Get the free Alternate Payment & Document Processing Options

Get, Create, Make and Sign alternate payment amp document

Editing alternate payment amp document online

Uncompromising security for your PDF editing and eSignature needs

How to fill out alternate payment amp document

How to fill out alternate payment amp document

Who needs alternate payment amp document?

A comprehensive guide on alternate payment and document forms

Overview of alternate payment options

Alternate payment methods extend beyond traditional cash and credit card transactions, offering flexibility and convenience. They include options like digital wallets, cryptocurrency, and blockchain-based systems, which provide consumers and businesses with a variety of ways to transact. The rise in online shopping and the need for efficient cross-border payments have accelerated the adoption of these methods.

The importance of alternate payment forms lies in their ability to meet diverse consumer preferences while fostering inclusivity. For instance, a 2022 study indicated that 60% of consumers are more likely to complete a transaction if multiple payment options are available. This adaptability is crucial, especially as digital commerce continues to grow, allowing businesses to cater to wider demographics.

Understanding document forms in payment systems

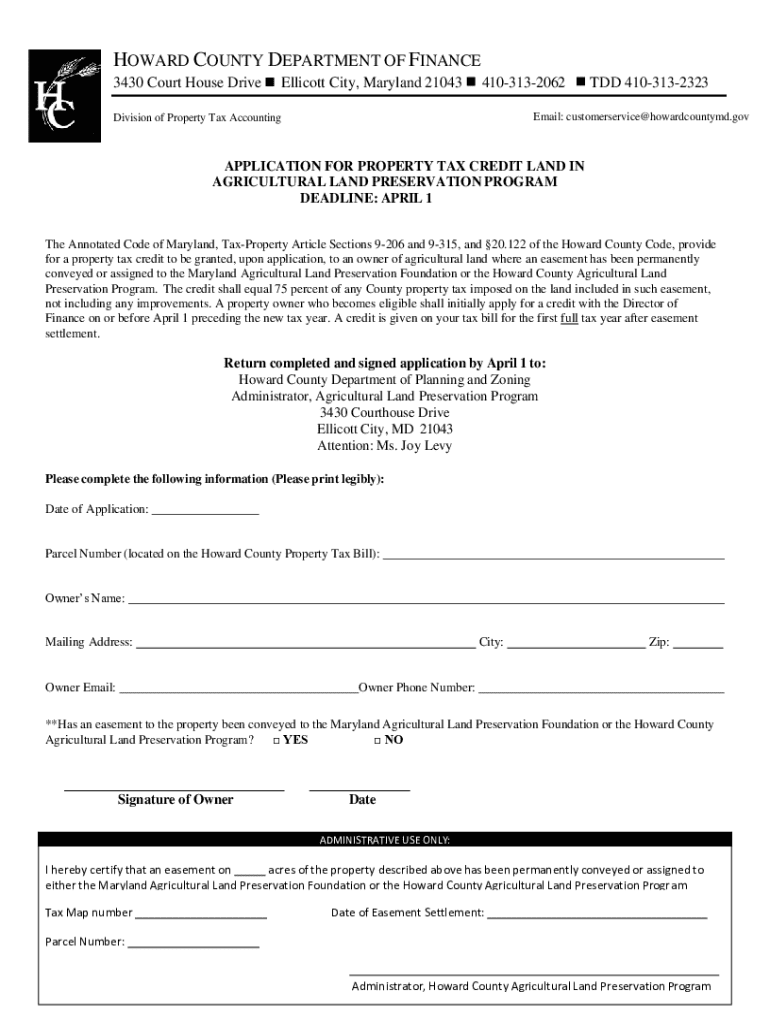

A document form is an essential component in payment systems, providing a structured format for capturing necessary information. These forms help ensure that transactions are carried out smoothly and legally, serving as a record for all parties involved. In an era where data security and clarity are paramount, effective document forms mitigate risks associated with payment processing.

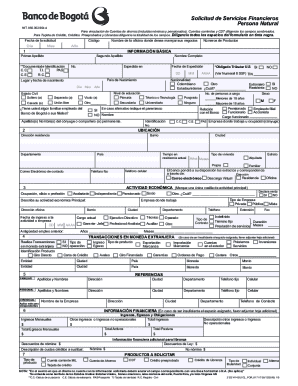

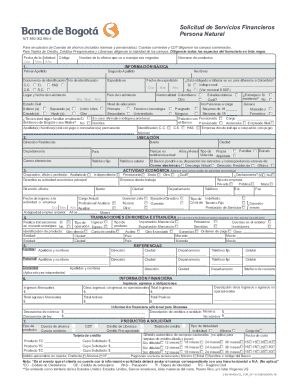

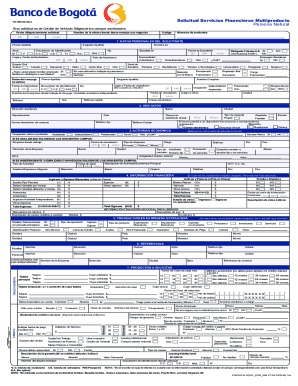

Effective payment forms should have key features such as clear instructions, mandatory fields, and the ability to accept different payment methods based on user preferences. Common types include invoicing forms for businesses, receipt forms for consumer transactions, and direct debit authorization forms. Each form type must be designed to comply with relevant regulations while facilitating easy completion.

