Get the free Payroll Deduction DonationsDeed Help Center

Get, Create, Make and Sign payroll deduction donationsdeed help

How to edit payroll deduction donationsdeed help online

Uncompromising security for your PDF editing and eSignature needs

How to fill out payroll deduction donationsdeed help

How to fill out payroll deduction donationsdeed help

Who needs payroll deduction donationsdeed help?

Understanding Payroll Deduction Donations Deed Help Form

Understanding payroll deduction donations

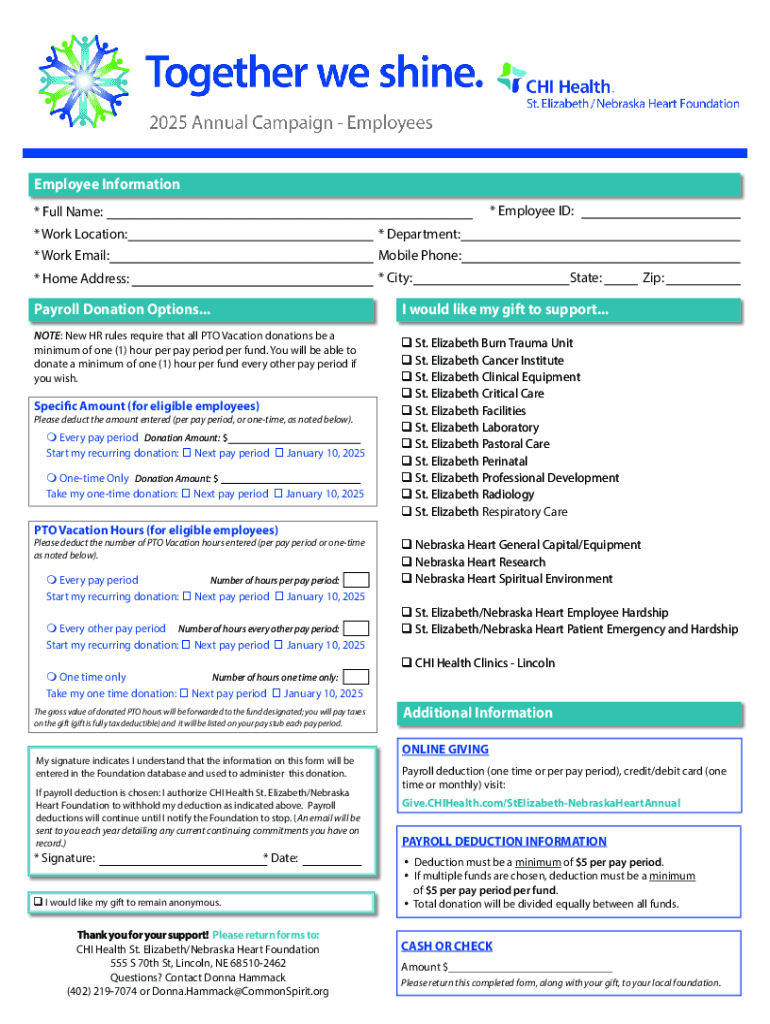

Payroll deduction donations represent a systematic way for employees to contribute to charitable organizations directly from their paychecks. This method not only simplifies the giving process for donors but also enhances contributions to various causes, thereby boosting nonprofit funding.

The importance of payroll deductions in charitable giving cannot be overstated. By allowing employees to donate automatically, organizations can count on a steady stream of support. This consistency is particularly beneficial for charities, which rely on monthly or ongoing contributions to plan their initiatives.

