Get the free 9 ?i), Rev. - sos idaho

Get, Create, Make and Sign 9 i rev

Editing 9 i rev online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 9 i rev

How to fill out 9 i rev

Who needs 9 i rev?

Your Comprehensive Guide to the 9 Rev Form

Understanding the 9 Rev Form

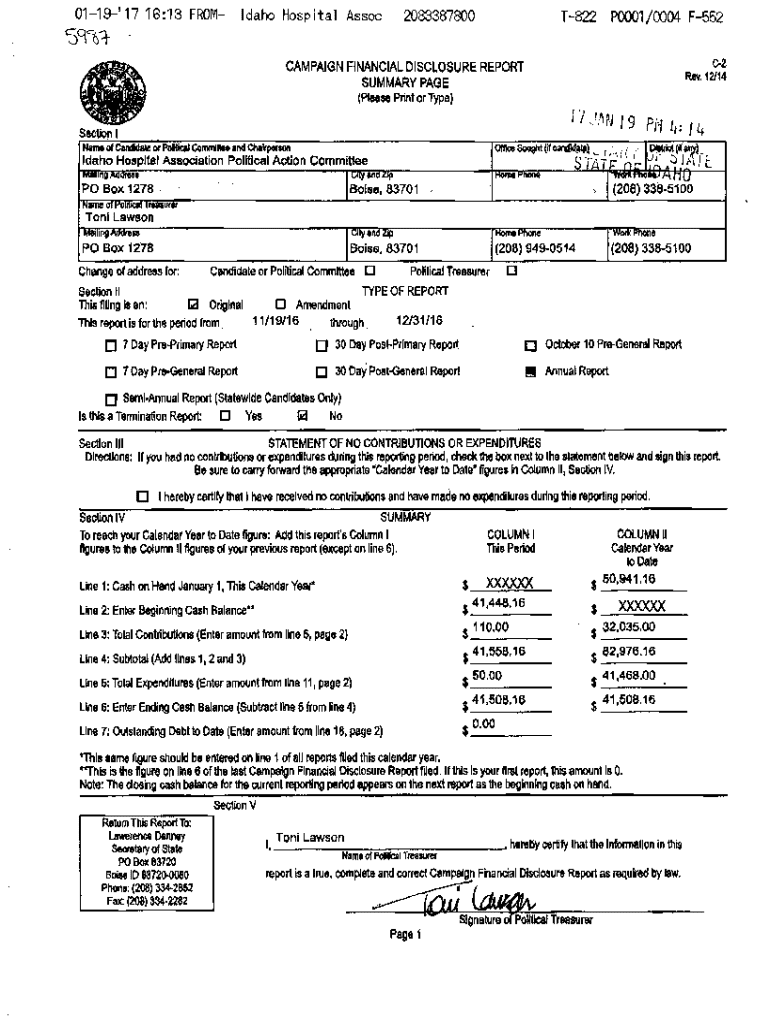

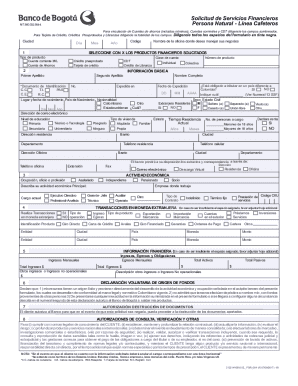

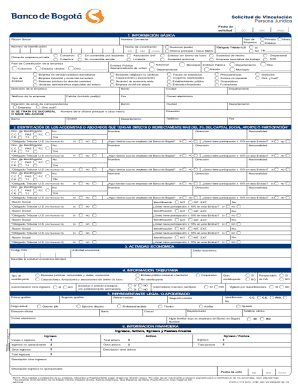

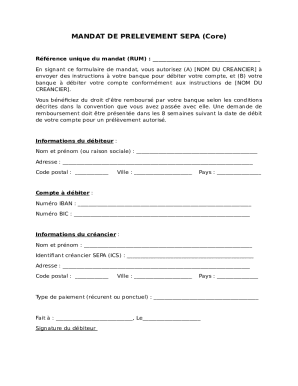

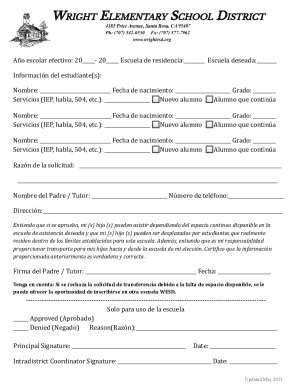

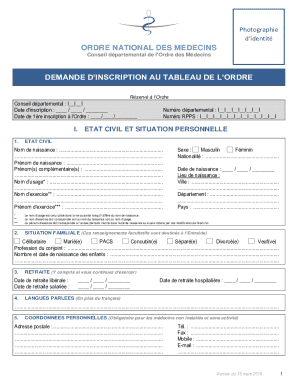

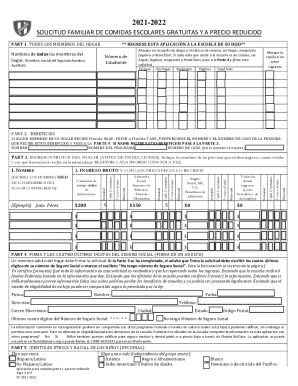

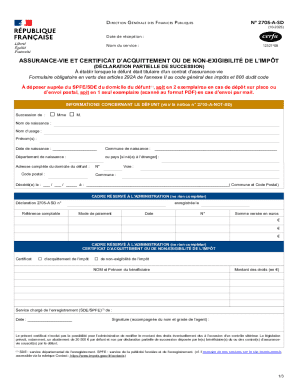

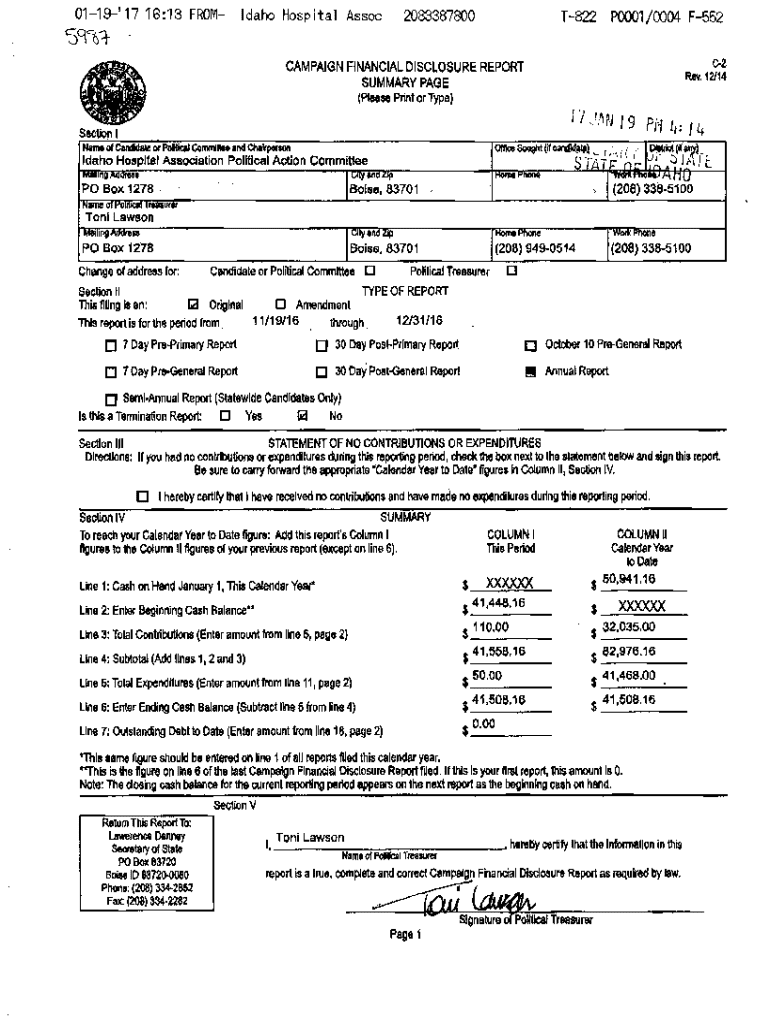

The 9 i Rev Form plays a crucial role in tax documentation and management. It is primarily used for declaring various tax liabilities, ensuring compliance with state and federal regulations. The form provides a standardized structure for reporting information about tax categories, property taxes, and other essential financial data. Due to its versatile nature, it is widely used across industries, particularly in administrative and governmental operations. Understanding its purpose is vital for anyone involved in property management, tax accounting, or business ownership.

Typically, the 9 i Rev Form is utilized in scenarios such as updating property details, applying for tax credits like the child care tax credits program, or managing contributions to local initiatives like the live local program contributions. Using this form can aid in minimizing errors during tax filing and ensure that all necessary information is appropriately documented and submitted, enhancing transparency and compliance with tax obligations.

