Get the free IRS Drops Form 708: 40% Tax, Gifts & Bequests, Covered ...

Get, Create, Make and Sign irs drops form 708

How to edit irs drops form 708 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs drops form 708

How to fill out irs drops form 708

Who needs irs drops form 708?

IRS Drops Form 708 Form: A Comprehensive Guide for Expatriates and Individuals

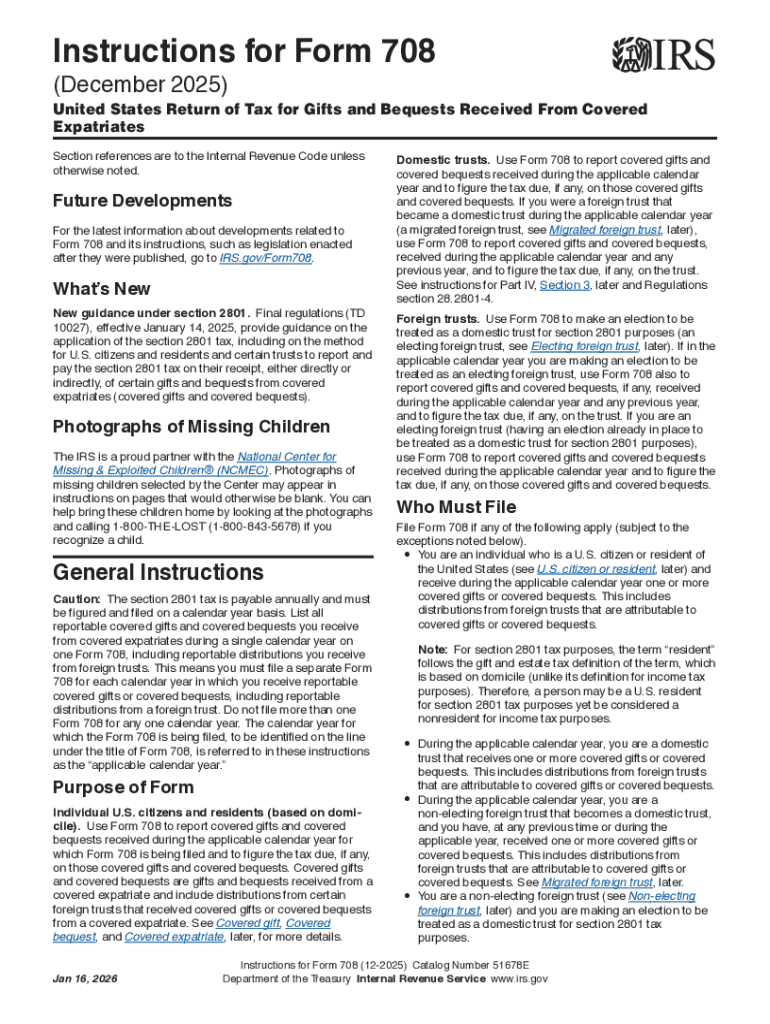

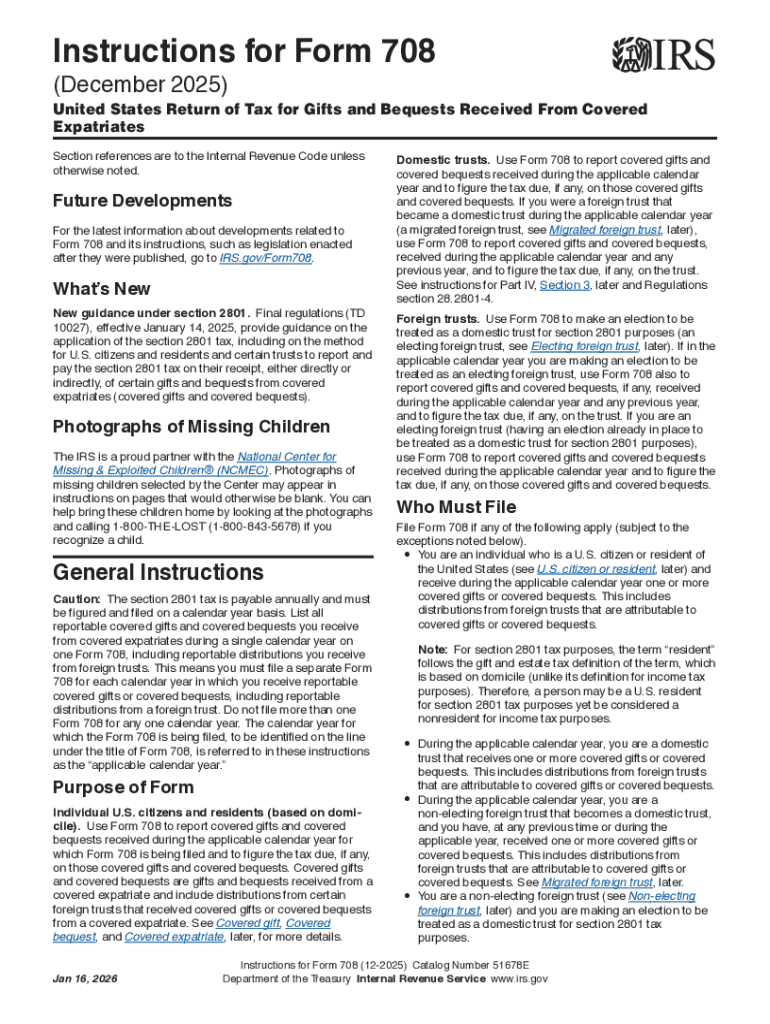

Understanding IRS Form 708

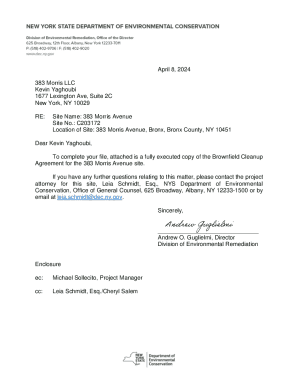

IRS Form 708 is a tax form used to report gifts and bequests made by U.S. expatriates to individuals, typically foreign recipients. The form's primary purpose is to ensure compliance with U.S. transfer tax laws, particularly when a donor is no longer a resident of the United States. Form 708 is crucial for expatriates as it helps avoid penalties associated with unreported gifts and ensures that both donors and recipients understand their tax obligations.

Filing Form 708 is particularly significant for U.S. citizens who have renounced their citizenship or long-term residents who have ceased to be lawful permanent residents. Such individuals may find themselves subject to an exit tax along with gift tax on any covered gifts and bequests, which underscores the importance of accurate and timely filing.

Key components of IRS Form 708

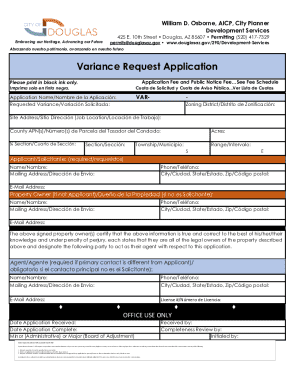

