section. Understanding how these changes impact your tax filing process is essential, so you can strategically adjust your tax plans.

Key sections of the 2025 general form

Navigating the IRS 2025 General Form requires familiarity with its essential sections. Firstly, personal information must be accurately filled out to identify you as the taxpayer, including your name, Social Security number, and address. This section establishes your identity with the IRS and must be clear and correct to avoid complications.

The income reporting section is another crucial element where taxpayers detail their earnings from various sources, including wages, dividends, and freelance work. Ensuring accuracy in this section is vital, as it affects your total tax liability. Finally, the claiming credits and deductions section is where you leverage your eligible credits, such as the ones mentioned earlier, to lower your overall tax obligation. A thorough understanding of these sections will bolster your confidence when filling out the form.

Filling out the 2025 general form: Step-by-step guide

Step 1: Gather necessary documents

Before initiating the form-filling process, it's imperative to gather all necessary documentation. A comprehensive list includes your W-2 forms from employers, 1099 forms for other income sources, receipts for deductible expenses, and previous tax returns. Having these documents on hand will not only expedite the process but also enhance the accuracy of your submission.

Step 2: Completing the personal information section

When filling out your personal information, double-check for accuracy. Common mistakes include typos in your Social Security number or address. Use the same name that appears on your Social Security card and ensure your address is current to prevent any filing mismatches.

Step 3: Reporting your income

Accurate income reporting is crucial as it is fundamental to calculating your tax obligation. Report different types of income using their corresponding lines on the form. Include wages, business income, and any other earnings. If you have complex income sources, consider utilizing tax software or consulting a tax professional for accuracy.

Step 4: Claiming tax credits and deductions

This step is where you can maximize your financial benefits. Review your eligibility for credits thoroughly and claim what you are entitled to. For example, families with children might consider the Child Tax Credit, while those with recent adoptions should ensure they apply for the Refundable Adoption Credit. Providing proper documentation is essential to support your claims. An example scenario may involve a family with two qualifying children — they would calculate their total refundable credit based on the new guidelines set forth in the 2025 General Form.

Step 5: Review and finalize your submission

Before submission, reviewing your completed form is paramount. Look for any potential errors, inconsistencies, or missing information. Consider using tools to review your form digitally, which can help mitigate common mistakes. Tools like pdfFiller can be invaluable here, offering features to edit, sign, and manage your forms effectively.

Interactive tools for managing your IRS forms

Using interactive tools can significantly simplify your tax filing process. pdfFiller offers user-friendly solutions that enable you to fill, edit, sign, and manage documents from a single, cloud-based platform. This versatility allows you to access and modify your tax forms from anywhere, making it easier to meet deadlines and stay organized.

With pdfFiller, you can easily incorporate your personal documents, eliminate the hassle of physical paperwork, and reduce clutter. Plus, the cloud-based nature of the platform means your documents are securely stored and easily retrievable, ensuring you have access when needed.

Common FAQs related to the 2025 general form

Many taxpayers often have questions regarding the filling process for the new 2025 General Form. A common query is about eligibility for certain credits and deductions; understanding how to apply these changes can prevent errors and ensure that you maximize your potential refund.

Clarifications on filing procedures are also prevalent; many wonder about deadlines and the importance of timely and accurate submissions. Troubleshooting common issues during the filing process, such as tax software errors or missing documentation, also tends to be a significant concern for filers. Having a solid understanding of frequently asked questions can facilitate smoother filing experiences.

Future considerations: What to expect after 2025

As we look beyond 2025, anticipated changes in tax legislation may continue to influence how taxpayers manage their filings. This could include further adjustments in tax credits or modifications to the general form based on economic trends. Staying aware of these potential changes is essential for effective tax planning and long-term financial strategy.

Preparing for future forms and regulations means being proactive. Consider subscribing to tax news updates from reputable sources to ensure you remain informed of any legislative tweaks that could affect your financial obligations. An adaptable tax plan will serve you well in navigating future changes.

Getting updates directly from the IRS

One effective way to stay abreast of the latest updates regarding the IRS 2025 General Form and other tax-related news is to sign up for email updates directly from the IRS. This not only keeps you informed about important announcements but also offers guidance relevant to form submissions and upcoming deadlines.

By subscribing to these updates, you can ensure that you are always aligned with the IRS's evolving standards and requirements, protecting you from potential errors and ensuring your compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify irs releases 2025 general without leaving Google Drive?

How do I fill out the irs releases 2025 general form on my smartphone?

How can I fill out irs releases 2025 general on an iOS device?

What is irs releases 2025 general?

Who is required to file irs releases 2025 general?

How to fill out irs releases 2025 general?

What is the purpose of irs releases 2025 general?

What information must be reported on irs releases 2025 general?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.