Overview of the payroll deduction donations deed

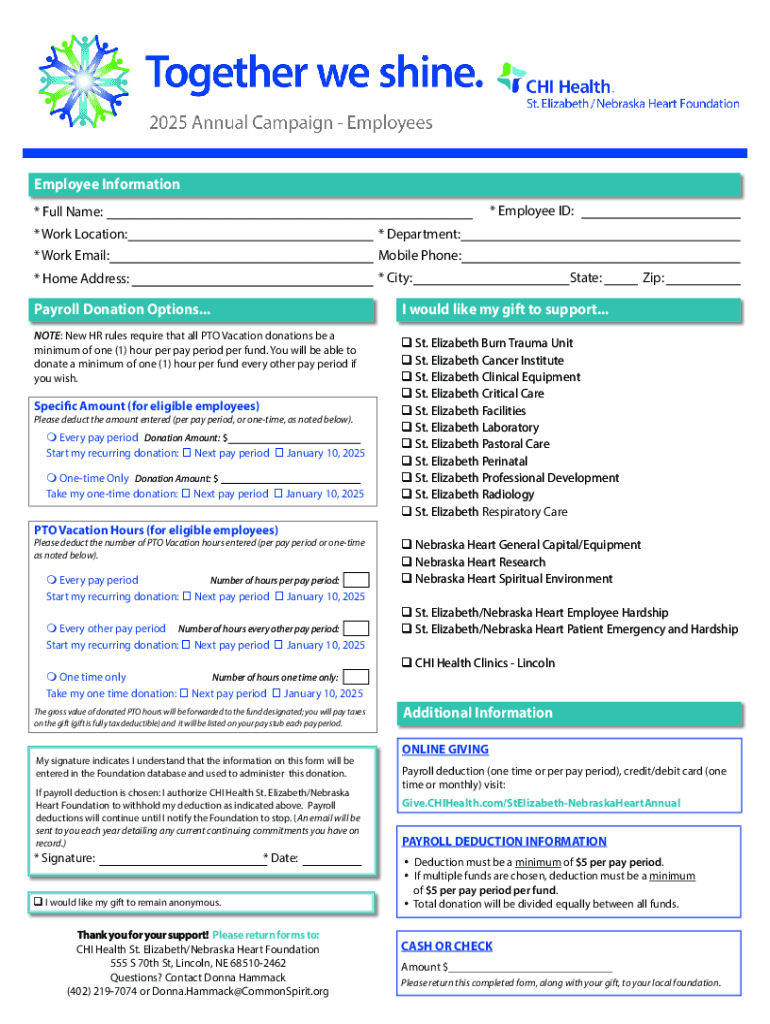

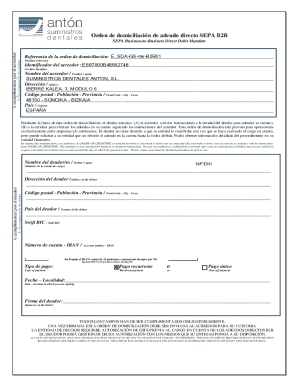

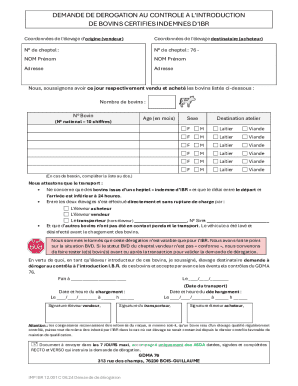

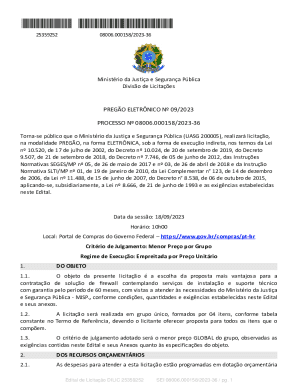

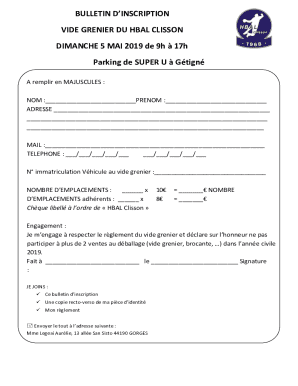

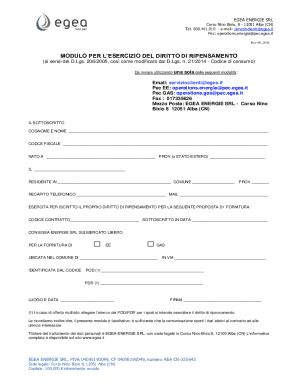

A payroll deduction donations deed serves as a formal document utilized during the process of setting up automatic donations from an employee’s paycheck. Unlike ordinary donation forms, this deed has specific legal standing, outlining the terms and conditions of the contributions, ensuring compliance with tax requirements.

The deed plays a crucial role in documenting donor intentions clearly and ensuring that charities receive the intended contributions. This distinction is vital for both the employees making contributions and the organizations receiving them.

Step-by-step guide to filling out the payroll deduction donations deed

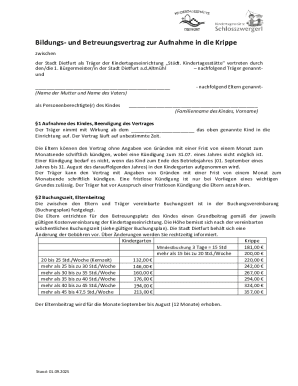

Filling out the payroll deduction donations deed begins with gathering necessary information. Ensure that you have the donor's personal details, the charity's information, and the specific deduction amounts ready. This initial step is crucial to streamline the process, minimizing delays and errors.

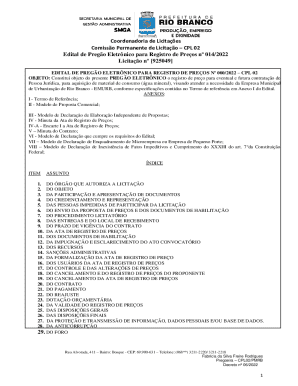

Accessing the payroll deduction donations deed can be easily done through platforms like pdfFiller, which provide straightforward document creation tools. Users can download the deed template, making it easily editable and customizable according to their donation preferences.

