Get the free As previously reported, on May 3, 2021, GPM Investments, LLC, a Delaware limited lia...

Get, Create, Make and Sign as previously reported on

Editing as previously reported on online

Uncompromising security for your PDF editing and eSignature needs

How to fill out as previously reported on

How to fill out as previously reported on

Who needs as previously reported on?

How to use the 'as previously reported on' form: A comprehensive guide

Understanding the 'as previously reported on' form

The 'as previously reported on' form is a critical document utilized primarily within the context of tax reporting. This form serves the purpose of providing clear and transparent communication regarding income, transactions, and other financial details as previously disclosed to the Internal Revenue Service (IRS). Its significance lies in its ability to maintain accurate financial records and ensure compliance with reporting requirements, particularly for proprietors and businesses navigating state-specific regulations.

The importance of this form cannot be overstated as it helps avoid discrepancies during tax filing, thus fostering confidence in financial statements. Individuals and teams alike use it to track reporting thresholds related to income and profits amidst changing rules in various states. From tracking payments to fulfilling the IRS's requirements, this document acts as a linchpin for efficient document management.

Preparing for your 'as previously reported on' form

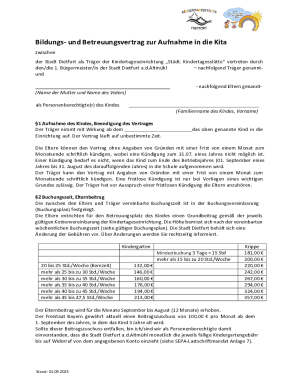

Before diving into the completion of the 'as previously reported on' form, it's crucial to have the right preparations in place. Familiarizing yourself with necessary tools and software can significantly enhance the efficiency of this process. For instance, utilizing pdfFiller allows users to access a cloud-based platform where they can create, edit, and manage this form securely from anywhere.

Two fundamental prerequisites include the establishment of a user account and ensuring your document access aligns with IRS requirements. Before starting, confirm that you possess all pertinent financial documents that outline your income, transactions, and prior reporting. Understanding document requirements is paramount, especially since various states may have distinct regulations and reporting thresholds pertaining to taxes and businesses.

Step-by-step instructions on the 'as previously reported on' form

The process of completing the 'as previously reported on' form becomes significantly streamlined using pdfFiller. Below, we outline the steps to effectively fill out this essential document:

Step 1: Accessing the Right Template on pdfFiller. Begin by navigating the pdfFiller interface. Search for the 'as previously reported on' form template to ensure you're using the correct version. This template provides predefined fields that guide users in filling out their information accurately.

Step 2: Filling Out The Form. Once you've accessed the template, input your information diligently. Utilize the auto-fill features to make this process more efficient. Ensure you double-check accuracy in your entries, especially concerning income and other financial items.

Step 3: Adding Signatures and Collaborations. With pdfFiller's tools, you can easily eSign directly on the platform. Moreover, if collaborations are necessary, pdfFiller allows you to invite others to review your document before finalization, which is handy when managing multi-person teams or clients.

Step 4: Finalizing and Managing Your Document. After ensuring accuracy, save your document in various formats that meet your needs (PDF, DOCX, etc.). Organize your completed documents for future access, and share them securely through pdfFiller, ensuring sensitive data remains protected.

Advanced features of pdfFiller for the 'as previously reported on' form

pdfFiller goes beyond basic document management to offer advanced functionalities that optimize the use of your 'as previously reported on' form. One notable feature is real-time collaboration, allowing multiple users to provide feedback and make changes directly to the document concurrently, which is ideal for managing finances across various departments.

Additionally, enhanced editing options are available to ensure your document is tailored to state-specific reporting thresholds and rules. pdfFiller also integrates seamlessly with other software, which enriches your workflow, especially for businesses that require extensive documentation related to their tax return processes.

Troubleshooting common issues with the 'as previously reported on' form

Navigating the completion of the 'as previously reported on' form can occasionally lead to misunderstandings or technical hiccups. Some frequent errors may include incorrectly inputting the reporting thresholds or issues with file compatibility. It’s vital to address such concerns promptly to avoid penalties that could affect income reporting.

An effective way to mitigate these issues starts by preparing for errors ahead of time. If you encounter an error message during the process, the pdfFiller support team offers resources and guidance to assist you in resolving these issues. Always keep in mind the importance of checking your internet connection and ensuring that your browser is up to date to prevent compatibility problems.

Best practices for using pdfFiller with the 'as previously reported on' form

To maximize the effectiveness of the 'as previously reported on' form, best practices must be adhered to. First, ensure data security and privacy by utilizing encrypted sharing options within pdfFiller. This measure protects sensitive information such as income, transactions, and proprietor details from unauthorized access.

Additionally, keeping your documents organized and regularly updated is essential in maintaining accuracy in tax reporting. Implement a systematic filing approach, and routinely review past records to catch any threshold changes that may need to be reported. Lastly, effective collaboration amongst teams is critical—regularly communicate updates and provide training on utilizing pdfFiller’s collaborative tools to enhance overall efficiency.

User testimonials and case studies

Numerous individuals and organizations have experienced success through the effective use of the 'as previously reported on' form in conjunction with pdfFiller. User testimonials highlight the simplicity and efficiency that pdfFiller brings to document management, particularly in maintaining compliance with IRS regulations.

Case studies from small business owners demonstrate how utilizing this form led to reduced errors during tax filing, enhancing transparency and facilitating smoother audits. These real-world examples showcase not only the effectiveness of using the 'as previously reported on' form for income reporting but also underline how pdfFiller enhances the user experience by simplifying the entire process.

Future developments related to the 'as previously reported on' form

Future advancements in document management are poised to significantly impact how we approach forms like the 'as previously reported on.' Trends indicate an increase in artificial intelligence tools designed to assist users in completing tax-related documents with greater accuracy and speed. This is particularly relevant for navigating evolving reporting thresholds and state regulations that frequently change.

Additionally, pdfFiller is expected to roll out updates that incorporate these technological advancements, enhancing user experiences across various devices. By keeping abreast of expected features and improvements, individuals and teams can remain proactive in managing their document needs and ensuring compliance with pertinent rules.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the as previously reported on in Chrome?

Can I create an electronic signature for signing my as previously reported on in Gmail?

How do I fill out the as previously reported on form on my smartphone?

What is as previously reported on?

Who is required to file as previously reported on?

How to fill out as previously reported on?

What is the purpose of as previously reported on?

What information must be reported on as previously reported on?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.