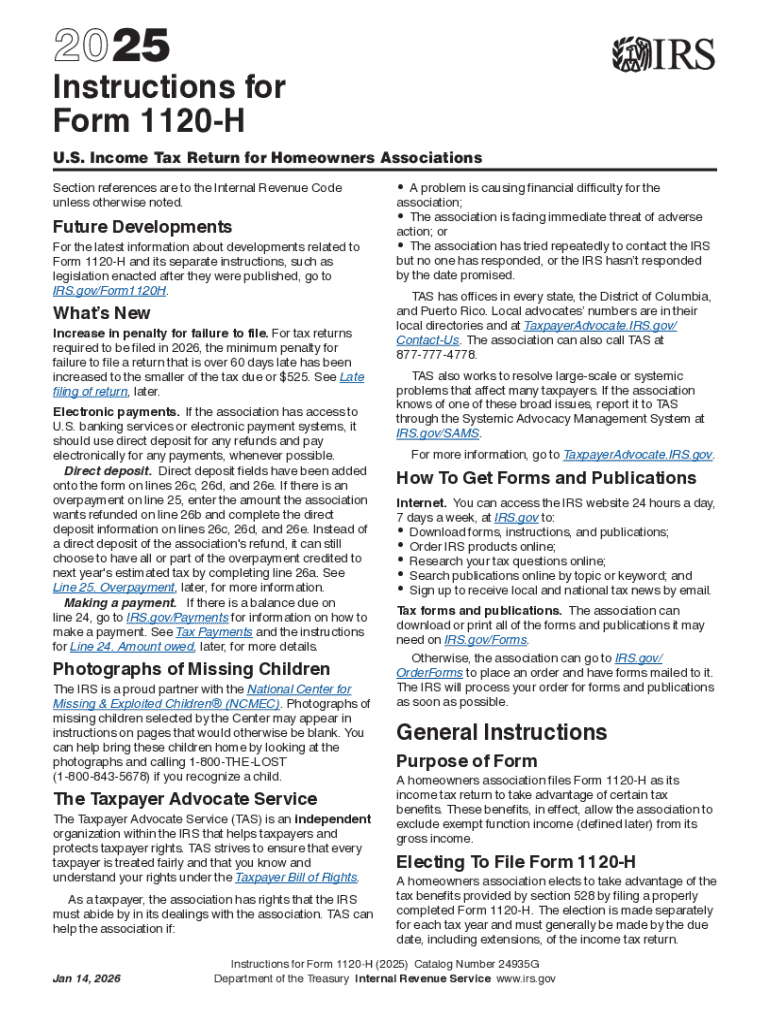

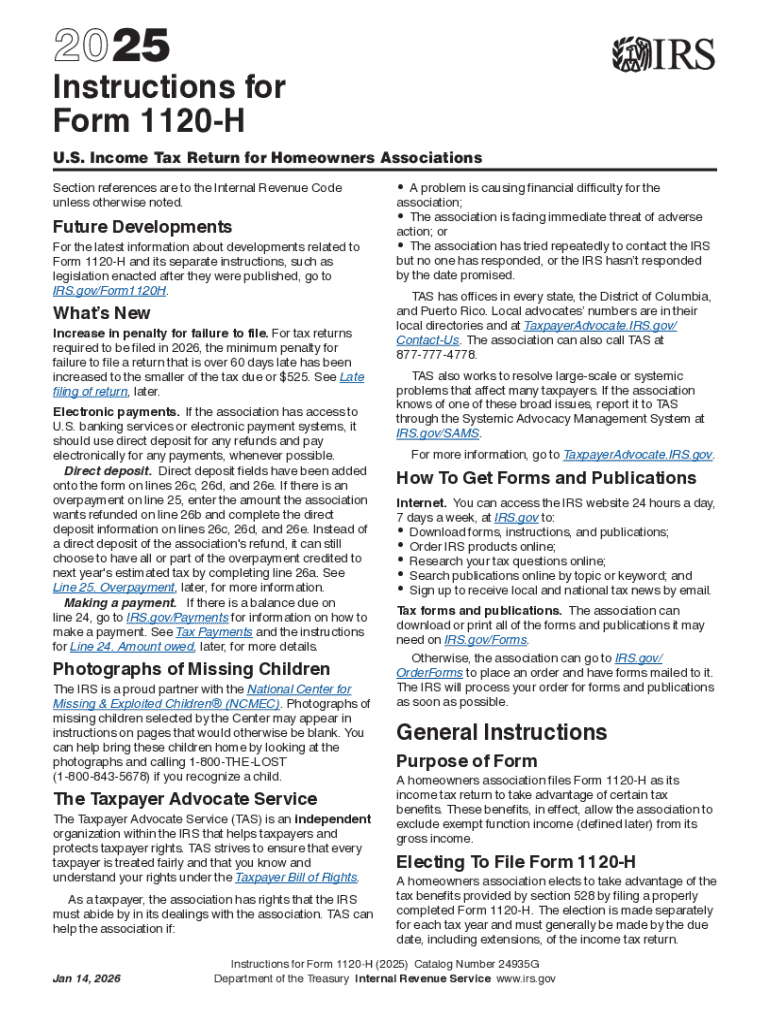

Get the free 2025 Instructions forForm 1120-H. Instructions forForm 1120-H, U.S. Income Tax Retur...

Get, Create, Make and Sign 2025 instructions forform 1120-h

How to edit 2025 instructions forform 1120-h online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 instructions forform 1120-h

How to fill out 2025 instructions forform 1120-h

Who needs 2025 instructions forform 1120-h?

