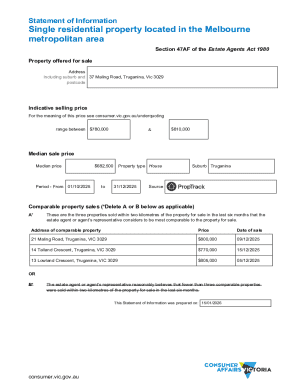

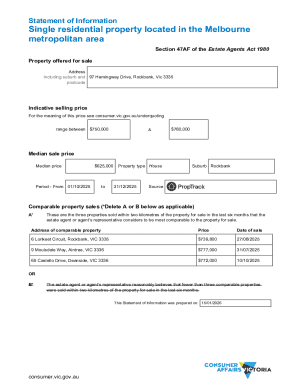

MO 4711 2025-2026 free printable template

Get, Create, Make and Sign MO 4711

How to edit MO 4711 online

Uncompromising security for your PDF editing and eSignature needs

MO 4711 Form Versions

How to fill out MO 4711

How to fill out 4711 - 2025 missouri

Who needs 4711 - 2025 missouri?

4711 - 2025 Missouri Form: Comprehensive Guide

Overview of the 4711 - 2025 Missouri Form

The 4711 - 2025 Missouri Form is essential for various tax-related submissions in the state of Missouri. Designed to capture key information necessary for accurate processing by state authorities, this form serves a critical purpose for both individuals and businesses. By ensuring compliance with state regulations, the 4711 form fosters transparency and responsibility in financial reporting.

For individuals, completing the form correctly can significantly influence their tax liabilities and refunds. Businesses benefit by utilizing this form to maintain adherence to state tax requirements, thereby avoiding potential legal issues. Therefore, understanding the ins and outs of the 4711 - 2025 Missouri Form is crucial.

Key features & benefits

Accessibility is a hallmark of the 4711 - 2025 Missouri Form. Users can access this document both online and offline, ensuring its availability whenever needed. This flexibility allows users to choose the method that suits them best, whether they prefer filling it out digitally or manually.

Another essential tool for users is the myriad of interactive features available for filling and editing the form. These tools enhance the user experience and ensure that all required fields are completed accurately. Additionally, using pdfFiller offers considerable advantages, such as seamless cloud-based document management, eSigning capabilities, and collaborative functions that allow multiple users to work together efficiently.

Step-by-step instructions for completing the 4711 - 2025 Missouri Form

Step 1: Downloading the Form - The first action required is downloading the form. Users can find it on the Missouri Department of Revenue's website or directly through pdfFiller for immediate access.

Step 2: Filling Out the Form - Accurate completion of the form is vital. Users should ensure they provide all required fields such as personal identification information, financial details, and relevant state codes. A common tip for maintaining accuracy is to double-check all figures and information entered.

Step 3: Editing the Form - Users can leverage the editing tools at pdfFiller to correct any mistakes or make necessary adjustments. It’s essential to avoid common pitfalls like missing signature fields or incorrect dates.

Step 4: Signing and Submitting the Form - For electronic signing, pdfFiller provides an intuitive interface, allowing users to sign documents effortlessly. Once the form is signed, it can be submitted through online methods or mailed in as per the user's preference.

Frequently asked questions (FAQs)

Common queries arise regarding the 4711 - 2025 Missouri Form, including what to do if mistakes are made during completion. If users realize they have made an error after submission, it’s advisable to contact the department directly for instructions on amending the submission.

Another frequent question is how to check the status of a submitted form. Users can typically find status updates directly on the Missouri Department of Revenue's portal. Regarding legal and compliance issues, another common concern is whether the form needs notarization. In most cases, notarization is not required, but verifying specific submission types is always best. Deadlines for submission may vary; thus, ensure to confirm these dates for timely filings.

Troubleshooting common issues

Access problems can frustrate users attempting to obtain the 4711 - 2025 Missouri Form. Solutions often involve checking network connections or ensuring the browser used supports the form format. If users encounter error messages during the submission process, commonly, these can be resolved by addressing any noted discrepancies in the form fields or confirming internet connectivity.

It's pertinent for users to remain vigilant against submission errors, which can often occur due to missed required fields. Ensuring that the form adheres to all stipulated guidelines can mitigate these issues, ensuring a smoother submission process.

Case studies: successful use of the 4711 - 2025 Missouri Form

Individual users can share numerous success stories after effectively utilizing the 4711 - 2025 Missouri Form. For example, one user reported that completing their tax return using the form saved them substantial time, resulting in an earlier refund approval.

Businesses have also benefited from utilizing the form as part of their tax processes. A local business found that streamlining their submissions through collective use of the 4711 led to increased efficiency in their team’s workflow, allowing them to focus on growth rather than compliance headaches.

Additional tools & resources for form management

pdfFiller not only provides access to the 4711 - 2025 Missouri Form but also enriches the user experience with practical document collaboration tools. These features enable teams to work together on forms, ensuring that all members have access to the most up-to-date version and can contribute as needed.

Moreover, the platform supports integration with accounting software and CRM systems, allowing users to manage their documents in a cohesive environment. This integration can streamline operations, as users can work on financial documents without switching between applications, greatly enhancing productivity.

Updates and changes to the 4711 - 2025 Missouri Form

Each year, the 4711 - 2025 Missouri Form undergoes changes that reflect updated laws and tax policies. Understanding these yearly updates and their implications is critical for both individuals and businesses to remain compliant. Users should familiarize themselves with any adjustments from previous years, such as changes in reporting requirements or new fields.

Staying updated on these changes can significantly impact submission efficiency and accuracy, ensuring users do not face unnecessary complications when filing their forms. Keeping abreast of annual revisions allows individuals and businesses alike to strategize their financial reporting proactively.

Related forms and their uses

There are several related forms that users might encounter within Missouri's tax framework. Forms such as the Missouri Individual Income Tax Return and the Corporate Income Tax Form serve specific purposes and help clarify various tax statuses. Each of these forms addresses unique needs, thereby allowing users to find the correct documentation for their specific circumstances.

To determine which form is needed, users may benefit from visual aids, such as flowcharts or decision trees, guiding them through the different options available. This structured approach simplifies the process, ensuring that individuals and businesses alike avoid unnecessary complications during their tax reporting.

Community discussions and user experiences

Real-life experiences from pdfFiller users reveal valuable insights into the practical applications of the 4711 - 2025 Missouri Form. Many users have shared altruistic testimonials highlighting how the platform has enhanced their document management processes, particularly in avoiding tax errors and facilitating timely submissions.

Additionally, forum discussions frequently touch upon various tips and tricks users have learned through the form completion process. This community-driven approach not only provides encouragement but also fosters a shared understanding of effective strategies for utilizing the 4711 effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in MO 4711?

Can I sign the MO 4711 electronically in Chrome?

How can I fill out MO 4711 on an iOS device?

What is 4711 - 2025 missouri?

Who is required to file 4711 - 2025 missouri?

How to fill out 4711 - 2025 missouri?

What is the purpose of 4711 - 2025 missouri?

What information must be reported on 4711 - 2025 missouri?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.