Get the free Instructions for Form 1120-RIC, U.S. income tax ... - NUsearch

Get, Create, Make and Sign instructions for form 1120-ric

How to edit instructions for form 1120-ric online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form 1120-ric

How to fill out instructions for form 1120-ric

Who needs instructions for form 1120-ric?

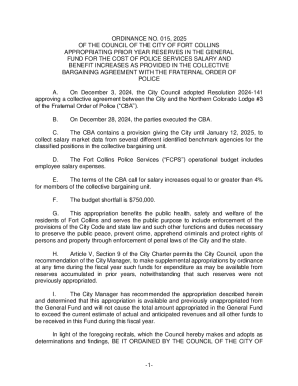

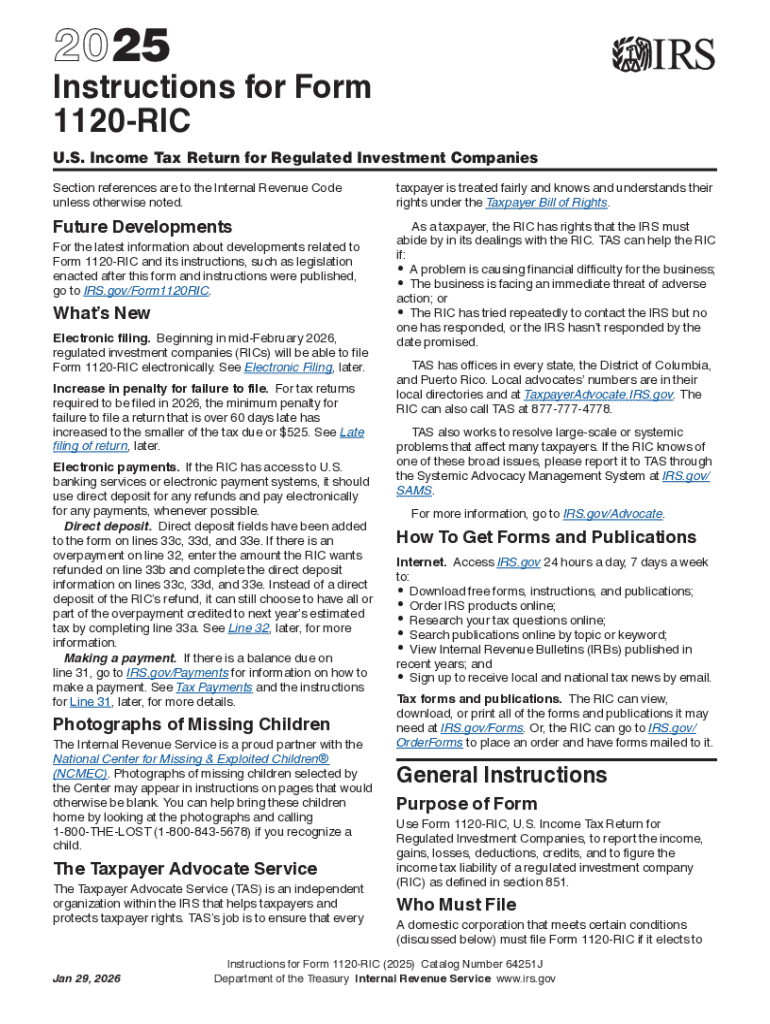

Instructions for Form 1120-RIC: A Comprehensive Guide

Overview of Form 1120-RIC

Form 1120-RIC is a specialized tax form used by registered investment companies (RICs) to report their income, deductions, and tax liability to the Internal Revenue Service (IRS). This form serves as a declaration that the investment company is compliant with tax laws and regulations, assuring investors that profits are correctly tracked and taxed.

Any entity that qualifies as a RIC under the Internal Revenue Code must file this form annually. This includes mutual funds, closed-end funds, and real estate investment trusts (REITs) that meet the necessary qualifications, ensuring they receive the tax benefits available to RICs.

Importance of compliance

Filing Form 1120-RIC is not just a bureaucratic requirement; it carries significant legal implications. Failure to file timely or accurately can lead to fines and penalties, affecting the financial standing of the investment company. Maintaining compliance also contributes to an organization’s credibility in the capital markets.

