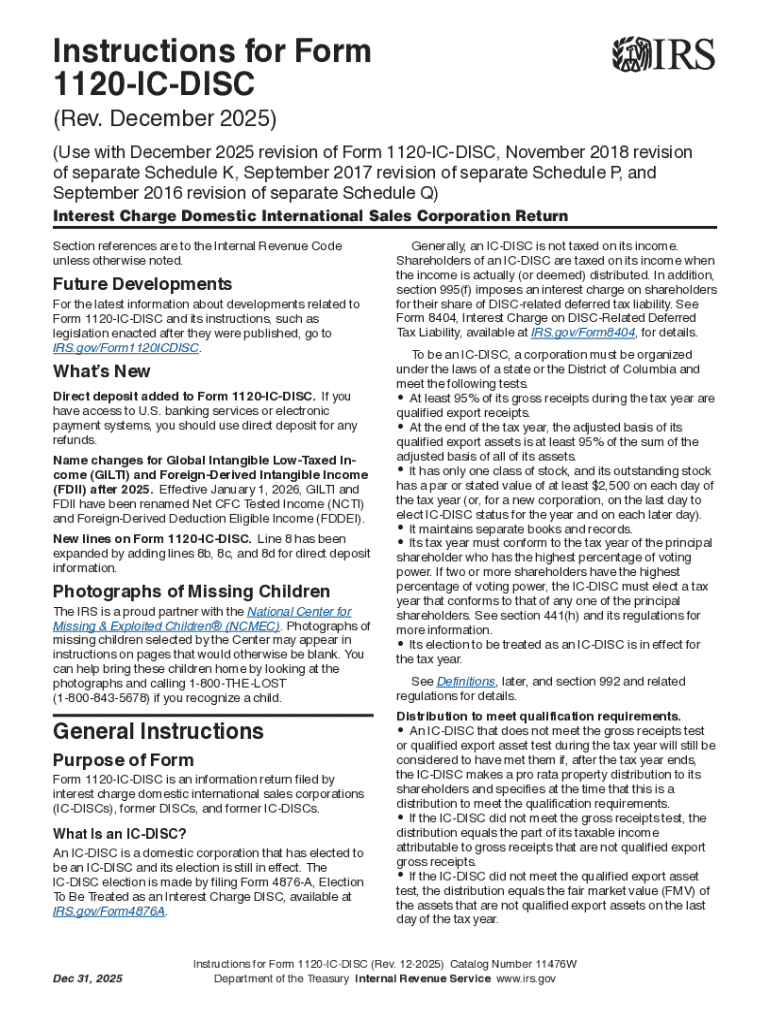

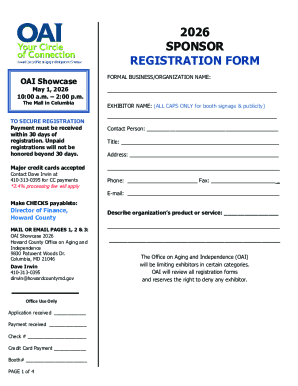

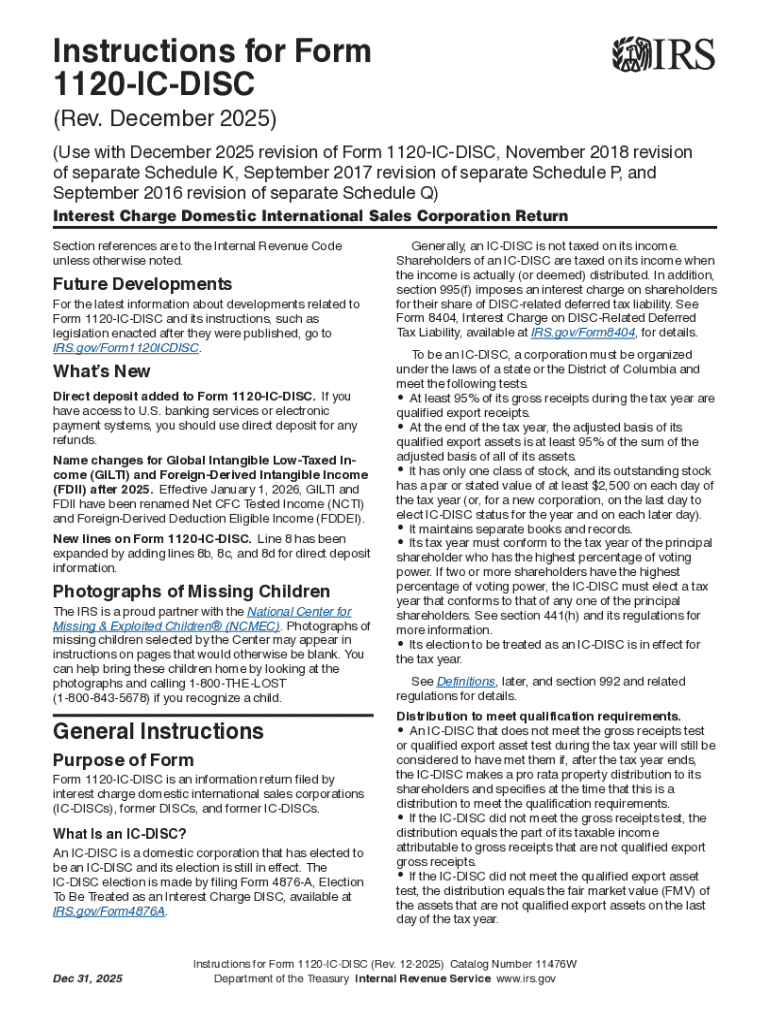

Get the free Instructions for Form 1120-IC-DISC (Rev. December 2025). Instructions for Form 1120-...

Get, Create, Make and Sign instructions for form 1120-ic-disc

Editing instructions for form 1120-ic-disc online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form 1120-ic-disc

How to fill out instructions for form 1120-ic-disc

Who needs instructions for form 1120-ic-disc?

Instructions for Form 1120--DISC

Overview of Form 1120--DISC

The Form 1120-IC-DISC is a vital tax form for corporations that elect to be treated as Interest Charge Domestic International Sales Corporations (IC-DISC). This special corporate structure serves purposefully within the United States tax code, providing significant tax benefits to incentivize and support U.S. companies engaged in international exports.

Utilizing Form 1120-IC-DISC helps businesses optimize their tax positions while engaging in international markets. Before completing this form, companies should ensure they fully understand the IC-DISC regulations and how they pertain to export tax management.

Understanding -DISC benefits

Establishing a corporation as an IC-DISC conveys substantial tax advantages, particularly for companies heavily involved in exporting goods or services. This structure allows U.S. exporters to minimize taxes on income generated from international sales, which can translate into a substantial financial relief.

One primary benefit of utilizing IC-DISC is the ability to receive tax-exempt dividends, enhancing a company's competitive pricing in foreign markets. By significantly reducing tax liabilities, companies can redirect savings into further business development, innovation, or marketing their products internationally.

In-depth examination of Form 1120--DISC required information

The Form 1120-IC-DISC consists of several sections requiring specific details that must be accurately reported. Understanding each section thoroughly is essential to ensure compliance and grant access to the beneficial tax incentives available through IC-DISC.

Key sections of the form include the General Information Section, where basic details of the corporation are recorded; the Income Section, which outlines income generated from export activity; the Deduction Section, where eligible deductions can be reported; and the Additional Information Section that substantiates the IC-DISC claims.

Step-by-step guide to completing Form 1120--DISC

To successfully complete Form 1120-IC-DISC, following a methodical approach ensures nothing is overlooked. Each step is critical to ensure compliance with IRS regulations and to maximize potential tax savings.