Form 708 consists of several key sections, each requiring specific information that helps delineate the nature and extent of gifts given. These sections include personal identification details, a report of gifts or bequests made, and any necessary calculations related to transfer taxes. Understanding these components is vital for accurate completion of the form.

For instance, the first section typically requires the expatriate's name, Social Security number, and contact details, while subsequent sections delve into the particulars of each gift. It involves reporting the identity and relationship to the recipient, alongside the fair market value of the gifted property at the time of transfer.

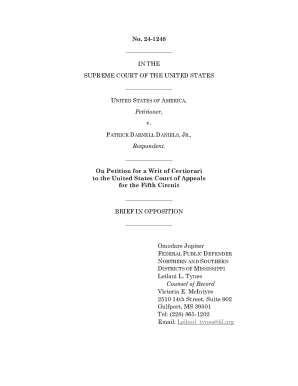

The filing process for IRS Form 708

Completing IRS Form 708 involves a structured approach. Begin with gathering necessary financial documents like bank statements, property appraisals, and previous gift records. It is crucial to have a thorough understanding of the fair market value of any items you wish to report as gifts.

Next, fill out your personal information accurately, as mistakes can lead to delays or issues with the IRS. Report each gift meticulously, providing details of the recipients and the value of the gifts. Ensure all calculations regarding the transfer tax are precise, as errors could result in penalties.

