Get the free Understanding Form 5498: A Guide to Coverdell Education ...

Get, Create, Make and Sign understanding form 5498 a

Editing understanding form 5498 a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out understanding form 5498 a

How to fill out understanding form 5498 a

Who needs understanding form 5498 a?

Understanding Form 5498: A Comprehensive Guide

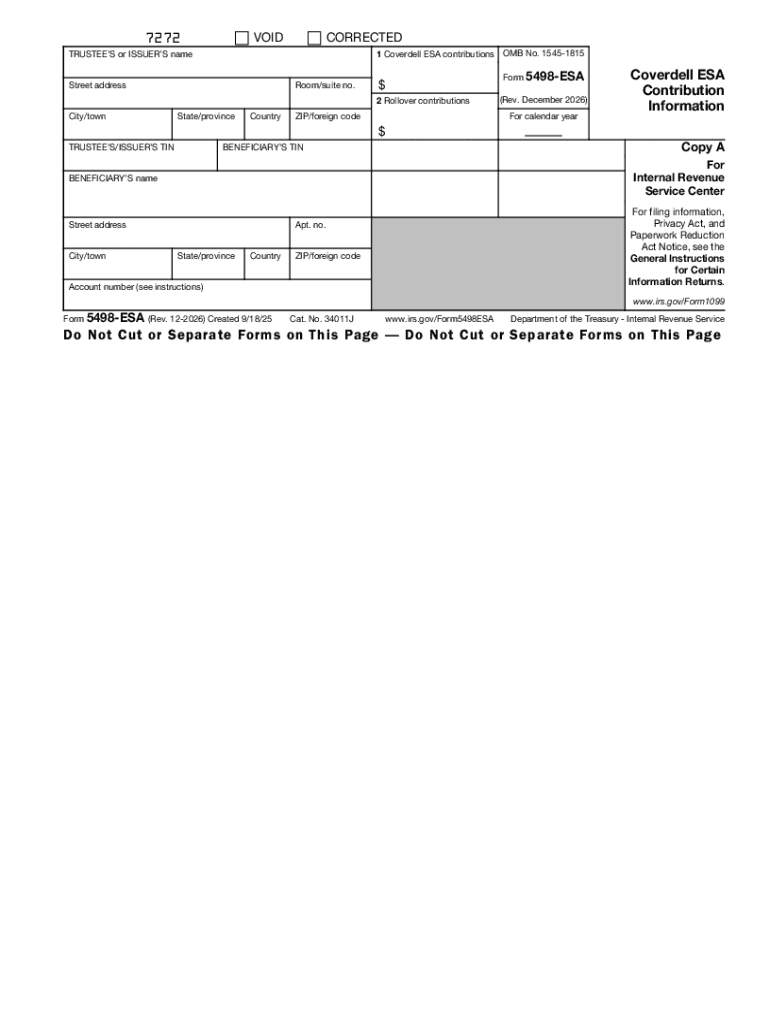

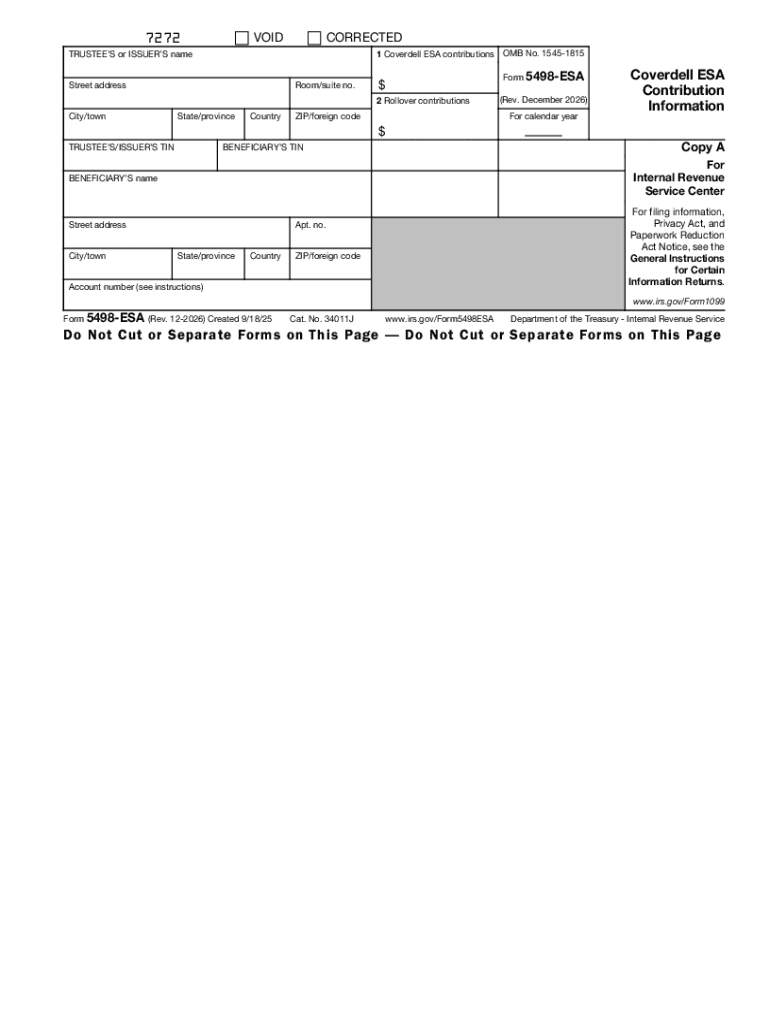

Overview of Form 5498

Form 5498 is a crucial document in the world of retirement planning. It serves as an informational return used to report contributions to various types of Individual Retirement Accounts (IRAs), including Traditional IRAs, Roth IRAs, SEP IRAs, and SIMPLE IRAs. Financial institutions, such as banks and brokerage firms, are responsible for issuing this form to account holders and the IRS. The primary purpose of Form 5498 is to provide a clear account of contributions made to these retirement accounts over the tax year, ensuring that both the taxpayer and the IRS have accurate records.

The importance of Form 5498 extends beyond mere reporting; it plays a pivotal role in shaping a taxpayer's overall financial landscape. It helps individuals track their IRA contributions, which directly influences their long-term retirement strategy. Accurate reporting through Form 5498 can significantly affect tax obligations, including potential penalties for exceeding contribution limits. Therefore, understanding the nuances of this form is essential for effective retirement planning.

Key components of Form 5498

Understanding Form 5498 entails familiarizing oneself with its key components. This form comprises several boxes, each designated for specific types of information regarding contributions. Here’s a detailed breakdown of notable boxes on the form:

In addition to these, there are various other boxes on Form 5498 that report significant details such as the type of IRA account and beneficiaries. Common mistakes when filling out Form 5498 often include misreporting contributions or providing incorrect beneficiary details, which can lead to administrative hassles or tax issues later on.

Who needs to file Form 5498?

Form 5498 is primarily issued to individuals who are account holders of IRAs. This includes those who have Traditional IRAs, Roth IRAs, SEP IRAs, and SIMPLE IRAs. If you have made contributions to any of these accounts during the tax year, you will receive a Form 5498 from your financial institution. This is essential for ensuring that all contributions are correctly reported and accounted for in IRS records.

Financial institutions play a vital role in the Form 5498 filing process. They are required to file this form with the IRS and also provide a copy to the account holder by May 31 of the following tax year. For custodians and trustees, understanding their filing obligations is crucial to maintaining compliance with IRS rules. This allows them to ensure that taxpayers receive accurate and timely information about their retirement contributions.