Gathering required information

Efficiency is key when collecting this information. You may wish to reach out directly to HR or the charity to confirm precise details. Once you have everything, navigating the pdfFiller platform becomes a simple task of editing and filling in the blanks.

Accessing the payroll deduction donations deed

Navigate to pdfFiller’s website, and use the search feature to locate the payroll deduction donations deed. Once found, make sure to download the editable PDF version. This enables you to enter all pertinent information directly into the form.

Completing the deed form

As you complete the deed form, each section requires careful attention. Begin with the donor information, ensuring accurate and up-to-date personal details. Follow this by filling in the charity's information, paying attention to the tax identification number as it is critical for tax-deductibility.

Next, specify the deduction amounts. It's essential to include both the per paycheck amount and the frequency. Many donors overlook this detail, which can lead to significant confusion later. By clearly defining amounts, you guarantee consistency in contributions and avoid potential discrepancies.

Common mistakes include omitting critical details or providing outdated information. Review the completed form thoroughly before moving on to the next steps.

Editing and customizing your deed

pdfFiller provides various editing tools that allow you to modify your form easily and efficiently. With drag-and-drop features, you can add text boxes, checkboxes, and electronic signatures. Start by printing or saving your deed; then, use the edit tools to make necessary adjustments directly on the platform.

Include any additional information or personal notes that might enhance your charitable communication. Maybe you want to express why this particular charity matters to you. Custom messages can serve to deepen the connection between the donor and the organization.

Signing and submitting your deed

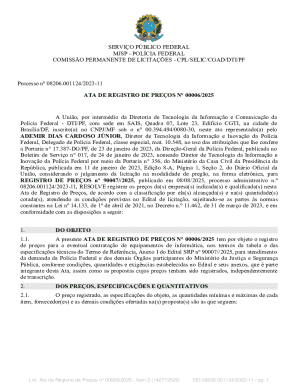

The act of signing your payroll deduction donations deed is crucial, establishing your commitment to the donations. pdfFiller offers eSigning options which provide a legally binding way to confirm your agreement without needing to print the document. This ensures that the process remains seamless.

Submitting the completed deed can vary depending on employer policies or charity requirements. Typically, the deed is submitted to your HR department or directly to the charity's finance office. Always confirm the submission process to ensure timely and proper processing of your deductions.

Managing your payroll deduction contributions

Monitoring your charitable contributions through payroll deductions can be done effortlessly by reviewing your pay stubs or accessing your employer's online payroll portal. While contributions automatically deduct from your paycheck, keeping a record ensures that you remain aware of your total contributions for tax purposes.

If you decide to adjust or cancel your donations, familiarize yourself with your employer's specific policies regarding payroll deductions. Some organizations may require formal requests or have specific timelines for changes, making it vital to stay informed.

Frequently asked questions (FAQs)

People often have inquiries about the payroll deduction donations process. Common questions revolve around eligibility criteria, the suitability of various contributions, and what to do if there are errors in submitted forms. Addressing these concerns upfront helps streamline the process and fosters a clear understanding between donors and charities.

In cases where errors occur, it’s essential to have open lines of communication with your charity and employer representative. Additionally, knowing where to seek further assistance can help alleviate potential frustrations associated with the giving process.

Case studies and success stories

Several organizations have shared inspiring success stories about how payroll deduction donations have significantly impacted their fundraising efforts. Charities have documented increased funding due to employees’ willingness to support local causes through this reliable method. These case studies showcase the transformative power of sustained giving that payroll deductions facilitate.

Employees often provide testimonials highlighting how engaging in payroll deductions has deepened their connection to their workplace and community, enriching their workplace culture significantly. For example, a local food bank reported a surge in resources due to payroll contributors who found alignment between their personal values and the charity’s mission.

Troubleshooting common issues

When submitting the payroll deduction donations deed, some common issues may arise. Understanding these issues helps prepare donors to respond effectively. Potential complications can include missing information or technical difficulties while accessing the pdfFiller platform.

Additionally, questions regarding tax implications may occur based on individual financial situations. It's advisable to consult with tax professionals for personalized advice regarding charitable contributions and their impact on taxation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my payroll deduction donationsdeed help in Gmail?

How do I fill out payroll deduction donationsdeed help using my mobile device?

How do I edit payroll deduction donationsdeed help on an iOS device?

What is payroll deduction donationsdeed help?

Who is required to file payroll deduction donationsdeed help?

How to fill out payroll deduction donationsdeed help?

What is the purpose of payroll deduction donationsdeed help?

What information must be reported on payroll deduction donationsdeed help?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.