Utilizing tools like pdfFiller can significantly ease this process. Their interactive features allow for easy edits, electronic signatures, and secure management of your forms. Accessing Form 708 through cloud-based solutions ensures that you can work on your tax documents from anywhere.

Common mistakes to avoid

Filing Form 708 can be tricky. One of the most common errors includes omissions, such as failing to report a significant gift or missing recipient information. These mistakes may lead to investigations and penalties from the IRS. It’s also essential to have clarity on taxation terms to avoid misunderstandings, specifically regarding 'covered gifts' and 'bequests.'

To spot errors effectively, always conduct a thorough review of the completed form before submission. Cross-check all financial values, and ensure that the form is signed and dated appropriately. Seeking feedback or assistance can also provide a fresh perspective to enhance accuracy.

The role of tax professionals

Navigating IRS Form 708 can be complex, especially for expatriates facing unique tax implications. Consulting a tax professional is advisable under several circumstances. If you have made significant gifts or have a complicated tax situation that includes multiple jurisdictions, a certified tax advisor can provide tailored guidance ensuring compliance and accuracy.

When choosing a tax advisor, look for credentials such as a CPA or an enrolled agent with specific experience in expatriate tax matters. They should also demonstrate strong communication skills and a proactive approach to tax planning and compliance.

Special considerations for expatriates

Expatriates face specific tax implications when filing Form 708 due to their status. The IRS classifies certain gifts as 'covered gifts' which may be subject to a special exit tax. Understanding the nature of these gifts is crucial as they can significantly impact both the donor and recipient's tax situations.

Covered gifts may include those that exceed annual exclusion limits, along with certain types of assets such as real estate or stocks. Expatriates must keep thorough records of any significant transfers to ensure they can accurately report them and calculate potential tax liabilities.

Appendix: Resources and tools

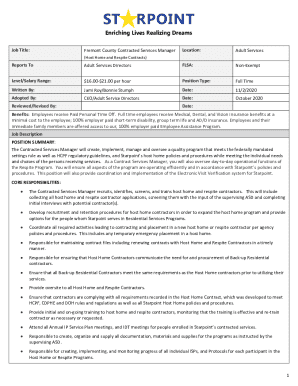

pdfFiller offers numerous features designed to facilitate the filing process for IRS Form 708. Users can fill, edit, and sign documents seamlessly. With cloud-based access, teams and individuals can collaborate from anywhere, simplifying how taxation documentation is managed. The platform's user-friendly interface is built for efficiency, ensuring taxes are filed correctly and on time.

Moreover, the FAQ sections on the pdfFiller website offer insights into common queries regarding Form 708, along with expert advice to assist with any potential complexities in filing. Leveraging these resources can help expatriates remain compliant and informed about their tax obligations.

Updates and changes in IRS regulations

In recent years, the IRS has made several updates that may impact how expatriates handle IRS Form 708. One notable change relates to the thresholds for reporting gifts and the categorization of what constitutes a covered gift. These updates necessitate continual monitoring for expatriates to ensure they remain compliant with evolving tax laws and avoid missed filings.

As the landscape of expatriate taxation continues to change, staying informed on forthcoming regulations and potential reforms on the IRS's approach to expatriate tax obligations will be critical. Being proactive in understanding these changes can help taxpayers strategically navigate their tax liabilities.

Final thoughts on managing IRS Form 708

Navigating the complexities of IRS Form 708 is a critical task for expatriates and individuals making significant gifts. Keeping abreast of your obligations can mitigate potential penalties and ensure smooth processing of your filings. Engaging in best practices such as utilizing comprehensive tools like pdfFiller, remaining updated on IRS regulations, and consulting tax professionals where necessary can make a noteworthy difference.

By harnessing the features offered by pdfFiller for document management, individuals and teams can effectively streamline their filing processes. The cloud-based platform promotes collaboration, enhancing accessibility and efficiency, which is essential in today’s fast-paced environment. Managing IRS Form 708 has never been more efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get irs drops form 708?

How do I execute irs drops form 708 online?

Can I edit irs drops form 708 on an Android device?

What is irs drops form 708?

Who is required to file irs drops form 708?

How to fill out irs drops form 708?

What is the purpose of irs drops form 708?

What information must be reported on irs drops form 708?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.