Step-by-step guide to creating an alternate payment form

Creating an efficient alternate payment form involves several steps, starting with identifying your specific payment needs. Assessing whether these forms will be used for personal transactions, small business invoicing, or corporate payments is vital for tailoring the document appropriately.

Consider factors such as payment frequency—monthly, quarterly, or one-time payments—as well as the amount and type of payment. For instance, recurring payments may require an authorization option, while one-off purchases can be more straightforward.

Choose the right format

The format of your alternate payment form is crucial. PDF documents offer a standardized view that maintains formatting across devices, whereas digital forms can enhance user experience through interactivity. Deciding between these options often boils down to intended usage and accessibility needs.

Tools for document creation vary widely. Platforms like pdfFiller allow users to create, edit, and fill out forms efficiently, making them ideal for quick and straightforward document management.

Input essential payment information

To create an effective alternate payment form, it is essential to input all necessary payment information meticulously. Required fields may vary depending on the payment type but should generally include payer information, payment amounts, methods, and relevant dates.

Ensuring accuracy and completeness is crucial. Inaccurate forms can lead to delays or failed transactions, which can affect both the payer and payee negatively. Therefore, incorporating checks before submission is a good practice.

Editing and customizing your payment document

To enhance the effectiveness of your alternate payment form, utilizing editing tools such as those provided by pdfFiller is advantageous. These tools allow you to make necessary adjustments easily, ensuring your document is not only functional but also visually appealing.

Branding your document form helps convey professionalism and trust. Adding elements like logos and custom headers can enhance your brand identity while maintaining compliance with regulatory requirements in your industry.

Signing and authenticating your alternate payment form

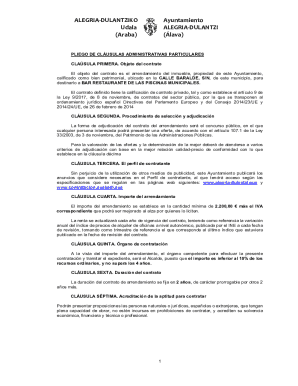

The signing and authentication process is pivotal in ensuring the validity of alternate payment forms. eSignatures offer a convenient way to attain consent without the need for physical presence, making transactions more efficient. Various types of electronic signatures, including simple, advanced, and qualified eSignatures, cater to different needs.

Legal validity varies by jurisdiction, but many countries recognize eSignatures as binding under electronic transaction laws. It’s vital to twofold check the legal framework in your area before implementing eSignature solutions.

Workflow for document signing with pdfFiller

To sign your payment form using pdfFiller, follow an intuitive workflow. Begin by uploading your document and selecting the signing feature. After that, you can add designated signer's email addresses to facilitate multi-party collaboration.

This enables a streamlined process where everyone involved can electronically sign the document, thus simplifying record-keeping and ensuring transparency.

Managing completed alternate payment forms

After the alternate payment form has been completed and signed, effective management becomes essential. Best practices for storage involve keeping forms secure to prevent unauthorized access. Utilizing cloud storage solutions like pdfFiller provides not only security but also accessibility from any device, ensuring that important documents are always available when needed.

To maintain transactional integrity, it’s important to keep detailed records. This involves documenting payment dates, amounts, and methods consistently. Tools available on pdfFiller can assist in monitoring payment status and history, enhancing your overall document management process.

Frequently asked questions (FAQs) about alternate payment and document forms

As alternate payment systems and document forms gain popularity, numerous inquiries arise regarding their functionality, security, and standard practices. Common concerns may include how to troubleshoot issues with document formats, the legal intricacies of using electronic signatures, and best practices for ensuring compliance and security in financial transactions.

Understanding these facets can significantly enhance user experience and confidence when engaging with these modern payment systems. Providing clear answers to these inquiries helps demystify alternate payment forms.

Popular templates and examples

Utilizing templates for alternate payment forms can expedite document creation. pdfFiller offers a variety of customizable templates catering to different transactional needs. Whether you're looking for a simple receipt or a detailed invoice, having a template can streamline the creation process significantly.

Interactive examples facilitate understanding of how to leverage these templates effectively. Users can customize fields, add branding, and configure payment specifics to suit diverse transactions, making them suitable for both personal and professional use.

Case studies: Successful implementation of alternate payment forms

Numerous real-world examples showcase the effectiveness of alternate payment forms. Businesses and individuals that have switched to using these solutions report not only an increase in transaction speed but also a reduction in late payments. For instance, a startup utilizing eInvoices saw a 30% increase in cash flow due to timely payments.

Moreover, companies leveraging digital payment forms noted significant time savings in invoice management processes, allowing teams to focus more on strategic initiatives rather than administrative duties.

Leveraging interactive tools for enhanced document management

Interactive features on platforms like pdfFiller can greatly improve document management efficiency. Tools such as tracking edits, collaborative signing, and digital record management streamline workflows, ultimately saving time and fostering greater collaboration among team members.

The role of automation in managing payment documents cannot be overstated. Automated reminders for payments, status updates, and storage solutions can effectively minimize human error and maximize efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit alternate payment amp document from Google Drive?

How do I complete alternate payment amp document on an iOS device?

Can I edit alternate payment amp document on an Android device?

What is alternate payment amp document?

Who is required to file alternate payment amp document?

How to fill out alternate payment amp document?

What is the purpose of alternate payment amp document?

What information must be reported on alternate payment amp document?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.