Step 1: Gather necessary documentation

Before filling out the form, gather all relevant documents including financial statements, invoices for exports, and details of export-related expenses. Accurate data collection is paramount, as any discrepancies can lead to compliance issues and potential audits.

Step 2: Complete General Information Section

In the General Information Section, provide the corporation's legal name, address, and EIN. Avoid common pitfalls such as typos or incorrect EINs, as these can delay processing or lead to rejection of the form. Ensure all information matches official records.

Step 3: Report income and deductions

When reporting income, include only gross receipts from qualified export activities. Itemizing deductions for related expenses can maximize tax benefits. Document each deduction thoroughly to substantiate claims, as the IRS may request supporting materials during audits.

Step 4: Fill out Additional Information Section

In this section, provide any additional details that support the IC-DISC assertions, including sales contracts, customer lists, or other relevant documents. Being detailed helps reinforce the corporation's claims for IC-DISC status.

Step 5: Review and double-check your entries

Conduct a thorough review of all entries and calculations before submission. Common entries mistakes include incorrect amounts, omitted information, and data mismatches. Create a checklist of potential errors to ensure every aspect is scrutinized.

Common errors when filing Form 1120--DISC

Corporations often face certain recurring errors when completing Form 1120-IC-DISC. Recognizing these common mistakes can help filers avoid delays and potential penalties.

Errors can include inaccuracies in reporting income or deductions, missing signatures, or failing to meet filing deadlines. Keeping abreast of IRS guidelines and timelines is essential to maintain compliance and facilitate smoother processing of the form.

Post-filing: What to expect after submission

After submitting Form 1120-IC-DISC, companies should expect a timeline of processing that can vary. Tracking the status of the form is recommended to ensure it is processed in a timely manner.

In some cases, the IRS may request additional information or clarification regarding the submitted form. Maintaining thorough records and correspondence makes addressing such requests more manageable. Keeping organized files will also aid in future tax filings.

Interactive tools for document management

pdfFiller offers a streamlined platform designed to simplify the management of Form 1120-IC-DISC. With powerful functionalities geared towards document creation and management, users can easily edit, sign, and share forms directly through the cloud-based platform.

Utilizing pdfFiller allows for seamless collaboration with team members when addressing IC-DISC documentation needs. Additionally, its custom templates can accelerate the process, ensuring that all necessary components are included.

Consultation services: Gain expert assistance

Navigating the complexities of Form 1120-IC-DISC can be challenging, and seeking professional consultation can be invaluable. Engaging with tax professionals who specialize in export tax management can ensure corporate compliance and may uncover additional savings.

Booking a consultation typically involves discussing your specific IC-DISC needs and obtaining tailored advice. During these sessions, professionals can highlight tax-saving strategies, review forms for compliance, and assist in future filings.

Frequently asked questions (FAQs) about Form 1120--DISC

Clarifying common inquiries surrounding Form 1120-IC-DISC can ease the filing process for many corporations. Here are some frequently asked questions that address key concerns.

Topics include eligibility criteria to maintain IC-DISC status, compliance with filing deadlines, and the process for amendments or corrections post-filing. Regularly reviewing the IRS guidelines and updates helps in remaining well-informed.

Importance of staying compliant with -DISC regulations

Adhering to compliance regulations associated with IC-DISC is essential for corporations to retain the benefits this designation provides. Non-compliance may lead to hefty penalties and the potential loss of tax advantages, making diligent management crucial.

Staying informed on regulatory requirements and deadlines ensures that businesses can take full advantage of export tax savings while avoiding pitfalls associated with misfiling or late submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find instructions for form 1120-ic-disc?

How do I edit instructions for form 1120-ic-disc online?

How do I edit instructions for form 1120-ic-disc on an Android device?

What is instructions for form 1120-ic-disc?

Who is required to file instructions for form 1120-ic-disc?

How to fill out instructions for form 1120-ic-disc?

What is the purpose of instructions for form 1120-ic-disc?

What information must be reported on instructions for form 1120-ic-disc?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.