Key features of the 9 Rev Form

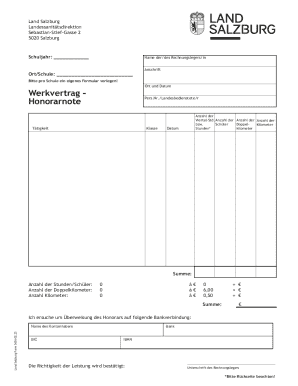

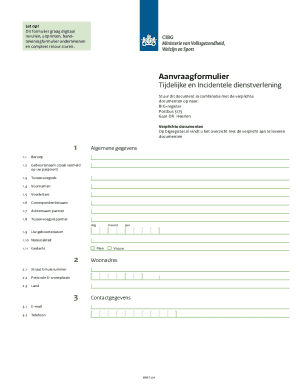

The 9 i Rev Form features a well-defined layout, ensuring clarity in data entry. Each section of the form is designed to guide users through the necessary information required for both personal and financial aspects. Common sections include personal information, financial information, and a certification section. This structure simplifies the user experience, making it easier to complete without missing critical components.

Interactive elements of the form further enhance usability. These dynamic fields allow for seamless data entry and validation, ensuring accurate information is captured. Proper completion of these fields is essential, as errors can lead to complications such as delays in approvals or potential legal issues related to taxation compliance.

Step-by-step guide to filling out the 9 Rev Form

Before diving into the form, adequate preparation is key. Gather the necessary documents, including your previous tax returns, property valuations, and any supporting materials related to exemptions or credits claimed. Efficiently compiling these documents allows you to fill the 9 i Rev Form without unnecessary interruptions.

To fill out the form, follow these detailed steps:

Common mistakes to avoid include omitting critical information, misreporting figures, or neglecting to provide supporting documents. A thorough double-check of your form can mitigate these issues, ensuring compliance and accuracy.

Editing and updating the 9 Rev Form

Once you’ve submitted the 9 i Rev Form, you may need to edit it for various reasons, such as correcting errors or updating information. With pdfFiller, editing becomes seamless. You can retrieve your saved form and make amendments directly within the platform.

To edit your form, consider these steps:

Monitoring changes is another crucial aspect. Revision history allows teams to track modifications made to the form, providing transparency and accountability. This feature is invaluable for collaboration among members handling tax matters.

Signing the 9 Rev Form electronically

Electronic signatures have transformed how we finalize documents. With pdfFiller, eSigning the 9 i Rev Form is straightforward. Users can create a secure signature and apply it directly on the document, ensuring compliance with electronic signature laws.

To electronically sign the form, follow these steps:

If you need to share the form with others for signature, utilize the sending options available in pdfFiller. You can manage multiple signatories, streamlining the process of obtaining necessary approvals, especially when dealing with entities requiring signatures for tax matters.

Managing the 9 Rev Form post-submission

After submitting the 9 i Rev Form, effective storage and organization are essential. Adopting a systematic approach to digital filing can prevent unnecessary complications in retrieval. pdfFiller offers an array of tools for organizing your documents, making it easier to establish a filing structure that suits your needs.

Implement these strategies to enhance your document management:

To stay updated on your submitted forms, establish a follow-up procedure. Monitoring the status of submissions ensures any issues are promptly addressed, safeguarding against missed deadlines, especially significant in tax compliance.

Frequently asked questions (FAQs)

When dealing with the 9 i Rev Form, users often have a range of questions. Common queries include clarity on submission deadlines, required documents, or how to rectify errors post-submission. Addressing these inquiries effectively can ease the concerns of both individuals and teams engaged in tax management.

Here are answers to some typical questions:

Equipping yourself with troubleshooting tips can also alleviate issues during submission. Should you encounter problems, checking for compatibility issues with the form or errors in entered data can provide quick solutions.

Integrative tools for form management

Collaboration and effective sharing are enhanced through pdfFiller's integrated tools. Users can simultaneously work on the 9 i Rev Form, accommodating team inputs while maintaining document integrity. This feature is essential when multiple stakeholders are involved in tax matters.

Additionally, leveraging cloud-based solutions presents significant benefits:

Utilizing comprehensive form management tools like pdfFiller allows teams to streamline processes such as tax category account management and other related administrative tasks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the 9 i rev in Gmail?

How can I fill out 9 i rev on an iOS device?

How do I fill out 9 i rev on an Android device?

What is 9 i rev?

Who is required to file 9 i rev?

How to fill out 9 i rev?

What is the purpose of 9 i rev?

What information must be reported on 9 i rev?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.