Proper adherence to filing procedures enhances an RIC’s ability to manage its assets efficiently and supports investor confidence, which is paramount in attracting and retaining capital.

Key components of Form 1120-RIC

The components of Form 1120-RIC encompass various sections that provide a comprehensive overview of the financial performance of the investment company. Understanding these components is crucial for accurate reporting.

Eligibility criteria

To qualify as a registered investment company, an entity must adhere to specific criteria, including being a domestic corporation, conducting activities primarily related to investing in securities, and distributing at least 90% of its taxable income to shareholders. These stipulations are designed to ensure that RICs function primarily as investment vehicles and maintain their tax-advantaged status.

Detailed breakdown of the form sections

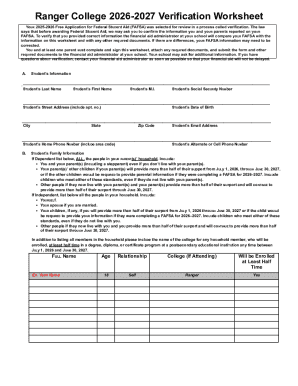

Step-by-step instructions for completing Form 1120-RIC

Completing Form 1120-RIC can seem daunting, but following a structured approach can simplify the process. Preparation is key.

Preparing before you start

Completing form sections

Begin by filling out the header information, ensuring that the company’s name, address, and EIN are correct. In the income section, list all forms of income meticulously, categorizing each to prevent reporting errors.

When calculating deductions, make sure to document all allowable expenses accurately to avoid penalties. Finally, verify tax calculations for accuracy; using accounting software or consulting a tax professional can help.

Tips for a smooth filing process

Common mistakes can derail an otherwise smooth filing process. Being aware of potential pitfalls is vital.

Common mistakes to avoid

Best practices for RIC filers

Maintaining accurate and organized records throughout the year will streamline the reporting process. Implementing a filing system and routinely updating financial statements can save time during the busy filing season.

Timely submissions are equally critical. Mark deadlines on your calendar to avoid last-minute scrambles that can lead to mistakes.

After filing: What to expect

Once Form 1120-RIC has been submitted, tracking its progression is essential.

Confirmation of receipt

After filing, you will receive confirmation from the IRS, which serves as proof that your submission was successful. Keeping this confirmation in your records is advised for future reference.

Handling audits and inquiries

In case the IRS raises questions or audits the filing, having organized documentation will be your greatest asset. Respond promptly and provide any requested documents to clarify your situation.

Amendments and corrections

Should you discover an error after submission, filing an amendment is crucial. Follow the IRS guidelines for making corrections to ensure compliance.

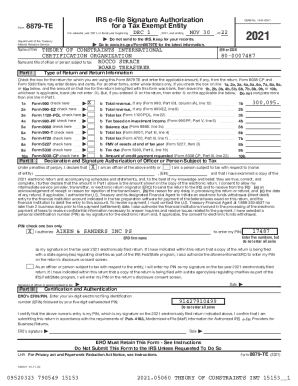

Leveraging pdfFiller for enhanced document management

Utilizing pdfFiller can significantly ease the process of completing Form 1120-RIC.

Features for streamlined completion of Form 1120-RIC

pdfFiller’s interactive tools facilitate filling out the form accurately, allowing users to enter data digitally and access responses anywhere, anytime. The cloud-based nature of pdfFiller ensures that you can edit, save, and retrieve documents with ease.

eSigning and document management

Electronic signatures create efficiency, enabling users to sign documents securely without needing physical copies. pdfFiller’s document management features allow users to keep track of revisions and history, ensuring that all changes are logged and easy to access.

Frequently asked questions (FAQs)

Investors and companies often have inquiries related to Form 1120-RIC that require clarification.

General questions about Form 1120-RIC

Specific concerns related to pdfFiller

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my instructions for form 1120-ric in Gmail?

How can I modify instructions for form 1120-ric without leaving Google Drive?

How do I make edits in instructions for form 1120-ric without leaving Chrome?

What is instructions for form 1120-ric?

Who is required to file instructions for form 1120-ric?

How to fill out instructions for form 1120-ric?

What is the purpose of instructions for form 1120-ric?

What information must be reported on instructions for form 1120-ric?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.