Get the free W2 Electronic Tax Forms Now Available

Get, Create, Make and Sign w2 electronic tax forms

Editing w2 electronic tax forms online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w2 electronic tax forms

How to fill out w2 electronic tax forms

Who needs w2 electronic tax forms?

W-2 Electronic Tax Forms Form - How-to Guide

Understanding W-2 forms

A W-2 form is a crucial document utilized in the United States for tax reporting purposes. Officially known as the Wage and Tax Statement, it is issued by employers to both the Internal Revenue Service (IRS) and employees, detailing the employees' annual wages, tips, and other compensation, alongside the taxes withheld from their paychecks. This form plays an integral role in ensuring that individuals file their taxes accurately.

The importance of W-2 forms in tax filing cannot be overstated. It helps the IRS ensure that workers report their income correctly, thereby preventing tax evasion. Additionally, for employees, these forms are crucial in understanding their earnings and tax contributions over the year, allowing them to prepare their tax returns efficiently.

Overview of electronic W-2 processing

The rise of technology has significantly impacted the processing of W-2 forms, leading many employers to adopt electronic W-2 processing. This approach presents various advantages. First and foremost, electronic forms facilitate speed in filing and processing, allowing both employers and employees to manage their taxes efficiently. When organizations transition to electronic formats, they often witness quicker data transfer and submission times.

Additionally, using electronic W-2 forms contributes to reducing paper waste and storage issues, which is imperative in today's environmentally conscious world. Enhanced security features, such as encryption and password protection, make electronic formats more secure than their paper counterparts, reducing the risk of identity theft and lost documents. However, there are common myths surrounding electronic W-2 forms, such as concerns over their legitimacy and security, which need to be addressed.

Who needs to use W-2 forms?

W-2 forms are essential for both employers and employees. Employers are responsible for issuing W-2 forms to their employees by January 31st each year, providing accurate information regarding wages and withholdings. Failure to comply can lead to penalties that may affect the bottom line. It's their responsibility to maintain proper payroll records which are used to generate these tax forms.

From an employee's perspective, understanding the importance of W-2 accuracy is equally vital. Employees should cross-check the figures reported on their W-2 forms against their pay stubs for correctness. This vigilance is crucial, as inaccuracies can lead to issues during tax filings or audits. It’s essential for both parties to be mindful of their responsibilities regarding W-2 filing to mitigate risks and ensure compliance with IRS regulations.

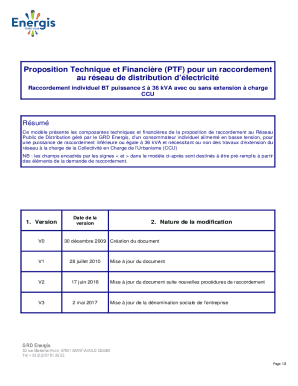

Key components of the W-2 form

Understanding the structure of a W-2 form is key to both filling it out correctly and interpreting the data it contains. The W-2 includes several sections, each important in its own right. The employee section gathers crucial information such as Social Security numbers, wages, and withholdings, while the employer section ensures accurate identification of the business responsible for the employment.

Wage and tax information reflects vital figures, including total earnings and taxes withheld, crucial for accurate tax reporting. Understanding the various codes and boxes on the W-2 is essential, as each indicates specific information regarding withholdings, benefits, and types of compensation received. For example, Box 1 shows total taxable wages, whereas Box 2 indicates federal income tax withheld.

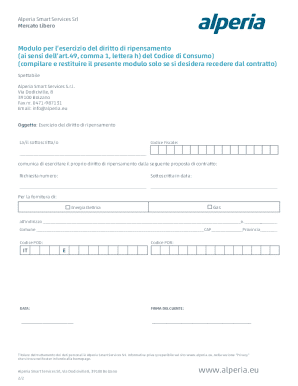

Preparing to fill out your W-2 form

Prior to initiating the filling process for your W-2 form, gathering necessary information is essential for accuracy. Start by compiling Social Security numbers, and ensure you have the most recent wage statements and tax documents. This preparation minimizes errors, making the form completion smoother and more reliable. Proper vigilance during this stage will pay dividends when it comes to filing your tax returns painlessly.

pdfFiller offers tools that can greatly simplify the preparation of your W-2 forms. With interactive document editing features, forms can be filled seamlessly, while collaboration and sharing options allow for smooth interactions between multiple parties. This process can save both time and ensure consistency across documents, thus enhancing overall productivity.

Step-by-step instructions for completing your W-2 online

Completing your W-2 online through pdfFiller is a straightforward process. Start by logging into your pdfFiller account. If you don’t have an account yet, creating one is quick and easy. Once logged in, select the appropriate W-2 template from the library. It’s important to choose the template that corresponds to the specific needs of your organization to ensure compliance.