2025 Instructions for Form 1120-H: A Comprehensive Guide for Homeowner Associations

Understanding Form 1120-H

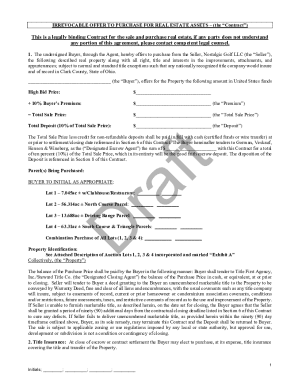

Form 1120-H is a crucial document designed for homeowner associations (HOAs) to report their income and expenses. This form allows such organizations to file their income tax return efficiently while maintaining their tax-exempt status. One clear advantage of Form 1120-H is that it simplifies the tax return process specifically for community organizations managing common areas and amenities.

The primary audience for this form includes various types of homeowner associations, including condominium associations and community organizations. Form 1120-H caters particularly to associations that operate under certain criteria—primarily focusing on the collective management of housing units. By utilizing this form, HOAs can leverage significant tax advantages not typically available to other types of organizations, providing them with a tax-efficient way to manage their finances.

Who should file Form 1120-H?

Eligibility for filing Form 1120-H is primarily determined by the association's organizational structure and its income profile. HOAs can utilize this form if at least 85% of their income is derived from membership fees and assessments. Furthermore, to qualify, these organizations must have a limited income threshold, which makes them suitable for this streamlined filing approach.

A common misconception among HOAs is that any organization with members can file this form. In fact, eligibility is restricted to homeowner associations that meet specific criteria regarding their income and expenses. Organizations that exceed the necessary income limits or have non-member derived income, such as retail sales, cannot use Form 1120-H.

A step-by-step guide to filing Form 1120-H

Preparing to file Form 1120-H involves gathering all necessary documentation and financial records, which are vital for ensuring accurate reporting. Essential documents may include financial statements, previous tax returns, and detailed accounts of income from member assessments and other sources. Proper record-keeping is crucial, as it provides the basis for all figures reported on the form.

Each section of Form 1120-H is designed to capture specific types of information. Here’s a detailed breakdown of how to approach filling out this form:

Filing requirements & deadlines for 2025

For the year 2025, filing deadlines for Form 1120-H are crucial to ensure compliance and avoid potential penalties. Typically, the deadline aligns with the 15th day of the third month following the end of the tax year, which means March 15 for most HOAs operating on a calendar year basis. If this date falls on a weekend or holiday, the deadline may be extended to the next business day.

Timely submission of Form 1120-H is vital as delayed filings may lead to substantial penalties. Furthermore, associations should be aware of where to file their forms—this could include postal mailing instructions for those submitting hard copies or options for online submissions through the IRS e-file platform.

Common mistakes to avoid when filing Form 1120-H

Filing errors can occur easily, and being aware of common pitfalls can help ensure accuracy. One significant mistake is inaccurately reporting income. HOAs should provide detailed documentation for all sources of income, especially when it comes to member assessments since this forms the basis of the tax return. Additionally, failing to claim eligible deductions is another frequent error that can lead to overpayment of taxes.

To avoid these mistakes, meticulous double-checking is essential. Utilizing checklists based on the information required in the form can provide a solid framework for ensuring accuracy. Collaboration with legal or financial professionals experienced in HOA tax filings can also contribute to a smoother submission process.

Comparing Form 1120-H and Form 1120

Understanding the differences between Form 1120-H and Form 1120 is crucial for HOAs in determining which form to file. Form 1120 is designed for corporations and is more complex, suitable for organizations that do not qualify for the simplified filing procedures of Form 1120-H. The requirement to file Form 1120 generally arises when an HOA exceeds the income limitations set for Form 1120-H.

Therefore, organizations considering a transition from Form 1120-H to Form 1120 need to carefully evaluate their income sources and potential tax implications. This decision is essential to maintain compliance while maximizing tax benefits.

FAQs about Form 1120-H

Several frequently asked questions arise when dealing with Form 1120-H. Some HOAs may be unclear about their eligibility, the filing process, or what constitutes grounds for audits and potential penalties. Common inquiries might involve clarifications regarding what types of income should be reported or the specific deductions that can be claimed.

It’s beneficial for first-time filers to engage with industry experts who can offer valuable insights. Recommendations from professionals can illuminate best practices for filling out Form 1120-H as well as strategies to avoid common pitfalls, ensuring that HOAs maintain their compliance without unnecessary tax liabilities.

Conclusion

Successfully completing Form 1120-H is vital for HOAs aiming to manage their tax liabilities while retaining tax-exempt status. This comprehensive guide has equipped reader associations with essential points necessary for producing an accurate filing. By understanding each section of the form and being aware of filing requirements, associations can navigate the complexities of tax filing with confidence.

Utilizing resources such as pdfFiller ensures that HOAs can manage their documents effectively, providing a cloud-based solution for editing, eSigning, and collaborating on critical documents. Encouraging proper compliance with IRS requirements underscores the importance of rigorous tax filing practices, ultimately supporting the financial health and sustainability of homeowner associations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2025 instructions forform 1120-h in Gmail?

How do I complete 2025 instructions forform 1120-h online?

How can I edit 2025 instructions forform 1120-h on a smartphone?

What is 2025 instructions for form 1120-H?

Who is required to file 2025 instructions for form 1120-H?

How to fill out 2025 instructions for form 1120-H?

What is the purpose of 2025 instructions for form 1120-H?

What information must be reported on 2025 instructions for form 1120-H?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.