Filling out Form 5498: Step-by-step instructions

Filling out Form 5498 may seem daunting, but with the right step-by-step approach, it becomes manageable. Here’s how to navigate the process:

As you complete Form 5498, it's vital to check for accuracy. Whether reporting contributions or other details, an error could lead to complications with your tax returns. Various tools, like calculators and document management solutions such as pdfFiller, can aid in streamlining this process.

Understanding the tax implications of Form 5498

Form 5498 holds significant implications for your tax return. Contributions reported on this form must be accurately reflected on your tax documents. The IRS requires that any excess contributions over the allowable limits be addressed, as this can lead to penalties. Understanding how these contributions impact your taxable income and determining eligibility for tax deductions associated with IRAs is crucial for effective retirement planning.

Moreover, rollover contributions, reported in Box 3, are significant for tax-free transfers from one retirement account to another. If properly executed, rollovers can provide tax advantages that can enhance your investment strategy. However, failure to follow IRS regulations regarding rollovers may lead to unintended tax consequences. It's imperative to be vigilant about such transactions and ensure compliance.

Mistakes on Form 5498, whether inadvertent misreporting or clerical errors, can trigger IRS penalties. Understanding how to correct errors or amend Form 5498, should any arise, is a key part of managing tax obligations effectively.

Monitoring your IRA contributions

Efficiently tracking IRA contributions throughout the year is vital for maintaining compliance with IRS rules and your personal retirement strategy. You can employ various tools to monitor your contributions, from spreadsheets to dedicated retirement planning software. Keeping organized records not only aids in filling out Form 5498 but also ensures that you are adhering to contribution limits.

Utilizing services like pdfFiller can significantly enhance your form management experience. Its capabilities include editing and signing documents, allowing users to stay organized. The cloud-based platform makes it possible to access your forms from anywhere, simplifying the task of managing your IRA contributions and ensuring that you have all necessary documentation at hand when filing.

Frequently asked questions about Form 5498

Many taxpayers find themselves wondering about Form 5498 and its implications. Here are some frequently asked questions to clarify common concerns:

Helpful resources for understanding Form 5498

For further information on retirement accounts and managing your forms effectively, numerous resources are available online. Accessing articles, guides, and interactive tools can provide deeper insights into retirement strategies and Form 5498 specifics. These resources also include calculators designed to help you understand your contribution limits, eligibility, and potential retirement outcomes.

Engaging with platforms that support retirement planning can enhance your understanding and management of these documents. Utilizing tools and services that are specifically designed to simplify these tasks can put you ahead, ensuring that you are well-informed about your contributions and obligations.

Using pdfFiller to simplify your form management

When it comes to managing documents like Form 5498, pdfFiller stands out as a tool that simplifies the process. Its seamless document editing capabilities allow users to fill out and e-sign forms directly online. This flexibility is vital for users who need to ensure their forms are accurate and readily accessible.

Moreover, pdfFiller enhances collaboration for teams working on form submissions. Its capabilities facilitate teamwork by allowing multiple users to access, edit, and finalize documents efficiently. With cloud-based management, users can access their forms anywhere, at any time, catering to the need for flexibility in today’s fast-paced environment.

Expert tips for avoiding common pitfalls

To avoid common pitfalls associated with Form 5498, it’s essential to maintain a few best practices. First, ensure that you regularly monitor your contributions throughout the year, keeping records that accurately reflect your IRA activity. This proactive approach minimizes mistakes during the submission process.

Consulting with financial advisors can also add a layer of security. They can offer tailored advice based on your financial situation, ensuring optimal management of your retirement accounts. By leveraging both personal diligence and professional guidance, you can navigate the complexities of Form 5498 with greater ease and confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in understanding form 5498 a?

How do I fill out understanding form 5498 a using my mobile device?

Can I edit understanding form 5498 a on an Android device?

What is understanding form 5498 A?

Who is required to file understanding form 5498 A?

How to fill out understanding form 5498 A?

What is the purpose of understanding form 5498 A?

What information must be reported on understanding form 5498 A?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.