Next, fill in employee and employer details with utmost care. It’s essential to manage every section of the form accurately, including entering wages and tax information. After inputting all necessary data, take the time to review the document for any errors or discrepancies. Making sure everything is accurate before finalizing will save you time and headaches in the long run.

Editing and customizing your electronic W-2 form

Once you have filled out your W-2 form, there may still be a need for adjustments or personalization. In pdfFiller, making changes to your W-2 document is simple. Utilize the editing functions available to insert annotations or modify text as needed. This flexibility allows for corrections to be made efficiently, ensuring that all details remain up-to-date and correct.

Furthermore, adding signatures electronically has never been easier. With advanced editing features, you can insert digital signatures to authenticate the document. After completing these steps, ensure that you save and store your document securely in pdfFiller's cloud-based storage, allowing for easy access and management moving forward.

eSigning your W-2 form

The eSigning process has become a vital aspect of tax form submissions, including W-2 forms. It ensures that the signed document is legally binding and complies with IRS regulations. pdfFiller makes the eSigning process seamless, allowing users to sign documents electronically without the need for printing. This not only saves time but also contributes to a more sustainable approach to tax documentation.

Legal compliance is necessary for any electronic signatures to be effective. Using pdfFiller’s eSigning options ensures that signatures are authenticated and verifiable. Once the signing process is complete, securely send your W-2 form to the necessary recipients, such as the IRS, state tax agencies, and employees, ensuring all parties receive their copy without any delays.

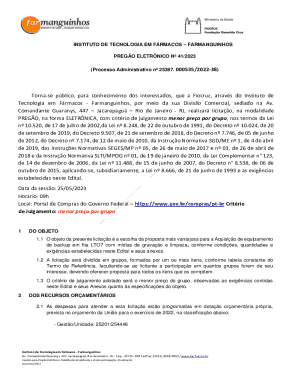

Filing your W-2 form with the IRS

When it comes to filing your W-2 form with the IRS, it’s essential to choose the right method. Employers have the option to e-file their W-2 forms or file them by mail. E-filing is often preferred for its speed and efficiency, particularly for businesses with a larger number of employees. The IRS provides specific e-filing requirements, and it’s important to familiarize yourself with them to ensure compliance.

Filing by mail is still a viable option but comes with important considerations, such as timing and ensuring the form reaches the IRS promptly. Tracking your submitted W-2 is advisable, especially when using mail, to confirm that it has been received and processed. Adhering to deadlines ensures that you avoid penalties and complications regarding tax filings.

Managing your W-2 forms after filing

Once you have filed your W-2 forms, managing them effectively should be your next priority. Retaining proper records is imperative. The IRS highly recommends keeping copies of your W-2 forms and any necessary documentation for at least three years. This ensures you have backup documentation for any potential audits or discrepancies that may arise.

Accessing your W-2 forms in pdfFiller is straightforward. With centralized cloud storage, you can retrieve your documents anytime and from anywhere. If unexpected issues arise post-filing, such as misplaced forms or disputes with employees regarding incorrect data, having quick access to all necessary files becomes invaluable.

Frequently asked questions about W-2 forms

Many questions arise surrounding W-2 forms, particularly around common mistakes to avoid. One notable mistake is failing to update employee information, which can lead to incorrect filings and delayed refunds. Another common issue is not verifying tax withholdings, which can misrepresent taxable income harshly impacting an individual’s tax return. Employees should know what to do if they haven’t received their W-2, such as contacting their employer for a resend or utilizing IRS resources for assistance.

Keeping updated with W-2 regulations is equally crucial. The IRS regularly updates requirements for tax filings, making it essential to consult reliable resources or tools like pdfFiller to remain compliant and informed.

Transitioning from paper to electronic W-2 forms

Transitioning from paper to electronic W-2 forms offers many advantages for businesses looking to streamline their processes. Employers must follow a structured approach when making this switch. It starts by assessing the current filing processes and identifying the necessary software or platforms, such as pdfFiller, that facilitate the transition.

pdfFiller offers robust solutions to ease this transition. The platform provides tools for efficient electronic filing, minimizing disruptions. Success stories reveal that businesses adopting electronic systems have not only saved time but also reduced errors, resulting in enhanced employee satisfaction regarding timely access to their tax forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my w2 electronic tax forms directly from Gmail?

Can I edit w2 electronic tax forms on an Android device?

How do I complete w2 electronic tax forms on an Android device?

What is w2 electronic tax forms?

Who is required to file w2 electronic tax forms?

How to fill out w2 electronic tax forms?

What is the purpose of w2 electronic tax forms?

What information must be reported on w2 electronic tax forms?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.